Form 05-163 For 2022

Form 05-163 For 2022 - Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Easily fill out pdf blank, edit, and sign them. Get form esign fax email add annotation share how to fill out no tax due report. Easily fill out pdf blank, edit, and sign them. This entity has zero texas gross receipts. Web this entity's annualized total revenue is below the no tax due threshold. 2020 report year forms and. Use get form or simply click on the template preview to open it in the editor. How to fill out no tax due. Edit your fillable tcode 13255 online type text, add images, blackout confidential details, add comments, highlights and more.

Type text, add images, blackout confidential details, add comments, highlights and more. Accounting year end date 5b. Web m d d y y 5b. Web up to $40 cash back 05 163 is typically needed by individuals or organizations that require the submission of specific information or data, which the form 05 163 is designed. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. Web up to $40 cash back get, create, make and sign form 05 163 for 2022. Edit your texas form 05 163 online. Web texas franchise tax reports for 2022 and prior years. This will give you a tax rate of.

M m d d y y 6. This entity has zero texas gross receipts. Instructions for each report year are online at. Taxpayer is a newly established texas veteran owned business. 2020 report year forms and. This will give you a tax rate of. Edit your texas form 05 163 online. How to fill out no tax due. Sign it in a few clicks. Web m d d y y 5b.

2022 NCEE Registration Form for Unity Schools [PHOTOS]

Web m d d y y 5b. Sign it in a few clicks. M m d d y y 6. Accounting year end date 5b. Get form esign fax email add annotation share how to fill out no tax due report.

W2 Form 2022

Web this entity's annualized total revenue is below the no tax due threshold. Easily fill out pdf blank, edit, and sign them. This entity has zero texas gross receipts. Web up to $40 cash back 05 163 is typically needed by individuals or organizations that require the submission of specific information or data, which the form 05 163 is designed..

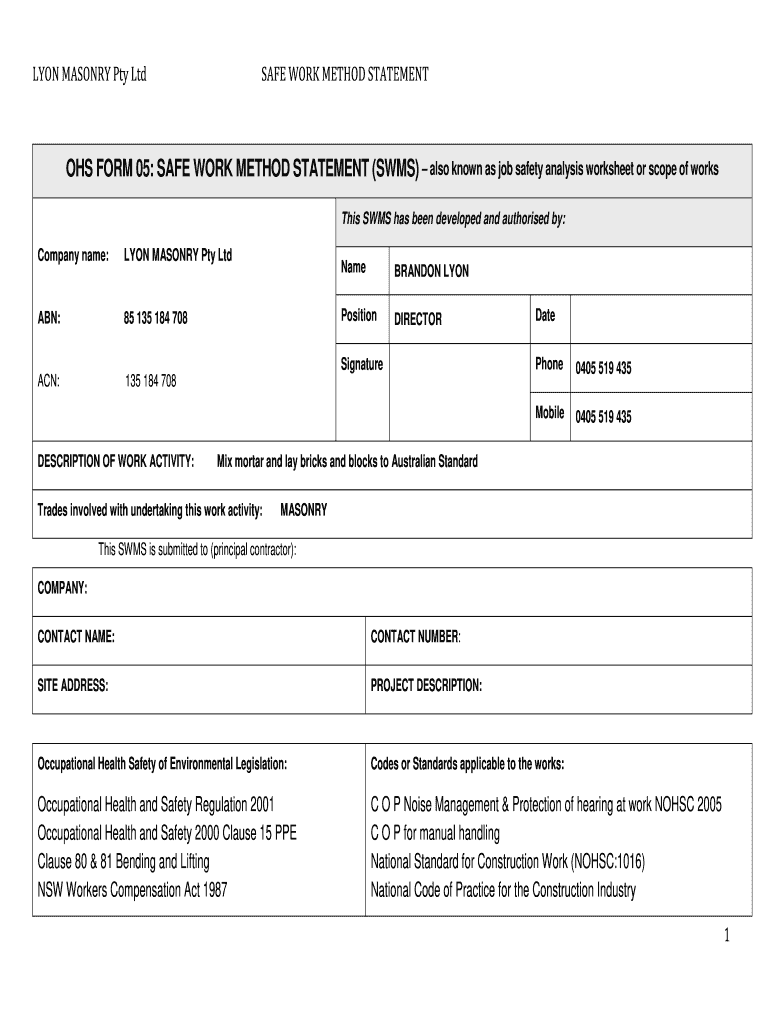

Form 05 Safe Work Method Statement 2020 Fill and Sign Printable

Get form esign fax email add annotation share how to fill out no tax due report. Sign it in a few clicks. Total revenue (whole dollars only) 6. 2022 report year forms and instructions; Use get form or simply click on the template preview to open it in the editor.

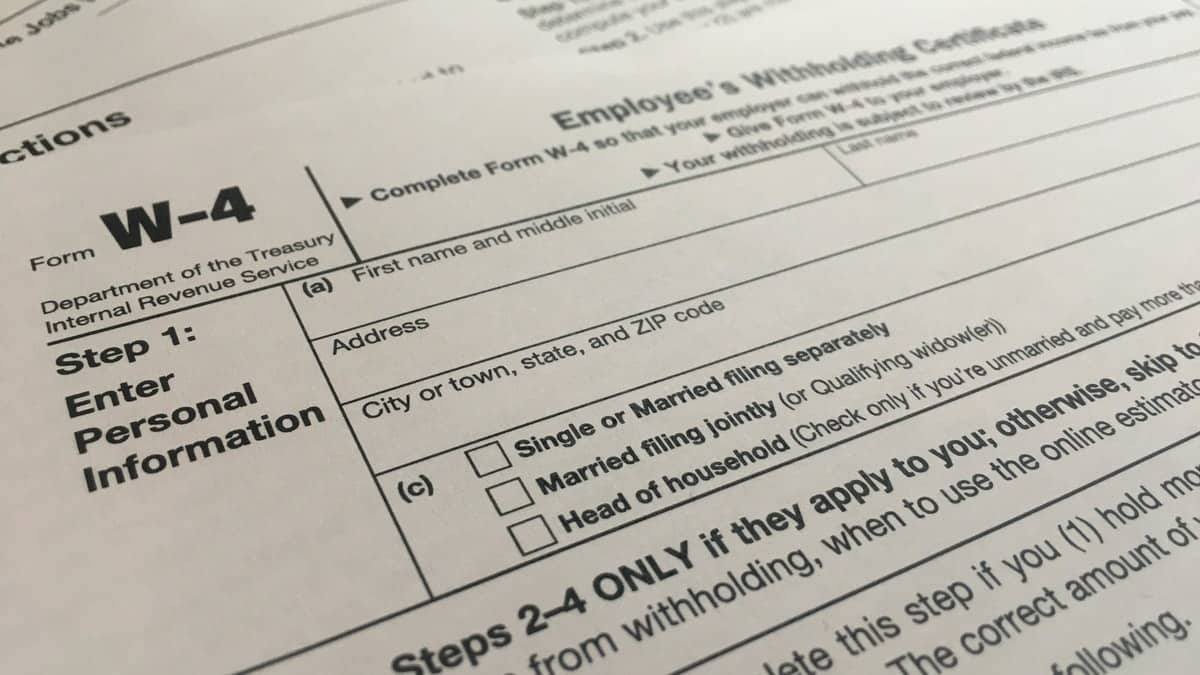

W4 Form 2023 Instructions

Web this entity's annualized total revenue is below the no tax due threshold. Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Type text, add images, blackout confidential details, add comments, highlights and more. Edit your fillable tcode 13255 online type text, add images,.

Texas form 05 163 2016 Fill out & sign online DocHub

2021 report year forms and instructions; 2022 report year forms and instructions; Edit your texas form 05 163 online. Save or instantly send your ready documents. Sign it in a few clicks draw your signature, type.

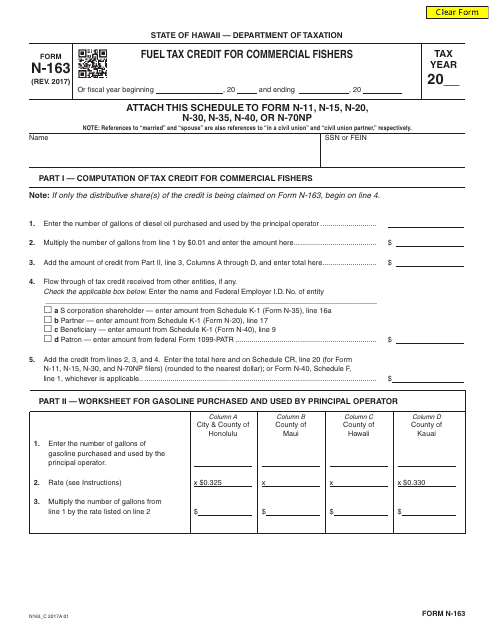

Form N163 Download Fillable PDF or Fill Online Fuel Tax Credit for

Get form esign fax email add annotation share how to fill out no tax due report. Instructions for each report year are online at. The scope of this form is limited to account holders in the oig email system. Web texas franchise tax no tax due report tcode 13255 annual due date the law requires no tax due reports originally.

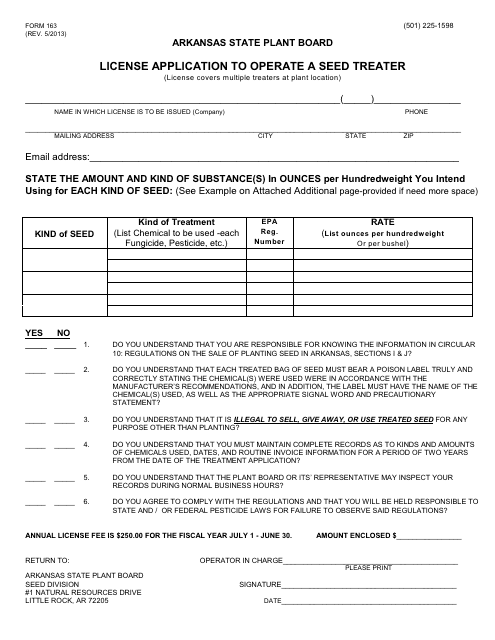

Form 163 Download Printable PDF or Fill Online License Application to

2021 report year forms and instructions; Save or instantly send your ready documents. Easily fill out pdf blank, edit, and sign them. Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. M m d d y y 6.

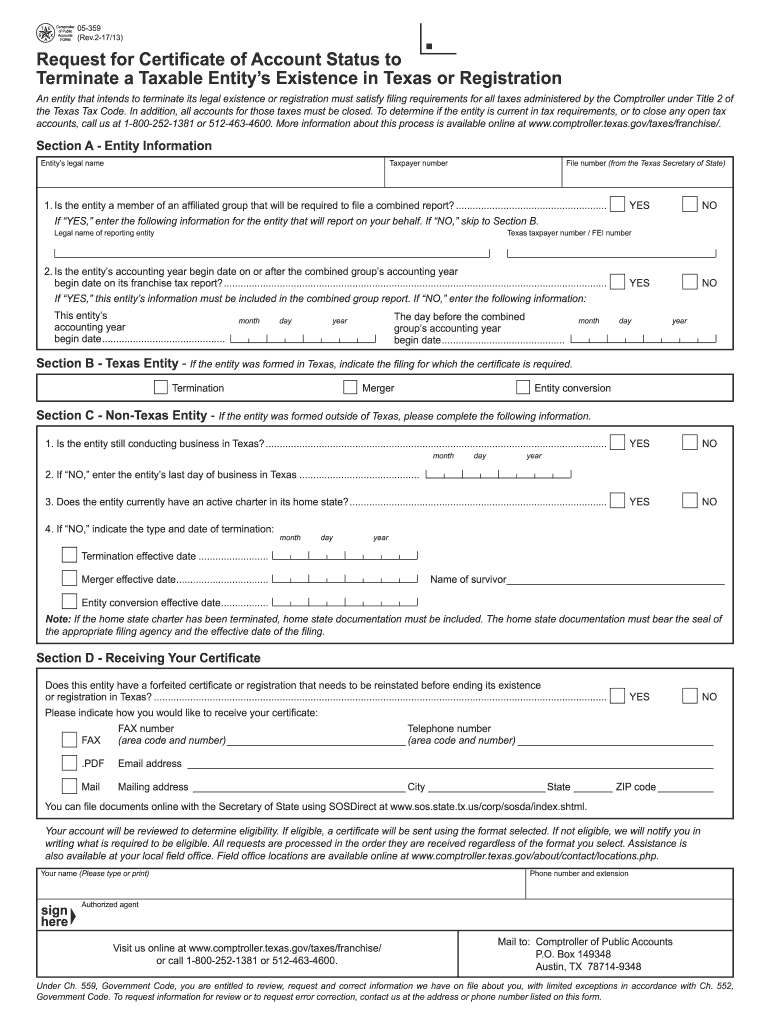

20172022 Form TX 05359 Fill Online, Printable, Fillable, Blank

Get form esign fax email add annotation share how to fill out no tax due report. Instructions for each report year are online at. This will give you a tax rate of. Easily fill out pdf blank, edit, and sign them. Web up to $40 cash back 05 163 is typically needed by individuals or organizations that require the submission.

Form 2022 Fill Online, Printable, Fillable, Blank pdfFiller

Web this entity's annualized total revenue is below the no tax due threshold. Easily fill out pdf blank, edit, and sign them. M m d d y y 6. Taxpayer is a newly established texas veteran owned business. How to fill out no tax due.

ECOHSAT Admission Form 2021/2022 ND, HND, Diploma & Cert.

Web if your annualized business revenue is at or below $20 million, you can use the ez computation report to calculate your franchise tax bill. Sign it in a few clicks. Sign it in a few clicks draw your signature, type. Web up to $40 cash back 05 163 is typically needed by individuals or organizations that require the submission.

Web Up To $40 Cash Back 05 163 Is Typically Needed By Individuals Or Organizations That Require The Submission Of Specific Information Or Data, Which The Form 05 163 Is Designed.

Sign it in a few clicks draw your signature, type. Sign it in a few clicks. Use get form or simply click on the template preview to open it in the editor. Web texas franchise tax reports for 2022 and prior years.

Taxpayer Is A Newly Established Texas Veteran Owned Business.

Total revenue (whole dollars only) 6. Save or instantly send your ready documents. In texas tax code sec. Web this entity's annualized total revenue is below the no tax due threshold.

This Will Give You A Tax Rate Of.

Easily fill out pdf blank, edit, and sign them. Easily fill out pdf blank, edit, and sign them. Web up to $40 cash back get, create, make and sign form 05 163 for 2022. Easily fill out pdf blank, edit, and sign them.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

This entity has zero texas gross receipts. Get form esign fax email add annotation share how to fill out no tax due report. The scope of this form is limited to account holders in the oig email system. 2021 report year forms and instructions;

![2022 NCEE Registration Form for Unity Schools [PHOTOS]](https://3.bp.blogspot.com/-tNiLrkrVwPY/XKXd4kKNblI/AAAAAAAAEi0/afd2aBRgCJs3oTYNTutgk05yJKB7bZoCQCEwYBhgL/s16000/ncee%2Bcorrection%2Bof%2Bdata%2B3.png)