Filing Bankruptcy Chapter 13 In Maryland

Filing Bankruptcy Chapter 13 In Maryland - Ad don't file for bankruptcy. Web chapter 13 bankruptcy is generally used by debtors who want to keep secured assets, such as a home or car, when they have more equity in the secured assets than they can protect with their maryland bankruptcy exemptions. Effective february 11, 2013, claims in all cases, in all chapters can be filed electronically using cm/ecf or through the court’s website without a login. Web required forms for chapter 7 and chapter 13 filings. If your median income is below the state level, you may file. Compare top 5 consolidation options. 7 bankruptcy and may need to file a chapter 13 bankruptcy instead. Motion to reopen fees chapter 7 $ 260: See if you qualify to save monthly on your debt. Stop foreclosure and repossession by paying the past due payments through a chapter 13.

Electronic filing through cm/ecf remains available. The maryland median income is. Effective february 11, 2013, claims in all cases, in all chapters can be filed electronically using cm/ecf or through the court’s website without a login. Depending on where you live (or have assets), your local district court may be in greenbelt or baltimore. Web 4 minutes read what happens after you file chapter 13 bankruptcy in maryland? Consolidate your debt to save with one lower monthly payment. Ch 13 to ch 11: Web required forms for chapter 7 and chapter 13 filings. The maryland median income is $65,723 for a. Consolidate your debt to save with one lower monthly payment.

Web if your income is above the maryland median income, you may not be eligible to file a chapter. A baltimore city bankruptcy lawyer explains. The maryland median income is. Compare top 5 consolidation options. After reasonable monthly expenses have been paid, how much money will you have. See if you qualify to save monthly on your debt. Chapter 13 bankruptcy, commonly called reorganization bankruptcy, is a process that allows you to repay your creditors over time. Is chapter 13 right for me? Motion to reopen fees chapter 7 $ 260: A chapter 13 plan must conform to local bankruptcy form m.

Tucson Bankruptcy Lawyer

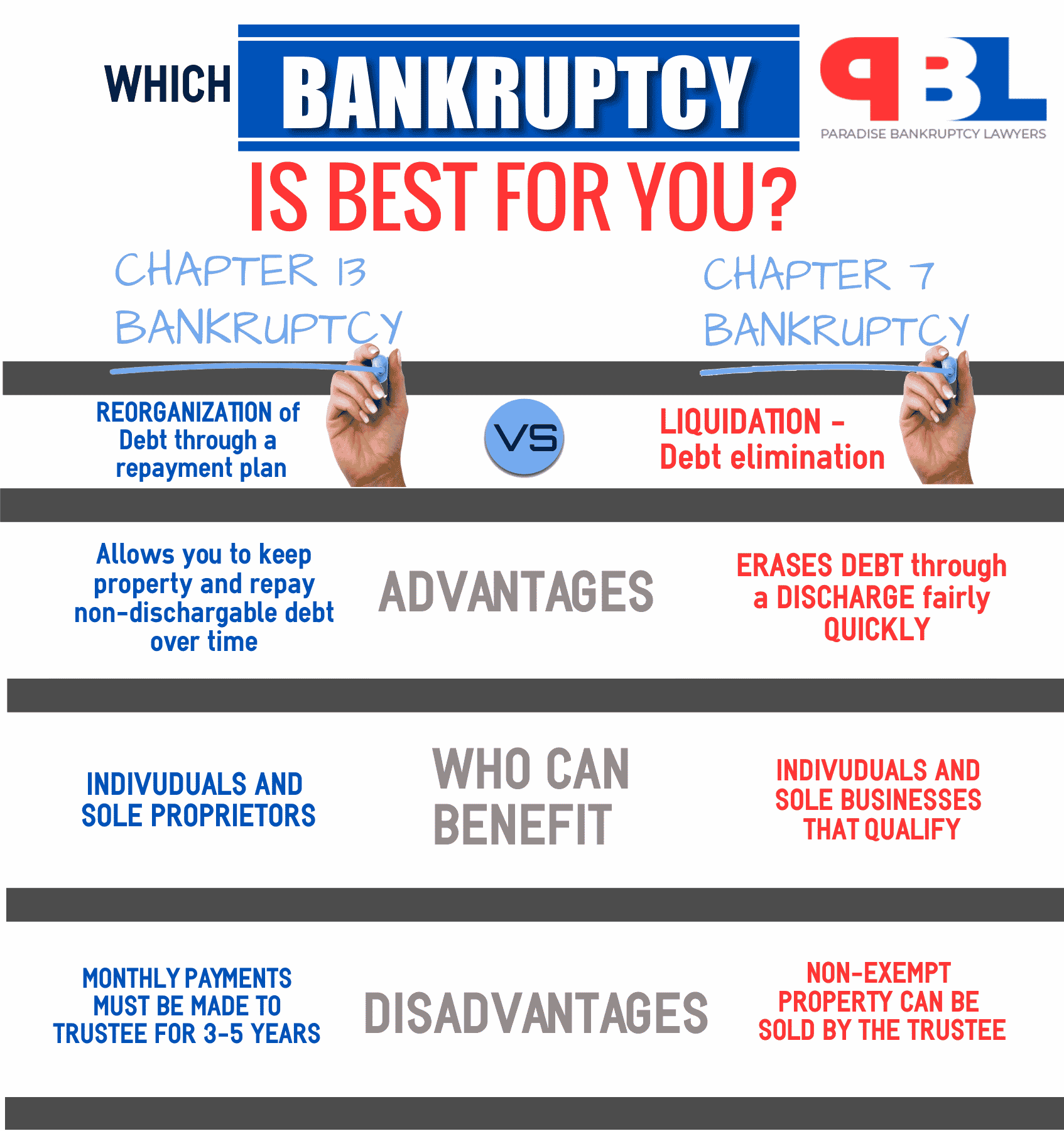

Chapter 13 bankruptcy is a reorganization whereas chapter 7 bankruptcy. The maryland median income is $65,723 for a. Web filing fees chapter 7: Web if your income is above the maryland median income, you may not be eligible to file a chapter. Must meet income requirements to qualify for a chapter 7 bankruptcy discharge.

What property can you keep when filing for Chapter 13 Bankruptcy in

Reside, have a domicile, a place of business, or property in the united states, or a municipality, have a source of regular income; Consolidate your debt to save with one lower monthly payment. See if you qualify to save monthly on your debt. Bankruptcy court for the district of maryland will be closed on monday september 4, 2023. Web household.

Chapter 13 Bankruptcy The Law Offices of Daniel J. Guenther

Ch 13 to ch 7: Maryland has a wildcard exemption protecting cash or property of any kind up to $6,000 in value. Below is a list of the documents needed for filing chapter 7 and chapter 13 bankruptcy cases. Motion to reopen fees chapter 7 $ 260: Along with the original plan and any amended or modified plan, the debtor.

Chapter 13 Bankruptcy Lawyer in Tucson Judge Law Firm

Web filing fees chapter 7: Web if your income is above the maryland median income, you may not be eligible to file a chapter. Ad (for maryland residents) request immediate help online for unmanageable debt. Ch 12 to ch 7: In chapter 13 bankruptcy, you will work with the court and your baltimore city bankruptcy.

What Are the Advantages of Filing for Bankruptcy in Maryland? Belsky

Maryland has a wildcard exemption protecting cash or property of any kind up to $6,000 in value. If your income is above the maryland median income, you may not be eligible to file a chapter. Consolidate your debt to save with one lower monthly payment. Ch 7 to ch 13: Steps to filing for bankruptcy in maryland if you live.

Paradise, NV Debt Relief Attorney Chapter 13 Bankruptcy, 7026053306

Consolidate your debt to save with one lower monthly payment. Web chapter 13 bankruptcy. Chapter 13 bankruptcy is a reorganization whereas chapter 7 bankruptcy. Chapter 13 gives debtors up to five years to catch. Ch 13 to ch 11:

Filing Chapter 7 Bankruptcy In NC Bankruptcy Attorney

Stop foreclosure and repossession by paying the past due payments through a chapter 13. Below is a list of the documents needed for filing chapter 7 and chapter 13 bankruptcy cases. Web chapter 13 bankruptcy. When unexpected life events (income reduction, medical, business downturn) create hardship See if you qualify to save monthly on your debt.

Can A Lawyer Stop A Foreclosure? Here are the facts you must know

Web household goods and household furnishings (including appliances), clothes, books, pets, and other personal items are exempt up to a total value of $1,000. Compare top 5 consolidation options. Bankruptcy court, district of maryland. Web 4 minutes read what happens after you file chapter 13 bankruptcy in maryland? Chapter 13 gives debtors up to five years to catch.

Steps to Filing a Chapter 13 Bankruptcy Chapter 13, Bankruptcy, Chapter

Web required forms for chapter 7 and chapter 13 filings. Web some benefits and disadvantages of filing under chapter 13 bankruptcy in maryland include: Ch 12 to ch 7: A baltimore city bankruptcy lawyer explains. Below is a list of the documents needed for filing chapter 7 and chapter 13 bankruptcy cases.

Chapter 13 Bankruptcy Explained Step By Step

Chapter 13 gives debtors up to five years to catch. If your median income is below the state level, you may file. Below is a list of the documents needed for filing chapter 7 and chapter 13 bankruptcy cases. Web if you have enough disposable income to pay at least 25% of your unsecured debts through a chapter 13 repayment.

Ch 13 To Ch 11:

Ch 13 to ch 7: Consolidate your debt to save with one lower monthly payment. 7 bankruptcy and may need to file a chapter 13 bankruptcy instead. A chapter 13 plan must conform to local bankruptcy form m.

$ 313 Conversion Fees Ch 7 To Ch 11:

Compare top 5 consolidation options. In chapter 13 bankruptcy, you will work with the court and your baltimore city bankruptcy. 7 bankruptcy and may need to file a chapter 13 bankruptcy instead. Web if you have enough disposable income to pay at least 25% of your unsecured debts through a chapter 13 repayment plan, then you don’t qualify for chapter 7.

Ad Don't File For Bankruptcy.

See if you qualify to save monthly on your debt. Web chapter 13 resources locations contact home attorneys 45 benefits of bankruptcy chapter 7 chapter 13 locations contact bankrupt in baltimore: Web chapter 13 requirements if you are filing a chapter 13 bankruptcy, a proposed repayment plan must also be submitted. If you’ve already filed under.

Depending On Where You Live (Or Have Assets), Your Local District Court May Be In Greenbelt Or Baltimore.

See if you qualify to save monthly on your debt. Effective february 11, 2013, claims in all cases, in all chapters can be filed electronically using cm/ecf or through the court’s website without a login. Stop foreclosure and repossession by paying the past due payments through a chapter 13. Maryland has a wildcard exemption protecting cash or property of any kind up to $6,000 in value.