Due Diligence Form 8867

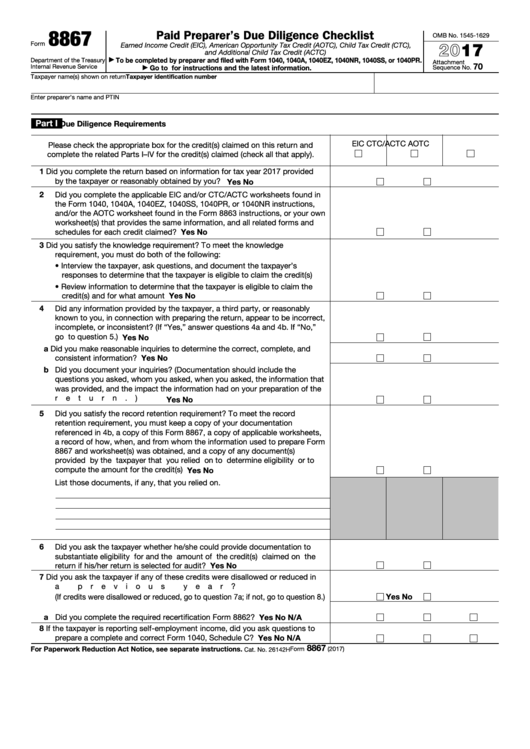

Due Diligence Form 8867 - Solvedby intuit•updated 20 minutes ago. Form 8867 and the due diligence required of tax practitioners are important measures put in place by the irs to ensure that tax returns are accurate and complete. Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. Get ready for tax season deadlines by completing any required tax forms today. Due to changes in the law, the paid tax return preparer eic due diligence requirements have been expanded to also cover the ctc/actc and. Web information about form 8867, paid preparer's earned income credit checklist, including recent updates, related forms and instructions on how to file. Web this section helps you understand due diligence requirements and resources. Publication 4687 pdf , paid preparer due. Paid preparer’s due diligence checklist. As part of exercising due.

Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. Complete, edit or print tax forms instantly. The american institute of certified public accountants' compreh. Publication 4687 pdf , paid preparer due. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. What are you waiting for? Paid preparer’s due diligence checklist. Web up to 10% cash back four requirements for due diligence. Due diligence topics due diligence law what is form 8867? Form 8867 and the due diligence required of tax practitioners are important measures put in place by the irs to ensure that tax returns are accurate and complete.

What are you waiting for? Web completing form 8867 paid preparer's due diligence checklist in proconnect. Ad typeforms are more engaging, so you get more responses and better data. Solvedby intuit•updated 20 minutes ago. Web what is form 8867? Web up to 10% cash back four requirements for due diligence. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Ad access irs tax forms. Use this section to provide information for and. Web form 8867 expanded and revised.

Fill Free fillable Form 8867 2019 Paid Preparer’s Due Diligence

Web information about form 8867, paid preparer's earned income credit checklist, including recent updates, related forms and instructions on how to file. Publication 4687 pdf , paid preparer due. Complete, edit or print tax forms instantly. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web this.

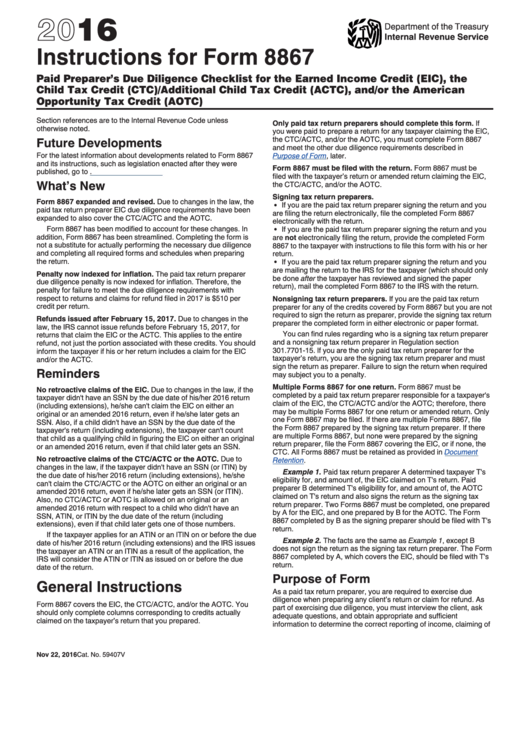

Instructions For Form 8867 Paid Preparer'S Due Diligence Checklist

Solvedby intuit•updated 20 minutes ago. Due to changes in the law, the paid tax return preparer eic due diligence requirements have been expanded to also cover the ctc/actc and. What are you waiting for? Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. Use this section.

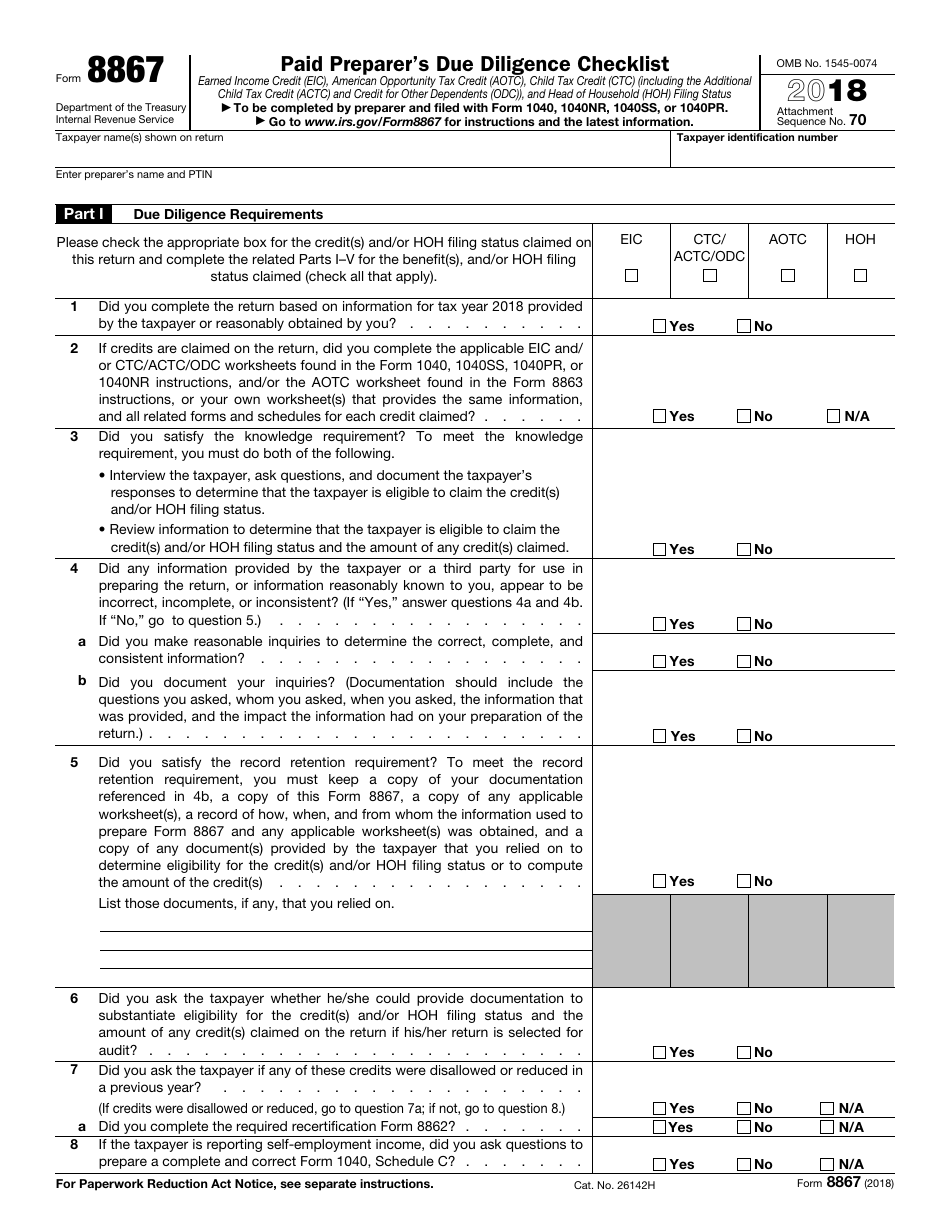

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Due to changes in the law, the paid tax return preparer eic due diligence requirements have been expanded to also cover the ctc/actc and. Web up to 10% cash back four requirements for due diligence. Form 8867 and the due diligence required of tax practitioners are important measures put in place by the irs to ensure that tax returns are.

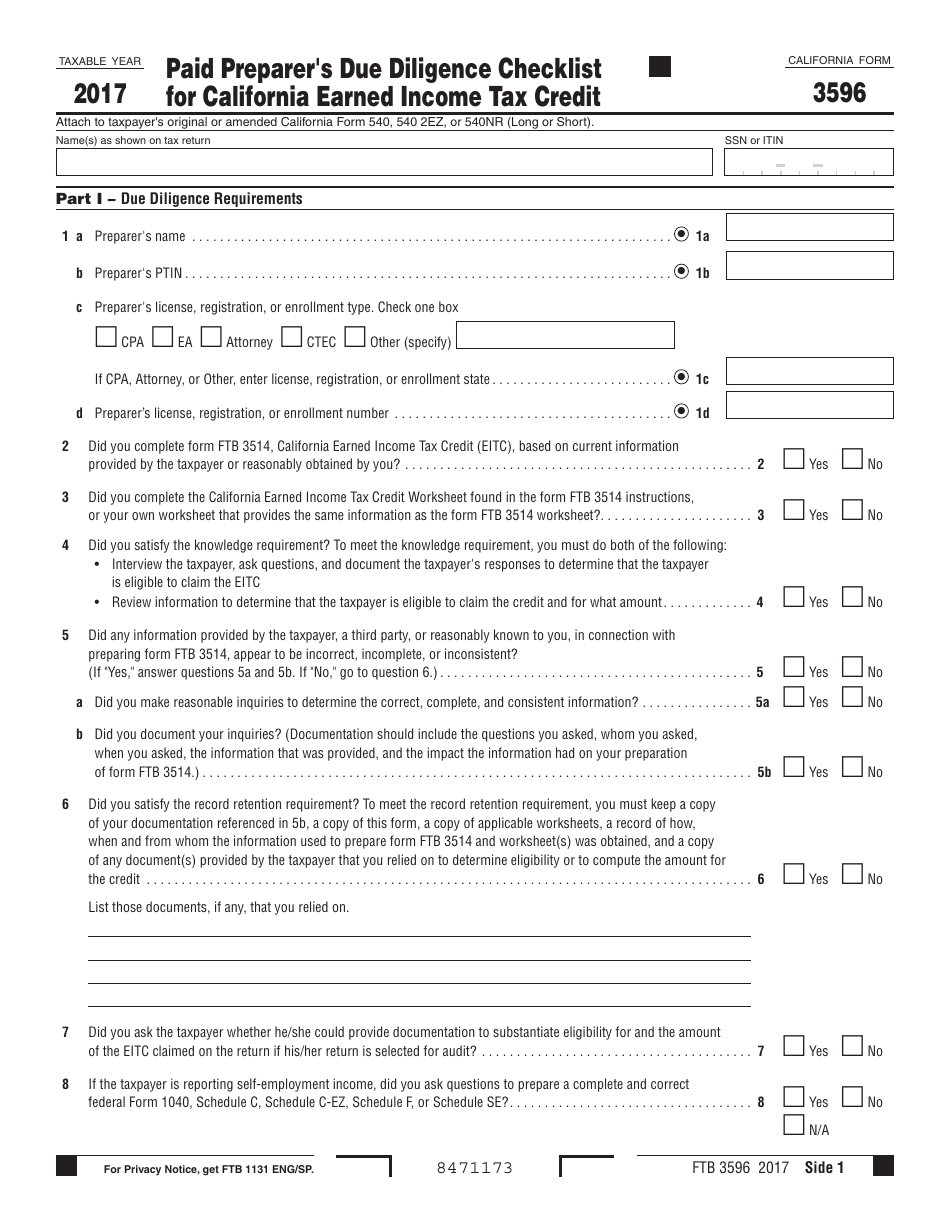

Form FTB3596 Download Printable PDF or Fill Online Paid Preparer's Due

Complete, edit or print tax forms instantly. Web completing form 8867 paid preparer's due diligence checklist in proconnect. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Web paid preparer’s due diligence checklist enter preparer’s name and ptin for paperwork reduction act notice, see.

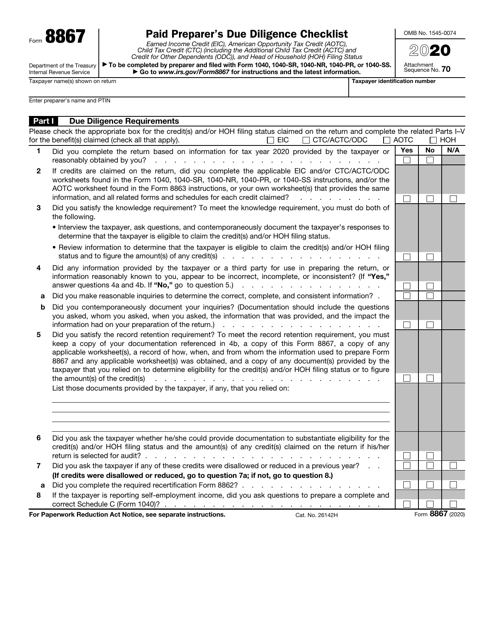

Draft of Form for Expanded Preparer Due Diligence Released by IRS

Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Publication 4687 pdf , paid preparer due. Due diligence requires paid preparers to satisfy these four tests when a.

IRS Form 8867 Download Fillable PDF or Fill Online Paid Preparer's Due

Web form 8867 department of the treasury internal revenue service paid preparer’s due diligence checklist earned income credit (eic), american opportunity tax credit. Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Due diligence requires paid preparers to satisfy these four tests when a return claims any.

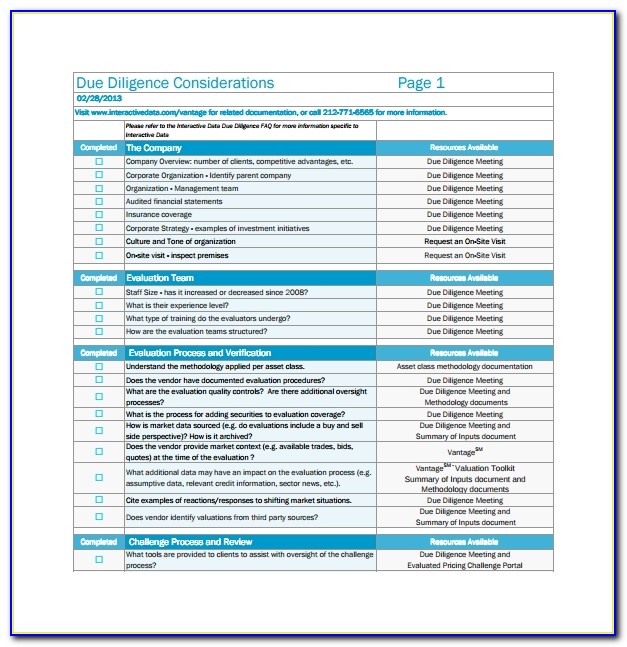

Due Diligence Checklist Template Uk

Paid preparer’s due diligence checklist. Web completing form 8867 paid preparer's due diligence checklist in proconnect. As part of exercising due. Form 8867 and the due diligence required of tax practitioners are important measures put in place by the irs to ensure that tax returns are accurate and complete. Web when form 8867 is required, lacerte will generate the paid.

Form 8867 Paid Preparer`s Due Diligence Checklist Editorial Stock Photo

Web information about form 8867, paid preparer's earned income credit checklist, including recent updates, related forms and instructions on how to file. Use this section to provide information for and. Web this section helps you understand due diligence requirements and resources. Paid preparer’s due diligence checklist. Due diligence requires paid preparers to satisfy these four tests when a return claims.

Fillable Form 8867 Paid Preparer'S Earned Credit Checklist

As part of exercising due. Web paid preparer’s due diligence checklist enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Form 8867 and the due diligence required of tax practitioners are important measures put in place by the irs to ensure that tax returns are accurate and complete. Ad typeforms are more engaging, so you get.

Due Diligence Checklist Template Word Template 1 Resume Examples

Form 8867 and the due diligence required of tax practitioners are important measures put in place by the irs to ensure that tax returns are accurate and complete. Web this section helps you understand due diligence requirements and resources. Ad typeforms are more engaging, so you get more responses and better data. Due diligence requires paid preparers to satisfy these.

Web This Section Helps You Understand Due Diligence Requirements And Resources.

Form 8867 and the due diligence required of tax practitioners are important measures put in place by the irs to ensure that tax returns are accurate and complete. Complete and submit form 8867 (treas. Publication 4687 pdf , paid preparer due. Web use this screen to enter information to complete form 8867, paid preparer’s due diligence checklist.

Web Under The Final Regulations Promulgated Under Section 6695 On November 5, 2018, Completing Form 8867 (Based On Information Provided By The Taxpayer) Is An.

Web form 8867 expanded and revised. Get ready for tax season deadlines by completing any required tax forms today. The american institute of certified public accountants' compreh. What are you waiting for?

Due Diligence Requires Paid Preparers To Satisfy These Four Tests When A Return Claims Any Of The Four Tax.

Use this section to provide information for and. As part of exercising due. Due to changes in the law, the paid tax return preparer eic due diligence requirements have been expanded to also cover the ctc/actc and. Complete, edit or print tax forms instantly.

December 2021) Department Of The Treasury Internal Revenue Service.

Web when form 8867 is required, lacerte will generate the paid preparer's due diligence checklist as though all requirements have been completed. Web paid preparer’s due diligence checklist enter preparer’s name and ptin for paperwork reduction act notice, see separate instructions. Web form 8867, paid preparer’s due diligence checklist, must be filed with the tax return for any taxpayer claiming eic, the ctc/actc, and/or the aotc. Web information about form 8867, paid preparer's earned income credit checklist, including recent updates, related forms and instructions on how to file.