Form 3115 Example

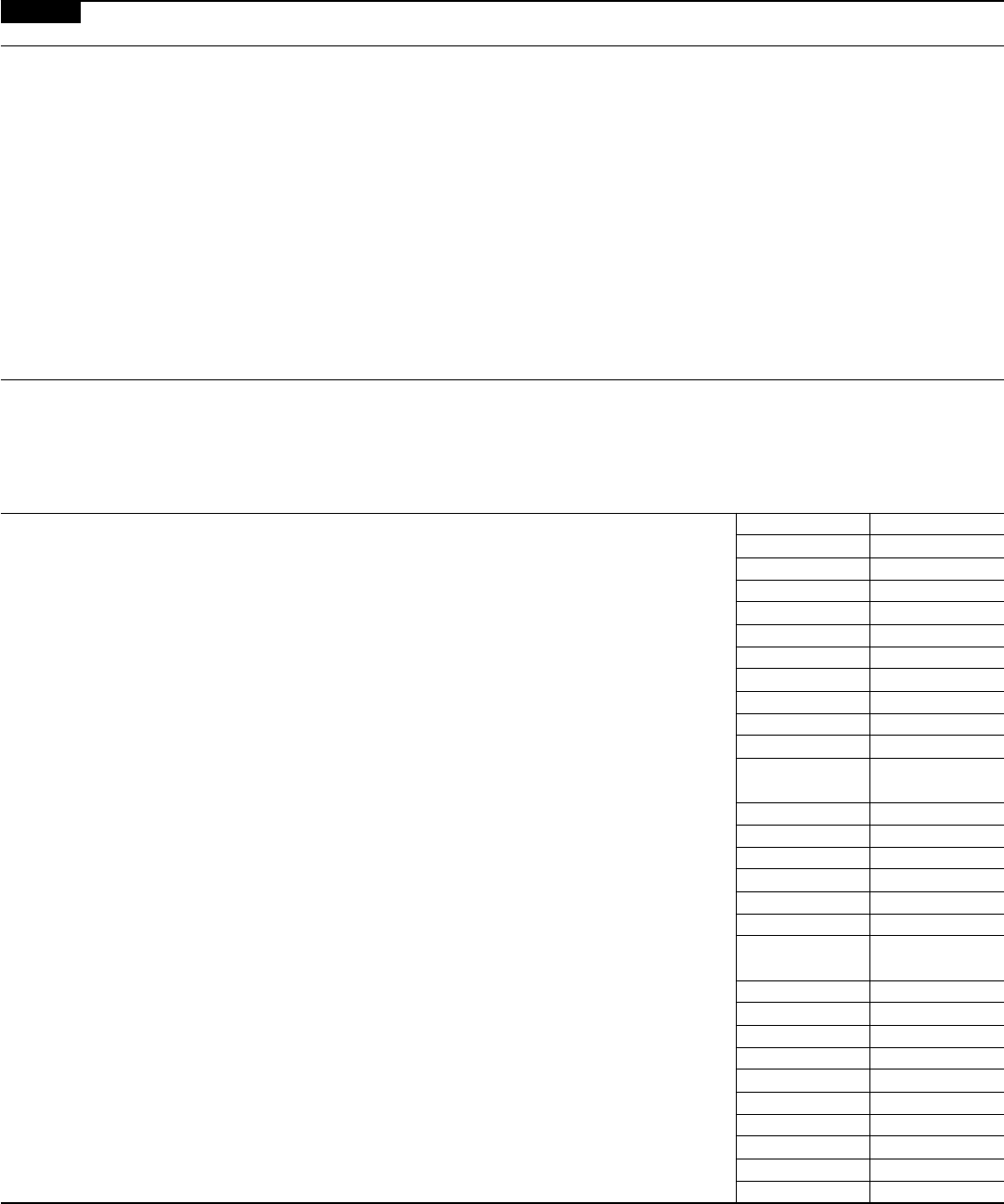

Form 3115 Example - Select the template you require in the collection of legal form samples. File this form to request a change in either: Even when the irs's consent is not required, taxpayers must file form 3115. Can i submit the form 3115 for the tax year 2016 or can you only file the form for the current and future years? Web a form 3115 is filed to change either an entity’s overall accounting method or the accounting treatment of any item, such as switching to the accrual method, accelerating depreciation, expensing a previously capitalized item under §263 (a), or a change in the reporting of inventory. Web have you ever had a client who was not depreciating their rental property? Web for example, another copy of form 3115 would be sent when an applicant is under examination, before an appeals office, or before a federal court, or is a certain foreign corporation or certain foreign partnership. About form 3115, application for change in accounting method | internal revenue service If “yes,” check the applicable box and attach the required statement. Web 1 part i information for automatic change request other (specify) enter the requested designated accounting method change number from the list of automatic accounting method changes (see instructions).

Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or production costs (dcn 192) may file a single form 3115 for both changes by including both dcns 184 and 192 on line 1(a) of form 3115. A straightforward process allows building owners to utilize cost segregation on older properties without amending returns. Web in most cases, business owners will fill out form 3115 to request a change in their accounting method. Web can you use the form 3115 to change an accounting method for a prior year? Enter only one method change number, except as provided for in the instructions. However, individual taxpayers, estates, and accountants can also fill out the form. The form is required for both changing your overall accounting method or the treatment of a particular item. For example, we have been cash basis since we started, but for several reasons, want to change to accrual. Web go to www.irs.gov/form3115 for instructions and the latest information. Web if you’d like to review an example form 3115 for a cost segregation study, email our director of cost segregation.

Here’s a list of types of businesses and individuals who may need to. Can i submit the form 3115 for the tax year 2016 or can you only file the form for the current and future years? Summary of form 3115 impact significant tax savings are available to property owners with older buildings. Kbkg authored an earlier overview of the new procedures and provides a single change 244 & 245 template that can be found here. Select the template you require in the collection of legal form samples. If “no,” attach an explanation. Web view sample form 3115 filled out. Web has a copy of this form 3115 been provided to the examining agent identified on line 6c? This template is free and can be accessed in our resource library. For example, we have been cash basis since we started, but for several reasons, want to change to accrual.

Form 3115 Application for Change in Accounting Method(2015) Free Download

Also known as application for change in accounting method, irs form 3115 is required for any taxpayer that changes their accounting method or makes or revokes certain late elections. Web if you’d like to review an example form 3115 for a cost segregation study, email our director of cost segregation. File this form to request a change in either: Kbkg.

Form 3115 Edit, Fill, Sign Online Handypdf

File this form to request a change in either: Select the get form button to open the document and start editing. Web for example, another copy of form 3115 would be sent when an applicant is under examination, before an appeals office, or before a federal court, or is a certain foreign corporation or certain foreign partnership. This template is.

Form 3115 App for change in acctg method Capstan Tax Strategies

Enter only one method change number, except as provided for in the instructions. Web kbkg has put together a sample form 3115 template with attachments for these new changes using designated change numbers (dcn) 244 and 245. If you want to change the accounting method your business uses, you need to request it from the irs by filing form 3115..

Form 3115 Edit, Fill, Sign Online Handypdf

This blog post is designed as an example on how to apply a cost segregation study on a tax return. Failing to request the change could result in penalties. Web have you ever had a client who was not depreciating their rental property? Web key takeaways businesses can choose to use the accrual accounting method or the cash accounting method,.

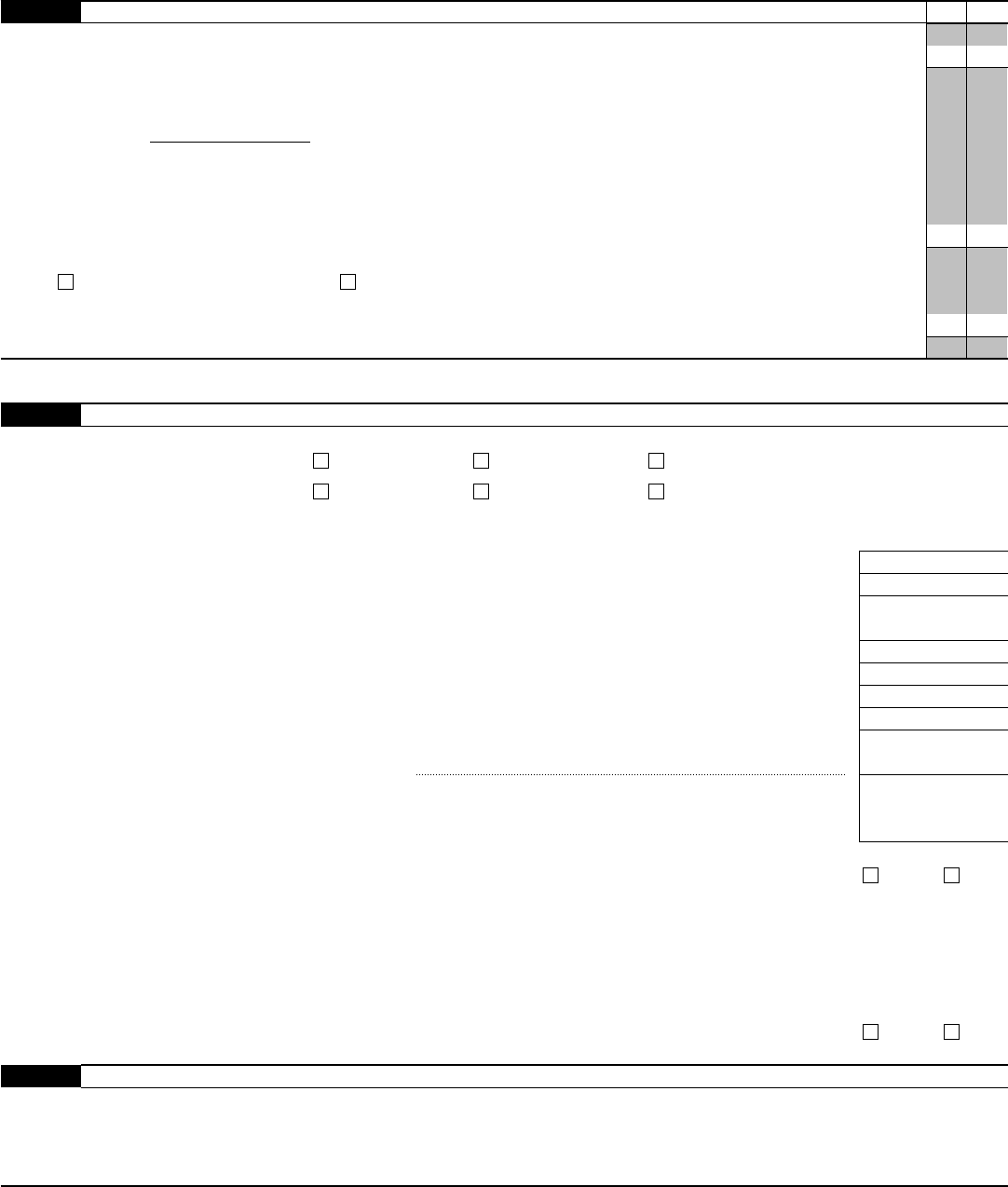

TPAT Form 3115 and New Tangible Property Regulations (TPR)

Web can you use the form 3115 to change an accounting method for a prior year? Even when the irs's consent is not required, taxpayers must file form 3115. If you want to change the accounting method your business uses, you need to request it from the irs by filing form 3115. Web go to www.irs.gov/form3115 for instructions and the.

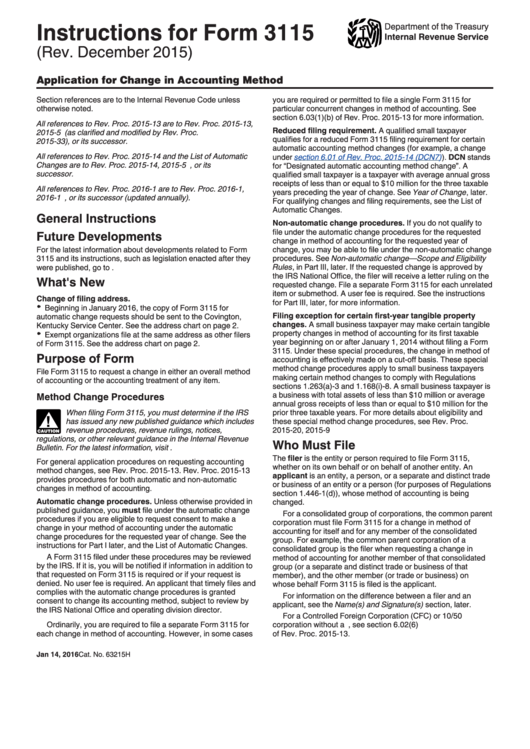

3115 Purpose of Form and Filing

Web to obtain the irs's consent, taxpayers file form 3115, application for change in accounting method. Web reduced form 3115 filing requirements are retained but taxpayers must take the remaining portion of a positive irc section 481(a) adjustment from a prior inventory change in the year of change. If you want to change the accounting method your business uses, you.

Fill Free fillable Form 3115 2018 Application for Change in

Also known as application for change in accounting method, irs form 3115 is required for any taxpayer that changes their accounting method or makes or revokes certain late elections. Summary of form 3115 impact significant tax savings are available to property owners with older buildings. Does audit protection apply to the applicant’s requested change in method of accounting? If “no,”.

Form 3115 Edit, Fill, Sign Online Handypdf

This template is free and can be accessed in our resource library. Web 1 part i information for automatic change request other (specify) enter the requested designated accounting method change number from the list of automatic accounting method changes (see instructions). Web kbkg has put together a sample form 3115 template with attachments for these new changes using designated change.

Instructions For Form 3115 (Rev. December 2015) printable pdf download

Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or production costs (dcn 192) may file a single form 3115 for both changes by including both dcns 184 and 192 on line 1a of form 3115. If “yes,” check the applicable box and.

Form 3115 Application for Change in Accounting Method(2015) Free Download

If you want to change the accounting method your business uses, you need to request it from the irs by filing form 3115. Web go to www.irs.gov/form3115 for instructions and the latest information. This template is free and can be accessed in our resource library. A straightforward process allows building owners to utilize cost segregation on older properties without amending.

Web View Sample Form 3115 Filled Out.

Web for example, an applicant requesting both a change to deduct repair and maintenance costs for tangible property (dcn 184) and a change to capitalize acquisition or production costs (dcn 192) may file a single form 3115 for both changes by including both dcns 184 and 192 on line 1a of form 3115. Summary of form 3115 impact significant tax savings are available to property owners with older buildings. Web reduced form 3115 filing requirements are retained but taxpayers must take the remaining portion of a positive irc section 481(a) adjustment from a prior inventory change in the year of change. Web for example, another copy of form 3115 would be sent when an applicant is under examination, before an appeals office, or before a federal court, or is a certain foreign corporation or certain foreign partnership.

File This Form To Request A Change In Either:

About form 3115, application for change in accounting method | internal revenue service Kbkg authored an earlier overview of the new procedures and provides a single change 244 & 245 template that can be found here. If you want to change the accounting method your business uses, you need to request it from the irs by filing form 3115. Even when the irs's consent is not required, taxpayers must file form 3115.

Failing To Request The Change Could Result In Penalties.

Can i submit the form 3115 for the tax year 2016 or can you only file the form for the current and future years? Web if you’d like to review an example form 3115 for a cost segregation study, email our director of cost segregation. Select the get form button to open the document and start editing. Here’s a list of types of businesses and individuals who may need to.

The Form Is Required For Both Changing Your Overall Accounting Method Or The Treatment Of A Particular Item.

Web key takeaways businesses can choose to use the accrual accounting method or the cash accounting method, and they must inform the irs of their choice. For example, we have been cash basis since we started, but for several reasons, want to change to accrual. This blog post is designed as an example on how to apply a cost segregation study on a tax return. Web has a copy of this form 3115 been provided to the examining agent identified on line 6c?