Delaware Form 1120

Delaware Form 1120 - If the corporation’s principal business, office, or agency is located in: The state of delaware has not adopted by. 1federal taxable income (see specific instructions). Web attach complete copy of federal form 1120s 1. Total subtractions from schedule 4a. Corporation income tax return, including recent updates, related forms and instructions on how to file. Web mailing addresses for forms 1120. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! The “total assets” figure you reported on form 1120, schedule l of your federal tax return) by the total number of. Web information about form 1120, u.s.

Web delaware requires a valid federal attachment in the electronic file. If the corporation’s principal business, office, or agency is located in: A copy of form de2210, pages 1 and 2, if you completed part 3 of the. Web attach completed copy of federal form 1120 1. Electronic filing is fast, convenient, accurate and. Web first, divide your business’ total gross assets (i.e. Web information about form 1120, u.s. Ad access irs tax forms. And the total assets at the end of the tax year are: Total subtractions from schedule 4a.

Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Total subtractions from schedule 4a. The state of delaware has not adopted by. Web if you are not redirected please download directly from the link provided. Web total gross assets, which are reported on the company’s federal tax return form 1120 total issued shares, which can be found in the company’s stock transfer ledger what if. Use this form to report the. Web first, divide your business’ total gross assets (i.e. Web mailing addresses for forms 1120. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Web delaware requires a valid federal attachment in the electronic file.

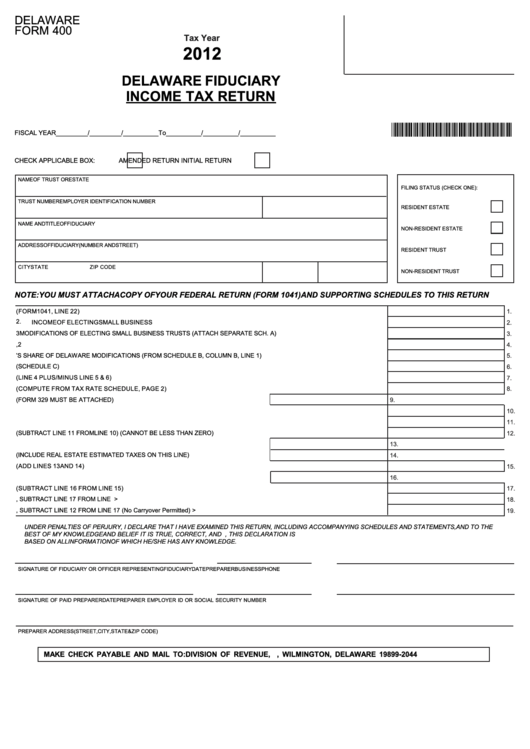

Delaware Form 400 Fiduciary Tax Return 2012 printable pdf

Join flightaware view more flight. Web information about form 1120, u.s. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. The state of delaware has not adopted by. Web form 1120 department of the treasury internal revenue service u.s.

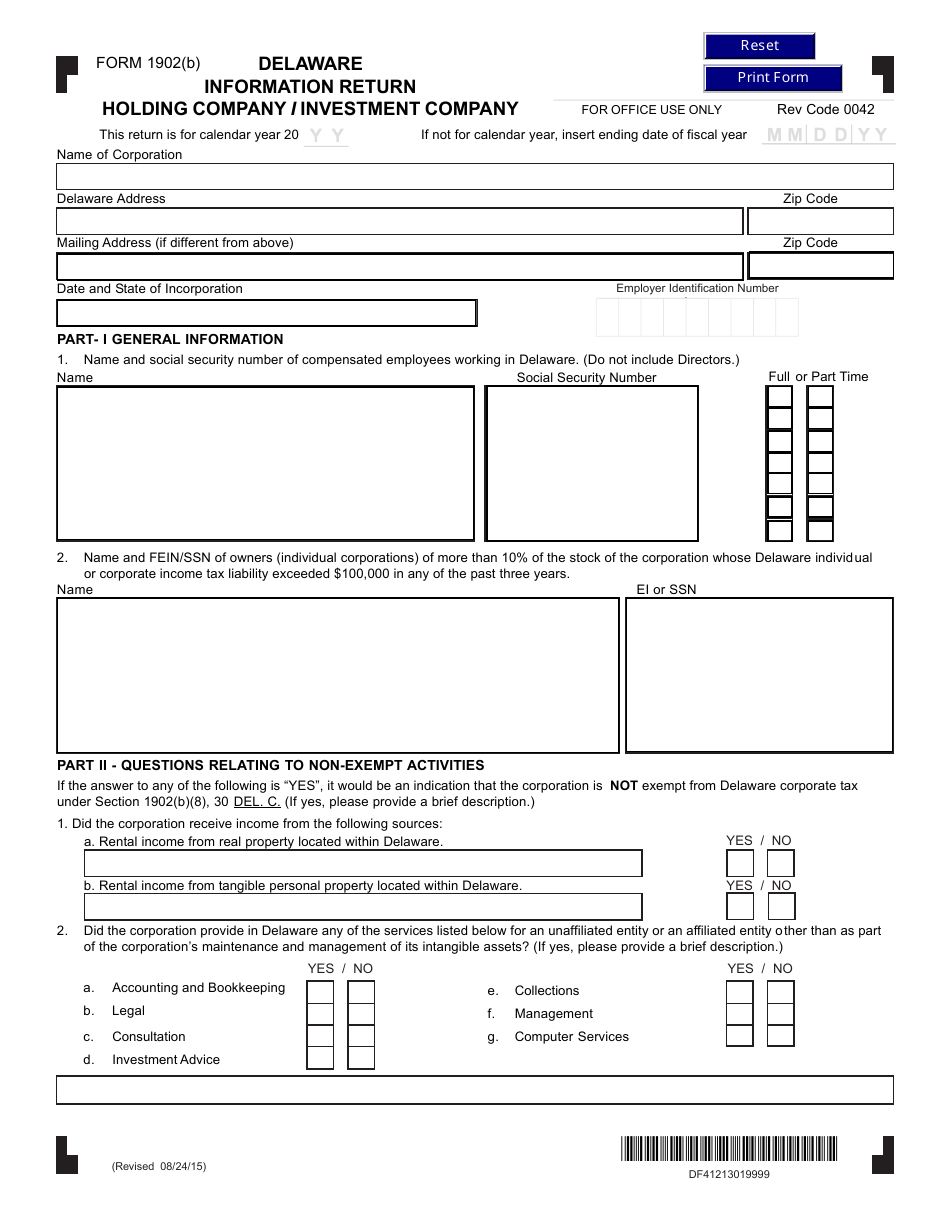

Form 1902(B) Download Fillable PDF or Fill Online Delaware Information

Web if you are not redirected please download directly from the link provided. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! A copy of form de2210, pages 1 and 2, if you completed part 3 of the. Electronic filing is fast, convenient, accurate and. Web total gross assets, which.

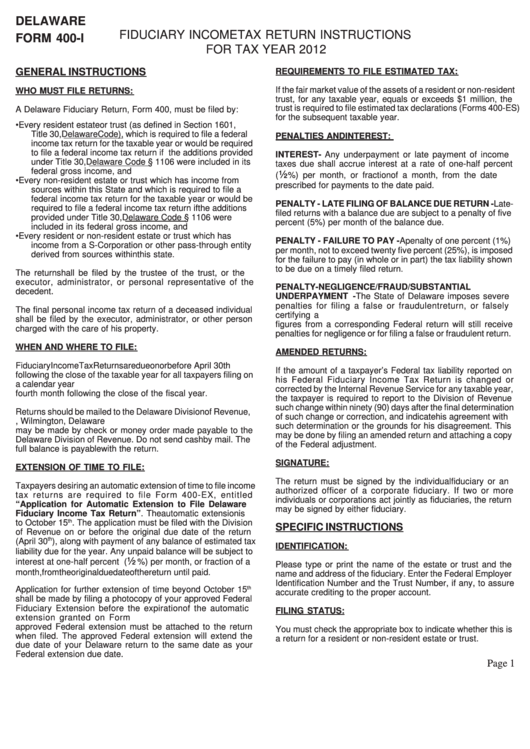

Instructions For Delaware Form 400I 2012 printable pdf download

And the total assets at the end of the tax year are: If the corporation’s principal business, office, or agency is located in: Complete, edit or print tax forms instantly. Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web attach complete copy of federal form 1120s 1.

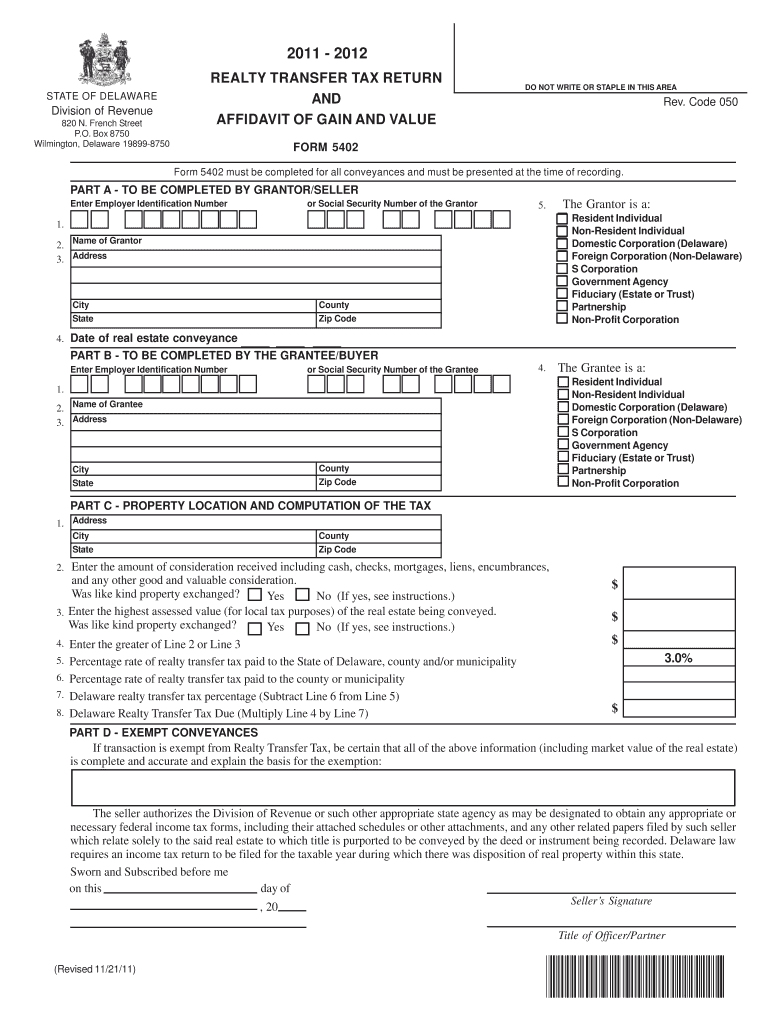

Delaware Form 5403 effective 1/1/2019 Required for All Transfers of

Web group must file a separate return (1120 pro forma) reporting income and deductions as if a separate federal income tax return was filed. 1federal taxable income (see specific instructions). If the corporation’s principal business, office, or agency is located in: Electronic filing is fast, convenient, accurate and. Web delaware division of corporations frequently asked tax questions listen return to.

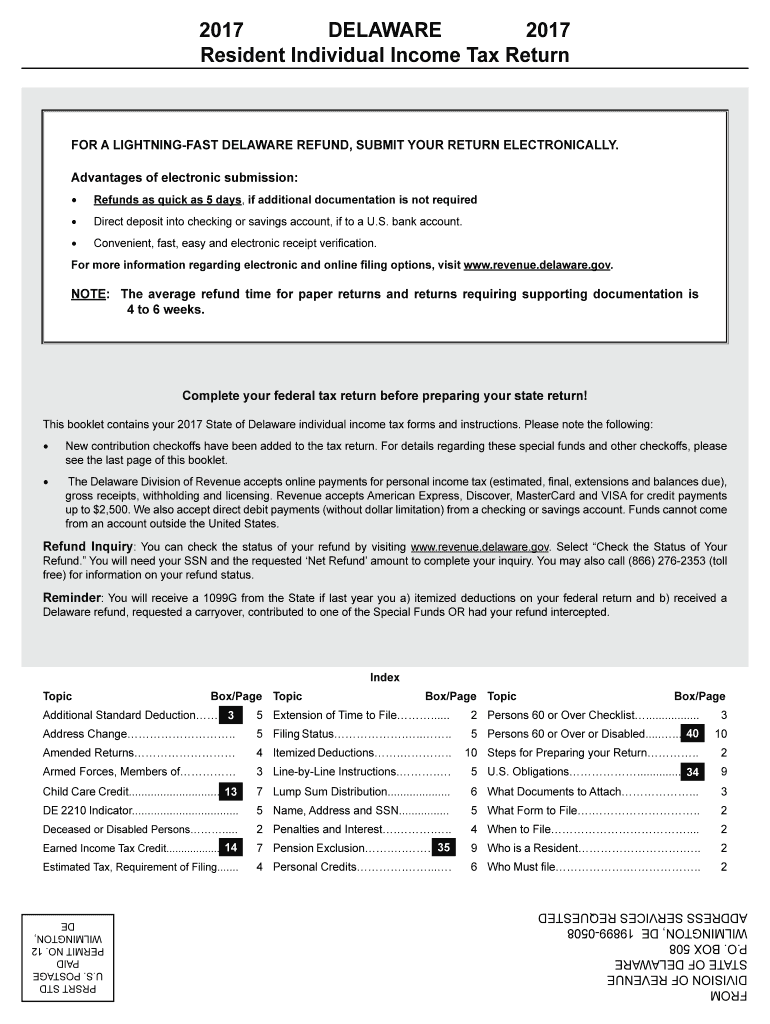

Delaware Form 200 01 Fill Out and Sign Printable PDF Template signNow

Total subtractions from schedule 4a. 1federal taxable income (see specific instructions). Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Web total gross assets, which are reported on the company’s federal tax return form 1120 total issued shares, which can be found in the company’s stock transfer ledger what if..

2013 Form IRS 1120POL Fill Online, Printable, Fillable, Blank pdfFiller

Web delaware requires a valid federal attachment in the electronic file. Web form 1120 department of the treasury internal revenue service u.s. Ad access irs tax forms. Web delaware division of corporations frequently asked tax questions listen return to annual report and tax instructions how do i contact the franchise tax department on march. Complete, edit or print tax forms.

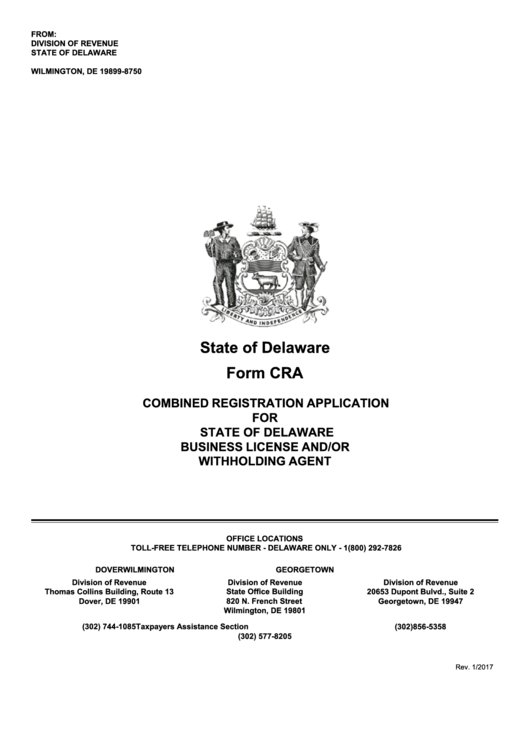

Form Cra Combined Registration Application For State Of Delaware

A copy of form de2210, pages 1 and 2, if you completed part 3 of the. Web attach complete copy of federal form 1120s 2. Corporation income tax return, including recent updates, related forms and instructions on how to file. Electronic filing is fast, convenient, accurate and. Join flightaware view more flight.

IRS Form 1120

Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. (a) (b) net interest from u.s securities to the extent included in line 1. Electronic filing is fast, convenient,. And the total assets at the end of the tax year are: If the corporation’s principal business, office, or agency is located in:

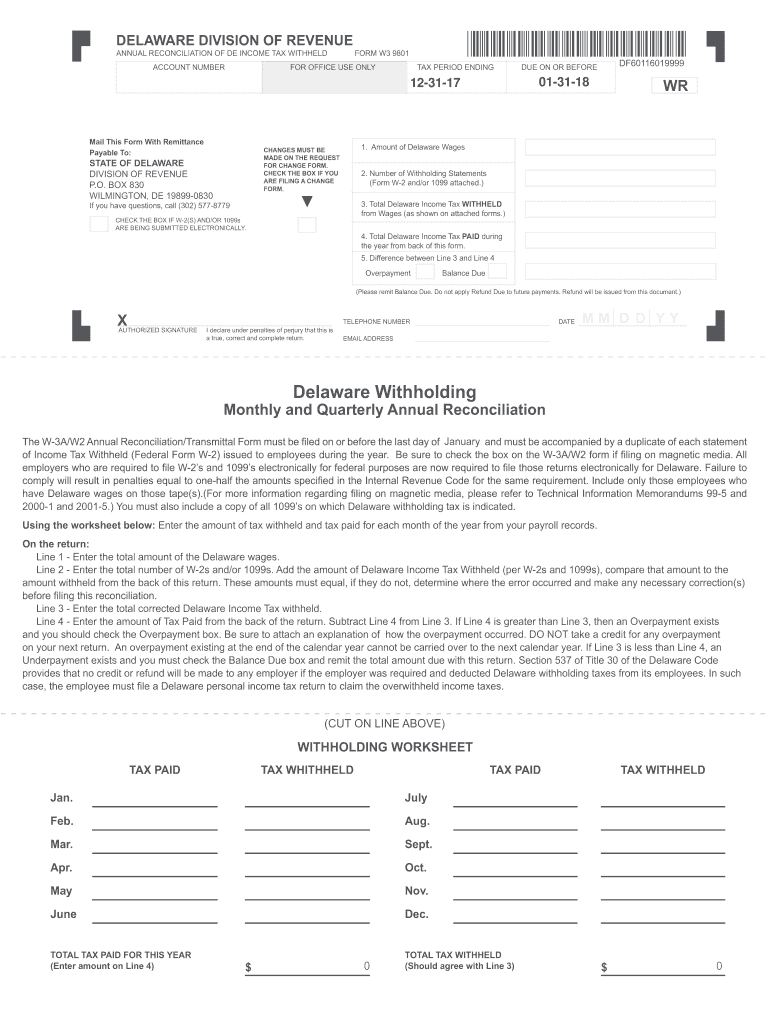

Delaware W3 Fill Out and Sign Printable PDF Template signNow

Do your past year business tax for tax year 2021 to 2000 easy, fast, secure & free to try! Total net income from delaware form 1100s, schedule a, column b, line 19 2. Corporation income tax return for calendar year 2022 or tax year beginning, 2022, ending , 20 go to. Web first, divide your business’ total gross assets (i.e..

Web Delaware Requires A Valid Federal Attachment In The Electronic File.

Ad easy, fast, secure & free to try! Web total gross assets, which are reported on the company’s federal tax return form 1120 total issued shares, which can be found in the company’s stock transfer ledger what if. Web group must file a separate return (1120 pro forma) reporting income and deductions as if a separate federal income tax return was filed. Web delaware division of corporations frequently asked tax questions listen return to annual report and tax instructions how do i contact the franchise tax department on march.

Ad Access Irs Tax Forms.

Web first, divide your business’ total gross assets (i.e. (a) (b) net interest from u.s securities to the extent included in line 1. Web if you are not redirected please download directly from the link provided. Corporation income tax return, including recent updates, related forms and instructions on how to file.

If The Corporation’s Principal Business, Office, Or Agency Is Located In:

Use this form to report the. Electronic filing is fast, convenient, accurate and. Web attach complete copy of federal form 1120s 1. 1federal taxable income (see specific instructions).

Corporation Income Tax Return For Calendar Year 2022 Or Tax Year Beginning, 2022, Ending , 20 Go To.

Electronic filing is fast, convenient,. Web attach complete copy of federal form 1120s 2. The “total assets” figure you reported on form 1120, schedule l of your federal tax return) by the total number of. Join flightaware view more flight.