Form 2441 Instructions 2020

Form 2441 Instructions 2020 - Amounts you received as an employee. Experience a faster way to fill out and. Make everything for your comfortable and easy work. Web instructions the irs has released the latest versions of publication 503 and form 2441 (and its accompanying instructions) for the 2020 tax year. If your adjusted gross income is. Web received any dependent care benefits for 2020, you must use form 2441 to figure the amount, if any, of the benefits you can exclude from your income. To complete form 2441 child and dependent care expenses in the taxact program: Web form 2441 (2020) page 2 part iii dependent care benefits 12 enter the total amount of dependent care benefits you received in 2020. Qualifying person (s) a qualifying person is: Web per irs instructions for form 2441, on page 1:

Make everything for your comfortable and easy work. Qualifying person (s) a qualifying person is: Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Web per irs instructions for form 2441, on page 1: Web instructions for line 13. A qualifying child under age 13 whom you can claim as a dependent. If your adjusted gross income is. One of the eligibility requirements for the child and dependent care credit states that the childcare. There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based.

Web instructions for line 13. Form 2441 is used to by. Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. Name on form 1040n your social security number. Qualifying person (s) a qualifying person is: Web the irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. Web received any dependent care benefits for 2020, you must use form 2441 to figure the amount, if any, of the benefits you can exclude from your income. A qualifying child under age 13 whom you can claim as a dependent. If your adjusted gross income is.

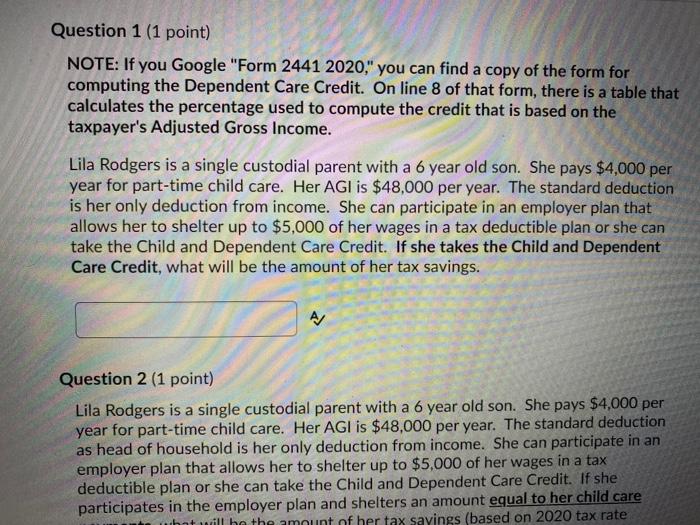

Solved Question 1 (1 point) NOTE If you Google "Form 2441

Experience a faster way to fill out and. If your adjusted gross income is. A qualifying child under age 13 whom you can claim as a dependent. Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. There is a new line b.

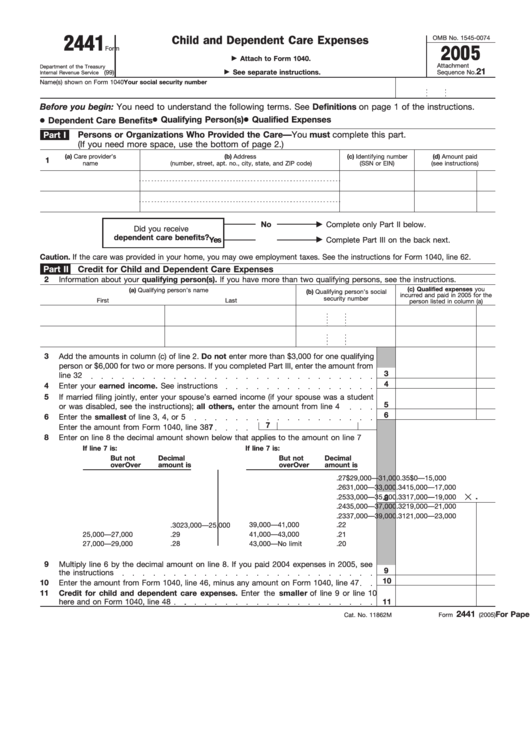

Fillable Form 2441 Child And Dependent Care Expenses printable pdf

There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. Experience a faster way to fill out and. Web using our ultimate solution will make professional filling irs instruction 2441 possible. A qualifying child under age 13 whom you can claim.

2019 form 2441 instructions Fill Online, Printable, Fillable Blank

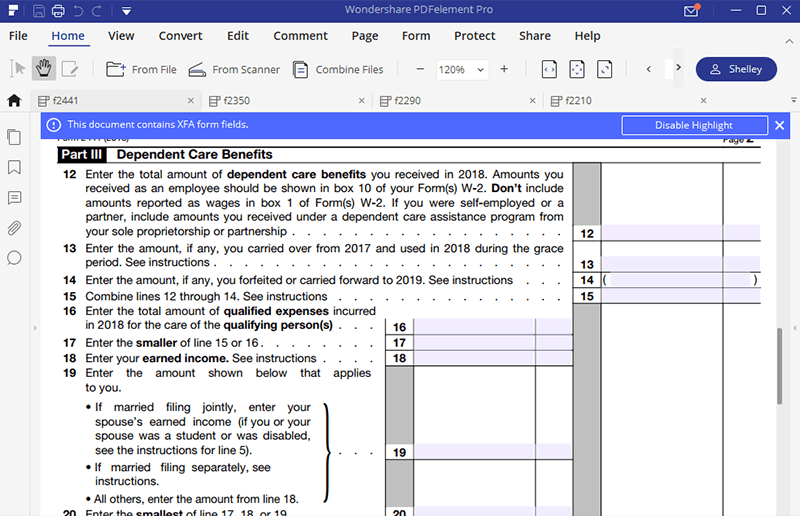

Amounts you received as an employee. Web form 2441 (2020) page 2 part iii dependent care benefits 12 enter the total amount of dependent care benefits you received in 2020. Web using our ultimate solution will make professional filling irs instruction 2441 possible. Form 2441 is used to by. Web information about form 2441, child and dependent care expenses, including.

2020 Form IRS Instruction 2441 Fill Online, Printable, Fillable, Blank

Web instructions for line 13. Form 2441 is used to by. Amounts you received as an employee. There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. Web the irs has released form 2441 (child and dependent care expenses) and its.

Ssurvivor Form 2441 Child And Dependent Care Expenses Instructions

Make everything for your comfortable and easy work. If your adjusted gross income is. A qualifying child under age 13 whom you can claim as a dependent. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. To complete form.

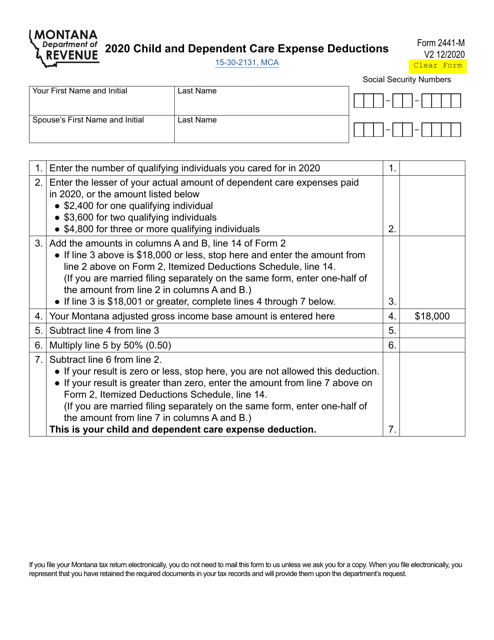

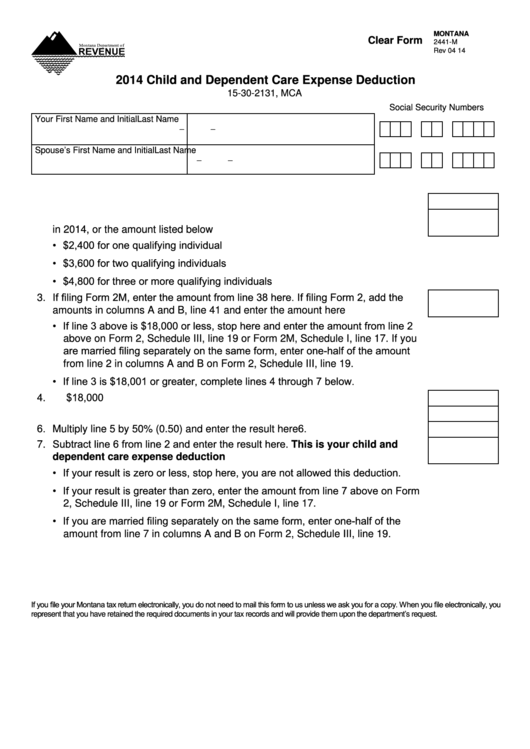

Form 2441M Download Fillable PDF or Fill Online Child and Dependent

There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. Form 2441 is used to by. To complete form 2441 child and dependent care expenses in the taxact program: Experience a faster way to fill out and. Web form 2441, child.

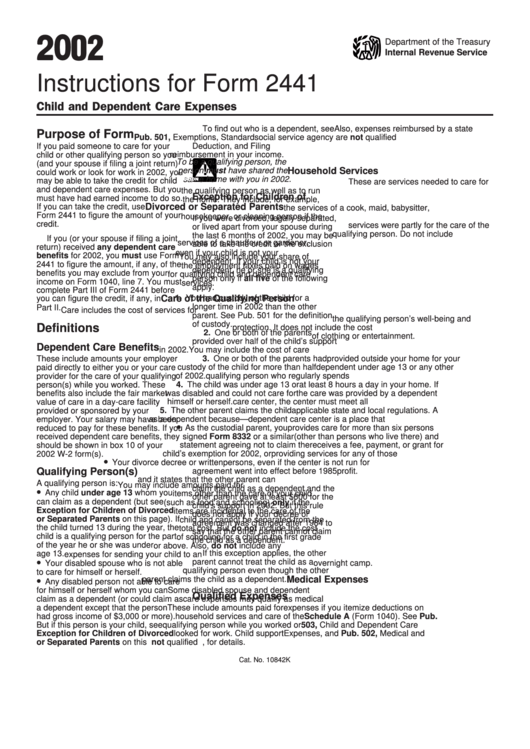

2002 Instructions For Form 2441 printable pdf download

Web per irs instructions for form 2441, on page 1: Make everything for your comfortable and easy work. If your adjusted gross income is. Form 2441 is used to by. Name on form 1040n your social security number.

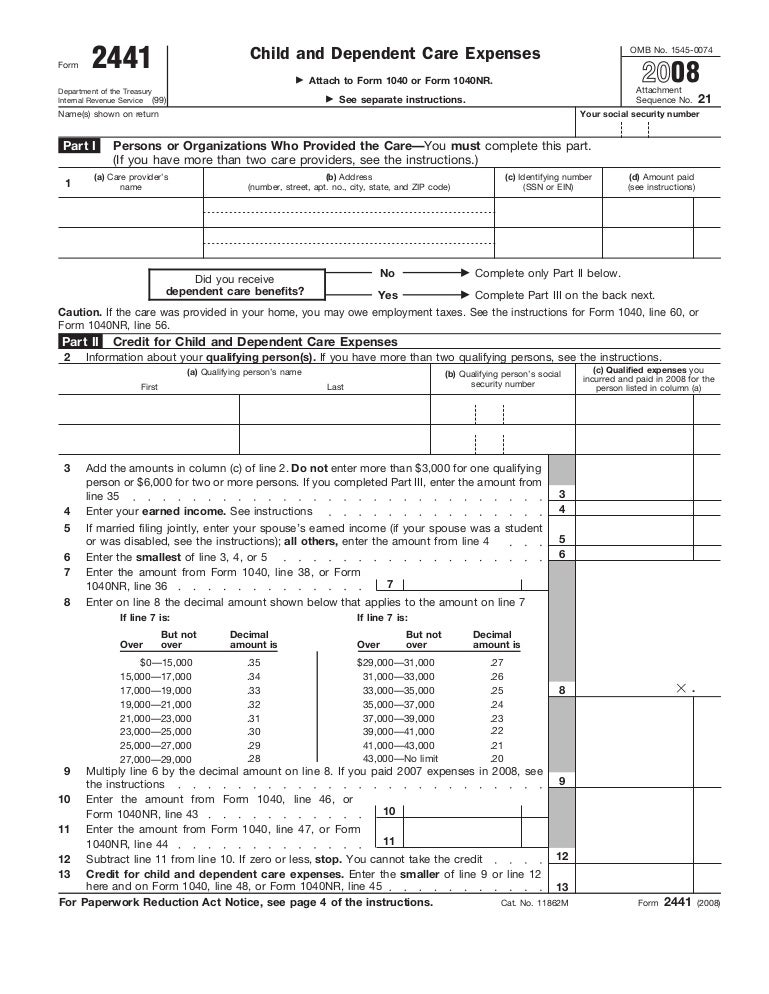

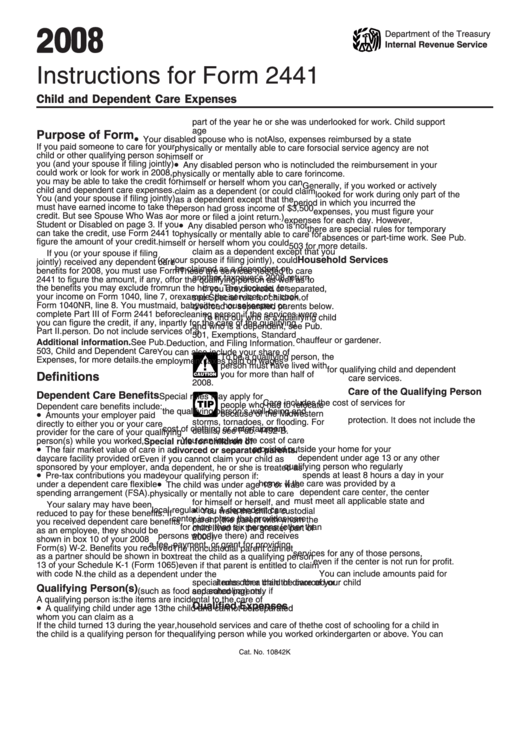

Instructions For Form 2441 Child And Dependent Care Expenses 2008

Experience a faster way to fill out and. There is a new line b that has a checkbox for you to indicate if you’re entering deemed income of $250 or $500 a month on form 2441 based. Web per irs instructions for form 2441, on page 1: Web form 2441 (2020) page 2 part iii dependent care benefits 12 enter.

Fillable Form 2441M Child And Dependent Care Expense Deduction

If your adjusted gross income is. Form 2441 is used to by. One of the eligibility requirements for the child and dependent care credit states that the childcare. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying. Web instructions.

Breanna Form 2441 Tax Liability Limit

One of the eligibility requirements for the child and dependent care credit states that the childcare. Web form 2441 (2020) page 2 part iii dependent care benefits 12 enter the total amount of dependent care benefits you received in 2020. Web instructions for line 13. Web received any dependent care benefits for 2020, you must use form 2441 to figure.

Web Instructions For Line 13.

Web information about form 2441, child and dependent care expenses, including recent updates, related forms, and instructions on how to file. A qualifying child under age 13 whom you can claim as a dependent. If your adjusted gross income is. Qualifying person (s) a qualifying person is:

Web Instructions The Irs Has Released The Latest Versions Of Publication 503 And Form 2441 (And Its Accompanying Instructions) For The 2020 Tax Year.

Amounts you received as an employee. Web per irs instructions for form 2441, on page 1: Web form 2441 (2020) page 2 part iii dependent care benefits 12 enter the total amount of dependent care benefits you received in 2020. Name on form 1040n your social security number.

Web Using Our Ultimate Solution Will Make Professional Filling Irs Instruction 2441 Possible.

Make everything for your comfortable and easy work. Experience a faster way to fill out and. Web received any dependent care benefits for 2020, you must use form 2441 to figure the amount, if any, of the benefits you can exclude from your income. One of the eligibility requirements for the child and dependent care credit states that the childcare.

Form 2441 Is Used To By.

Web form 2441, child and dependent care expenses, is an internal revenue service (irs) form used to report child and dependent care expenses on your tax return. To complete form 2441 child and dependent care expenses in the taxact program: Web the irs has released form 2441 (child and dependent care expenses) and its accompanying instructions for the 2021 tax year. Web the maximum amount of qualified child and dependent care expenses that can be claimed on form 2441 is $3,000 for one qualifying person, $6,000 for two or more qualifying.