Fillable Form 2848

Fillable Form 2848 - We are two financial specialists that have come together to create a website dedicated to providing valuable guidance and tips for people who use the 2848 form. Web irs power of attorney form 2848 | revised jan. Because a partnership representative is required to be designated for each tax year, it is recommended that a separate form 2848 be completed for each tax year a particular pr would like to appoint a power of attorney. Web 2848 power of attorney omb no. We are passionate about helping our readers understand the complexities of this form. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Web 2848 power of attorney form (rev. Irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership.

Web on this platform, users can access the form 2848 fillable pdf, which simplifies the process of inputting necessary information electronically. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. A separate form 2848 must be completed for each taxpayer. Department of the treasury internal revenue service type or print. We are two financial specialists that have come together to create a website dedicated to providing valuable guidance and tips for people who use the 2848 form. Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination. Irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Part i power of attorney caution: Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Please see representation for fbar issues section of report of foreign bank and financial accounts (fbar) for more.

We are two financial specialists that have come together to create a website dedicated to providing valuable guidance and tips for people who use the 2848 form. Irs power of attorney form 2848 is a document used when designating someone else (accountant) to file federal taxes on behalf of an entity or individual. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. A separate form 2848 must be completed for each taxpayer. Web on this platform, users can access the form 2848 fillable pdf, which simplifies the process of inputting necessary information electronically. Because a partnership representative is required to be designated for each tax year, it is recommended that a separate form 2848 be completed for each tax year a particular pr would like to appoint a power of attorney. We are passionate about helping our readers understand the complexities of this form. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Part i power of attorney caution: January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information.

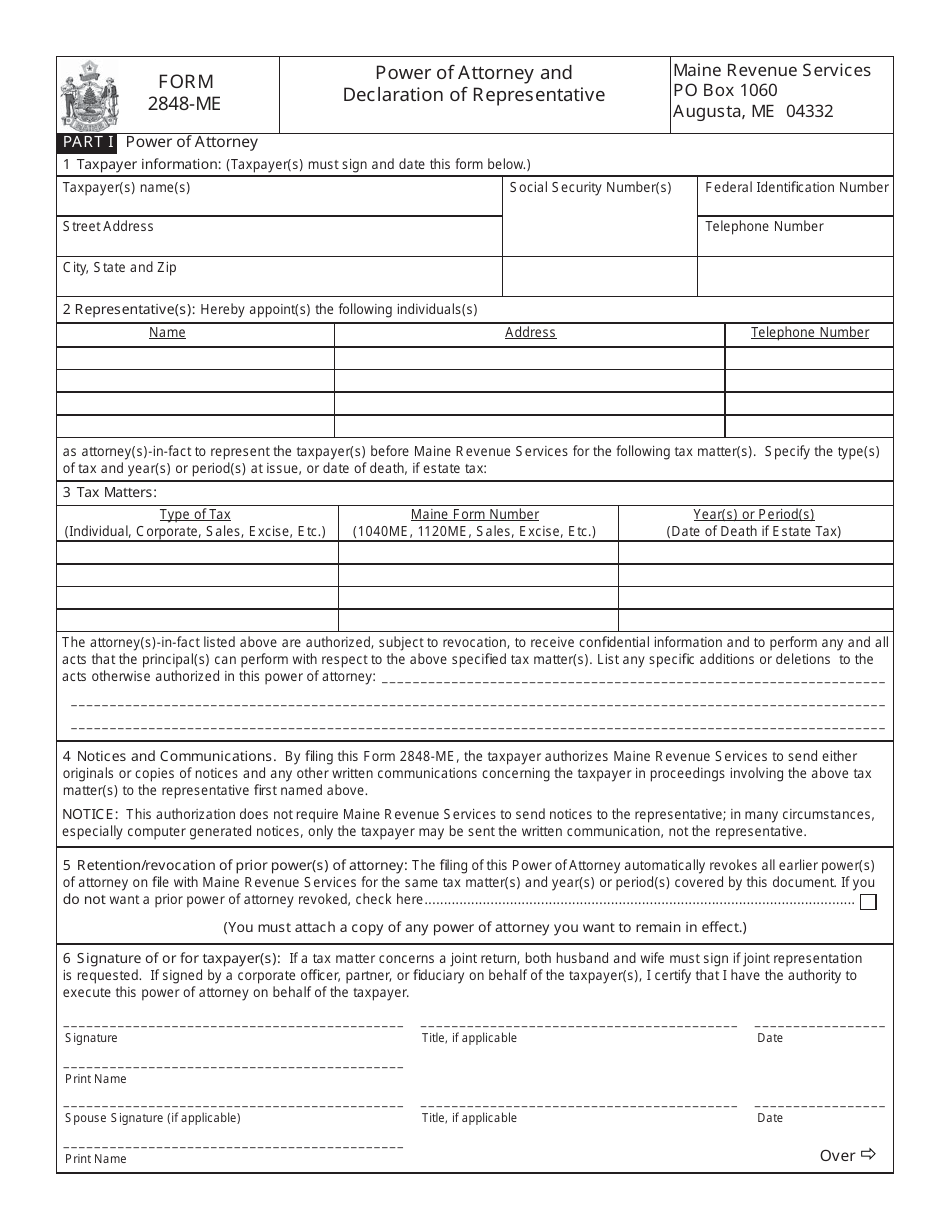

Form 2848‐ME‐L Download Fillable PDF or Fill Online Limited Power of

Web 2848 power of attorney form (rev. We are passionate about helping our readers understand the complexities of this form. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. Irs power of attorney form 2848 is a document used when.

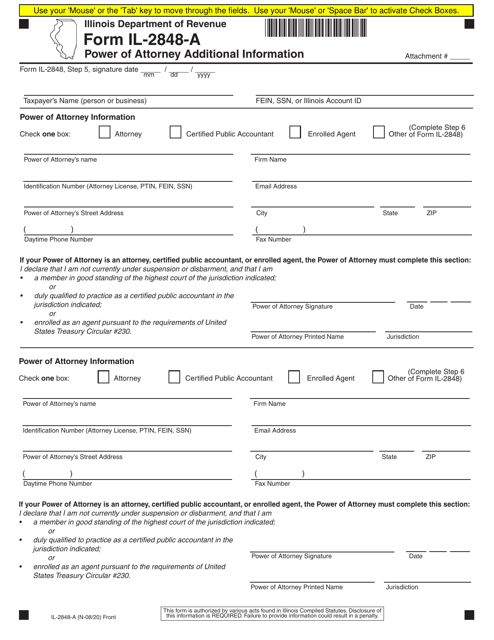

Form IL2848A Download Fillable PDF or Fill Online Power of Attorney

This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Part i power of attorney caution: Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax.

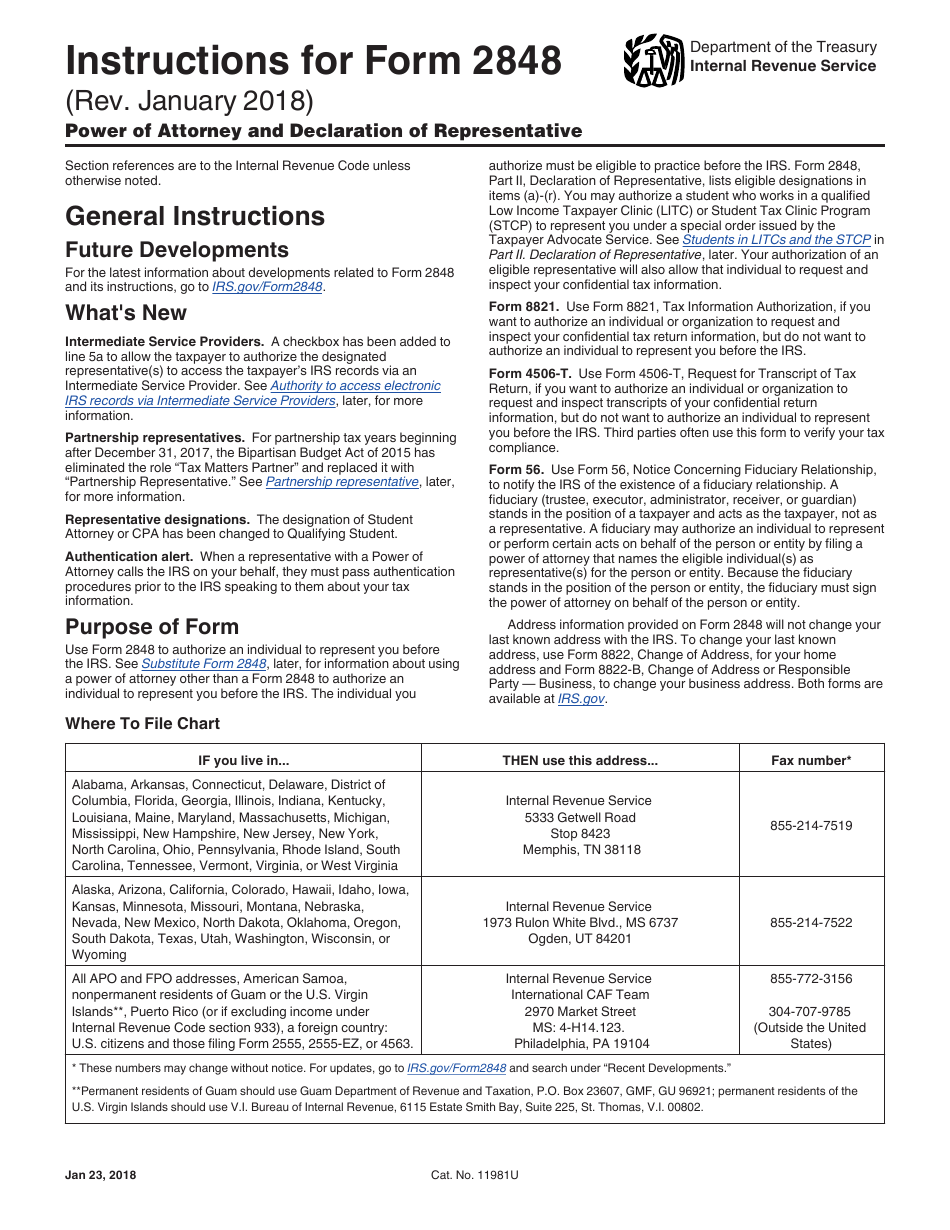

Download Instructions for IRS Form 2848 Power of Attorney and

A separate form 2848 should be completed for each taxpayer. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information. Web 2848.

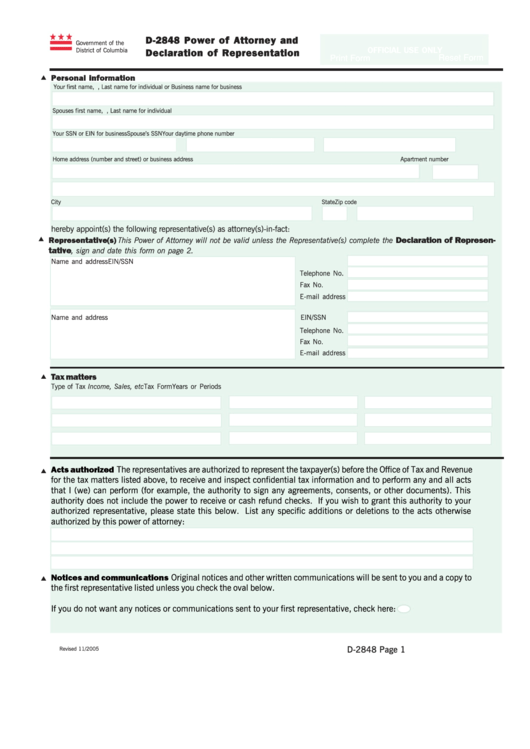

Fillable Form D2848 Power Of Attorney And Declaration Of

A separate form 2848 should be completed for each taxpayer. Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Web irs.

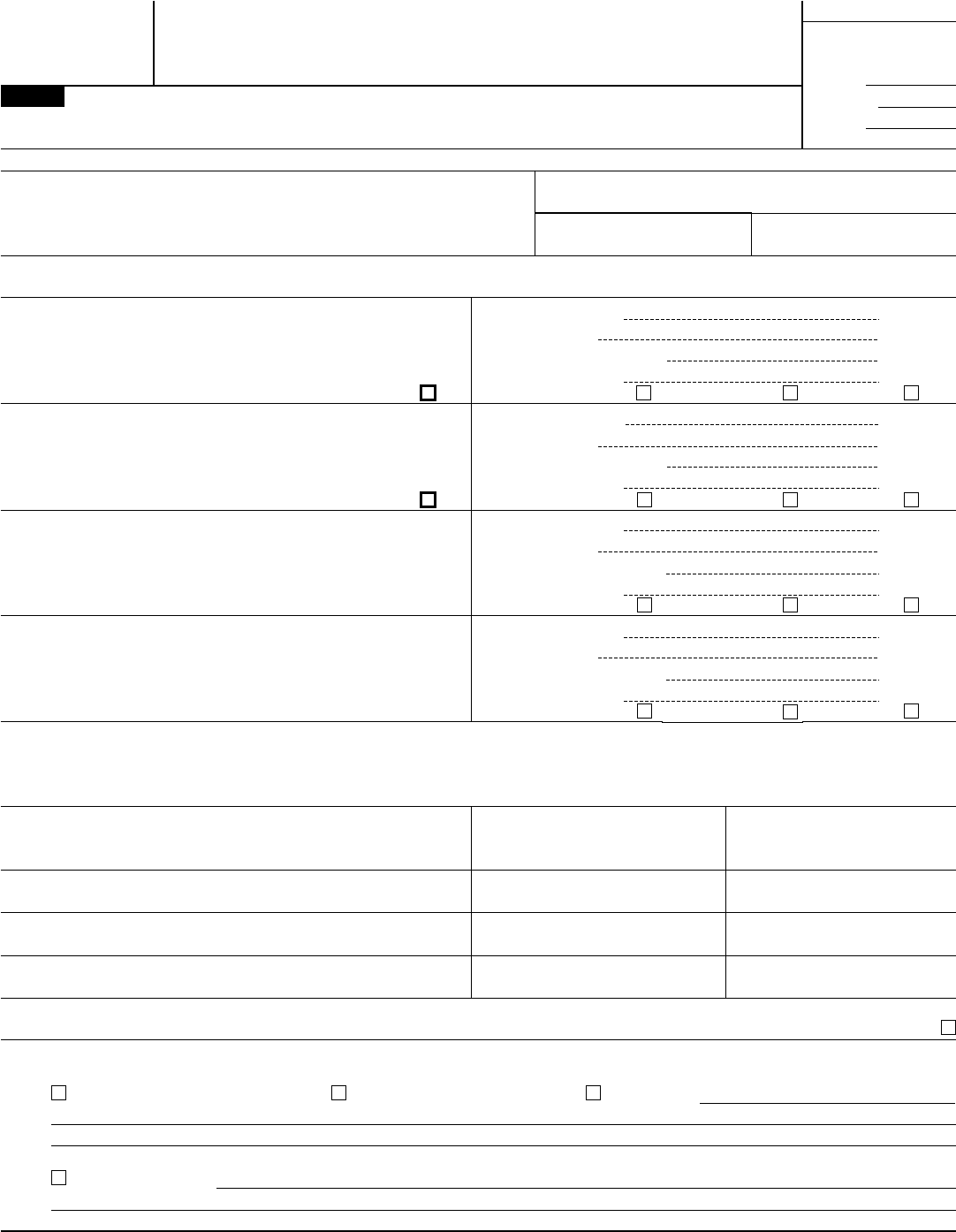

Form 2848 Edit, Fill, Sign Online Handypdf

A separate form 2848 must be completed for each taxpayer. Web 2848 power of attorney form (rev. Please see representation for fbar issues section of report of foreign bank and financial accounts (fbar) for more. We are passionate about helping our readers understand the complexities of this form. This form grants a designated individual the authority to represent you before.

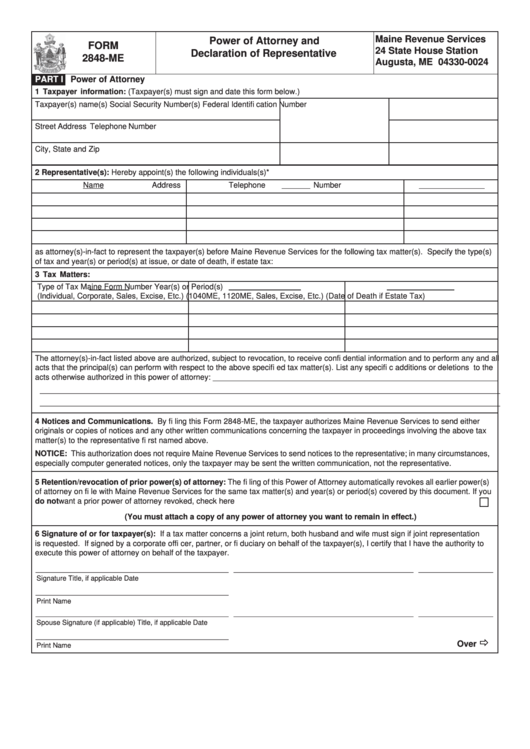

Form 2848ME Download Printable PDF or Fill Online Power of Attorney

Web 2848 power of attorney omb no. Web on this platform, users can access the form 2848 fillable pdf, which simplifies the process of inputting necessary information electronically. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership. January 2021) and.

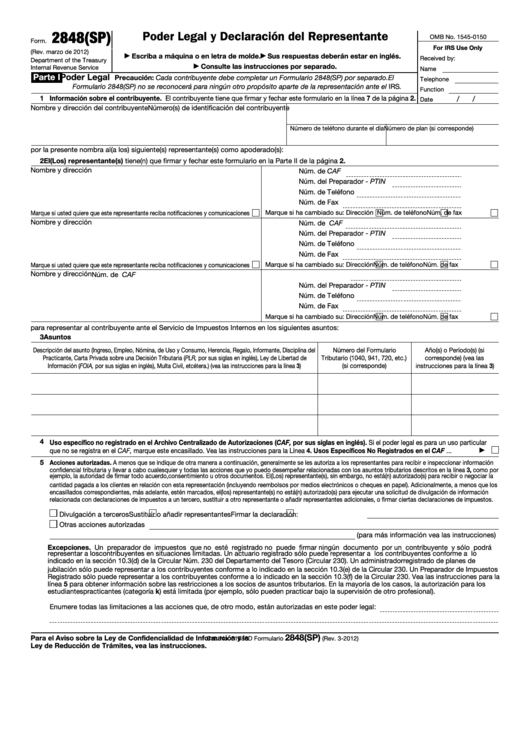

Fillable Form 2848(Sp) Poder Legal Y Declaracion Del Representante

A separate form 2848 should be completed for each taxpayer. Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Please see.

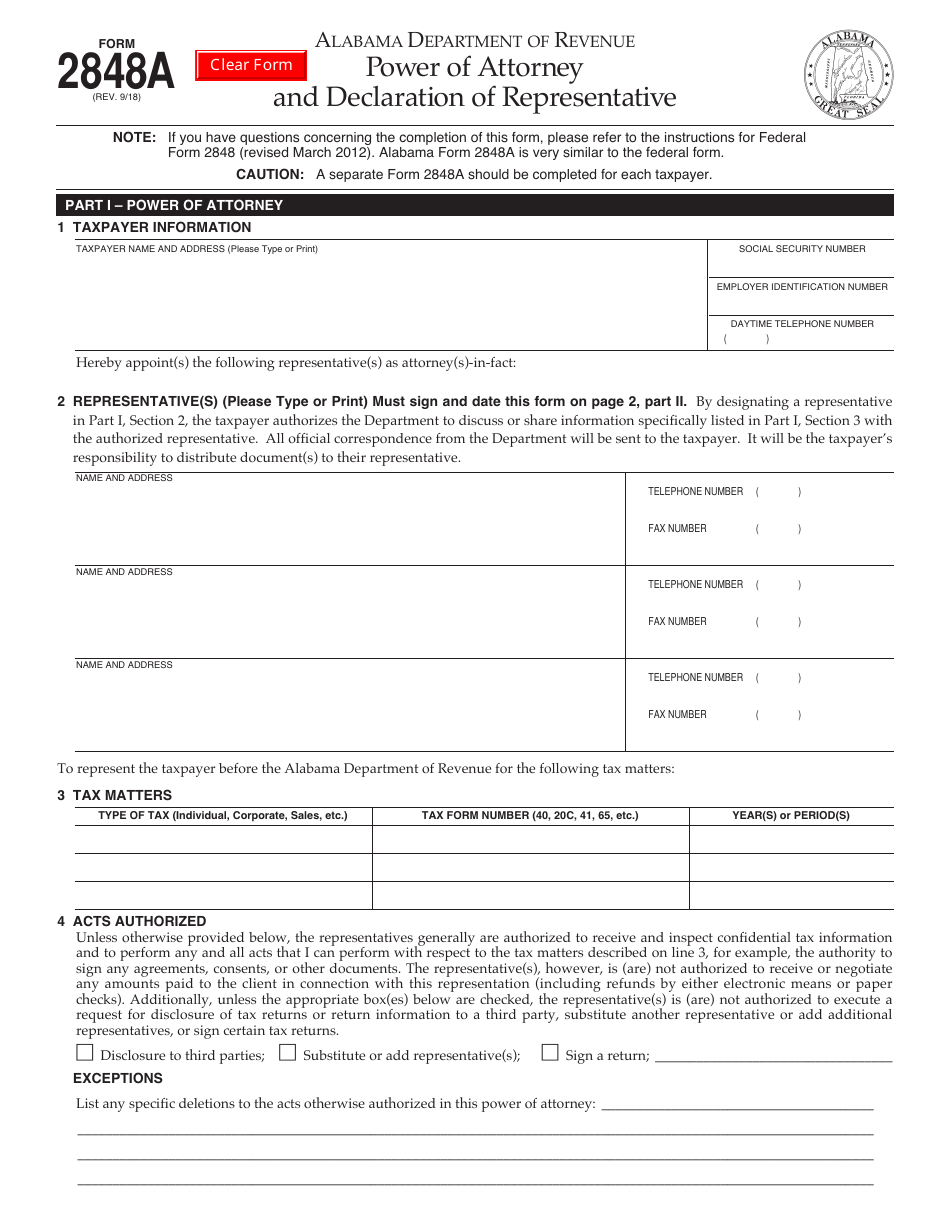

Form 2848A Download Fillable PDF or Fill Online Power of Attorney and

Part i power of attorney caution: Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. Department of the treasury internal revenue service type or print. A separate form 2848 must be completed for each taxpayer. Irs power of attorney form 2848 is a.

20182020 Form IRS 2848 Fill Online, Printable, Fillable, Blank PDFfiller

January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information. A separate form 2848 must be completed for each taxpayer. Please see representation for fbar issues section of report of foreign bank and financial accounts (fbar) for more. This form grants a designated individual the authority to represent.

Fillable Form 2848Me Power Of Attorney And Declaration Of

Web irs power of attorney form 2848 | revised jan. Please see representation for fbar issues section of report of foreign bank and financial accounts (fbar) for more. We are passionate about helping our readers understand the complexities of this form. Part i power of attorney caution: Department of the treasury internal revenue service type or print.

A Separate Form 2848 Must Be Completed For Each Taxpayer.

Students with a special order to represent taxpayers in qualified low income taxpayer clinics or the student tax clinic program, see the instructions for part ii. Web on this platform, users can access the form 2848 fillable pdf, which simplifies the process of inputting necessary information electronically. January 2021) and declaration of representative department of the treasury internal revenue service go to www.irs.gov/form2848 for instructions and the latest information. Web you can file form 2848, power of attorney and declaration of representative, if the irs begins a foreign bank and financial accounts (fbar) examination as a result of an income tax examination.

Because A Partnership Representative Is Required To Be Designated For Each Tax Year, It Is Recommended That A Separate Form 2848 Be Completed For Each Tax Year A Particular Pr Would Like To Appoint A Power Of Attorney.

We are two financial specialists that have come together to create a website dedicated to providing valuable guidance and tips for people who use the 2848 form. This form grants a designated individual the authority to represent you before the irs, so it's essential to fill it out correctly. Web irs power of attorney form 2848 | revised jan. Department of the treasury internal revenue service type or print.

Web 2848 Power Of Attorney Form (Rev.

Web 2848 power of attorney omb no. A separate form 2848 should be completed for each taxpayer. We are passionate about helping our readers understand the complexities of this form. Web form 2848 is used by the pr to appoint a power of attorney to act on its behalf in its capacity as the pr of the bba partnership.

Irs Power Of Attorney Form 2848 Is A Document Used When Designating Someone Else (Accountant) To File Federal Taxes On Behalf Of An Entity Or Individual.

Part i power of attorney caution: Filling instructions for 2023 filling out the declaration can be a daunting task for some, but with proper guidance, it can be done accurately and efficiently. Part i power of attorney caution: Please see representation for fbar issues section of report of foreign bank and financial accounts (fbar) for more.