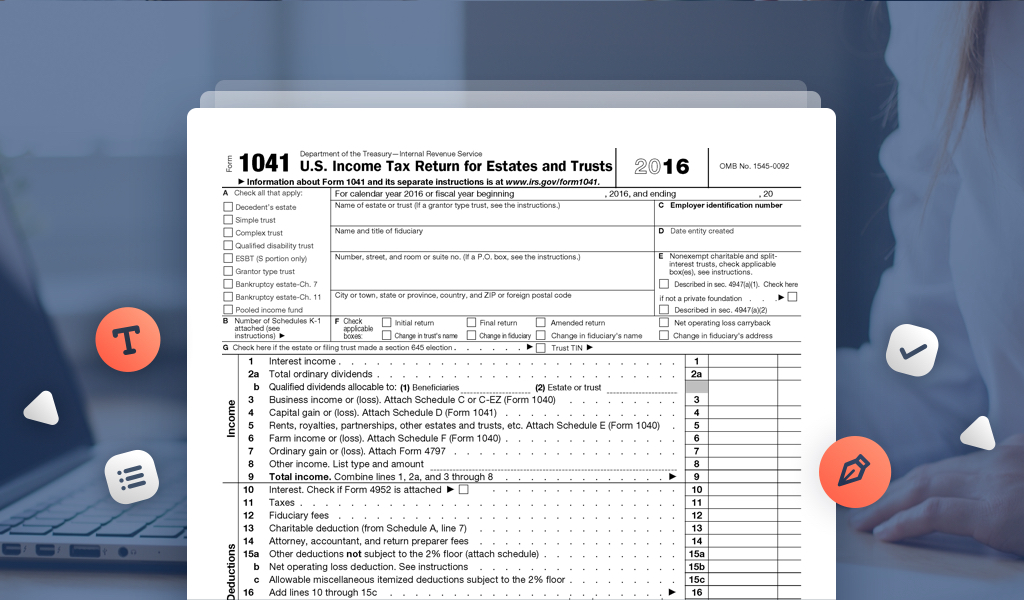

Form 1041 Pdf

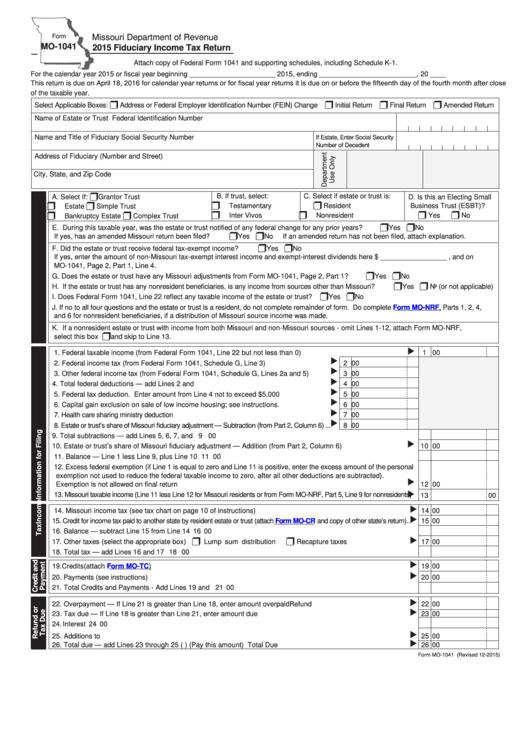

Form 1041 Pdf - Check out samples to report income, deductions & losses correctly. Web who must file form mo‑1041. Income tax return for estates and trusts For instructions and the latest information. Irs 1041 is an official form of tax return that can be used by trusts and estates. Ad form 1041 schedule j—trusts & throwback rules. Then download the relevant pdf to print out or find a. Information return trust accumulation of charitable amounts. Irs form 1041 is a very important document that should be handled with care. This form may be familiar to you as the american income tax return for.

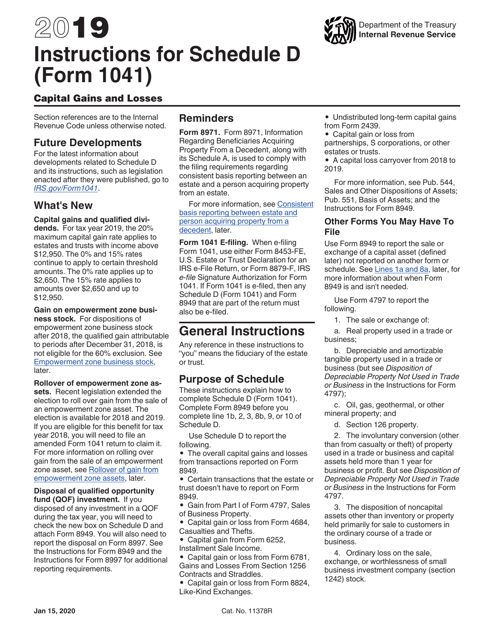

Download the 1041 form or obtain a fillable pdf to fill out & file online. Ad form 1041 schedule j—trusts & throwback rules. Obtain a sample of the 1041 estates tax return as a reference. Income tax return for estates and trusts This form may be familiar to you as the american income tax return for. Information return trust accumulation of charitable amounts. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¸ · » ¸ ·äº ¹¾»ºëâ»é ·äº ¸ u.s. Web what is irs form 1041? Irs 1041 is an official form of tax return that can be used by trusts and estates. You one software that has made.

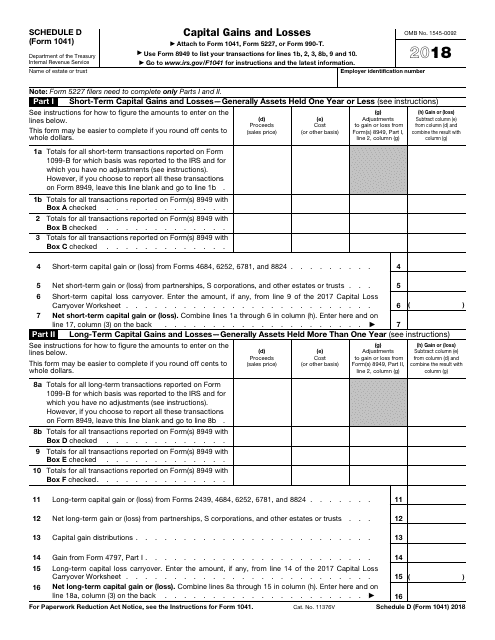

Ad form 1041 schedule j—trusts & throwback rules. 2 schedule a charitable deduction. Check out samples to report income, deductions & losses correctly. Web who must file form mo‑1041. Irs 1041 is an official form of tax return that can be used by trusts and estates. Then download the relevant pdf to print out or find a. For instructions and the latest information. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1041 (schedule d), fully updated for tax year 2022. Source income of foreign persons; Steps to complete the blank copy.

PDFfiller Fast. Easy. Secure.PDFfiller Fast. Easy. Secure.

Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1041 (schedule d), fully updated for tax year 2022. For instructions and the latest information. For calendar year 2020 or fiscal year beginning , 2020, and ending. Web irs form 1041 for 2022: A return must be filed by the following:

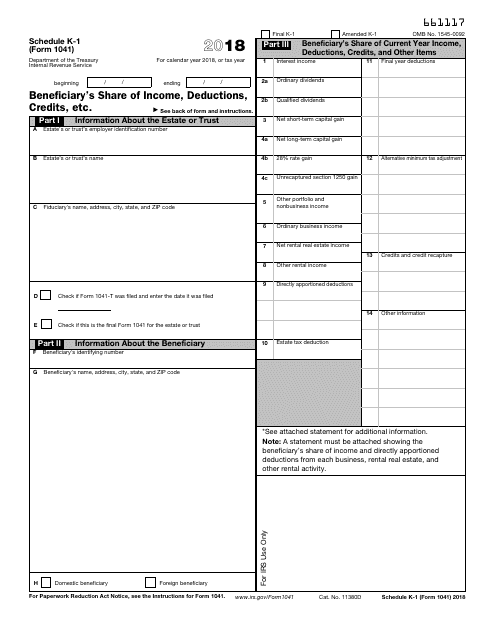

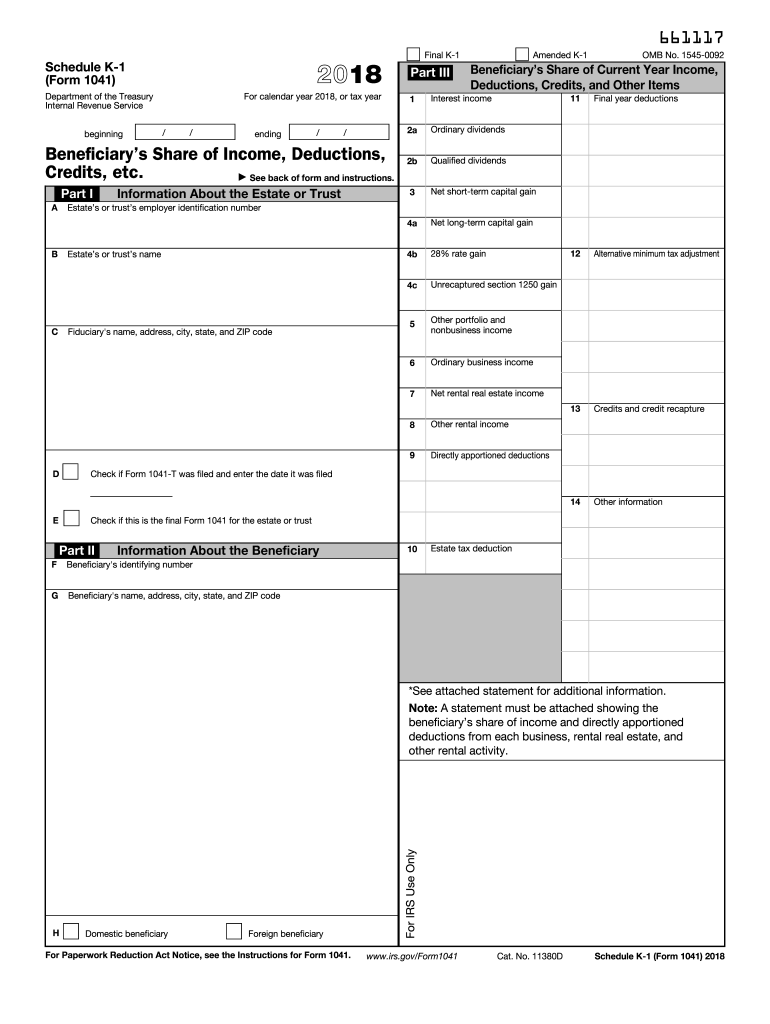

IRS Form 1041 Schedule K1 Download Fillable PDF or Fill Online

Don’t complete for a simple trust or a pooled income fund. Form 1042, annual withholding tax return for u.s. Steps to complete the blank copy. For calendar year 2020 or fiscal year beginning , 2020, and ending. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¸ · » ¸ ·äº ¹¾»ºëâ»é ·äº ¸ u.s.

K1 Form Fill Out and Sign Printable PDF Template signNow

Ad form 1041 schedule j—trusts & throwback rules. Every resident estate or trust that is required to file a federal form 1041. Check out samples to report income, deductions & losses correctly. 2 schedule a charitable deduction. Steps to complete the blank copy.

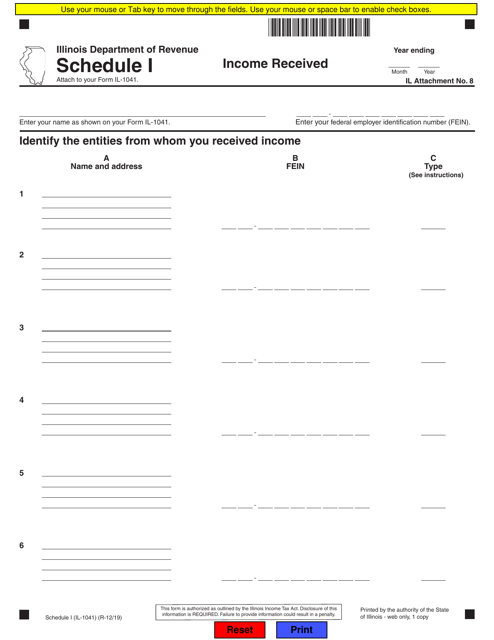

Form IL1041 Schedule I Download Fillable PDF or Fill Online

For instructions and the latest information. For calendar year 2020 or fiscal year beginning , 2020, and ending. Web get irs form 1041 for estates & trusts. Irs 1041 is an official form of tax return that can be used by trusts and estates. Ad form 1041 schedule j—trusts & throwback rules.

IRS Form 1041 Schedule D Download Fillable PDF or Fill Online Capital

Irs form 1041 is a very important document that should be handled with care. Every resident estate or trust that is required to file a federal form 1041. New jersey income tax fiduciary return. Web get irs form 1041 for estates & trusts. Income tax return for estates and trusts

2022 1041 Editable Pdf Editable Online Blank in PDF

Irs 1041 is an official form of tax return that can be used by trusts and estates. New jersey income tax fiduciary return. Steps to complete the blank copy. Then download the relevant pdf to print out or find a. Web irs form 1041 for 2022:

Download Instructions for IRS Form 1041 Schedule D Capital Gains and

Obtain a sample of the 1041 estates tax return as a reference. Web get irs form 1041 for estates & trusts. Download the 1041 form or obtain a fillable pdf to fill out & file online. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1041 (schedule d), fully updated.

1041 Fill Out and Sign Printable PDF Template signNow

Ad form 1041 schedule j—trusts & throwback rules. For instructions and the latest information. Web get irs form 1041 for estates & trusts. Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1041 (schedule d), fully updated for tax year 2022. This form may be familiar to you as the.

form 1041 sch b instructions Fill Online, Printable, Fillable Blank

For instructions and the latest information. New jersey income tax fiduciary return. Then download the relevant pdf to print out or find a. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¸ · » ¸ ·äº ¹¾»ºëâ»é ·äº ¸ u.s. 2 schedule a charitable deduction.

Fillable Form Mo1041 Fiduciary Tax Return 2015 printable

Web we last updated the capital gains and losses in december 2022, so this is the latest version of 1041 (schedule d), fully updated for tax year 2022. You can download or print. Download the 1041 form or obtain a fillable pdf to fill out & file online. 1041 (2022) form 1041 (2022) page. For calendar year 2020 or fiscal.

Information Return Trust Accumulation Of Charitable Amounts.

A return must be filed by the following: Ad download or email irs 1041 & more fillable forms, register and subscribe now! Irs 1041 is an official form of tax return that can be used by trusts and estates. Income tax return for estates and trusts

For Calendar Year 2020 Or Fiscal Year Beginning , 2020, And Ending.

2 schedule a charitable deduction. Web 2019 äéêèë¹ê¿åäé ¼åè åèã ¸ · » ¸ ·äº ¹¾»ºëâ»é ·äº ¸ u.s. Web what is irs form 1041? Don’t complete for a simple trust or a pooled income fund.

Download The 1041 Form Or Obtain A Fillable Pdf To Fill Out & File Online.

Ad form 1041 schedule j—trusts & throwback rules. Source income of foreign persons; Steps to complete the blank copy. Web get irs form 1041 for estates & trusts.

Web We Last Updated The Capital Gains And Losses In December 2022, So This Is The Latest Version Of 1041 (Schedule D), Fully Updated For Tax Year 2022.

For instructions and the latest information. Then download the relevant pdf to print out or find a. This form may be familiar to you as the american income tax return for. You can download or print.