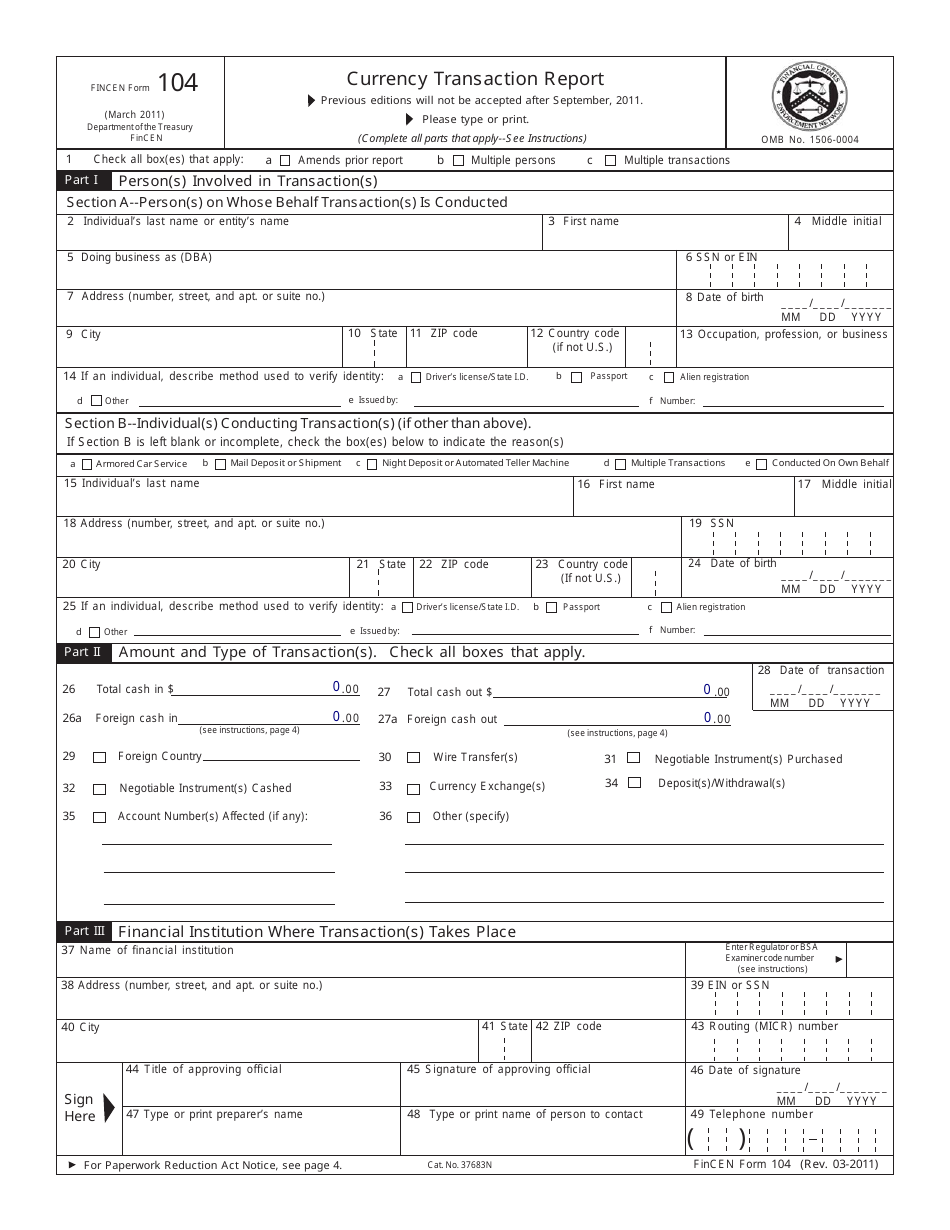

Fincen Form 104

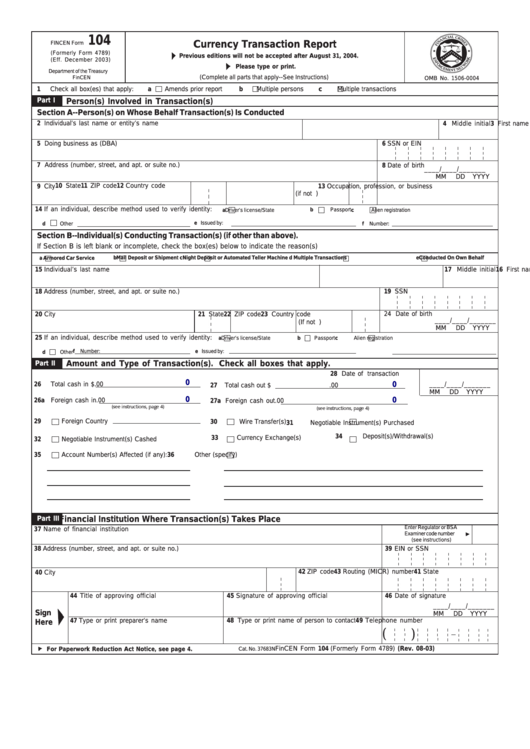

Fincen Form 104 - Postal service, must complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. Web fbar (foreign bank account report) 114. To file an fbar report. Financial institutions have requested guidance in. Bank secrecy act financial institutions, other than casinos1 and the u.s. Web crimes enforcement network (fincen) form 104 (formerly known as internal revenue service [irs] form 4789), for each currency transaction over $10,000. A nonfinancial trade or business may electronically file the form 8300. You can print other federal tax forms here. Web fincen is providing the following guidance concerning completion of fincen form 104, currency transaction report. On october 5, 2012, fincen held an informational webinar on the new fincen ctr.

In the first example, a customer of [ ] bank exchanges south korean currency for $3,000 in united states currency. In your letter, you present two examples. You can print other federal tax forms here. A nonfinancial trade or business may electronically file the form 8300. Web currency transaction report (ctr) fincen form 104. Web financial institutions other than casinos complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. The 114a may be signed. Web crimes enforcement network (fincen) form 104 (formerly known as internal revenue service [irs] form 4789), for each currency transaction over $10,000. Bank secrecy act financial institutions, other than casinos1 and the u.s. Web fbar (foreign bank account report) 114.

Web we last updated the currency transaction report in february 2023, so this is the latest version of form fincen104, fully updated for tax year 2022. In the first example, a customer of [ ] bank exchanges south korean currency for $3,000 in united states currency. Web fbar (foreign bank account report) 114. Web the new reports include the fincen ctr, which replaced the form 104 that financial institutions, including fcms and ibs, had previously used. You can print other federal tax forms here. Web currency transaction report (ctr) fincen form 104. A currency transaction is any transaction involving the physical transfer of currency from one person to another and covers deposits, withdrawals, exchanges, or transfers The 114a may be signed. On october 5, 2012, fincen held an informational webinar on the new fincen ctr. A nonfinancial trade or business may electronically file the form 8300.

Gallery of Fincen form 114 Due Date 2018 Unique 813plycoval forms form

Web currency transaction report (ctr) fincen form 104. In the first example, a customer of [ ] bank exchanges south korean currency for $3,000 in united states currency. Web financial institutions other than casinos complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. The electronic version of the fbar is currently available and must be filed electronically.

FinCen Form 114 / Treasury Form TD F 9022.1 SF Tax Counsel

In your letter, you present two examples. Web crimes enforcement network (fincen) form 104 (formerly known as internal revenue service [irs] form 4789), for each currency transaction over $10,000. Bank secrecy act financial institutions, other than casinos1 and the u.s. Line item instructions for completing the fbar (form 114) (08/2021) record of authorization to electronically file fbars (form 114a), note:.

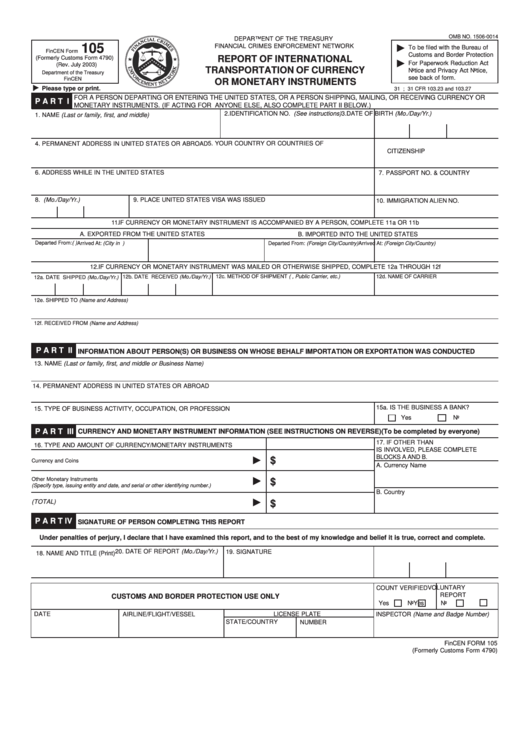

Fincen Form 105 Report Of International Transportation Of Currency Or

The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Web fbar (foreign bank account report) 114. Web the new reports include the fincen ctr, which replaced the form 104 that financial institutions, including fcms and ibs, had previously used. On october 5, 2012, fincen held an informational webinar on the new.

FinCEN Form 104 Download Fillable PDF or Fill Online Currency

In the first example, a customer of [ ] bank exchanges south korean currency for $3,000 in united states currency. A nonfinancial trade or business may electronically file the form 8300. You can print other federal tax forms here. Web fincen is providing the following guidance concerning completion of fincen form 104, currency transaction report. A currency transaction is any.

Fincen Form 114 Sample

Bank secrecy act financial institutions, other than casinos1 and the u.s. The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Web fbar (foreign bank account report) 114. Web financial institutions other than casinos complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. Web the new reports include the.

FinCEN Form 114, FBAR Foreign Bank Account Report YouTube

In your letter, you present two examples. The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Line item instructions for completing the fbar (form 114) (08/2021) record of authorization to electronically file fbars (form 114a), note: The 114a may be signed. Web crimes enforcement network (fincen) form 104 (formerly known as.

Gallery of Fincen form 114 Due Date 2018 New Va form 1010ez

Financial institutions have requested guidance in. A nonfinancial trade or business may electronically file the form 8300. In your letter, you present two examples. Web we last updated the currency transaction report in february 2023, so this is the latest version of form fincen104, fully updated for tax year 2022. On october 5, 2012, fincen held an informational webinar on.

Gallery of Fincen form 114 Due Date 2018 New Va form 1010ez

Postal service, must complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. You can print other federal tax forms here. Web fbar (foreign bank account report) 114. A currency transaction is any transaction involving the physical transfer of currency from one person to another and covers deposits, withdrawals, exchanges, or transfers Web we last updated the currency.

Fillable Fincen Form 104 Currency Transaction Report printable pdf

Web the new reports include the fincen ctr, which replaced the form 104 that financial institutions, including fcms and ibs, had previously used. Web fbar (foreign bank account report) 114. In the first example, a customer of [ ] bank exchanges south korean currency for $3,000 in united states currency. Web financial institutions other than casinos complete fincen form 104.

Fincen Form 104 ≡ Fill Out Printable PDF Forms Online

Postal service, must complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. Web financial institutions other than casinos complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. In your letter, you present two examples. A currency transaction is any transaction involving the physical transfer of currency from one person to another and covers deposits,.

Web Financial Institutions Other Than Casinos Complete Fincen Form 104 When Reporting Currency Transactions Under 31 Cfr §103.22.

The electronic version of the fbar is currently available and must be filed electronically effective july 1, 2013. Postal service, must complete fincen form 104 when reporting currency transactions under 31 cfr §103.22. Web we last updated the currency transaction report in february 2023, so this is the latest version of form fincen104, fully updated for tax year 2022. Web crimes enforcement network (fincen) form 104 (formerly known as internal revenue service [irs] form 4789), for each currency transaction over $10,000.

Bank Secrecy Act Financial Institutions, Other Than Casinos1 And The U.s.

You can print other federal tax forms here. Line item instructions for completing the fbar (form 114) (08/2021) record of authorization to electronically file fbars (form 114a), note: Web fbar (foreign bank account report) 114. The 114a may be signed.

In Your Letter, You Present Two Examples.

To file an fbar report. A nonfinancial trade or business may electronically file the form 8300. In the first example, a customer of [ ] bank exchanges south korean currency for $3,000 in united states currency. Web fincen is providing the following guidance concerning completion of fincen form 104, currency transaction report.

Web Currency Transaction Report (Ctr) Fincen Form 104.

A currency transaction is any transaction involving the physical transfer of currency from one person to another and covers deposits, withdrawals, exchanges, or transfers Web the new reports include the fincen ctr, which replaced the form 104 that financial institutions, including fcms and ibs, had previously used. Financial institutions have requested guidance in. On october 5, 2012, fincen held an informational webinar on the new fincen ctr.