Form 2441 Provider Ssn

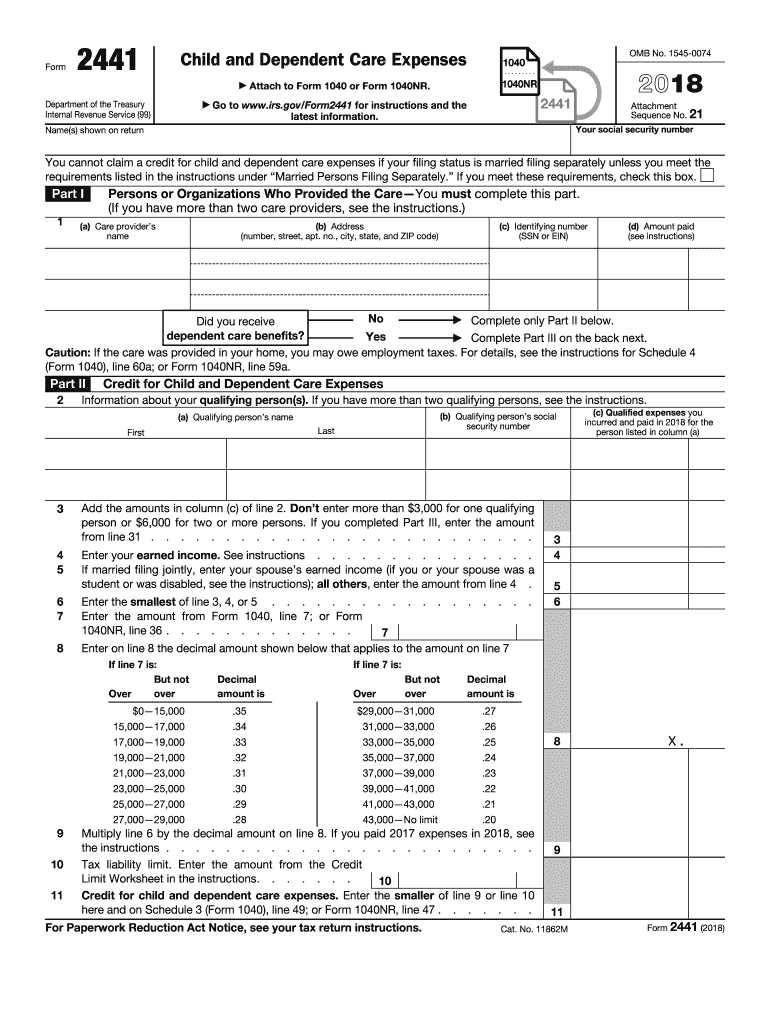

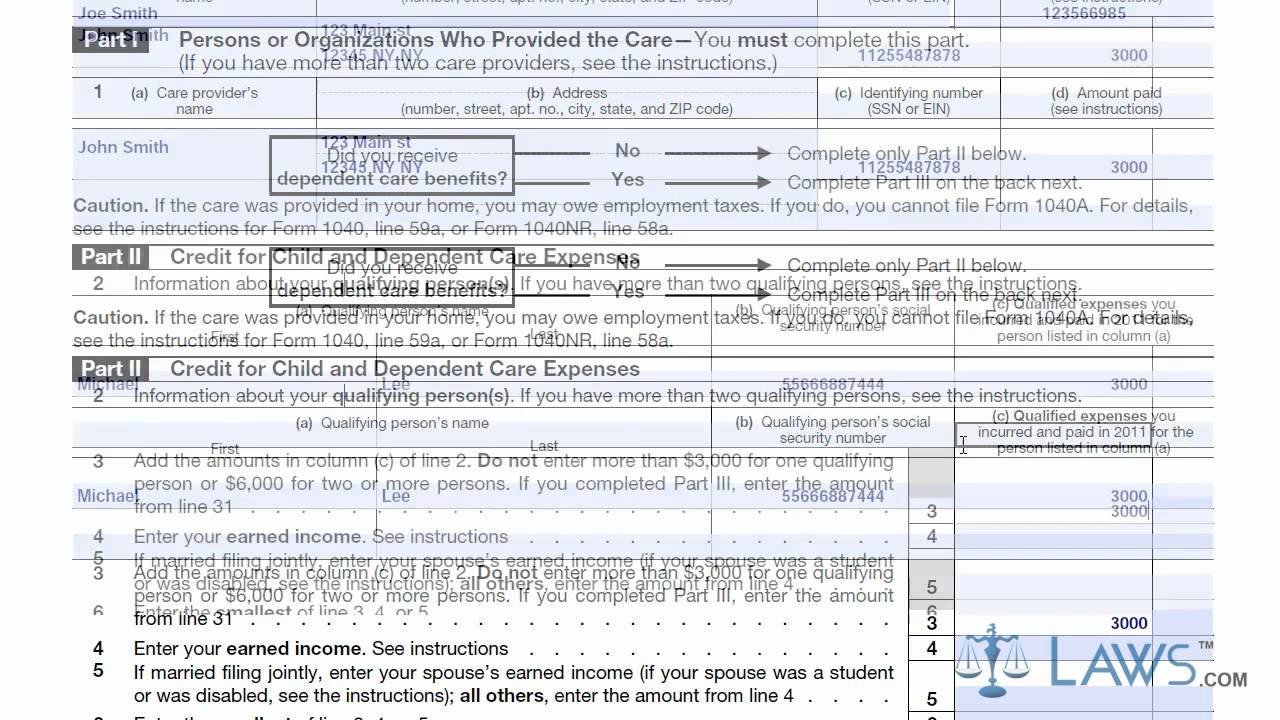

Form 2441 Provider Ssn - Enter the total amount paid to care provider in 2022 for all dependents. (updated august 24, 2021) q2. Web claim the childcare expenses on form 2441, child and dependent care expenses and provide the care provider's information you have available (such as name. Web 11 14,033 reply bookmark icon cherylw level 3 turbo tax is asking for the amount that you paid to your child's care provider. Next, enter the total amount of qualified expenses paid for each dependent. Web form 2441 based on the income rules listed in the instructions under. Column (c) if the care provider is an individual, enter his or her ssn. If your care provider is foreign and does not have or is not required to have a taxpayer identification. Taxpayer identification number (for example, an ssn or an ein). Select edit next to the appropriate dependent.

Part i persons or organizations. Select edit next to the appropriate dependent. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web claim the childcare expenses on form 2441, child and dependent care expenses and provide the care provider's information you have available (such as name. Fill out any other applicable information on this. No., city, state, and zip code) (c) identifying number (ssn or ein) Next, enter the total amount of qualified expenses paid for each dependent. Web add a child care provider. Web 1 min read it depends. If your care provider is foreign and does not have or is not required to have a taxpayer identification.

Am i eligible to claim the credit? Web 11 14,033 reply bookmark icon cherylw level 3 turbo tax is asking for the amount that you paid to your child's care provider. Web claiming the credit q1. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. You cannot claim a deduction for childcare expenses. Enter the total amount paid to care provider in 2022 for all dependents. No., city, state, and zip code) (c) identifying number (ssn or ein) Web 1 min read it depends. Select edit next to the appropriate dependent. You can usually find this amount on.

2020 Tax Form 2441 Create A Digital Sample in PDF

Am i eligible to claim the credit? (updated august 24, 2021) q2. Next, enter the total amount of qualified expenses paid for each dependent. Web form 2441 based on the income rules listed in the instructions under. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying.

Ssurvivor Form 2441 Child And Dependent Care Expenses

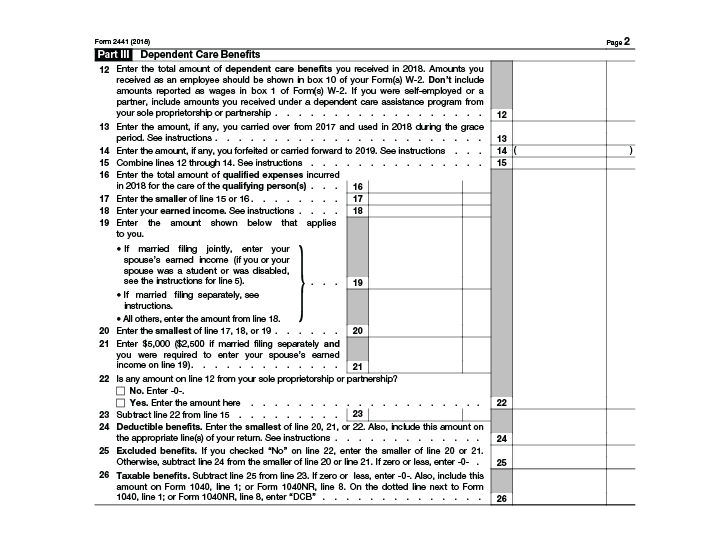

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Web.

Form 2441 YouTube

Web add a child care provider. Web 1 min read it depends. Column (c) if the care provider is an individual, enter his or her ssn. Web identification number (ssn or ein). Web if you don’t have any care providers and you are filing form 2441 only to report taxable income in part iii, enter “none” in line 1, column.

All About IRS Form 2441 SmartAsset

Web claim the childcare expenses on form 2441, child and dependent care expenses and provide the care provider's information you have available (such as name. Web 1 min read it depends. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based.

Form 2441 Definition

(updated august 24, 2021) q2. Part i persons or organizations. Web form 2441 based on the income rules listed in the instructions under. Am i eligible to claim the credit? If you or your spouse was a student or disabled, check this box.

IRS Form 2441 What It Is, Who Can File, and How To Fill it Out (2023)

Web 1 min read it depends. If you or your spouse was a student or disabled, check this box. Web form 2441 based on the income rules listed in the instructions under. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441.

Tax Form 2441 Filing Child and Dependent Care Expenses Top Daycare

Fill out any other applicable information on this. Web 1 min read it depends. You cannot claim a deduction for childcare expenses. Web per irs instructions for form 2441 child and dependent care expenses, page 3: Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to.

The child care tax credit is a good claim on 2020 taxes, even better

If you or your spouse was a student or disabled, check this box. Web add a child care provider. Part i persons or organizations. Web 11 14,033 reply bookmark icon cherylw level 3 turbo tax is asking for the amount that you paid to your child's care provider. To claim the child and dependent care credit, you must identify the.

2018 Form IRS 2441 Fill Online, Printable, Fillable, Blank PDFfiller

Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules. Web for the latest information about developments related to form 2441 and its instructions, such as legislation enacted after they were published, go to irs.gov/ form2441. Column.

Learn How to Fill the Form 2441 Dependent Care Expenses YouTube

Fill out any other applicable information on this. Enter the total amount paid to care provider in 2022 for all dependents. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. You can usually find this amount on. Next, enter.

(Updated August 24, 2021) Q3.

Fill out any other applicable information on this. If your care provider is foreign and does not have or is not required to have a taxpayer identification. No., city, state, and zip code) (c) identifying number (ssn or ein) Web form 2441 based on the income rules listed in the instructions under.

Web Identification Number (Ssn Or Ein).

If you or your spouse was a student or disabled, check this box. Web per irs instructions for form 2441 child and dependent care expenses, page 3: You cannot claim a deduction for childcare expenses. (updated august 24, 2021) q2.

Web 11 14,033 Reply Bookmark Icon Cherylw Level 3 Turbo Tax Is Asking For The Amount That You Paid To Your Child's Care Provider.

Enter the total amount paid to care provider in 2022 for all dependents. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Web 1 min read it depends. Web if you or your spouse was a student or was disabled during 2022 and you’re entering deemed income of $250 or $500 a month on form 2441 based on the income rules.

Web If You Don’t Have Any Care Providers And You Are Filing Form 2441 Only To Report Taxable Income In Part Iii, Enter “None” In Line 1, Column (A).

Web add a child care provider. Web if you are living abroad, your care provider may not have, and may not be required to get, a u.s. Am i eligible to claim the credit? Web 1 (a) care provider’s name (b) address care provider is your (number, street, apt.

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

:max_bytes(150000):strip_icc()/IRSForm2441Pg1jpeg-8199e1f7d5e74c94b3b7d4ce12d6071a.jpg)