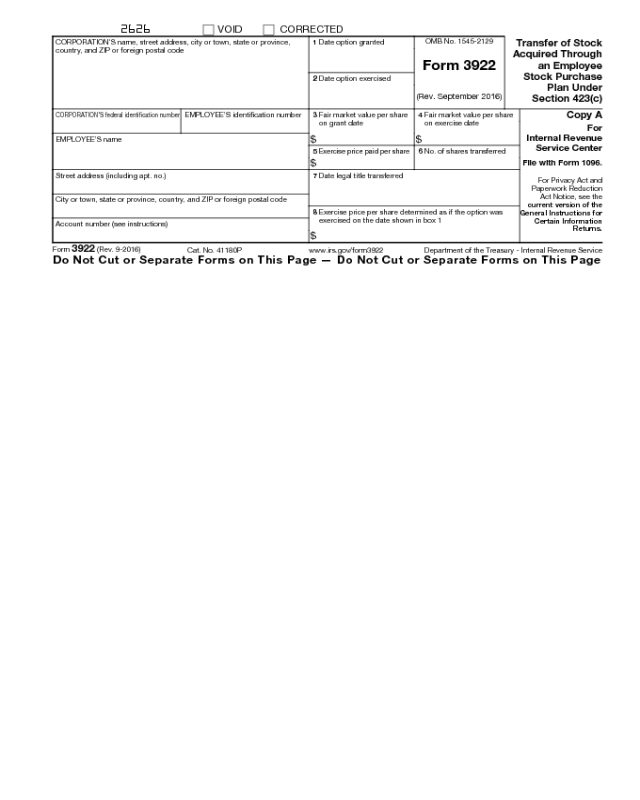

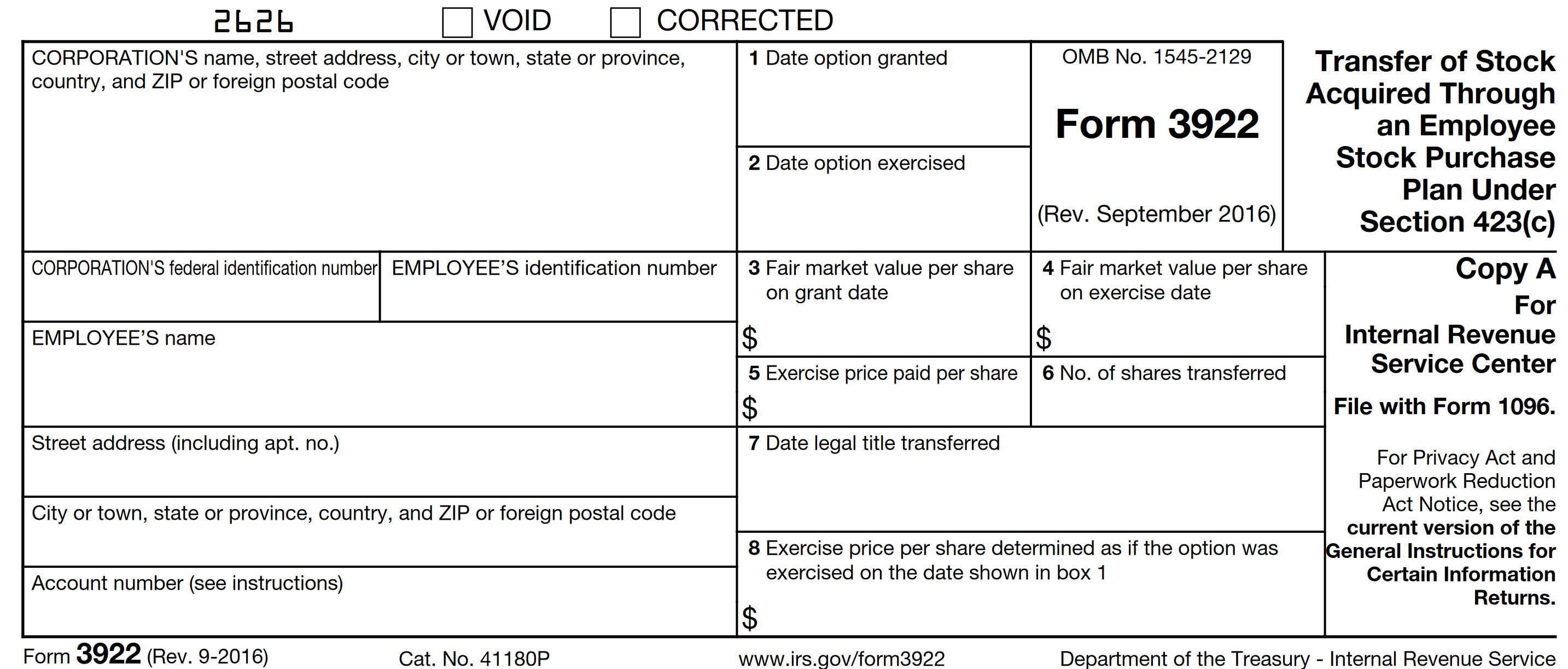

Form 3922 On Tax Return

Form 3922 On Tax Return - Sign in or open turbotax. Web irs form 3922 is for informational purposes only and isn't entered into your return. Keep this form and use it to figure the gain or loss. You will need the information reported on form 3922 to determine stock. Web if you are planning to file form 3922 online for the 2022 tax year, taxbandits is here to help you with making your filing process easier. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or otherwise. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web 1 best answer. Web a return is required by reason of a transfer described in section 6039 (a) (2) only for the first transfer of legal title of the shares by the transferor, including the first. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an.

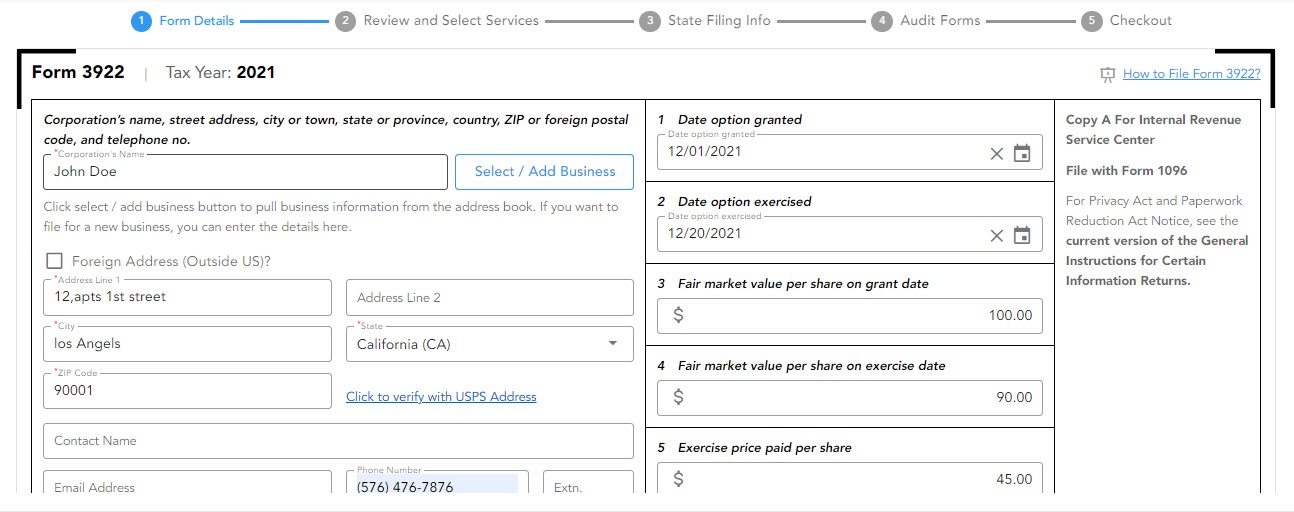

Web if you are planning to file form 3922 online for the 2022 tax year, taxbandits is here to help you with making your filing process easier. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web a return is required by reason of a transfer described in section 6039 (a) (2) only for the first transfer of legal title of the shares by the transferor, including the first. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web form 3922 is an informational statement and would not be entered into the tax return. You will need the information reported on form 3922 to determine stock. Web 1 best answer. Complete, edit or print tax forms instantly. Keep the form for your records because you’ll need the information when you sell, assign, or.

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web if you are planning to file form 3922 online for the 2022 tax year, taxbandits is here to help you with making your filing process easier. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and is not entered into your. This is the first day of the offering period, also referred to as the subscription date or. Keep this form and use it to figure the gain or loss. Click on take me to my return. Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.):

Form 3922 Edit, Fill, Sign Online Handypdf

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and is not entered into your. Web 1 best answer. Web form 3922 is an informational statement and would not.

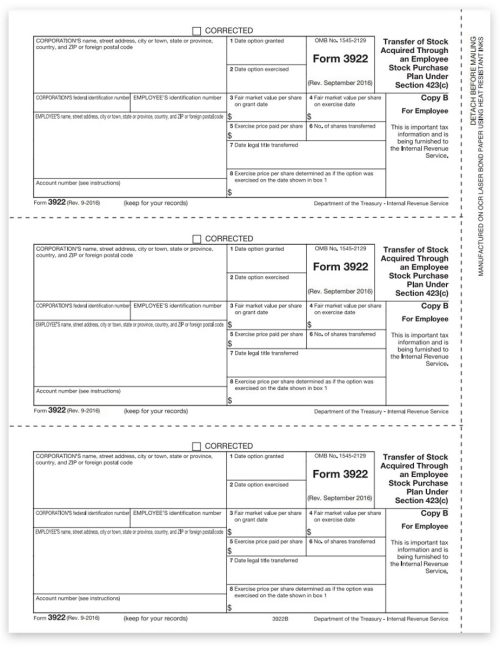

3922 Forms, Employee Stock Purchase, Employee Copy B DiscountTaxForms

Keep this form and use it to figure the gain or loss. Keep the form for your records because you’ll need the information when you sell, assign, or. Complete, edit or print tax forms instantly. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Get ready for tax season deadlines by completing any required tax.

IRS Form 3922 Download Fillable PDF or Fill Online Transfer of Stock

Web only if you sold stock that was purchased through an espp (employee stock purchase plan). Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for.

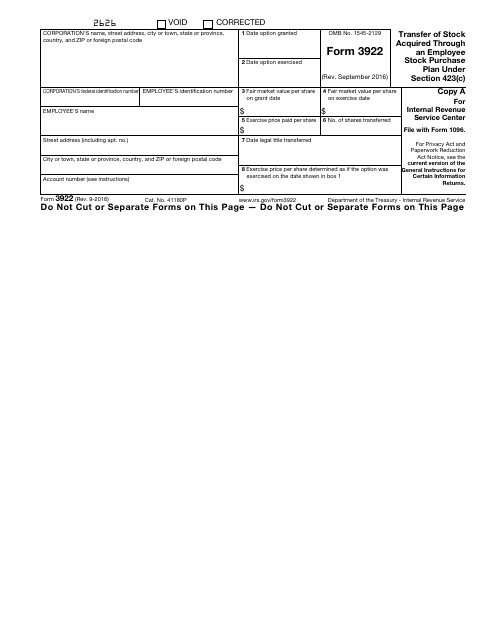

3922 2020 Public Documents 1099 Pro Wiki

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and is not entered into your. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a.

IRS Form 3922

Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and is not. Sign in or open turbotax. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web.

3922, Tax Reporting Instructions & Filing Requirements for Form 3922

Web irs form 3922 is for informational purposes only and isn't entered into your return. You will need the information reported on form 3922 to determine stock. If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an employee stock purchase. Web form 3922 transfer of stock acquired through an employee stock purchase.

IRS Form 3922 Software 289 eFile 3922 Software

This is the first day of the offering period, also referred to as the subscription date or. Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section.

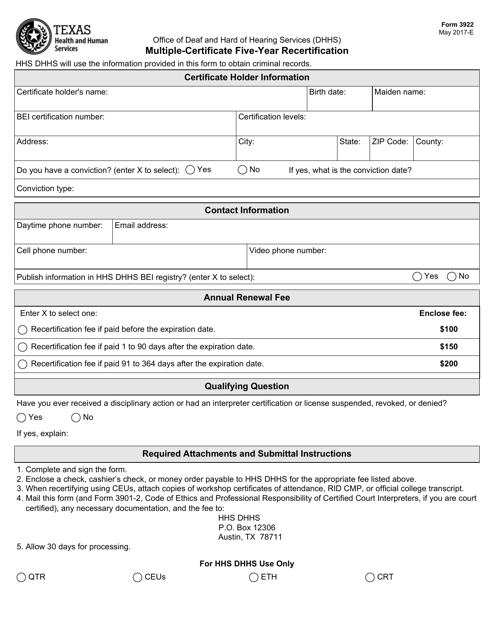

Form 3922 Download Fillable PDF or Fill Online MultipleCertificate

Complete, edit or print tax forms instantly. Web complete form 3922 are the most current general instructions for certain information returns and the most current instructions for forms 3921 and 3922. This is the first day of the offering period, also referred to as the subscription date or. If you purchased espp shares, your employer will send you form 3922,.

Documents to Bring To Tax Preparer Tax Documents Checklist

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Get ready for tax season deadlines by completing any required tax forms today. Web irs form 3922, transfer of stock acquired through an employee stock purchase plan under section 423(c), is a form.

File IRS Form 3922 Online EFile Form 3922 for 2022

This is the first day of the offering period, also referred to as the subscription date or. Web irs form 3922 is for informational purposes only and isn't entered into your return. Web step by step guidance if you participate in an employee stock purchase plan, you probably will receive irs form 3922 from your employer at the end of.

Web Recognize (Report) Gain Or Loss On Your Tax Return For The Year In Which You Sell Or Otherwise Dispose Of The Stock.

Web form 3922 tax reporting includes the following information: You will need the information reported on form 3922 to determine stock. Web irs form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your. Web irs form 3922 is for informational purposes only and isn't entered into your return.

This Is The First Day Of The Offering Period, Also Referred To As The Subscription Date Or.

If you purchased espp shares, your employer will send you form 3922, transfer of stock acquired through an. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Sign in or open turbotax. Click on take me to my return.

If You Purchased Espp Shares, Your Employer Will Send You Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase.

Web your employer will send you form 3922, transfer of stock acquired through an employee stock purchase plan under section 423 (c), if you purchased espp stock. Web to add form 3922 (transfer of stock acquired through employee stock purchase plan.): Web a return is required by reason of a transfer described in section 6039 (a) (2) only for the first transfer of legal title of the shares by the transferor, including the first. Web 1 best answer.

Web Irs Form 3922, Transfer Of Stock Acquired Through An Employee Stock Purchase Plan Under Section 423(C), Is A Form A Taxpayer Receives If They Have.

Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423 (c) is for informational purposes only and isn't entered into your return. Web form 3922 is an informational statement and would not be entered into the tax return. Web form 3922 transfer of stock acquired through an employee stock purchase plan under section 423(c) is for informational purposes only and isn't entered into your return. Web generally, form 3922 is issued for informational purposes only unless stock acquired through an employee stock purchase plan under section 423 (c) is sold or otherwise.