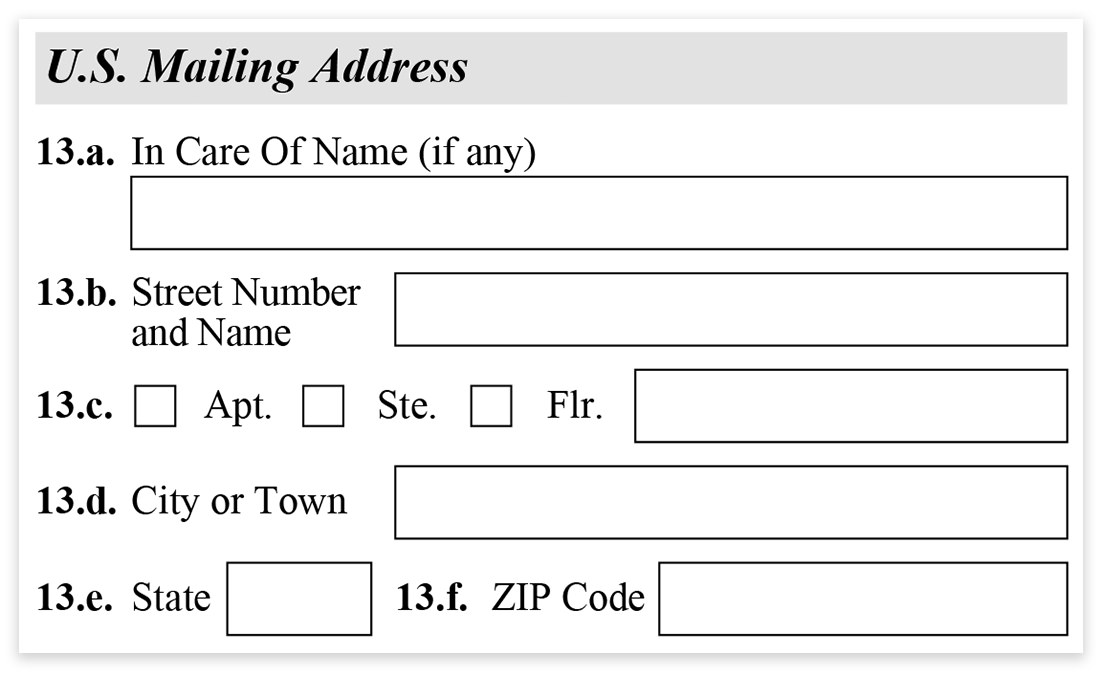

Form 2553 Mailing Address

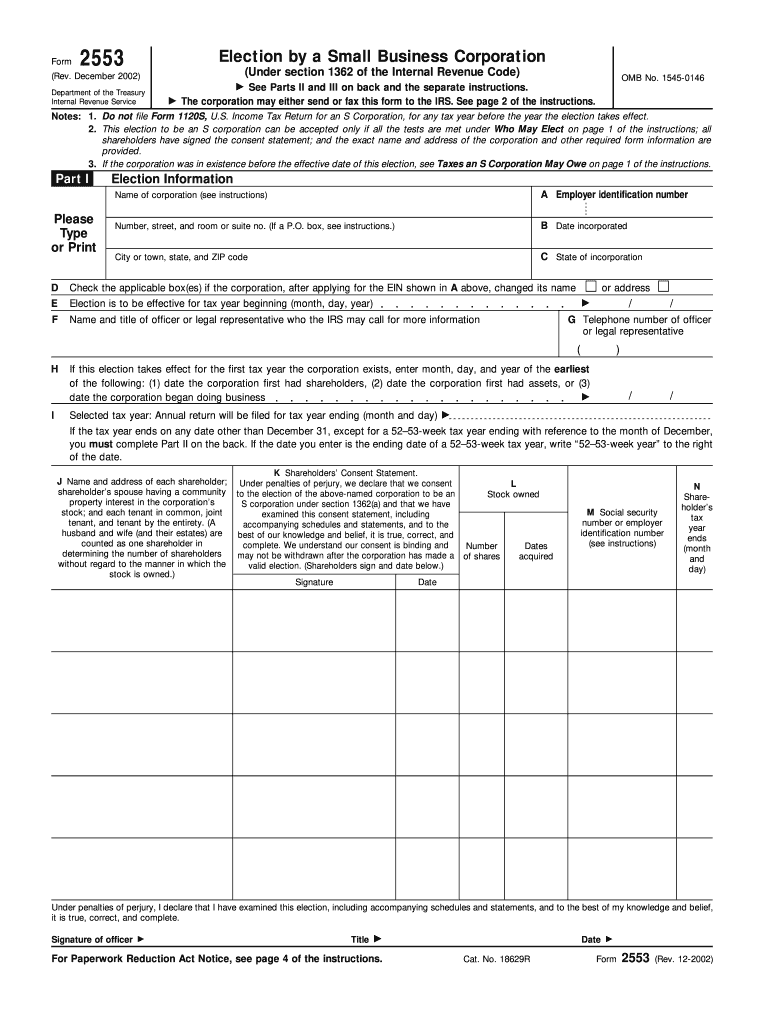

Form 2553 Mailing Address - The country is basically divided in half. This information is provided per irs. Web to start, compose a new email address to your recipient’s fax number, followed by @efaxsend.com. See address and fax numbers based on where the entity is located. The irs doesn’t have a. Web form 2553 can be filed by mail or fax as there is no online submission. When a business owner decides to register their small business as a corporation with the. December 2017) department of the treasury internal revenue service. Input the business’s employer identification number (ein) obtained from the irs. Election by a small business corporation (under section 1362 of the internal revenue.

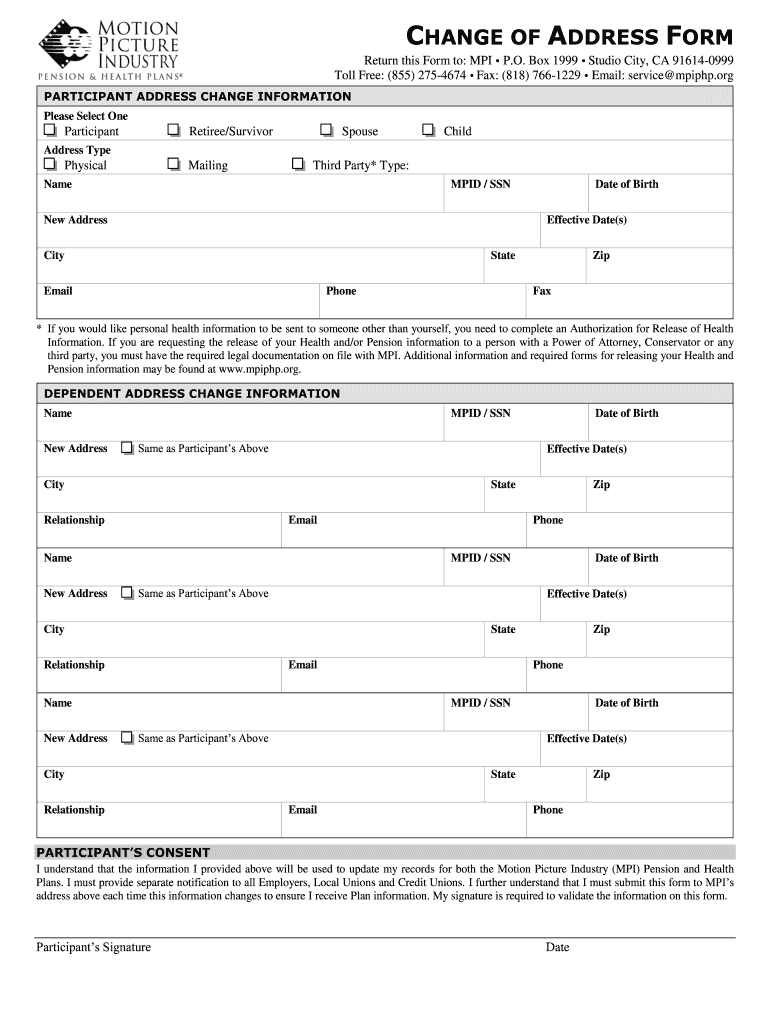

When a business owner decides to register their small business as a corporation with the. Web the title page of form 2553 highlights the address to send your application to. Under election information, fill in the corporation's name and address, along with your ein. Web you can file the form either via fax or via mail. Input the business’s mailing address in the appropriate lines. Web where to mail form 2553. Web timely file form 2553 and has acted diligently to correct the mistake upon discovery of its failure to timely file form 2553; The country is basically divided in half. We know the irs from the inside out. Web there are two department of the treasury internal revenue service center locations.

See address and fax numbers based on where the entity is located. There are two different mailing addresses depending on the state you live in. Web form 2553 can be filed by mail or fax as there is no online submission. The country is basically divided in half. Input the business’s employer identification number (ein) obtained from the irs. Web shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information. Form 2553 will be filed within 3 years and 75 days of. Department of the treasury, internal revenue service, cincinnati, oh 45999. The mailing address will vary depending on the state the small business is located. You can file form 2553 in the following ways:

What is IRS Form 2553? Bench Accounting

Web timely file form 2553 and has acted diligently to correct the mistake upon discovery of its failure to timely file form 2553; Web finally, it’s time to submit form 2553 to the irs! Everything you need to know. Identify your state and use the address to submit your form. Web form 2553 instructions:

Form 2553 Election by a Small Business Corporation (2014) Free Download

By mail to the address specified in the. Input the business’s employer identification number (ein) obtained from the irs. Web form 2553 instructions: There are two different mailing addresses depending on the state you live in. Web form 2553 can be filed by mail or fax as there is no online submission.

Where to Mail Form 2553 Address by State » Online 2553

Web to start, compose a new email address to your recipient’s fax number, followed by @efaxsend.com. The irs doesn’t have a. Input the business’s mailing address in the appropriate lines. It must contain the name, address, and ein of the corporation. Web form 2553 can be filed by mail or fax as there is no online submission.

Form 2553 Instructions How and Where to File mojafarma

Identify your state and use the address to submit your form. Web to start, compose a new email address to your recipient’s fax number, followed by @efaxsend.com. Web where to mail form 2553. This information is provided per irs. By mail to the address specified in the.

Form I485 part 1 US Mailing Address Immigration Learning Center

Web where to mail form 2553. The mailing address will vary depending on the state the small business is located. Web if you need a continuation sheet or use a separate consent statement, attach it to form 2553. Identify your state and use the address to submit your form. Input the business’s employer identification number (ein) obtained from the irs.

IRS Form 2553 Instructions How and Where to File This Tax Form

Web to start, compose a new email address to your recipient’s fax number, followed by @efaxsend.com. Web if you choose to mail your form 2553, you send it to this address: This information is provided per irs. Department of the treasury, internal revenue service, cincinnati, oh 45999. Web you can file the form either via fax or via mail.

Sorting fields in customer address form edit admin section. Magento

The irs doesn’t have a. Form 2553 will be filed within 3 years and 75 days of. Department of the treasury, internal revenue service, cincinnati, oh 45999. Web you can file the form either via fax or via mail. The mailing address will vary depending on the state the small business is located.

Irs Form 2553 Fill in Fill Out and Sign Printable PDF Template signNow

Which location you send it to depends on your corporation’s principal. The mailing address will vary depending on the state the small business is located. Input the business’s employer identification number (ein) obtained from the irs. Web how to file form 2553 via online fax. Web the title page of form 2553 highlights the address to send your application to.

Post Office Change Of Address Form Fill Online, Printable, Fillable

Web shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information. The country is basically divided in half. Identify your state and use the address to submit your form. Everything you need to know. Web timely file form 2553 and has acted diligently to.

2007 Form IRS 2553 Fill Online, Printable, Fillable, Blank PDFfiller

When a business owner decides to register their small business as a corporation with the. Effective june 18, 2019, the filing address. You can file form 2553 in the following ways: See address and fax numbers based on where the entity is located. Web how to file form 2553 via online fax.

Web If You Choose To Mail Your Form 2553, You Send It To This Address:

Input the business’s mailing address in the appropriate lines. You can mail or fax form 2553 to the appropriate irs center for your state. This information is provided per irs. Web finally, it’s time to submit form 2553 to the irs!

Web Form 2553 Can Be Filed By Mail Or Fax As There Is No Online Submission.

Identify your state and use the address to submit your form. Under election information, fill in the corporation's name and address, along with your ein. Web timely file form 2553 and has acted diligently to correct the mistake upon discovery of its failure to timely file form 2553; Web the title page of form 2553 highlights the address to send your application to.

Web To Start, Compose A New Email Address To Your Recipient’s Fax Number, Followed By @Efaxsend.com.

You can file form 2553 in the following ways: The mailing address will vary depending on the state the small business is located. Web shareholders have signed the consent statement, an officer has signed below, and the exact name and address of the corporation (entity) and other required form information. Web you can file the form either via fax or via mail.

Web How To File Form 2553 Via Online Fax.

The irs doesn’t have a. Everything you need to know. Election by a small business corporation (under section 1362 of the internal revenue. Web if you need a continuation sheet or use a separate consent statement, attach it to form 2553.