Florida Hotel Tax Exemption Form

Florida Hotel Tax Exemption Form - Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. And provide a copy of any changes submitted t. Web the state does allow hotels to require a certificate of exemption. Ad valorem tax exemption application and return for multifamily project and affordable housing property: Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Web florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 2. The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; Some states require government travelers to submit a form for this exemption. Web this form should only be used for state & local government and exempt nongovernment organizations exempt organization’s attestation of diret illing and payment state of florida.

Web attach a list of the following information for each subsidiary applying for exemption: Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Provide a copy of the determination letter for 501(c)(3) federal tax status issued by the irs (including the list of qualified subsidiary organizations); Web this form should only be used for state & local government and exempt nongovernment organizations exempt organization’s attestation of diret illing and payment state of florida. Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; This exemption does not apply to other taxable sales or rentals at the camp or park. Legal name, mailing address, location address, and fein; See below for more information. Some states require government travelers to submit a form for this exemption.

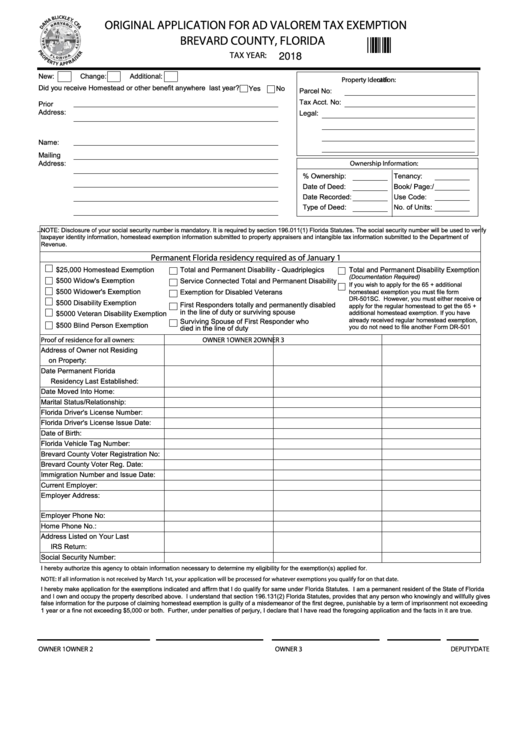

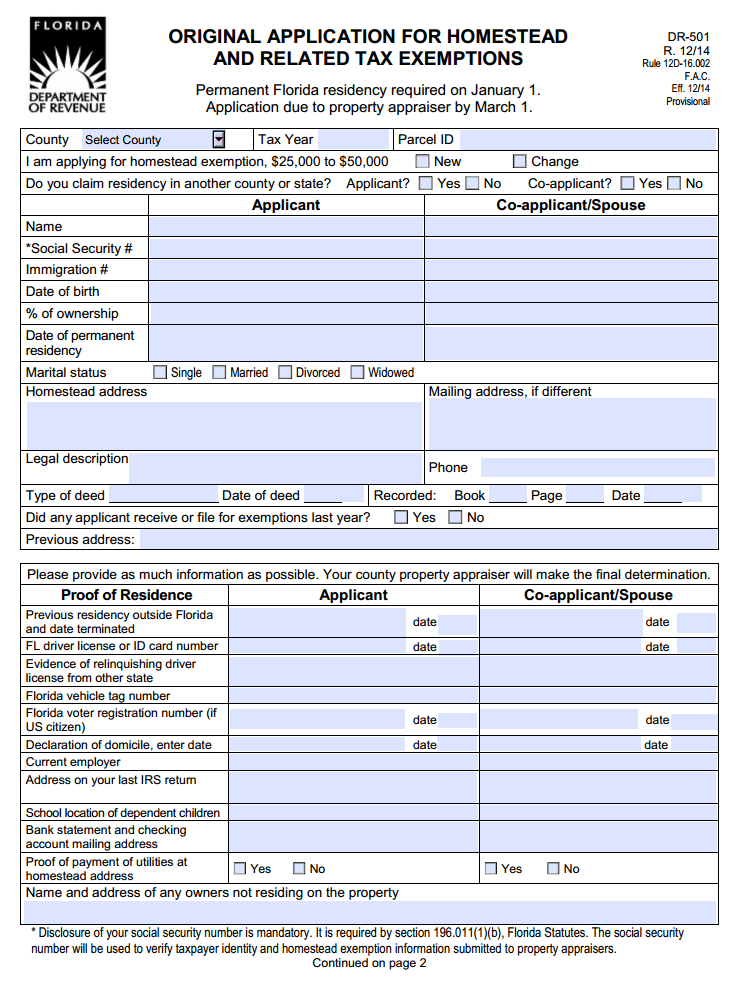

The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption; Web attach a list of the following information for each subsidiary applying for exemption: Legal name, mailing address, location address, and fein; And provide a copy of any changes submitted t. Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: Ad valorem tax exemption application and return for multifamily project and affordable housing property: Web florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 2. Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. Web this form should only be used for state & local government and exempt nongovernment organizations exempt organization’s attestation of diret illing and payment state of florida.

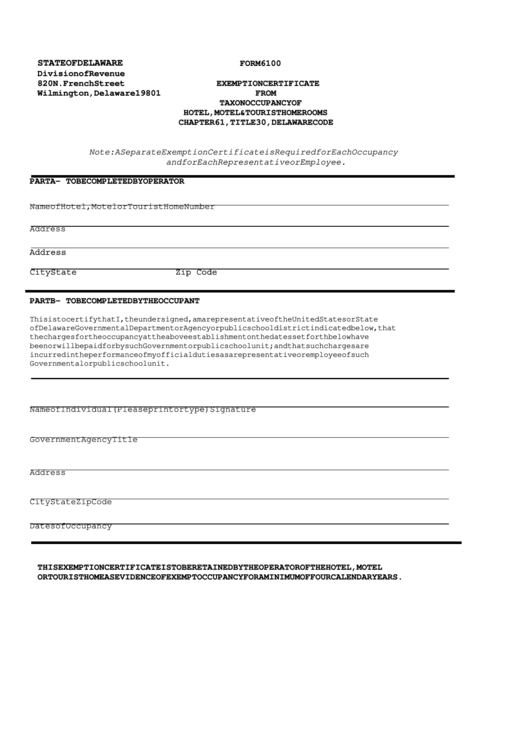

Fillable Form 6100 Form 6100 Exemption Certificate From Tax On

Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for a term of six months or less. Web this certificate may not be used.

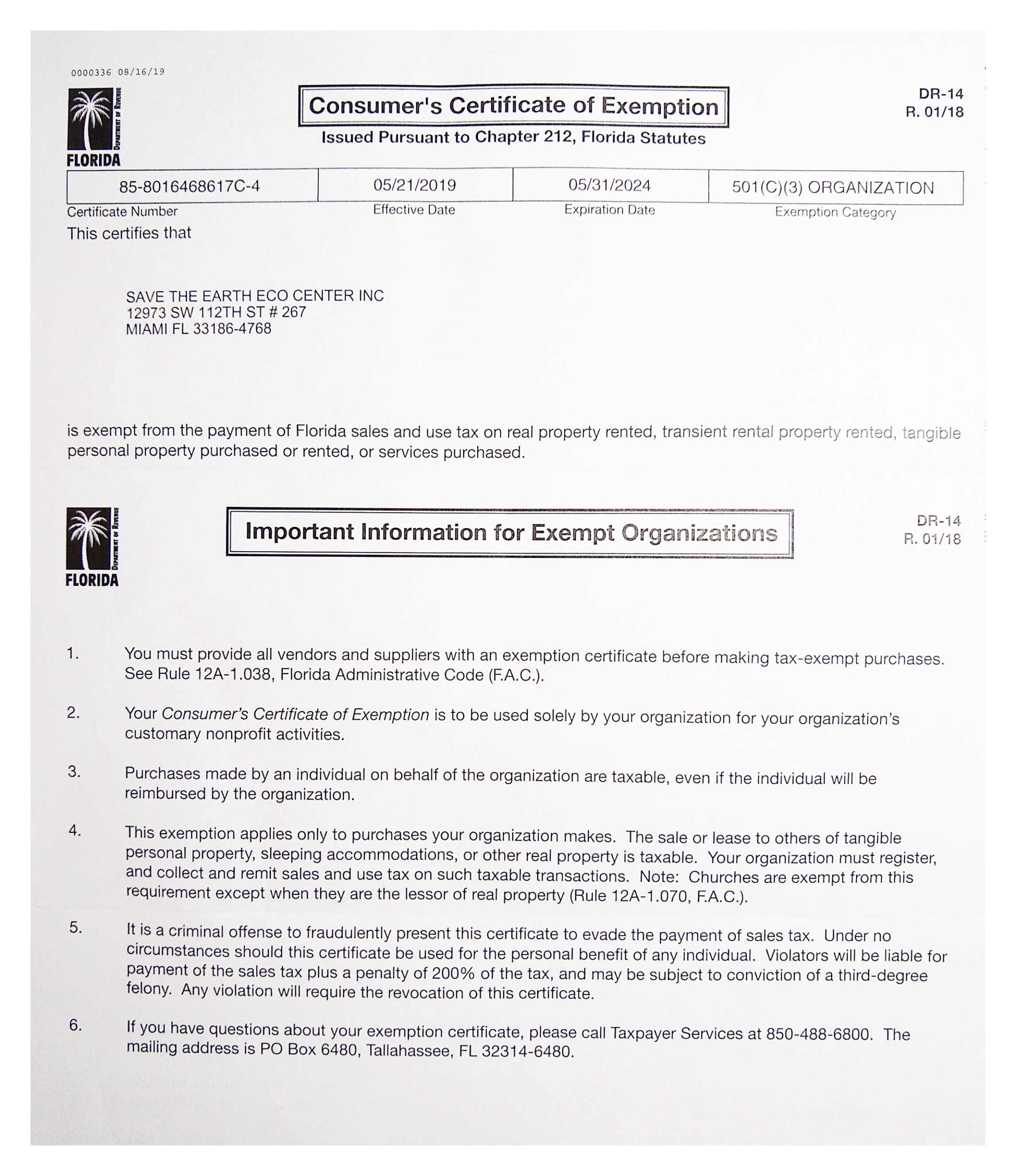

FL DR14 2015 Fill out Tax Template Online US Legal Forms

Legal name, mailing address, location address, and fein; Web the state does allow hotels to require a certificate of exemption. Ad valorem tax exemption application and return for multifamily project and affordable housing property: Web florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 2. Provide a copy of the determination letter for.

Top 77 Florida Tax Exempt Form Templates free to download in PDF format

Web attach a list of the following information for each subsidiary applying for exemption: Legal name, mailing address, location address, and fein; Ad valorem tax exemption application and return for multifamily project and affordable housing property: And provide a copy of any changes submitted t. Web florida department of revenue, sales and use tax on rental of living or sleeping.

Federal Government Hotel Tax Exempt Form Virginia

Web the state does allow hotels to require a certificate of exemption. Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Web in addition to state sales and use tax and.

What Is A Sales Tax Exemption Certificate In Florida Printable Form

Web attach a list of the following information for each subsidiary applying for exemption: Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local option transient rental taxes on rentals or leases of accommodations in hotels, motels, apartments, rooming houses, mobile home parks, rv parks, condominiums, or timeshare resorts for.

2019 Fla Sales Tax Exemption Certificate to 2024 STEEI EARTHSAVE FLORIDA

Legal name, mailing address, location address, and fein; This exemption does not apply to other taxable sales or rentals at the camp or park. Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web this certificate may not be used to.

Florida State Tax Exemption Form Hotel

Ad valorem tax exemption application and return for multifamily project and affordable housing property: Web attach a list of the following information for each subsidiary applying for exemption: Web the state does allow hotels to require a certificate of exemption. Web in addition to state sales and use tax and discretionary sales surtax, florida law allows counties to impose local.

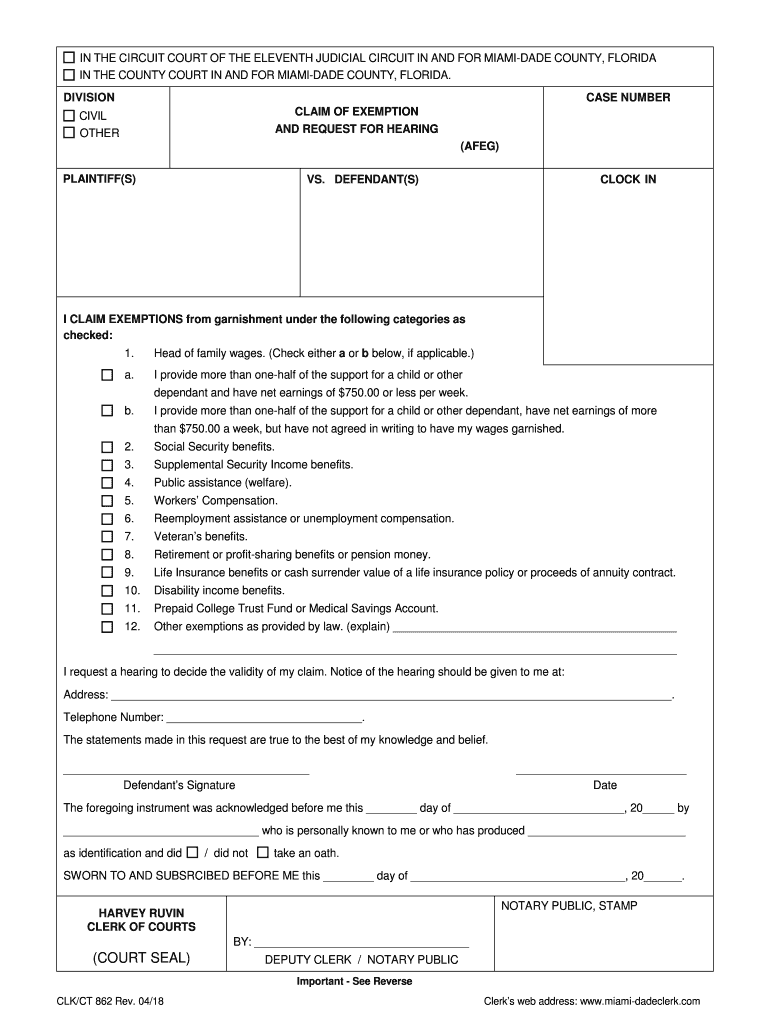

Florida Claim Exemption Form Fill Out And Sign Printable PDF Template

See below for more information. And provide a copy of any changes submitted t. Provide a copy of the determination letter for 501(c)(3) federal tax status issued by the irs (including the list of qualified subsidiary organizations); Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: Some states.

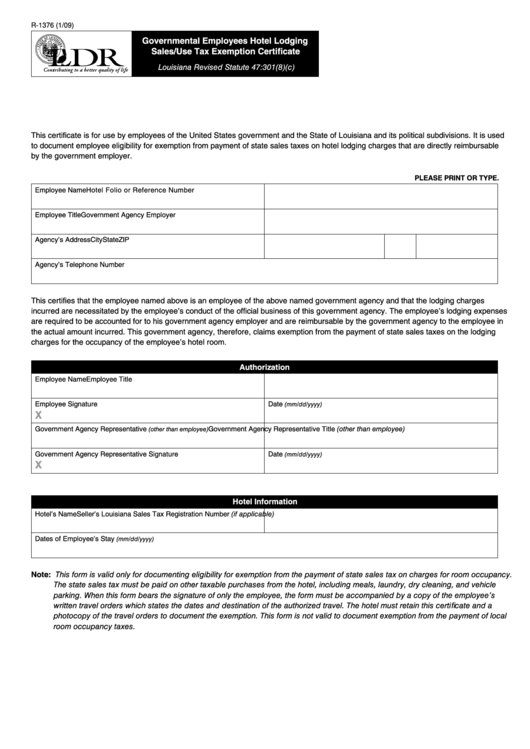

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Legal name, mailing address, location address, and fein; Web this form should only be used for state & local government and exempt.

Bupa Tax Exemption Form / Printable Wyoming Sales Tax Exemption

And provide a copy of any changes submitted t. Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Ad valorem tax exemption application and return for multifamily project and affordable housing.

Legal Name, Mailing Address, Location Address, And Fein;

Web florida department of revenue, sales and use tax on rental of living or sleeping accommodations, page 2. Some states require government travelers to submit a form for this exemption. Web ad valorem tax exemption application return for charitable, religious, scientific, literary organizations, hospitals, nursing homes, and homes for special services: Proper identification is required before this certificate may be accepted by the seller.

Ad Valorem Tax Exemption Application And Return For Multifamily Project And Affordable Housing Property:

Web this certificate may not be used to make exempt purchases or leases of tangible personal property or services or rental of living accommodations for the personal use of any individual employed by a united states governmental agency. Web the state does allow hotels to require a certificate of exemption. See below for more information. And provide a copy of any changes submitted t.

Web In Addition To State Sales And Use Tax And Discretionary Sales Surtax, Florida Law Allows Counties To Impose Local Option Transient Rental Taxes On Rentals Or Leases Of Accommodations In Hotels, Motels, Apartments, Rooming Houses, Mobile Home Parks, Rv Parks, Condominiums, Or Timeshare Resorts For A Term Of Six Months Or Less.

This exemption does not apply to other taxable sales or rentals at the camp or park. Provide a copy of the determination letter for 501(c)(3) federal tax status issued by the irs (including the list of qualified subsidiary organizations); Web tax exemptions when you use your government travel charge card (gtcc) for official travel, your hotel stay may be exempt from certain state and local sales tax. Web attach a list of the following information for each subsidiary applying for exemption:

Web This Form Should Only Be Used For State & Local Government And Exempt Nongovernment Organizations Exempt Organization’s Attestation Of Diret Illing And Payment State Of Florida.

The united states government or any (of its federal agencies) is not required to obtain a florida consumer’s certificate of exemption;