Form 4562 2020

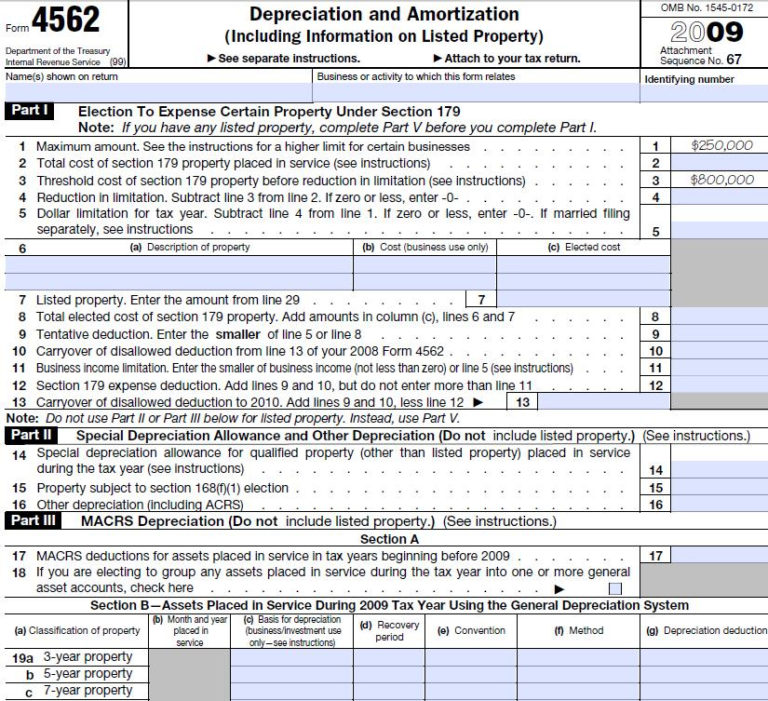

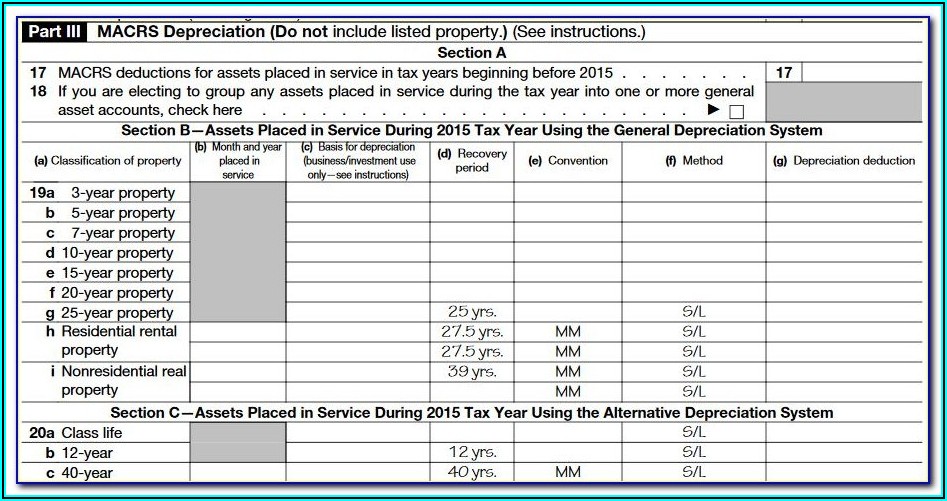

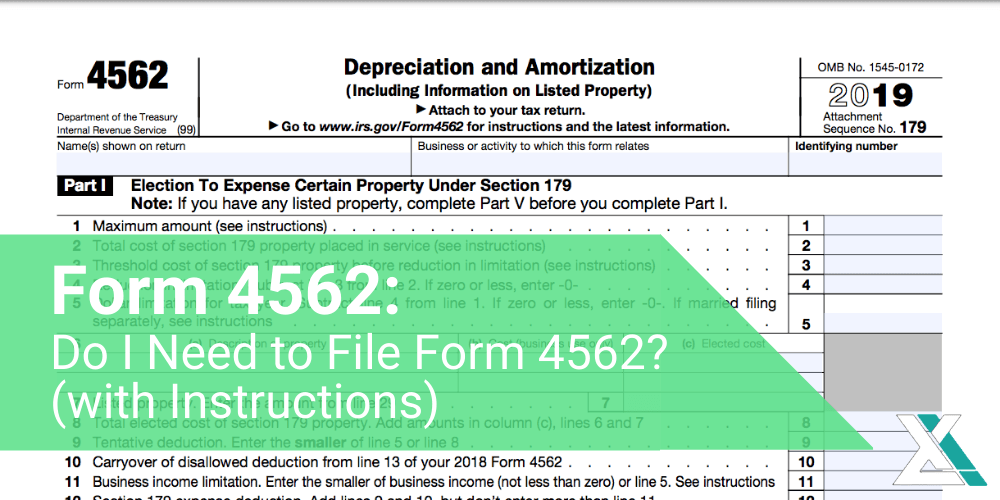

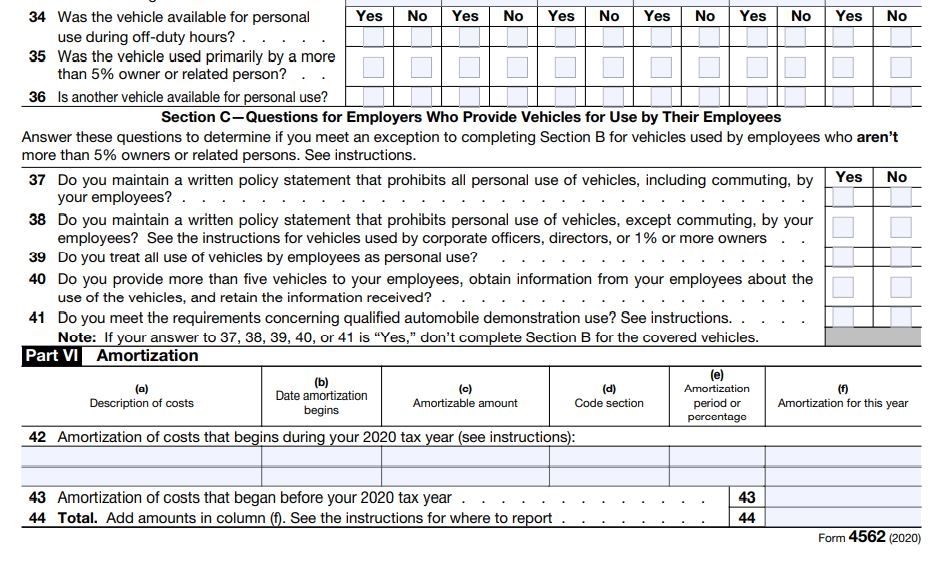

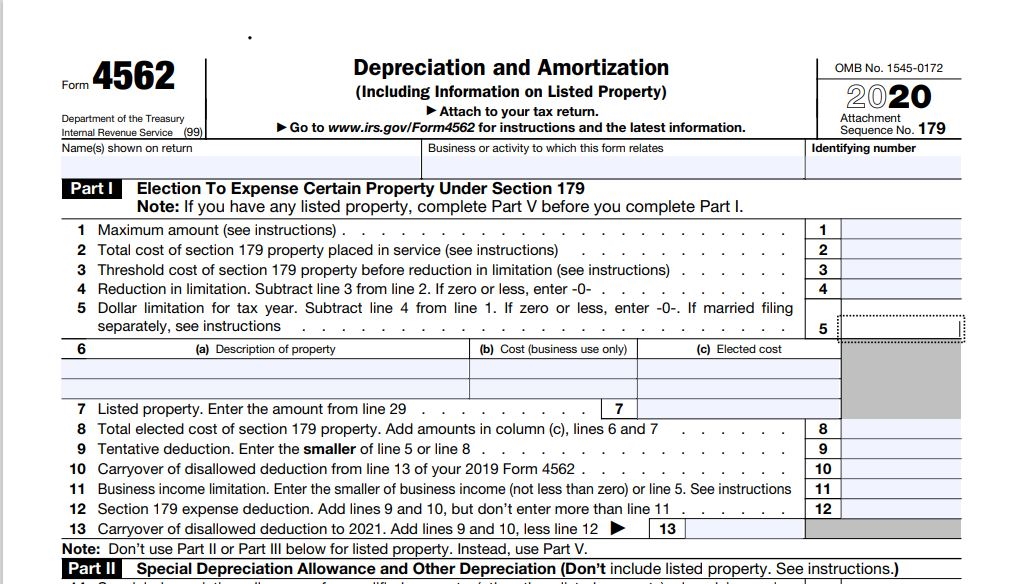

Form 4562 2020 - Provide information on the business/investment use of automobiles and other listed property. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. This limit is reduced by the amount by which the cost of section 179 property placed. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. 2020 form 4562 depreciation and amortization: Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and • provide information on the business/ investment use of automobiles and other listed property. Web general instructions purpose of form use form 4562 to: When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years.

Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. Web irs form 4562 is used to claim deductions for depreciation and amortization. It’s also used to expense certain types of property using an accelerated depreciation deduction under section 179 of the internal revenue code. Web part 1 line 11 to 13 form 4562video playlist: Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. For instructions and the latest information. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). Web purpose of form use form 4562 to: Claim your deduction for depreciation and amortization, make the election under section 179 to expense certain property, and. Web general instructions purpose of form use form 4562 to:

Web irs form 4562 is used to claim deductions for depreciation and amortization. Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. Attach to your tax return. This limit is reduced by the amount by which the cost of section 179 property placed. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. Web general instructions purpose of form use form 4562 to: Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property. Web part 1 line 11 to 13 form 4562video playlist: When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file.

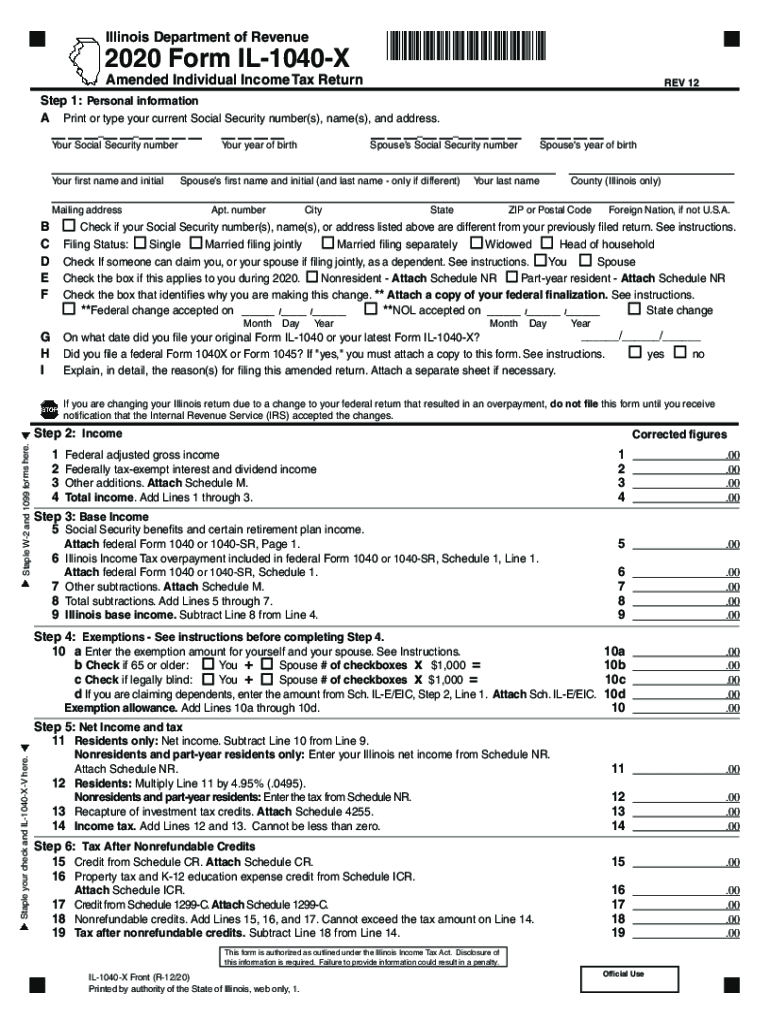

Mn Revenue Recapture Login REVNEUS

Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. Attach to your tax return. Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. For instructions and.

IRS Form 4562 Information And Instructions 2021 Tax Forms 1040 Printable

Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years. Provide information on the business/investment.

Irs Form 4562 Year 2014 Form Resume Examples l6YN7007V3

Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and. Web part 1 line 11 to 13 form 4562video playlist: This limit is reduced by the amount by which the cost of section 179 property placed. Web file form 4562 with your individual or.

Form 4562 Do I Need to File Form 4562? (with Instructions)

Provide information on the business/investment use of automobiles and other listed property. When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years. Web section 179 deduction dollar limits. For tax years beginning in 2022, the maximum section 179 expense deduction is.

2020 Form 4562 Depreciation and Amortization1 YouTube

• claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and • provide information on the business/ investment use of automobiles and other listed property. When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount.

Il 1040 Fill Out and Sign Printable PDF Template signNow

Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years. It’s also used to expense certain types of property using an accelerated.

2020 Form IRS 4562 Instructions Fill Online, Printable, Fillable, Blank

Provide information on the business/investment use of automobiles and other listed property. Web form 4562 department of the treasury internal revenue service (99) depreciation and amortization (including information on listed property). For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. Web purpose of form use form 4562 to: For instructions and the latest information.

2020 Form 4562 Depreciation and Amortization22 Nina's Soap

This limit is reduced by the amount by which the cost of section 179 property placed. Web file form 4562 with your individual or business tax return for any year you are claiming a depreciation deduction or making a section 179 election. For instructions and the latest information. Web form 4562 department of the treasury internal revenue service (99) depreciation.

2020 Form 4562 Depreciation and Amortization6 Nina's Soap

Provide information on the business/investment use of automobiles and other listed property. It’s also used to expense certain types of property using an accelerated depreciation deduction under section 179 of the internal revenue code. Claim your deduction for depreciation and amortization, make the election under section 179 to expense certain property, and. Attach to your tax return. Web irs form.

2022 Form IRS 4562 Fill Online, Printable, Fillable, Blank pdfFiller

Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web we last updated the depreciation and amortization (including information on listed property) in december 2022, so this is the latest version of form 4562, fully updated for tax year 2022. 2020 form 4562 depreciation and amortization: Form 4562 is used.

Web Form 4562 Department Of The Treasury Internal Revenue Service (99) Depreciation And Amortization (Including Information On Listed Property).

Web general instructions purpose of form use form 4562 to: Claim your deduction for depreciation and amortization, make the election under section 179 to expense certain property, and. For instructions and the latest information. When you claim depreciation, it’s incredibly important that you retain copies of all 4562's so you can track your prior deductions and claim the appropriate amount in future years.

Web Section 179 Deduction Dollar Limits.

Attach to your tax return. 2020 form 4562 depreciation and amortization: Web part 1 line 11 to 13 form 4562video playlist: Depreciation and amortization is an internal revenue service (irs) form used to claim deductions for the depreciation or amortization of an asset, expense certain property, and.

It’s Also Used To Expense Certain Types Of Property Using An Accelerated Depreciation Deduction Under Section 179 Of The Internal Revenue Code.

This limit is reduced by the amount by which the cost of section 179 property placed. Web information about form 4562, depreciation and amortization, including recent updates, related forms, and instructions on how to file. Web purpose of form use form 4562 to: Form 4562 is used to claim a depreciation/amortization deduction, to expense certain property, and to note the business use of cars/property.

Web We Last Updated The Depreciation And Amortization (Including Information On Listed Property) In December 2022, So This Is The Latest Version Of Form 4562, Fully Updated For Tax Year 2022.

Web irs form 4562 is used to claim deductions for depreciation and amortization. For tax years beginning in 2022, the maximum section 179 expense deduction is $1,080,000. • claim your deduction for depreciation and amortization, • make the election under section 179 to expense certain property, and • provide information on the business/ investment use of automobiles and other listed property. Provide information on the business/investment use of automobiles and other listed property.