Form 1120 Schedule O

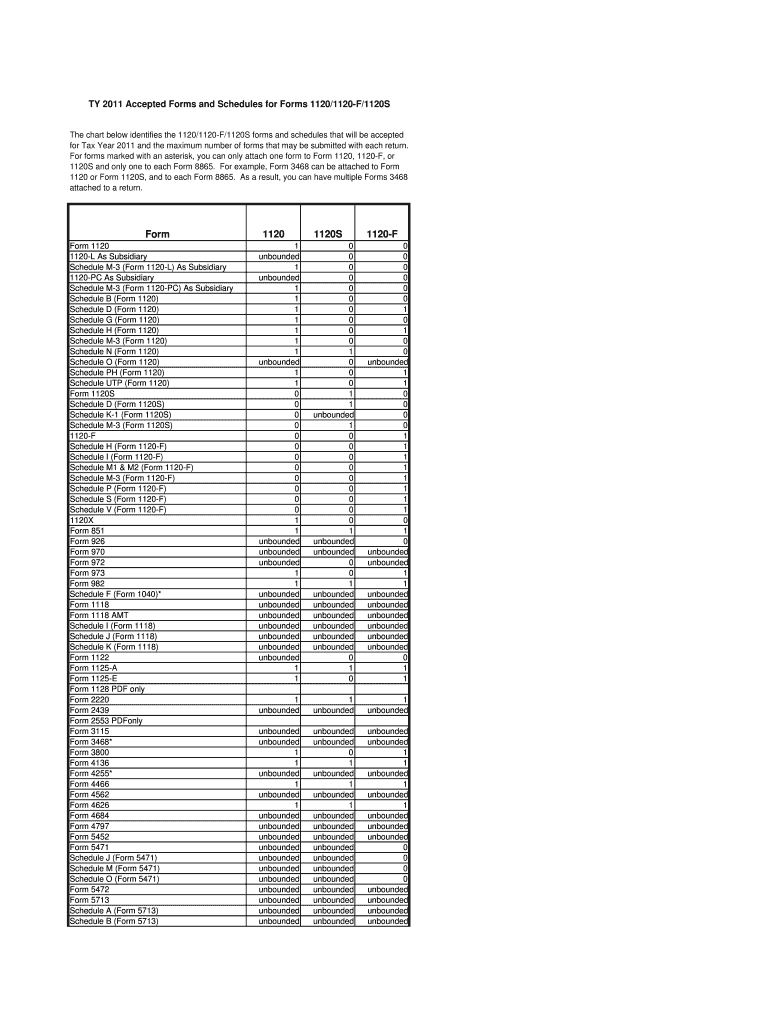

Form 1120 Schedule O - This is the first circulated draft of the schedule o (form 1120) (rev. Web schedule o (form 1120) (2011) page 2 part ii taxable income apportionment (see instructions) caution: These changes are effective for tax years beginning after december 31, 2017. Employer identification number (ein) date you incorporated total assets gross receipts. Web schedule o (form 1120) (rev. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax year 2022. Web schedule o (form 1120), consent plan and apportionment schedule for a controlled group (rev. Component members of a controlled group must use schedule o to report the apportionment of certain tax benefits between the members of the group. Consent plan and apportionment schedule for a controlled group. Condominium management, residential real estate management, or timeshare association that elects to be treated as an hoa ;

Web a corporation that is a component member of a controlled group must use schedule o (form 1120) to report the apportionment of taxable income, income tax, and certain tax benefits between all component members of the group. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. These changes are effective for tax years beginning after december 31, 2017. This is the first circulated draft of the schedule o (form 1120) (rev. Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat 21% corporate tax rate and the repeal of the corporate alternative minimum tax. For instructions and the latest information. December 2018) department of the treasury internal revenue service. December 2009) for your review and comments. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax year 2022. Web schedule o (form 1120), consent plan and apportionment schedule for a controlled group (rev.

Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. None, but one may be arranged if. This is the first circulated draft of the schedule o (form 1120) (rev. Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax year 2022. Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat 21% corporate tax rate and the repeal of the corporate alternative minimum tax. Each total in part ii, column (g) for each component member must equal taxable income from form 1120, page 1, line 30 or the comparable line of such member’s tax return. Component members of a controlled group must use schedule o to report the apportionment of certain tax benefits between the members of the group. December 2018) department of the treasury internal revenue service. For instructions and the latest information. (a) group member’s name and employer identification number

IRS Form 1120 Schedule O Download Fillable PDF or Fill Online Consent

For instructions and the latest information. Consent plan and apportionment schedule for a controlled group. Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat 21% corporate tax rate and the repeal of the corporate alternative minimum tax. For cooperatives, including.

Form 1120 Line 26 Other Deductions Worksheet Fill Out and Sign

Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat 21% corporate tax rate and the repeal of the corporate alternative minimum tax. None, but one may be arranged if. See below for a discussion of the major changes. For instructions.

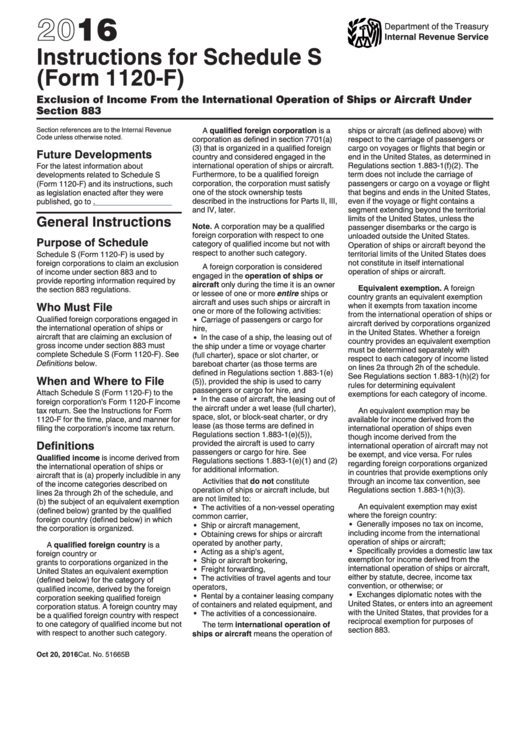

Instructions For Schedule S (form 1120f) 2016 printable pdf download

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Web schedule o (form 1120), consent plan and apportionment schedule for a controlled group (rev. Web a corporation that is a component member of a controlled group must use schedule o (form 1120) to report.

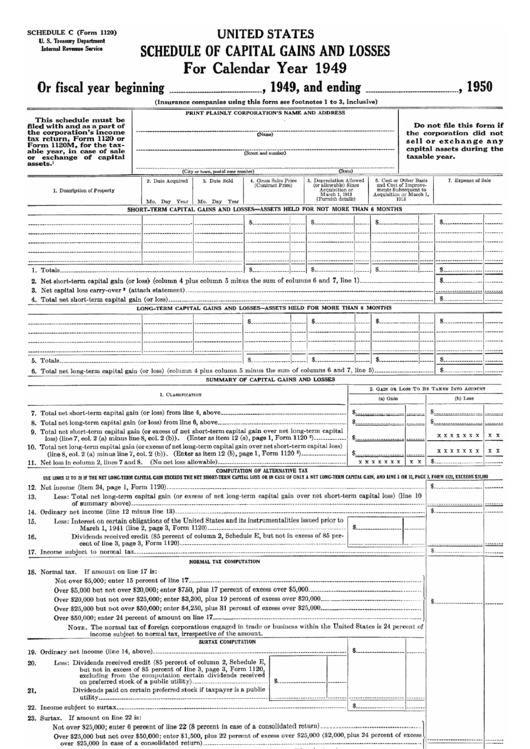

Form 1120 Schedule C Schedule Of Capital Gains And Losses 1949

(a) group member’s name and employer identification number Employer identification number (ein) date you incorporated total assets gross receipts. This is the first circulated draft of the schedule o (form 1120) (rev. Consent plan and apportionment schedule for a controlled group. December 2018) department of the treasury internal revenue service.

Federal Form 1120 Schedule E Instructions Bizfluent

Gather your business and financial information beforehand so you’re ready to fill out form 1120, including: This is the first circulated draft of the schedule o (form 1120) (rev. Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. See below for a discussion of the major changes. For cooperatives, including farmers’ cooperatives.

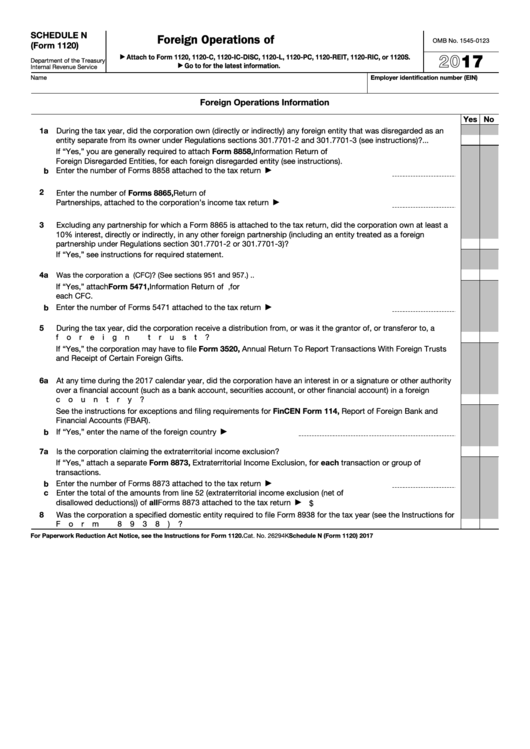

Fillable Schedule N (Form 1120) Foreign Operations Of U.s

Each total in part ii, column (g) for each component member must equal taxable income from form 1120, page 1, line 30 or the comparable line of such member’s tax return. Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat.

Form 1120 (Schedule O) Consent Plan and Apportionment Schedule (2012

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. Condominium management, residential real estate management, or timeshare association that elects to be treated as an hoa ; Component members of a controlled group must use schedule o to report the apportionment of certain tax.

Form 1120 (Schedule O) Consent Plan and Apportionment Schedule (2012

(a) group member’s name and employer identification number For instructions and the latest information. December 2018) department of the treasury internal revenue service. These changes are effective for tax years beginning after december 31, 2017. Component members of a controlled group must use schedule o to report the apportionment of certain tax benefits between the members of the group.

3.11.16 Corporate Tax Returns Internal Revenue Service

For cooperatives, including farmers’ cooperatives ; Web schedule o (form 1120) (rev. None, but one may be arranged if. This is the first circulated draft of the schedule o (form 1120) (rev. (a) group member’s name and employer identification number

Form 1120 (Schedule O) Consent Plan and Apportionment Schedule (2012

(a) group member’s name and employer identification number Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. See below for a discussion of the major changes. Gather your business and financial information beforehand so you’re ready to fill out form 1120, including: Employer identification number (ein) date you incorporated total assets gross.

This Is The First Circulated Draft Of The Schedule O (Form 1120) (Rev.

None, but one may be arranged if. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to www.irs.gov/form1120 for instructions and the latest information. December 2009) for your review and comments. (a) group member’s name and employer identification number

Condominium Management, Residential Real Estate Management, Or Timeshare Association That Elects To Be Treated As An Hoa ;

See below for a discussion of the major changes. For cooperatives, including farmers’ cooperatives ; Web complete and attach schedule o (form 1120), consent plan and apportionment schedule for a controlled group. These changes are effective for tax years beginning after december 31, 2017.

Web Schedule O (Form 1120) (Rev.

Web schedule o (form 1120), consent plan and apportionment schedule for a controlled group (rev. Consent plan and apportionment schedule for a controlled group. Each total in part ii, column (g) for each component member must equal taxable income from form 1120, page 1, line 30 or the comparable line of such member’s tax return. Web schedule o (form 1120) (2011) page 2 part ii taxable income apportionment (see instructions) caution:

For Instructions And The Latest Information.

Web we last updated the consent plan and apportionment schedule for a controlled group in february 2023, so this is the latest version of 1120 (schedule o), fully updated for tax year 2022. Employer identification number (ein) date you incorporated total assets gross receipts. Web schedule o (form 1120) and the instructions for schedule o (form 1120) have been revised to reflect the replacement of the graduated corporate tax structure with a flat 21% corporate tax rate and the repeal of the corporate alternative minimum tax. Component members of a controlled group must use schedule o to report the apportionment of certain tax benefits between the members of the group.