Form 3921 Due Date

Form 3921 Due Date - Web failure to file form 3921. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web where do i enter information for form 3921? Who must file nominee/middleman returns. Web in addition to the employee information statements, corporations must file returns with the internal revenue service (irs) on forms 3921 and 3922 no later than. Area which is supposed to cover 3921, it only allows me to. Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos). Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. The deadline for filing the forms is february 28, 2023, or march 31, 2023, if.

A startup is required to file one. When i go to the "stocks, bonds, mutual funds" Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). The deadline for filing the forms is february 28, 2023, or march 31, 2023, if. Web if it is done electronically, the due date is march 31. The company must furnish a copy b. If you don’t file the correct information by the due date, you’ll likely pay a penalty. Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos). Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section.

The company must furnish a copy b. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if filed. For electronic filing, copy a of form 3921 should be submitted by march 31 next year after the employee. Web in addition to the employee information statements, corporations must file returns with the internal revenue service (irs) on forms 3921 and 3922 no later than. Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos). If you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921. How much you pay depends on when you file the correct. When i go to the "stocks, bonds, mutual funds" Web may 5, 2023 form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). Web below are the three different deadlines for form 3921 based on the filing methods, deadline to distribute form 3921 copy b:

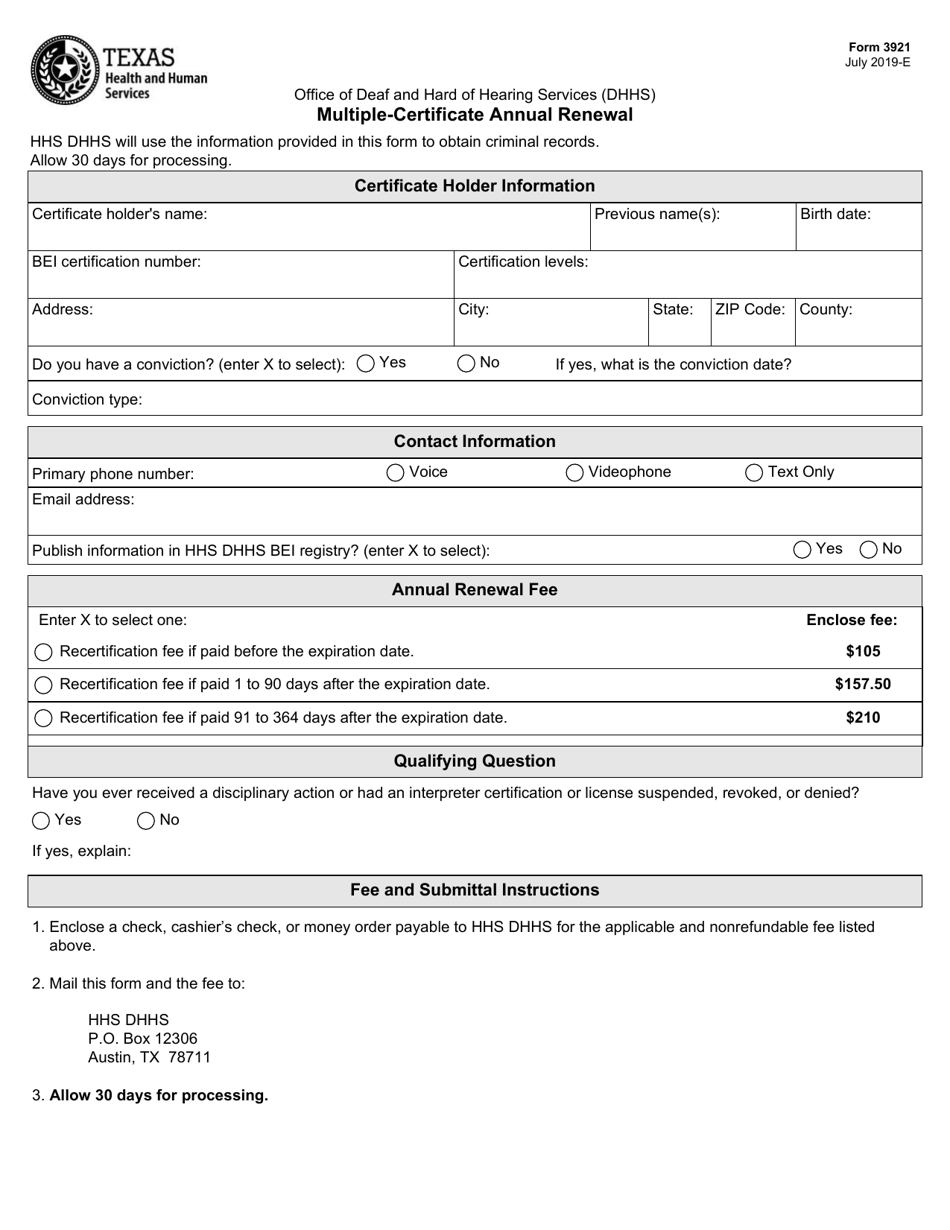

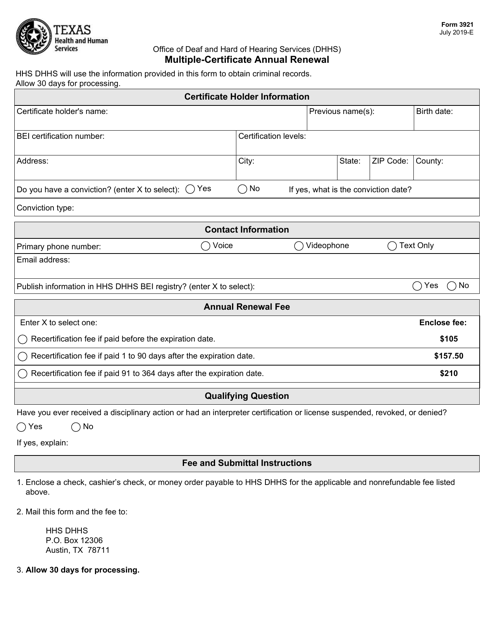

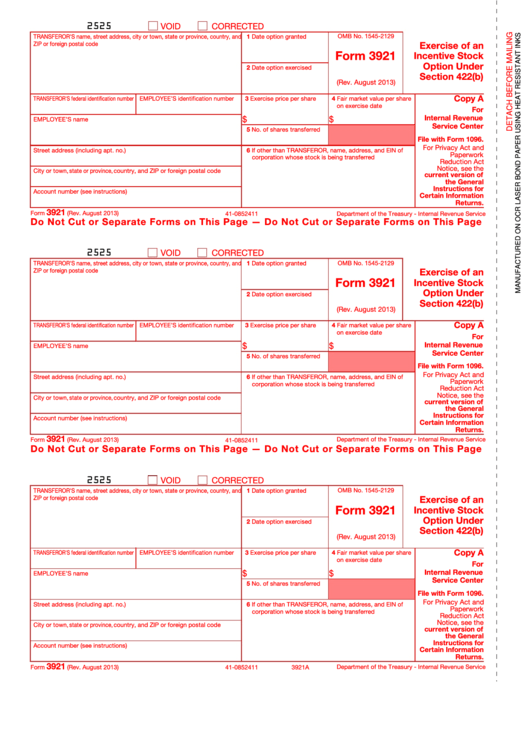

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

How much you pay depends on when you file the correct. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Who must file nominee/middleman returns. The company must furnish a copy b. Web if it is done electronically, the due date is march 31.

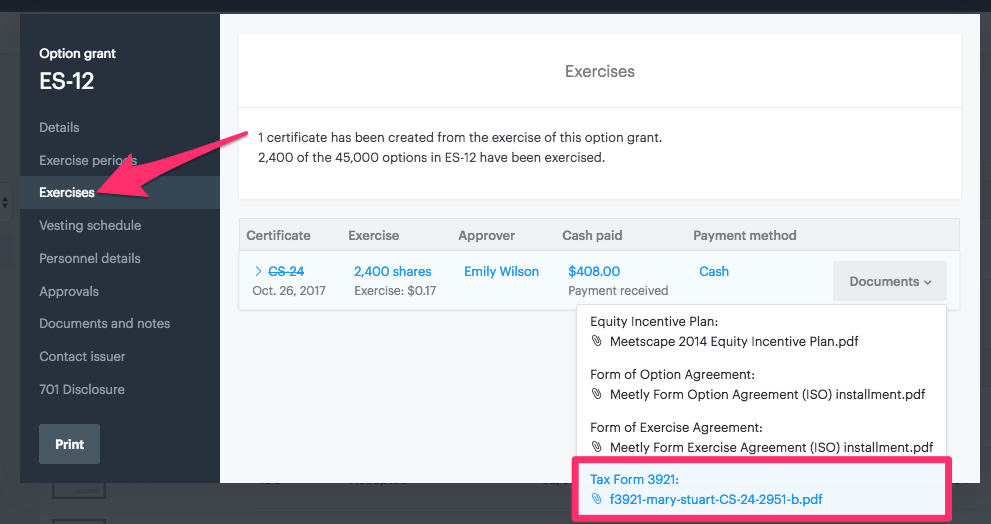

What is Form 3921? Instructions on When & How to File Form 3921 Carta

Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Web may 5, 2023 form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). If you don’t file the correct information by the due date, you’ll likely pay a penalty. Web.

3921 Form Download (For Employees)

The company must furnish a copy b. For electronic filing, copy a of form 3921 should be submitted by march 31 next year after the employee. Who must file nominee/middleman returns. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if filed. Area which is supposed to cover 3921, it only allows me to.

Form 3921 How to Report Transfer of Incentive Stock Options in 2016

Web where do i enter information for form 3921? For electronic filing, copy a of form 3921 should be submitted by march 31 next year after the employee. If you don’t file the correct information by the due date, you’ll likely pay a penalty. A startup is required to file one. When i go to the "stocks, bonds, mutual funds"

IRS Form 3921

When i go to the "stocks, bonds, mutual funds" Web may 5, 2023 form 3921 is a tax form that helps the irs keep track of when and how employees exercise their incentive stock options (isos). How much you pay depends on when you file the correct. Web below are the three different deadlines for form 3921 based on the.

20172022 Form IRS 3921 Fill Online, Printable, Fillable, Blank pdfFiller

If you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if filed. If you don’t file the correct information by the due date, you’ll likely pay a penalty. For electronic filing, copy a of form.

What is Form 3921? Instructions on When & How to File Form 3921 Carta

When i go to the "stocks, bonds, mutual funds" Web if it is done electronically, the due date is march 31. The company must furnish a copy b. Web who must file. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if filed.

Form 3921 Download Fillable PDF or Fill Online MultipleCertificate

Web corporations file this form for each transfer of stock to any person pursuant to that person's exercise of an incentive stock option described in section 422(b). Web who must file. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Web form 3921 is a tax form that is required to be filed.

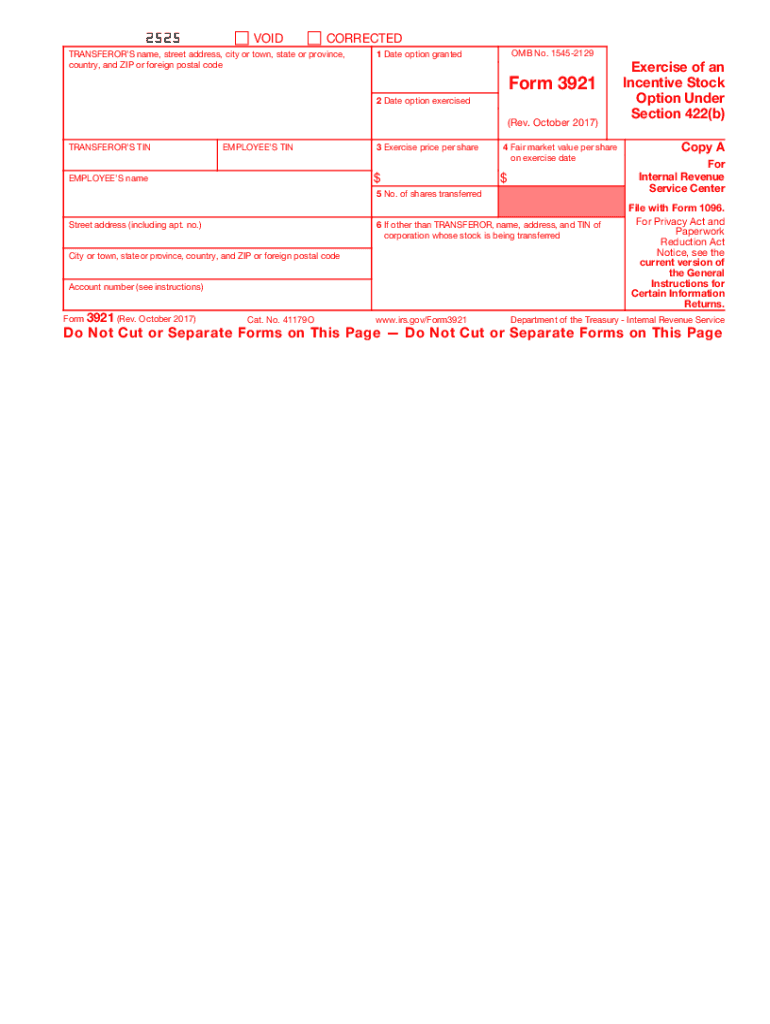

Form 3921 Exercise Of An Incentive Stock Option Under Section 422b

Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section. Web where do i enter information for form 3921? The company must furnish a copy b. How to file 3921 instructions & requirements 2022 with form 3921 due date 2022. Web.

3921 IRS Tax Form Copy A Free Shipping

A startup is required to file one. How much you pay depends on when you file the correct. Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Who must file nominee/middleman returns. If you don’t file the correct information by the due date, you’ll.

Web Where Do I Enter Information For Form 3921?

If you don’t file the correct information by the due date, you’ll likely pay a penalty. The company must furnish a copy b. Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. Web failure to file form 3921.

Web Corporations File This Form For Each Transfer Of Stock To Any Person Pursuant To That Person's Exercise Of An Incentive Stock Option Described In Section 422(B).

Web what is the due date to file a 3921 form? Every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option. Area which is supposed to cover 3921, it only allows me to. The deadline for filing the forms is march 1, 2021, or march 31, 2021, if filed.

When I Go To The &Quot;Stocks, Bonds, Mutual Funds&Quot;

Web in addition to notifying employees, the corporation must file the forms 3921 with the irs. If you are a startup that has employees who exercised incentive stock options (isos), the deadline/due date to provide form 3921. Web below are the three different deadlines for form 3921 based on the filing methods, deadline to distribute form 3921 copy b: The deadline for filing the forms is february 28, 2023, or march 31, 2023, if.

Web Who Must File.

A startup is required to file one. Who must file nominee/middleman returns. Web form 3921 is a tax form that is required to be filed with the internal revenue service (irs) when an employee exercises isos or incentive stock options (isos). Web every corporation which in any calendar year transfers to any person a share of stock pursuant to that person's exercise of an incentive stock option described in section.