Form 1065-X

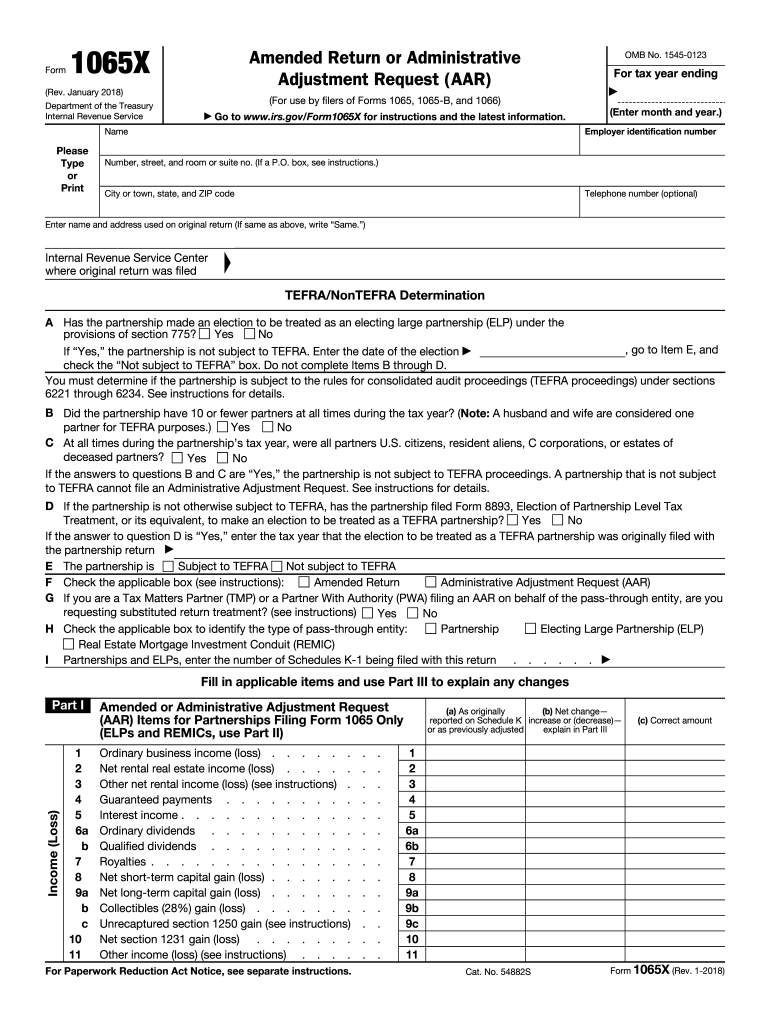

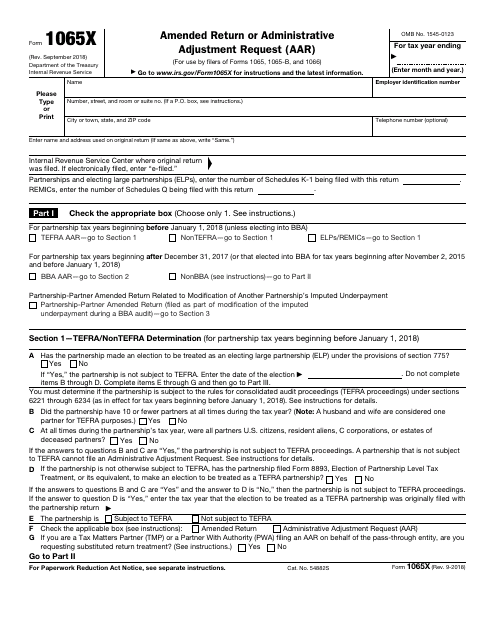

Form 1065-X - And the total assets at the end of the tax year. The requirement to file an electronic. Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being electronically filed. Web form 1065x pdf details. Form 1065x is an amended u.s. When you enter this information, ultratax. Web click the statement dialog button for the amended return field, and enter the reason for the amended return in the statement dialog. If the partnership's principal business, office, or agency is located in: Complete, edit or print tax forms instantly. Department of the treasury internal revenue service.

And the total assets at the end of the tax year. If the partnership's principal business, office, or agency is located in: Complete, edit or print tax forms instantly. Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being electronically filed. Web form 1065x to correct their previously filed partnership or remic return. When you enter this information, ultratax. Department of the treasury internal revenue service. Ad file partnership and llc form 1065 fed and state taxes with taxact® business. The requirement to file an electronic. Web click the statement dialog button for the amended return field, and enter the reason for the amended return in the statement dialog.

For instructions and the latest. Department of the treasury internal revenue service. And the total assets at the end of the tax year. When you enter this information, ultratax. Web developments related to form 1065x and its instructions, such as legislation enacted after they were published, go to irs.gov/form1065x. See specific instructions, later, for information on completing form 1065x as an amended return. The requirement to file an electronic. Web click the statement dialog button for the amended return field, and enter the reason for the amended return in the statement dialog. What's new tax and payment. If the partnership's principal business, office, or agency is located in:

Download Form 1065 for Free Page 2 FormTemplate

If the partnership's principal business, office, or agency is located in: The requirement to file an electronic. Web form 1065x to correct their previously filed partnership or remic return. Web form 1065x pdf details. Web click the statement dialog button for the amended return field, and enter the reason for the amended return in the statement dialog.

Form 1065X Amended Return or Administrative Adjustment Request (2012

Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being electronically filed. What's new tax and payment. For instructions and the latest. If the partnership's principal business, office, or agency is located in: Ad file partnership and llc form 1065 fed and state taxes with taxact® business.

1065X Irs Fill Out and Sign Printable PDF Template signNow

Department of the treasury internal revenue service. For instructions and the latest. If the partnership's principal business, office, or agency is located in: See specific instructions, later, for information on completing form 1065x as an amended return. Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being.

Form 1065X Amended Return or Administrative Adjustment Request (2012

Web developments related to form 1065x and its instructions, such as legislation enacted after they were published, go to irs.gov/form1065x. Department of the treasury internal revenue service. Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being electronically filed. Complete, edit or print tax forms instantly. Web.

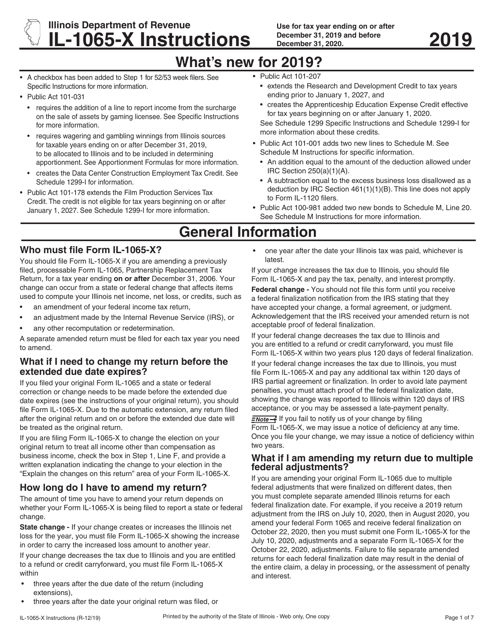

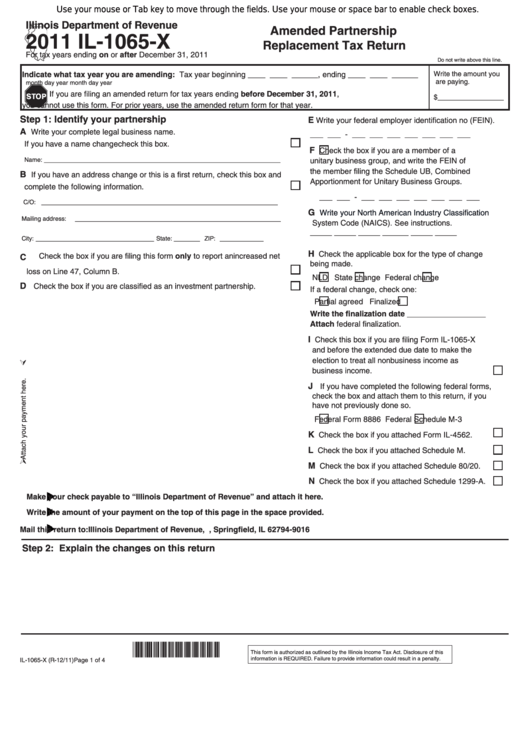

Download Instructions for Form IL1065X ' amended Partnership

Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being electronically filed. For instructions and the latest. Web what is the form used for? Complete, edit or print tax forms instantly. And the total assets at the end of the tax year.

IRS Form 1065X Download Fillable PDF or Fill Online Amended Return or

Web form 1065x pdf details. When you enter this information, ultratax. Web what is the form used for? Web form 1065x to correct their previously filed partnership or remic return. Department of the treasury internal revenue service.

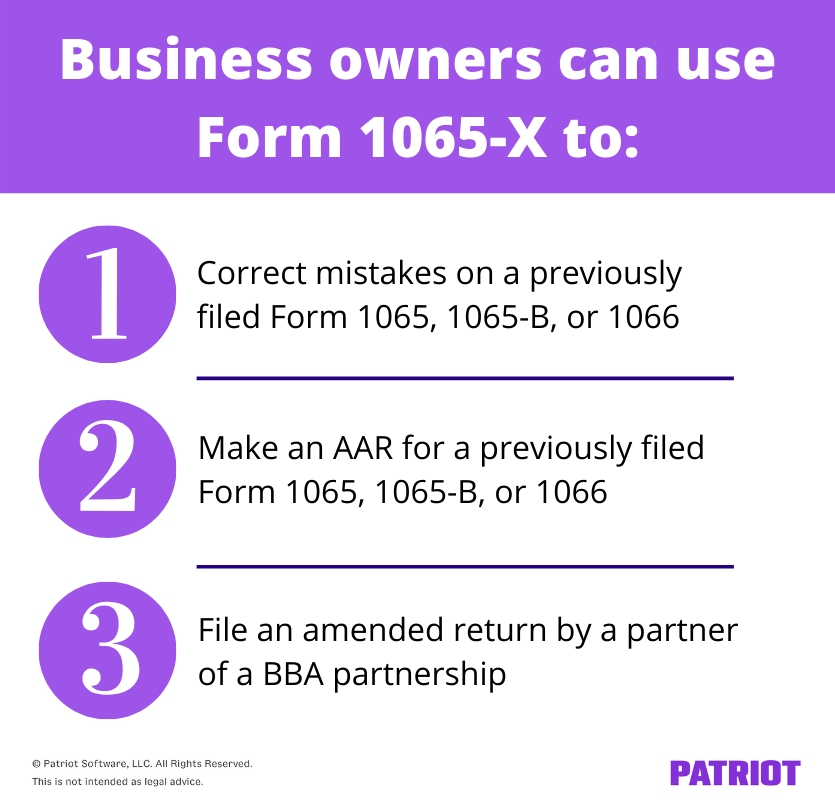

What Is Form 1065X? Definition, Sections, & More

What's new tax and payment. Form 1065x is an amended u.s. Complete, edit or print tax forms instantly. Web form 1065x pdf details. The requirement to file an electronic.

Fillable Form Il1065X Amended Partnership Replacement Tax Return

Web click the statement dialog button for the amended return field, and enter the reason for the amended return in the statement dialog. For instructions and the latest. What's new tax and payment. Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are.

Fill Free fillable Amended Return or Administrative Adjustment

Ad file partnership and llc form 1065 fed and state taxes with taxact® business. And the total assets at the end of the tax year. Complete, edit or print tax forms instantly. Web where to file your taxes for form 1065. If the partnership's principal business, office, or agency is located in:

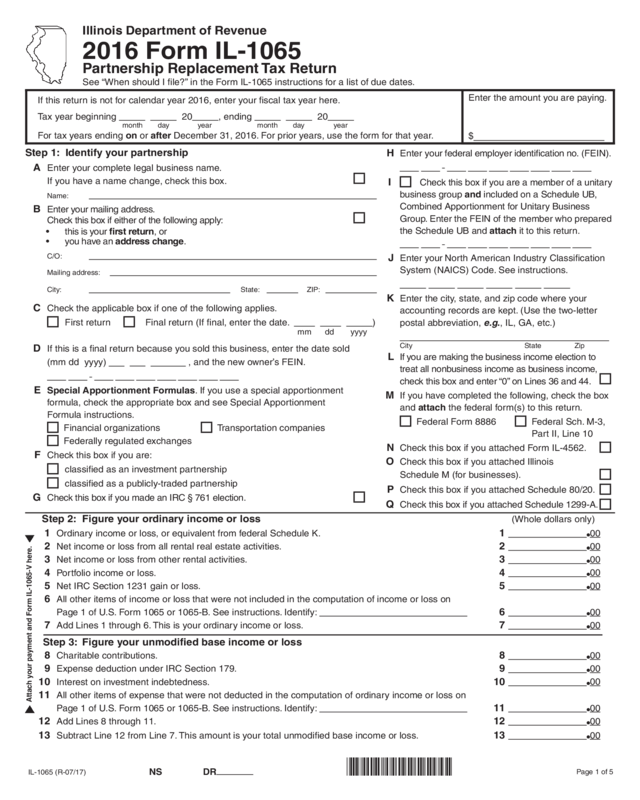

2016 Form Il1065, Partnership Replacement Tax Return Edit, Fill

Web click the statement dialog button for the amended return field, and enter the reason for the amended return in the statement dialog. Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being electronically filed. Complete, edit or print tax forms instantly. Web developments related to form.

Department Of The Treasury Internal Revenue Service.

Web click the statement dialog button for the amended return field, and enter the reason for the amended return in the statement dialog. And the total assets at the end of the tax year. Web developments related to form 1065x and its instructions, such as legislation enacted after they were published, go to irs.gov/form1065x. Web where to file your taxes for form 1065.

Ad File Partnership And Llc Form 1065 Fed And State Taxes With Taxact® Business.

• make an aar for a. Complete, edit or print tax forms instantly. What's new tax and payment. For instructions and the latest.

When You Enter This Information, Ultratax.

Web what is the form used for? If the partnership's principal business, office, or agency is located in: Complete, edit or print tax forms instantly. Web no, form 1065x is not available to be electronically filed and does not get included when an amended partnership return is being electronically filed.

See Specific Instructions, Later, For Information On Completing Form 1065X As An Amended Return.

Web form 1065 is an informational tax form used to report the income, gains, losses, deductions and credits of a partnership or llc, but no taxes are calculated or. Web form 1065x pdf details. Web form 1065x to correct their previously filed partnership or remic return. The requirement to file an electronic.