Due Date Form 5500

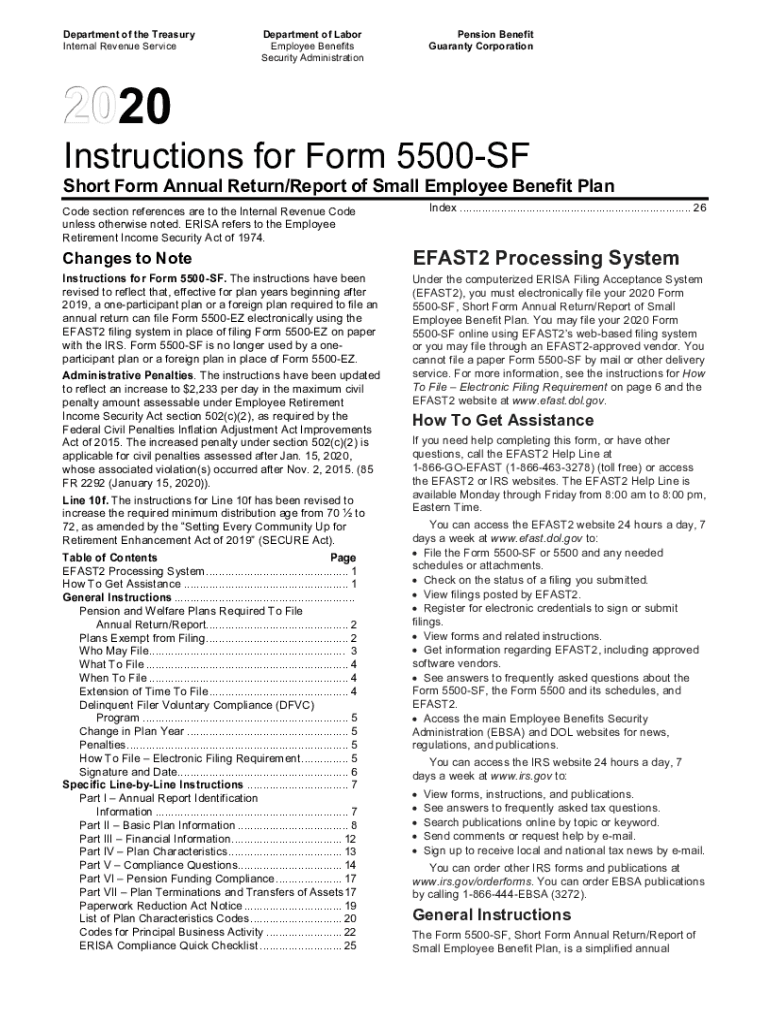

Due Date Form 5500 - Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Web for penalties assessed after jan. Web form 5500 due date. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. Must file electronically through efast2. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. The dol per day penalty for failure to properly file form 5500 has increased to $2,259 from $2,233, with no maximum.

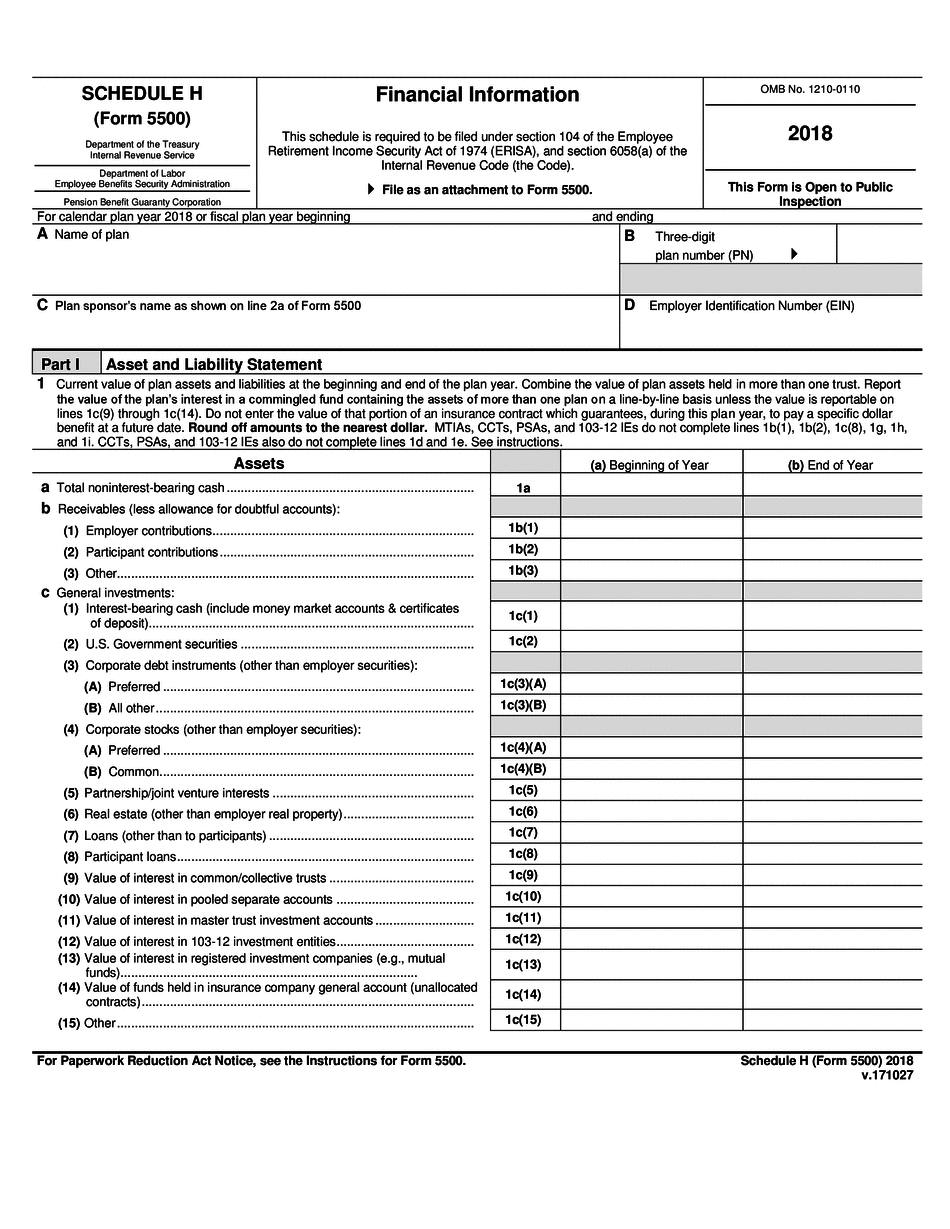

The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. The form 5500 due date for filing depends on the plan year. The irs can also assess a. Web for penalties assessed after jan. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Calendar year plans have a form 5500 due date of july 31 st. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. Must file electronically through efast2.

Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. Thus, filing of the 2023 forms generally will not begin until july 2024. Must file electronically through efast2. The dol per day penalty for failure to properly file form 5500 has increased to $2,259 from $2,233, with no maximum. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web for penalties assessed after jan. Calendar year plans have a form 5500 due date of july 31 st. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension.

form 5500 extension due date 2022 Fill Online, Printable, Fillable

Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. The dol per day penalty for failure to properly file form 5500 has increased to $2,259 from $2,233, with no maximum. Calendar year plans have a form 5500 due date of july 31 st. The form 5500 series is documentation designed to.

The Due Date For Your 401K Form 5500 Is Now! Benefits Compliance

If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. The general rule is that form 5500s.

Form 5500 Due Date Avoid Serious Late Filing Penalties BASIC

The dol per day penalty for failure to properly file form 5500 has increased to $2,259 from $2,233, with no maximum. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. The last day of the seventh month after the plan year ends (july 31 for.

Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]

The dol per day penalty for failure to properly file form 5500 has increased to $2,259 from $2,233, with no maximum. The irs can also assess a. Thus, filing of the 2023 forms generally will not begin until july 2024. Web frequently asked questions what is form 5500? Web typically, the form 5500 is due by july 31st for calendar.

Form 5500 Annual Fill Out and Sign Printable PDF Template signNow

Web for penalties assessed after jan. Web this topic provides electronic filing opening day information and information about relevant due dates for 5500 returns. The dol per day penalty for failure to properly file form 5500 has increased to $2,259 from $2,233, with no maximum. Thus, filing of the 2023 forms generally will not begin until july 2024. Web file.

Retirement plan 5500 due date Early Retirement

15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Thus, filing of the 2023 forms generally will not begin until july 2024. Web file form 5500.

How to File Form 5500EZ Solo 401k

Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r. Web form 5500 due date. Web.

Due Date Log Templates 6+ Free Printable Word & Excel Samples

Web form 5500 due date. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. The form 5500 series.

August 1st Form 5500 Due Matthews, Carter & Boyce

The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in.

SLT Adapting to New Federal Tax Returns Due Dates in New York The

The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension. The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web form 5500 due date. 15th, but if the filing due date falls on.

Web For Penalties Assessed After Jan.

The irs can also assess a. Must file electronically through efast2. The form 5500 series is documentation designed to satisfy the annual reporting requirements under title i and title iv of the employee retirement income security act (erisa) and the internal revenue code. The form 5500 due date for filing depends on the plan year.

Calendar Year Plans Have A Form 5500 Due Date Of July 31 St.

The last day of the seventh month after the plan year ends (july 31 for a calendar year plan). Web form 5500 due date. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Thus, filing of the 2023 forms generally will not begin until july 2024.

Web Frequently Asked Questions What Is Form 5500?

Web file form 5500 to report information on the qualification of the plan, its financial condition, investments and the operations of the plan. The dol per day penalty for failure to properly file form 5500 has increased to $2,259 from $2,233, with no maximum. 15th, but if the filing due date falls on a saturday, sunday or federal holiday, it may be filed on the next business day. The general rule is that form 5500s must be filed by the last day of the seventh month after the plan year ends, unless filing an extension.

Web This Topic Provides Electronic Filing Opening Day Information And Information About Relevant Due Dates For 5500 Returns.

Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Notes there is no limit for the grace period on a rejected 5500 return, but you should resubmit the return as soon as possible. If the deadline falls on a saturday, sunday, or federal holiday, the filing may be submitted on the next business day that is not a saturday, sunday, or federal holiday. Web the form 5500 series is part of erisa's overall reporting and disclosure framework, which is intended to assure that employee benefit plans are operated and managed in accordance with certain prescribed standards and that participants and beneficiaries, as well as regulators, are provided or have access to sufficient information to protect the r.

![Form 5500EZ Example Complete in a Few Easy Steps! [Infographic]](http://www.emparion.com/wp-content/uploads/2018/05/5500ez-part-2.png)