File Form 568 Online

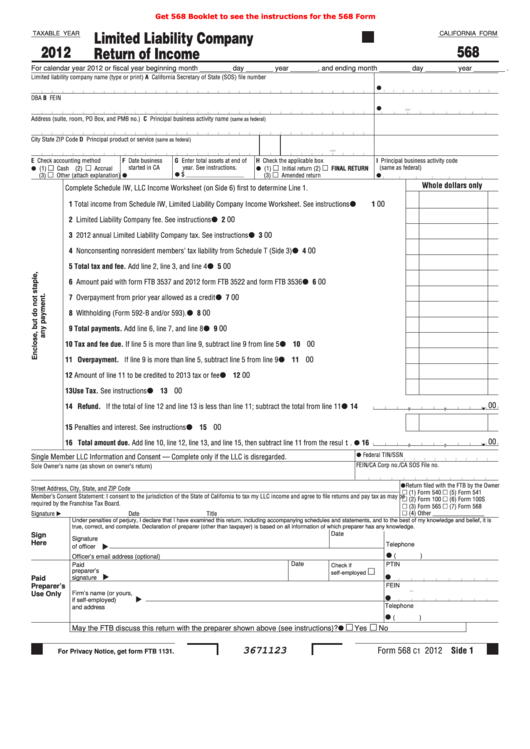

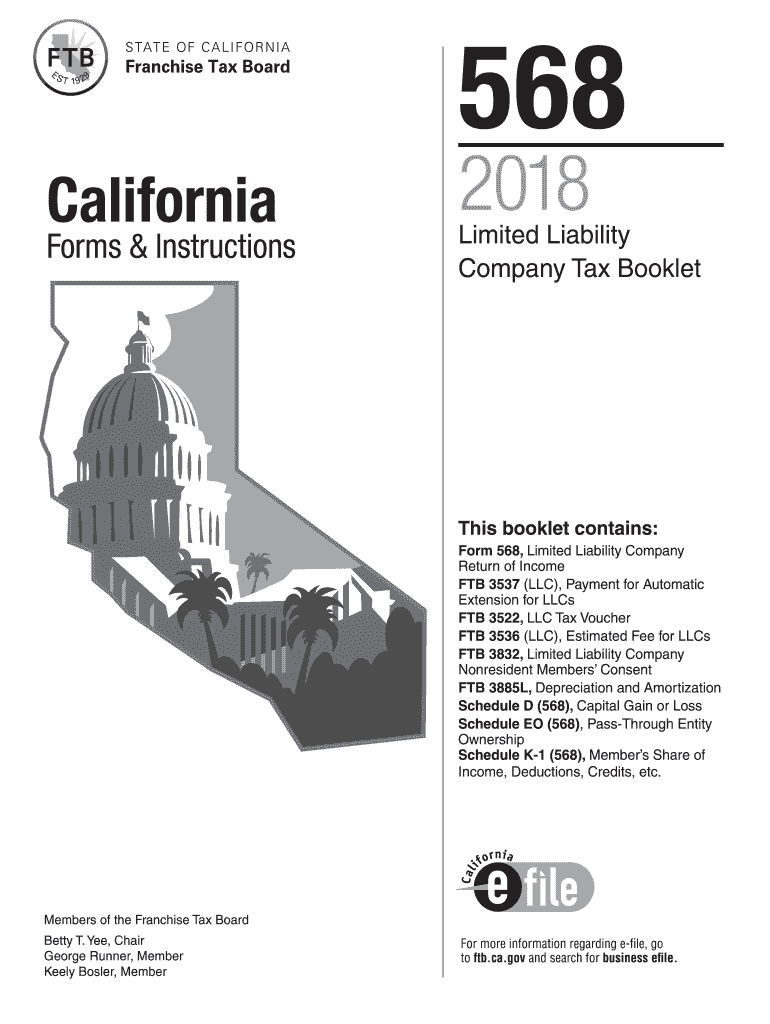

File Form 568 Online - Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Web to generate form 568, limited liability company return of income, choose file > client properties, click the california tab, and mark the limited liability company option. Web you still have to file form 568 if the llc is registered in california. When is the annual tax due? Registration after the year begins. Web file limited liability company return of income (form 568) by the original return due date. It isn't included with the regular ca state partnership formset. Web llcs classified as partnerships file form 568. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california.

Web llcs classified as partnerships file form 568. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web single member llc filing california form 568 efile (turbotax online self employed) i am a bit confused and seeing mixed messages on turbotax pages saying. For an llc, it is probably the most important tax document. Web to complete california form 568 for a partnership, from the main menu of the california return, select: Web form 568 due date. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web ca form 568 is a tax document. If your llc files on an extension, refer to payment for automatic extension for. Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax.

Web california form 568 for limited liability company return of income is a separate state formset. Llcs classified as a disregarded entity or. If your llc files on an extension, refer to payment for automatic extension for. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web file limited liability company return of income (form 568) by the original return due date. While you can submit your state income tax return and federal income tax return by april 15,. Web ca form 568 is a tax document. Web you still have to file form 568 if the llc is registered in california. Web what is form 568?

Fillable California Form 568 Limited Liability Company Return Of

It isn't included with the regular ca state partnership formset. Web single member llc filing california form 568 efile (turbotax online self employed) i am a bit confused and seeing mixed messages on turbotax pages saying. Web llcs classified as partnerships file form 568. How to fill in california form 568 if you have an llc, here’s how to fill.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web when is form 568 due? Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. They are subject to the annual tax, llc fee and credit.

form 568 2015 Fill out & sign online DocHub

Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc. Most llcs doing business in california must file form ca form 568 (limited liability company return of income), form ftb 3522 (llc tax. Web form 568 due.

2020 Form CA FTB 568 Fill Online, Printable, Fillable, Blank pdfFiller

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. The llc must file the appropriate. You and your clients should be aware that a disregarded smllc is required to: Web form 568 due date. Web to generate form 568, limited liability company return of income,.

FTB Form 568 Assistance Dimov Tax & CPA Services

It isn't included with the regular ca state partnership formset. All the other additional financial records and tax documents must agree and. Web when is form 568 due? Web california form 568 for limited liability company return of income is a separate state formset. Web single member llc filing california form 568 efile (turbotax online self employed) i am a.

2013 Form 568 Limited Liability Company Return Of Edit, Fill

Web you still have to file form 568 if the llc is registered in california. It isn't included with the regular ca state partnership formset. All the other additional financial records and tax documents must agree and. When is the annual tax due? Most llcs doing business in california must file form ca form 568 (limited liability company return of.

Ca Form 568 Instructions 2021 Mailing Address To File manyways.top 2021

Web form 568 due date. Web to complete california form 568 for a partnership, from the main menu of the california return, select: They are subject to the annual tax, llc fee and credit limitations. Web llcs classified as partnerships file form 568. If your llc files on an extension, refer to payment for automatic extension for.

Form 568 Instructions 2022 2023 State Tax TaxUni

Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. If your llc files on an extension, refer to payment for automatic extension for. You and your clients should be aware that a disregarded smllc is required to: The llc must file the appropriate. • form.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

For an llc, it is probably the most important tax document. Web to complete california form 568 for a partnership, from the main menu of the california return, select: The llc must file the appropriate. Registration after the year begins. It isn't included with the regular ca state partnership formset.

2016 Form 568 Limited Liability Company Return Of Edit, Fill

Web when is form 568 due? They are subject to the annual tax, llc fee and credit limitations. Web single member llc filing california form 568 efile (turbotax online self employed) i am a bit confused and seeing mixed messages on turbotax pages saying. All the other additional financial records and tax documents must agree and. How to fill in.

Web Llcs Classified As Partnerships File Form 568.

All the other additional financial records and tax documents must agree and. Side 3 (continued from side 2) • federal tin/ssn sole owner’s name (as shown on owner’s return) • fein/ca corp no./ca sos file no. Web california form 568 for limited liability company return of income is a separate state formset. The llc must file the appropriate.

You And Your Clients Should Be Aware That A Disregarded Smllc Is Required To:

Web smllcs, owned by an individual, are required to file form 568 on or before april 15. Llcs may be classified for tax purposes as a partnership, a corporation, or a disregarded entity. Web we require an smllc to file form 568, even though they are considered a disregarded entity for tax purposes. Web i (1)during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this llc or any legal entity in which the llc.

Web To Generate Form 568, Limited Liability Company Return Of Income, Choose File > Client Properties, Click The California Tab, And Mark The Limited Liability Company Option.

They are subject to the annual tax, llc fee and credit limitations. • form 568, limited liability company return of income • form 565, partnership return of income • form 100, california. How to fill in california form 568 if you have an llc, here’s how to fill in the california form 568:. Web single member llc filing california form 568 efile (turbotax online self employed) i am a bit confused and seeing mixed messages on turbotax pages saying.

Llcs Classified As A Disregarded Entity Or.

Web file limited liability company return of income (form 568) by the original return due date. If your llc files on an extension, refer to payment for automatic extension for. For an llc, it is probably the most important tax document. Web you still have to file form 568 if the llc is registered in california.