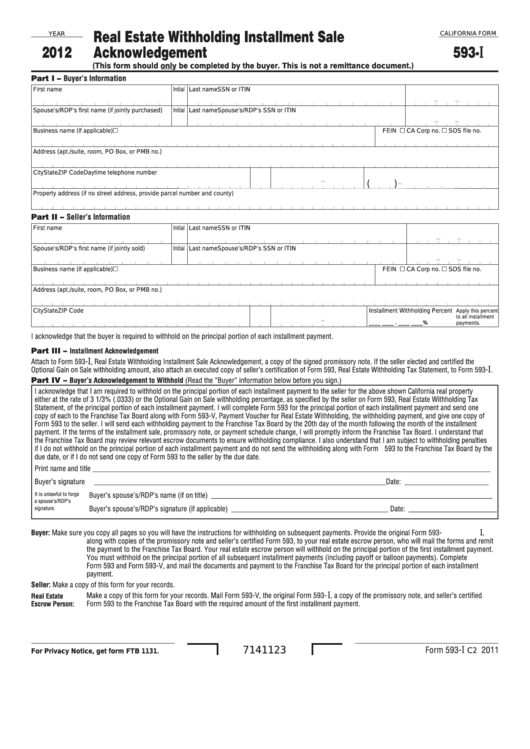

Form 3522 California 2021

Form 3522 California 2021 - Web this dos not work because it only allows entries relating to ca form 540 personal income tax. The 15th day of 3rd month after end of their tax year if the due date falls on a weekend or holiday, you have until the next business day to file and pay. The zestimate for this house is $1,486,900, which has increased by $9,913 in the last 30 days. The first $800 payment is due in the llc’s 2nd year. Let’s look at a few examples below. Web if your california llc goes into existence on or after january 1st, 2021 (but before december 31st, 2023), there is no $800 payment due the 1st year. Select the appropriate tax year. • the llc has articles of organization accepted by the california. The rent zestimate for this home is. File and pay on time to avoid penalties and fees and use web pay to make your payment.

File and pay on time to avoid penalties and fees and use web pay to make your payment. The llc has articles of organization accepted by the california secretary of state (sos). This form is for income earned in tax year 2022, with tax returns due in april 2023. It contains 1 bedroom and 1 bathroom. An llc should use this voucher if any of the following apply: • the llc has articles of organization accepted by the california. 1635 california st apt 22, san francisco, ca is a condo home that contains 866 sq ft and was built in 2005. Web zestimate® home value: Web this dos not work because it only allows entries relating to ca form 540 personal income tax. The rent zestimate for this home is $3,994/mo, which has increased.

Web instructions is form ftb 3588 preprinted with the llc’s information? Verify that the following information is correct before mailing the voucher and the check or money order: Sign it in a few clicks draw your signature, type it, upload its image, or use your mobile device as a signature pad. The rent zestimate for this home is $2,163/mo, which has increased by $2,163/mo in the. An llc should use this voucher if any of the following apply: The rent zestimate for this home is. The zestimate for this house is $1,021,300, which has decreased by $73,213 in the last 30 days. Get ready for tax season deadlines by completing any required tax forms today. Web look for form 3522 and click the link to download; Let’s look at a few examples below.

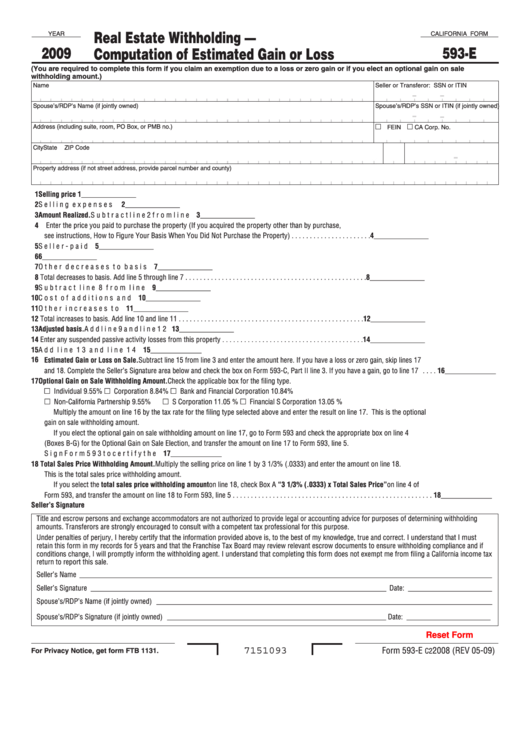

California Form 3522 ≡ Fill Out Printable PDF Forms Online

You can print other california tax forms here. Download blank or fill out online in pdf format. An llc should use this voucher if any of the following apply: This is filed on form 3536 and is calculated based on your california llc’s gross receipts (total revenue). March 15, 2023 fiscal tax year:

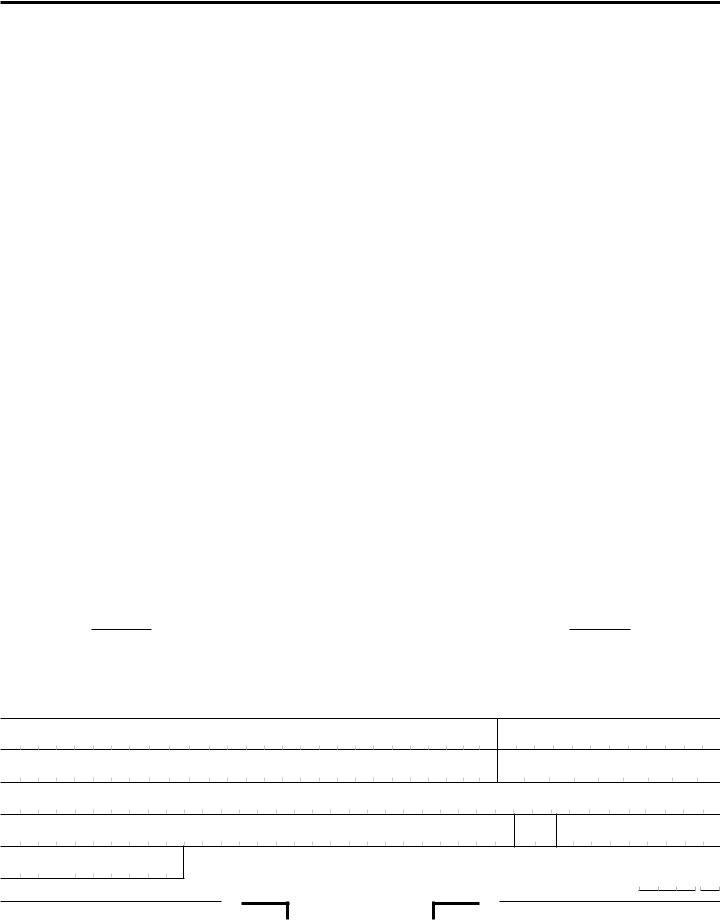

Fillable California Form 593I Real Estate Withholding Installment

The rent zestimate for this home is $2,163/mo, which has increased by $2,163/mo in the. This form is for income earned in tax year 2022, with tax returns due in april 2023. An llc should use this voucher if any of the following apply: The 15th day of 3rd month after end of their tax year if the due date.

Ftb 3522 Fill Out and Sign Printable PDF Template signNow

Form 3522 is used to pay the $800 annual franchise tax each year. The larger the gross receipts, the higher. Edit your ftb 3522 online type text, add images, blackout confidential details, add comments, highlights and more. The rent zestimate for this home is $3,994/mo, which has increased. Complete, sign, print and send your tax documents easily with us legal.

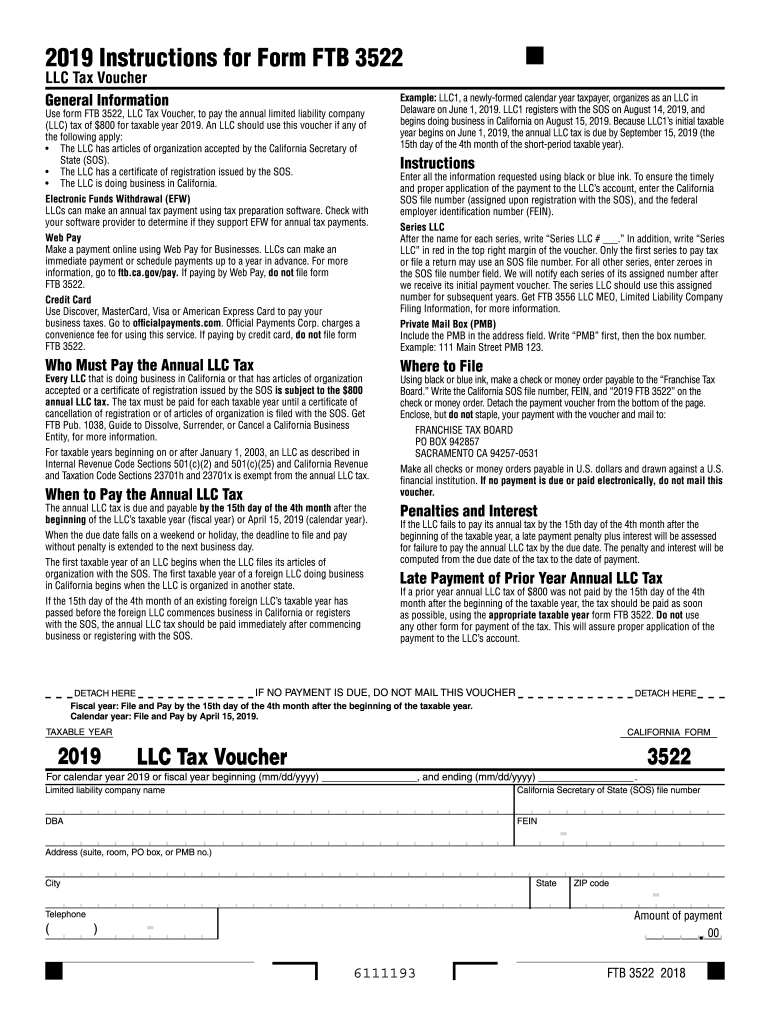

Fillable California Form 593 Real Estate Withholding Tax Statement

The rent zestimate for this home is $2,163/mo, which has increased by $2,163/mo in the. This form is for income earned in tax year 2022, with tax returns due in april 2023. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. I need to.

Form 3522 California ≡ Fill Out Printable PDF Forms Online

Llc’s name doing business as (dba) address california secretary of state (sos) file number This is filed on form 3536 and is calculated based on your california llc’s gross receipts (total revenue). Every llc formed or registered to do business in or doing business in the state of california must file 2021 form 3522 with the california franchise tax board.

How to Dissolve an LLC In California (Form 3552 Instructions) (2021)

Web get forms, instructions, and publications. Web this dos not work because it only allows entries relating to ca form 540 personal income tax. Edit your ftb 3522 online type text, add images, blackout confidential details, add comments, highlights and more. The llc has a certificate of registration issued by the sos. Web use form ftb 3522, llc tax voucher,.

Regarding California LLC formed Nov 2020, Form 568, EIN, Tax year 2020

An llc should use this voucher if any of the following apply: The zestimate for this house is $533,500, which has decreased by $2,513 in the last 30 days. Edit your ftb 3522 online type text, add images, blackout confidential details, add comments, highlights and more. The program was telling me i needed to send in form 3522 and $800.

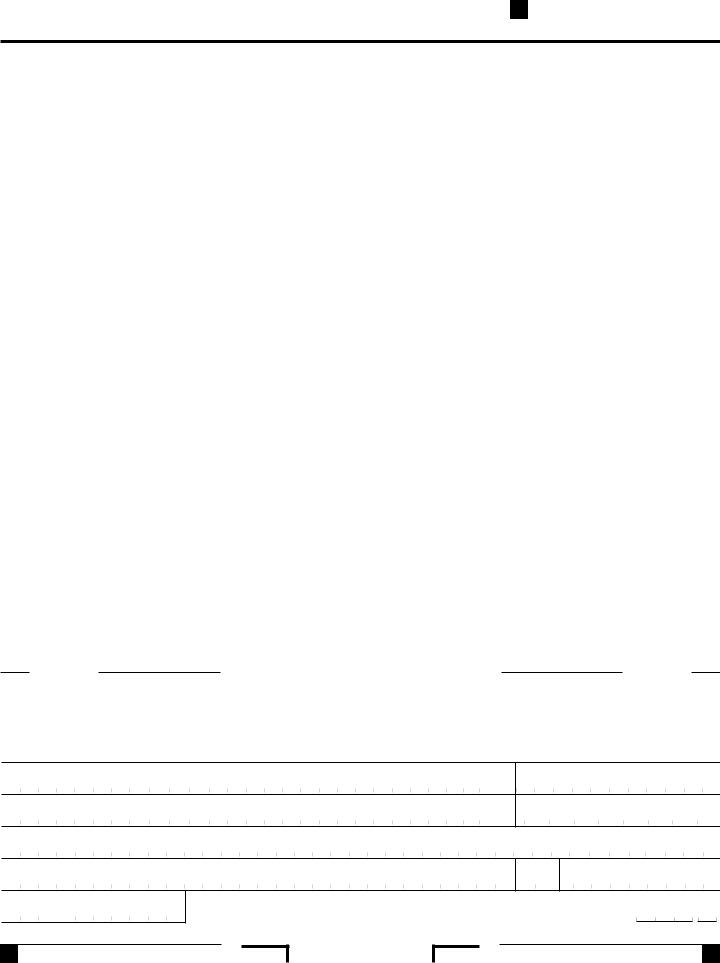

Dwc Ca Fill Out and Sign Printable PDF Template signNow

Secure and trusted digital platform! March 15, 2023 fiscal tax year: The zestimate for this house is $1,021,300, which has decreased by $73,213 in the last 30 days. The larger the gross receipts, the higher. Complete, edit or print tax forms instantly.

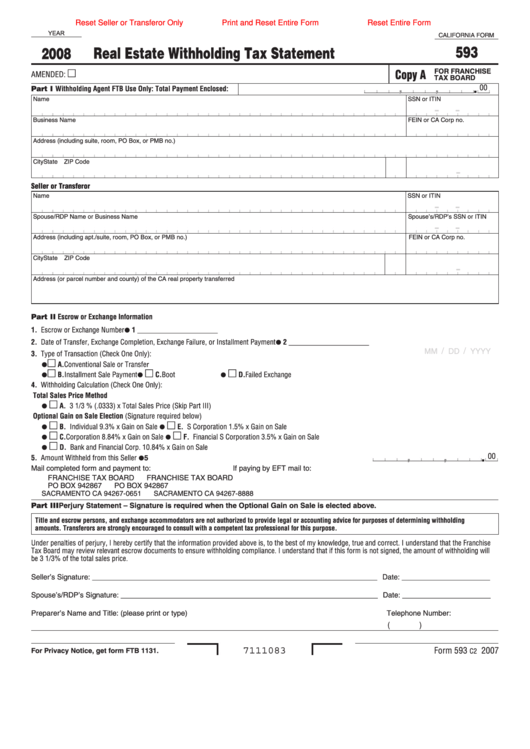

Ca Form 593 slidesharetrick

File and pay on time to avoid penalties and fees and use web pay to make your payment. The first $800 payment is due in the llc’s 2nd year. An llc should use this voucher if any of the following apply: The rent zestimate for this home is $2,163/mo, which has increased by $2,163/mo in the. The rent zestimate for.

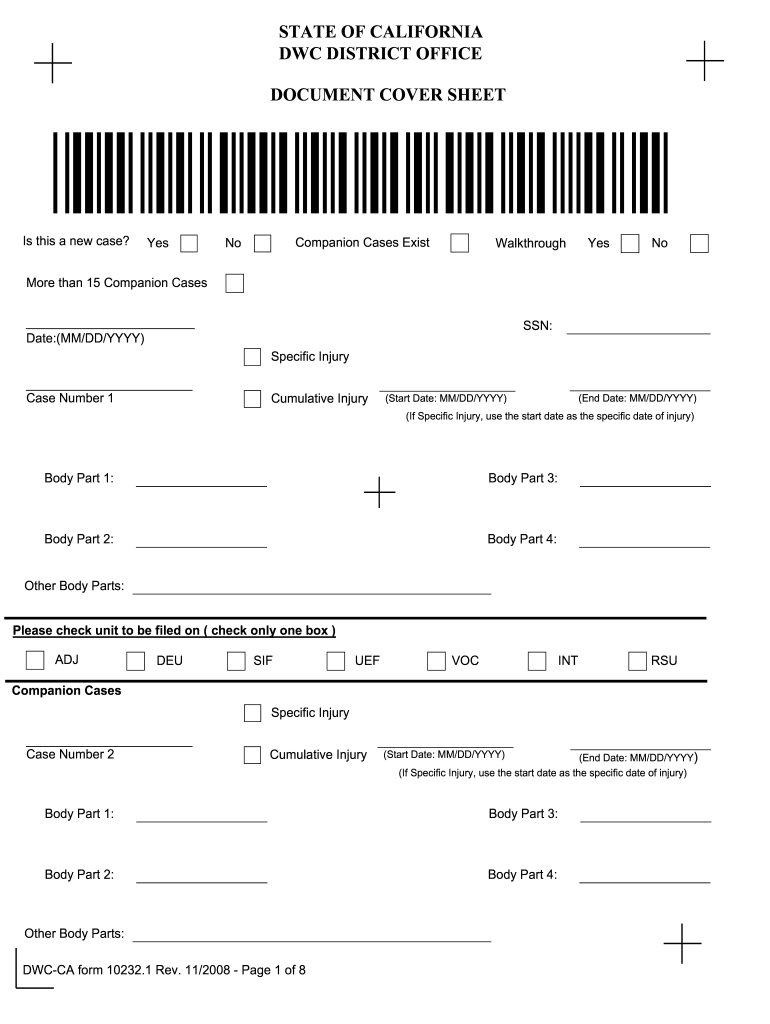

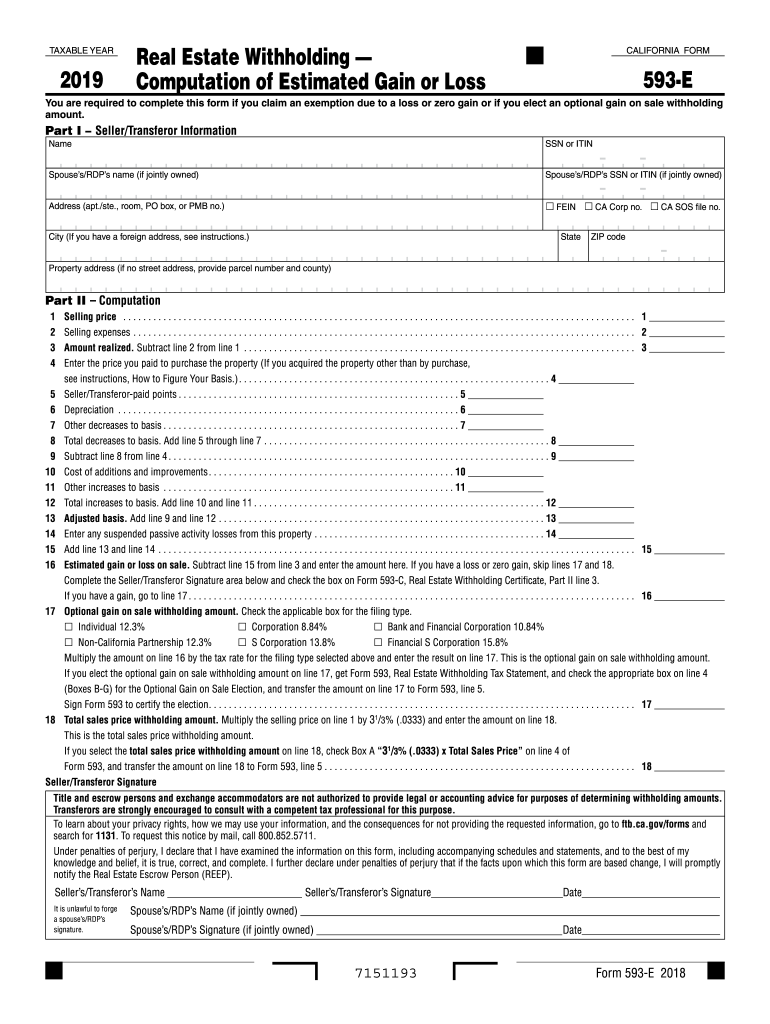

Fillable California Form 593E Real Estate Withholding Computation

California llc franchise tax due dates (after assembly bill 85): It contains 1 bedroom and 1 bathroom. Web the 3522 is for the 2020 annual payment, the 3536 is used during the tax year to pay next year's llc tax. Form 3522 is used to pay the $800 annual franchise tax each year. Llcs should use form ftb 3536, estimated.

The First $800 Payment Is Due In The Llc’s 2Nd Year.

March 15, 2023 fiscal tax year: Ad edit, sign and print tax forms on any device with signnow. We will update this page with a new version of the form for 2024 as soon as it is made available by the california government. Llc’s name doing business as (dba) address california secretary of state (sos) file number

The Program Was Telling Me I Needed To Send In Form 3522 And $800 For The Year 2021 Franchise Tax Fee.

Web get forms, instructions, and publications. You use form ftb 3522, llc tax voucher to pay the annual limited liability company (llc) tax of $800 for taxable year. It contains 2 bedrooms and 2 bathrooms. The llc has articles of organization accepted by the california secretary of state (sos).

Web This Dos Not Work Because It Only Allows Entries Relating To Ca Form 540 Personal Income Tax.

General information use form ftb 3522, llc tax voucher, to pay the annual llc tax of $800 for taxable year 2011. Web general information the limited liability company (llc) must estimate the fee it will owe for the taxable year and must make an estimated fee payment by the 15th day of the 6th month of the current taxable year. Complete, sign, print and send your tax documents easily with us legal forms. This is filed on form 3536 and is calculated based on your california llc’s gross receipts (total revenue).

The 15Th Day Of 3Rd Month After End Of Their Tax Year If The Due Date Falls On A Weekend Or Holiday, You Have Until The Next Business Day To File And Pay.

Web instructions is form ftb 3588 preprinted with the llc’s information? It contains 1 bedroom and 1 bathroom. Web we last updated california form 3522 in january 2023 from the california franchise tax board. Every llc formed or registered to do business in or doing business in the state of california must file 2021 form 3522 with the california franchise tax board every year.