Form 3804 Cr Instructions

Form 3804 Cr Instructions - Web tax forms and instructions: In addition to entering the current year credit. Attach the completed form ftb 3804. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Web form 8804 is also a transmittal form for form(s) 8805. Web information, get form ftb 3804. Web file a separate form 8805 for each foreign partner. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required. Use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax.

Web form 8804 is also a transmittal form for form(s) 8805. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever is greater; Form 3800, tax computation for certain children with unearned income. I have two shareholders and need to. Use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax. Web tax forms and instructions: I elective tax credit amount. In addition to entering the current year credit. Web file a separate form 8805 for each foreign partner. Form ftb 3804 also includes a schedule of qualified taxpayers that requires.

Web form 8804 is also a transmittal form for form(s) 8805. Form 3800, tax computation for certain children with unearned income. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. I elective tax credit amount. In addition to entering the current year credit. Web file a separate form 8805 for each foreign partner. I have two shareholders and need to. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. This is only available by request.

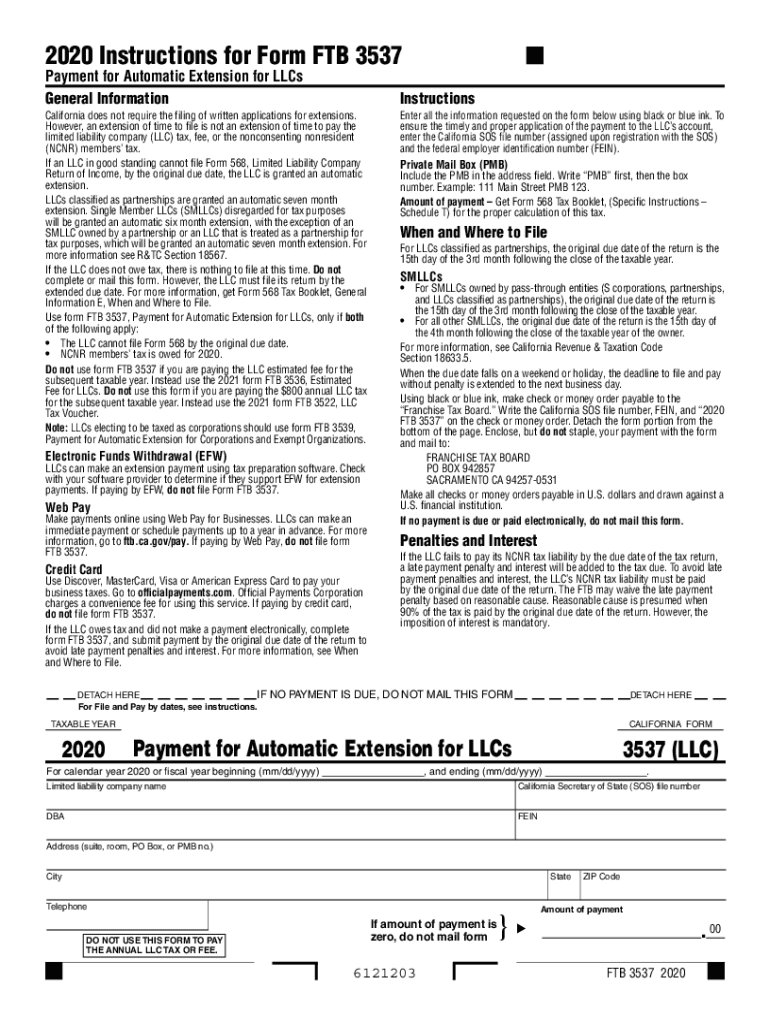

CA FTB 3537 20202022 Fill out Tax Template Online US Legal Forms

Attach to your california tax return. Web tax forms and instructions: Form 3800, tax computation for certain children with unearned income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax.

특정용도에 사용되는 전기용품의 확인신청서 샘플, 양식 다운로드

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. This is only available by request. Web form 8804 is also a transmittal form for form(s) 8805. Web information, get form ftb 3804. Attach to your california tax return.

3801 activity Fill out & sign online DocHub

Attach the completed form ftb 3804. Web information, get form ftb 3804. Form 3800, tax computation for certain children with unearned income. In addition to entering the current year credit. I have two shareholders and need to.

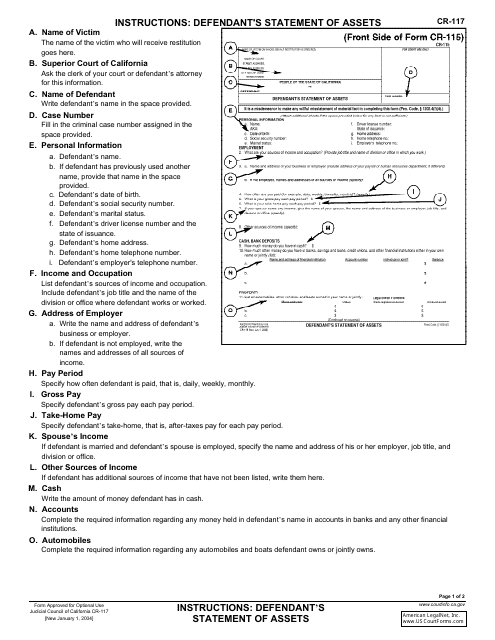

Download Instructions for Form CR115 Defendant's Statement of Assets

I elective tax credit amount. Please provide your email address and it will be emailed to. In addition to entering the current year credit. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever is greater; Attach the.

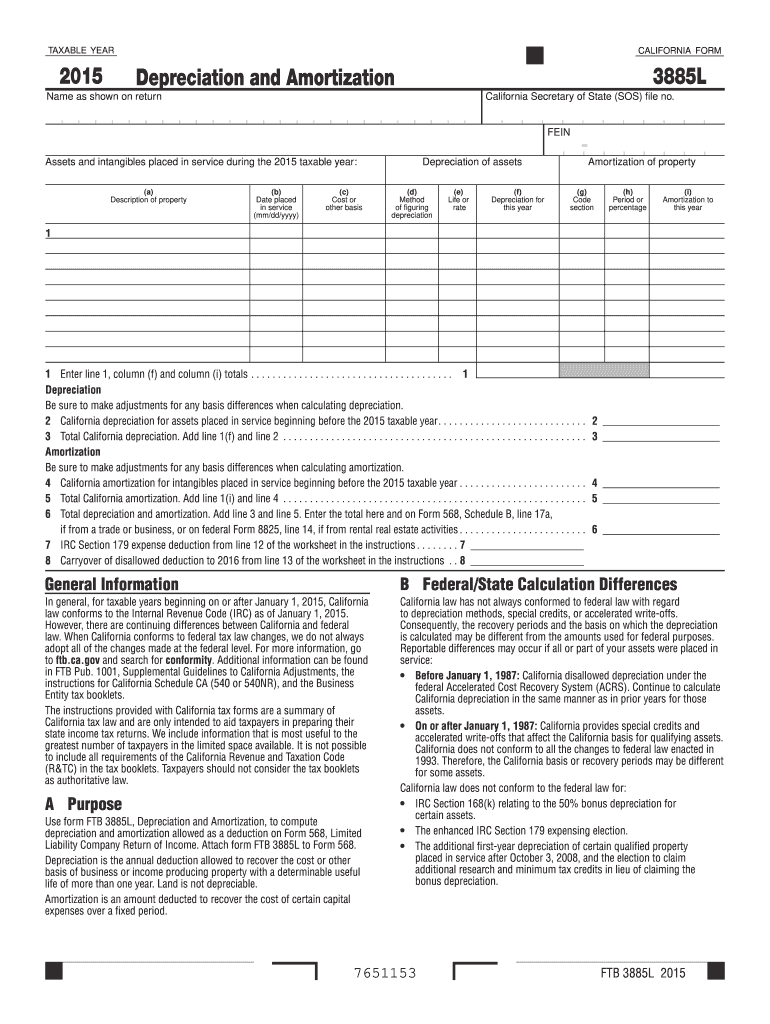

Form 3885L Fill Out and Sign Printable PDF Template signNow

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web information, get form ftb 3804. The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required. Use form 8805.

LILLY_083804CR_V057

Web information, get form ftb 3804. I have two shareholders and need to. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required. I elective tax credit amount. Attach the completed form ftb 3804.

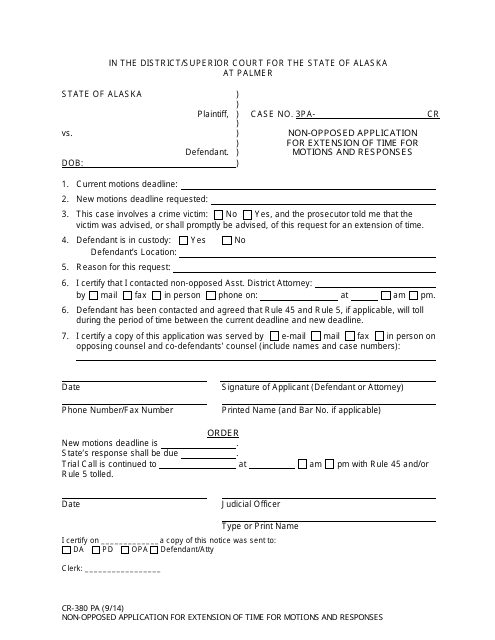

Form CR380 PA Download Fillable PDF or Fill Online Nonopposed

The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax. This is only available by request. I have two shareholders and need to. Web up to 10% cash back.

Seksowny kostium uczennicy Chiliroser CR3804 sklep Dlazmyslow.pl

Form 3800, tax computation for certain children with unearned income. Web information, get form ftb 3804. I elective tax credit amount. Web file a separate form 8805 for each foreign partner. Use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax.

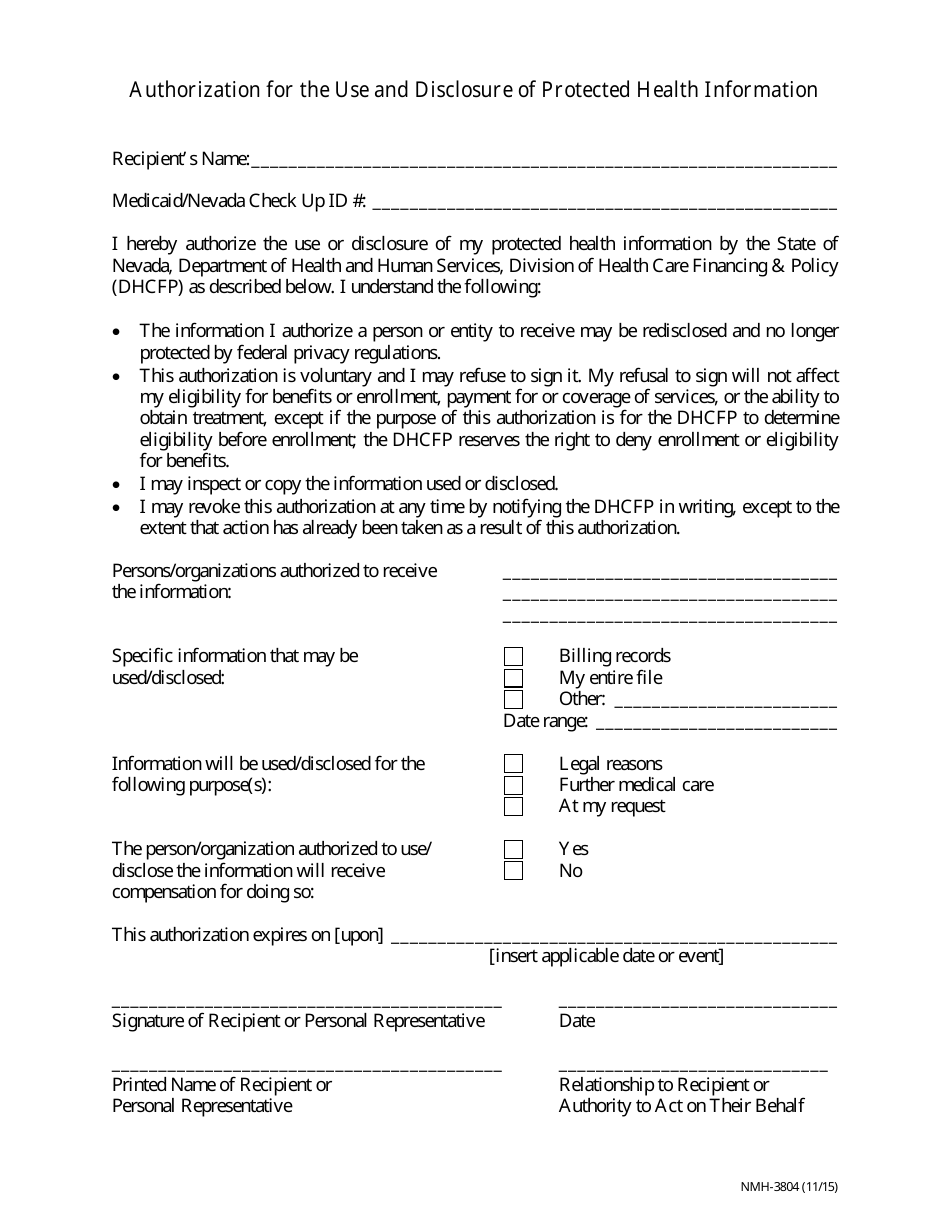

Form NMH3804 Download Fillable PDF or Fill Online Authorization for

Form 3800, tax computation for certain children with unearned income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web information, get form ftb 3804. I elective tax credit amount. This is only available by request.

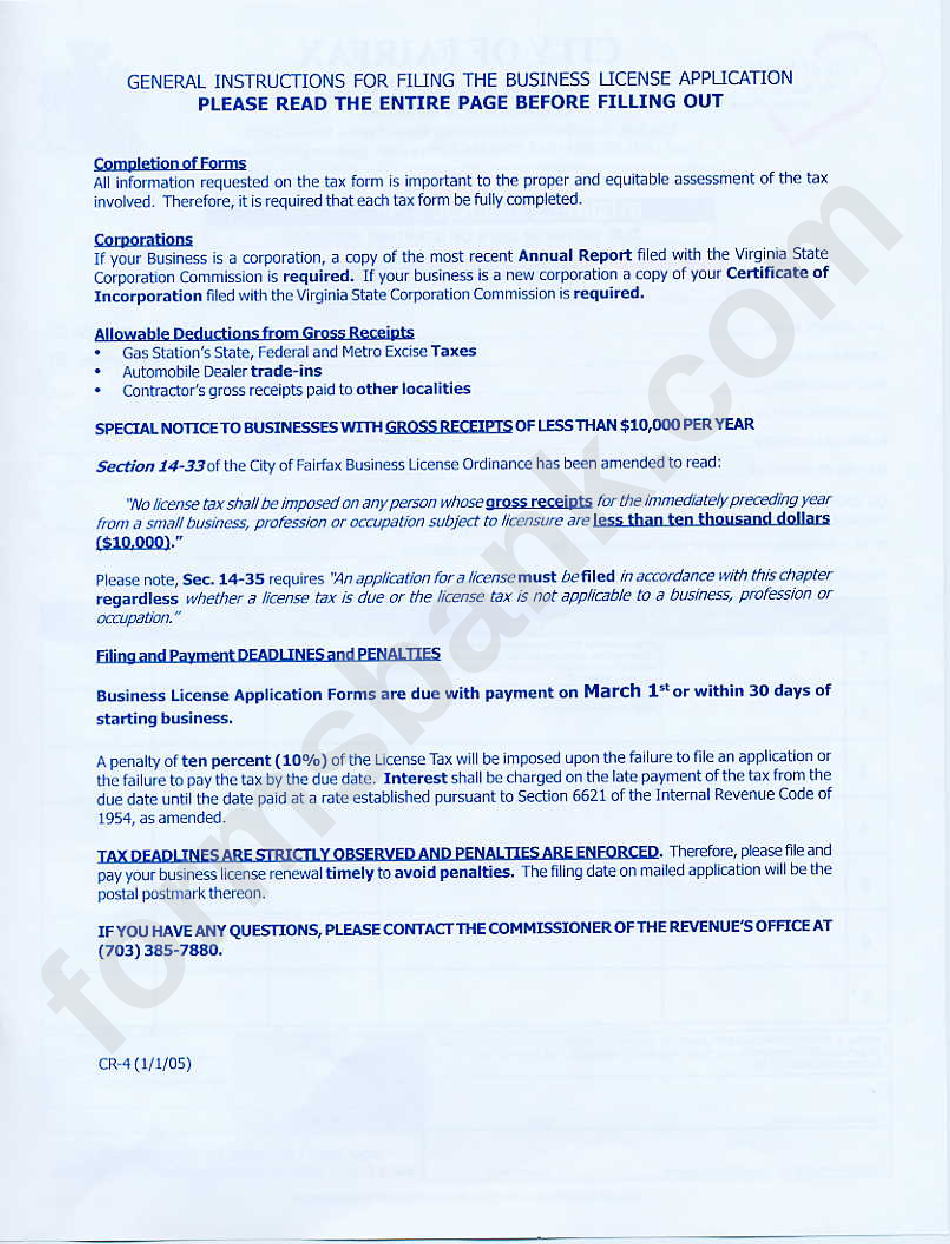

Form Cr4 General Instructions Filing The Business License

The credit is nonrefundable, and the unused credit may be carried forward for five years, or until exhausted. Form 3800, tax computation for certain children with unearned income. Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Please provide your email address and it will be emailed to. I have two shareholders and need to.

In Addition To Entering The Current Year Credit.

Attach the completed form ftb 3804. Web information, get form ftb 3804. Web use form ftb 3804 to report the elective tax on the electing qualified pte’s qualified net income. This is only available by request.

I Elective Tax Credit Amount.

Attach to your california tax return. Web tax forms and instructions: I have two shareholders and need to. Web up to 10% cash back by june 15 of the tax year of the election, at least 50% of the elective tax paid in the prior tax year or $1,000, whichever is greater;

Web Form 8804 Is Also A Transmittal Form For Form(S) 8805.

Please provide your email address and it will be emailed to. See reporting to partners and the instructions for line 8b of form 8805, later, to determine when form 8805 is required. Form 3800, tax computation for certain children with unearned income. Use form 8805 to show the amount of ecti and the total tax credit allocable to the foreign partner for the partnership's tax.

The Credit Is Nonrefundable, And The Unused Credit May Be Carried Forward For Five Years, Or Until Exhausted.

Form ftb 3804 also includes a schedule of qualified taxpayers that requires. Web file a separate form 8805 for each foreign partner.