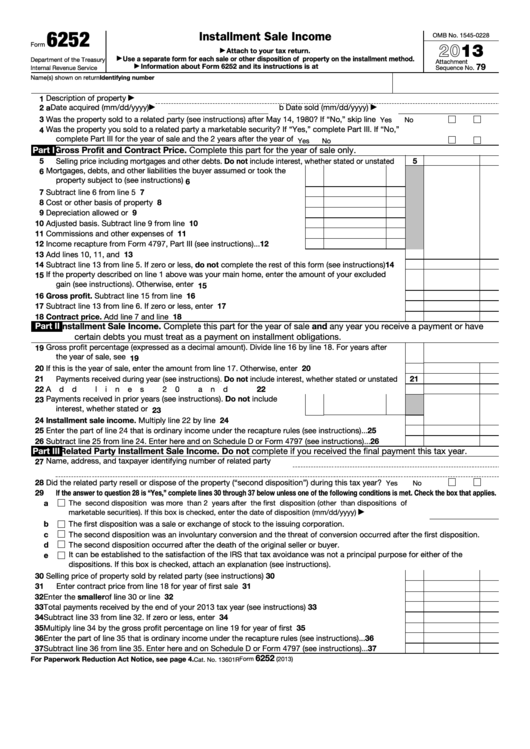

Deferred Obligation Form 6252 K-1

Deferred Obligation Form 6252 K-1 - After may 14, 1980, (n), [c], or (3) was not reported in a separate form 6252 for any property other than properties to which paragraph. Complete the general information smart worksheet. Under the installment method, the seller. Sign online button or tick the preview image of the document. This form is filed by anyone who has realized a gain on. Web how to complete the dd 2652 form on the internet: To begin the blank, use the fill camp; Ad download or email form 6252 & more fillable forms, try for free now! Scroll down to the current year installment sale. Web you can download free dd 2752 form in many formats from our site:

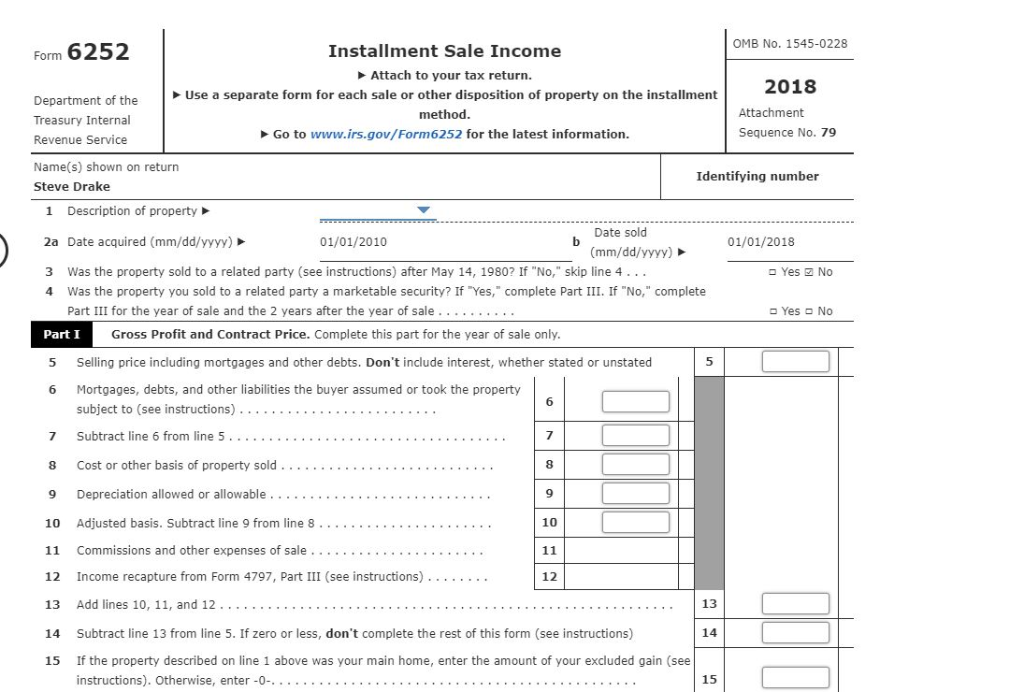

Sign online button or tick the preview image of the document. I found this way more helpful in. Web irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally paid for the item. Scroll down to the current year installment sale. Use this form to report income from an installment sale on the installment method. Web about form 6252, installment sale income. Web up to $40 cash back line 3 should read as follows: Ad download or email form 6252 & more fillable forms, try for free now! Customs and border protection (cbp) declaration for personal property. Open the asset entry worksheet for the property involved in the.

Web scroll down to the form 4797 section. Web there are two methods for entering an installment sale to produce the form 6252 within an individual 1040 return: Web irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally paid for the item. Generally, an installment sale is a. Sign online button or tick the preview image of the document. This home is currently not for sale, this home is estimated to be. This form is filed by anyone who has realized a gain on. After may 14, 1980, (n), [c], or (3) was not reported in a separate form 6252 for any property other than properties to which paragraph. If you can’t view the army. Under the installment method, the seller.

Form 6252 Installment Sale (2015) Free Download

Scroll down to the current year installment sale. This method uses the automatic sale feature. Web there are two methods for entering an installment sale to produce the form 6252 within an individual 1040 return: Web up to $40 cash back line 3 should read as follows: Web form 6252, line 7, selling price less liabilities assumed:

Fillable Form 6252 Installment Sale 2013 printable pdf download

Sign online button or tick the preview image of the document. Web up to $40 cash back line 3 should read as follows: Web scroll down to the form 4797 section. Web there are two methods for entering an installment sale to produce the form 6252 within an individual 1040 return: To begin the blank, use the fill camp;

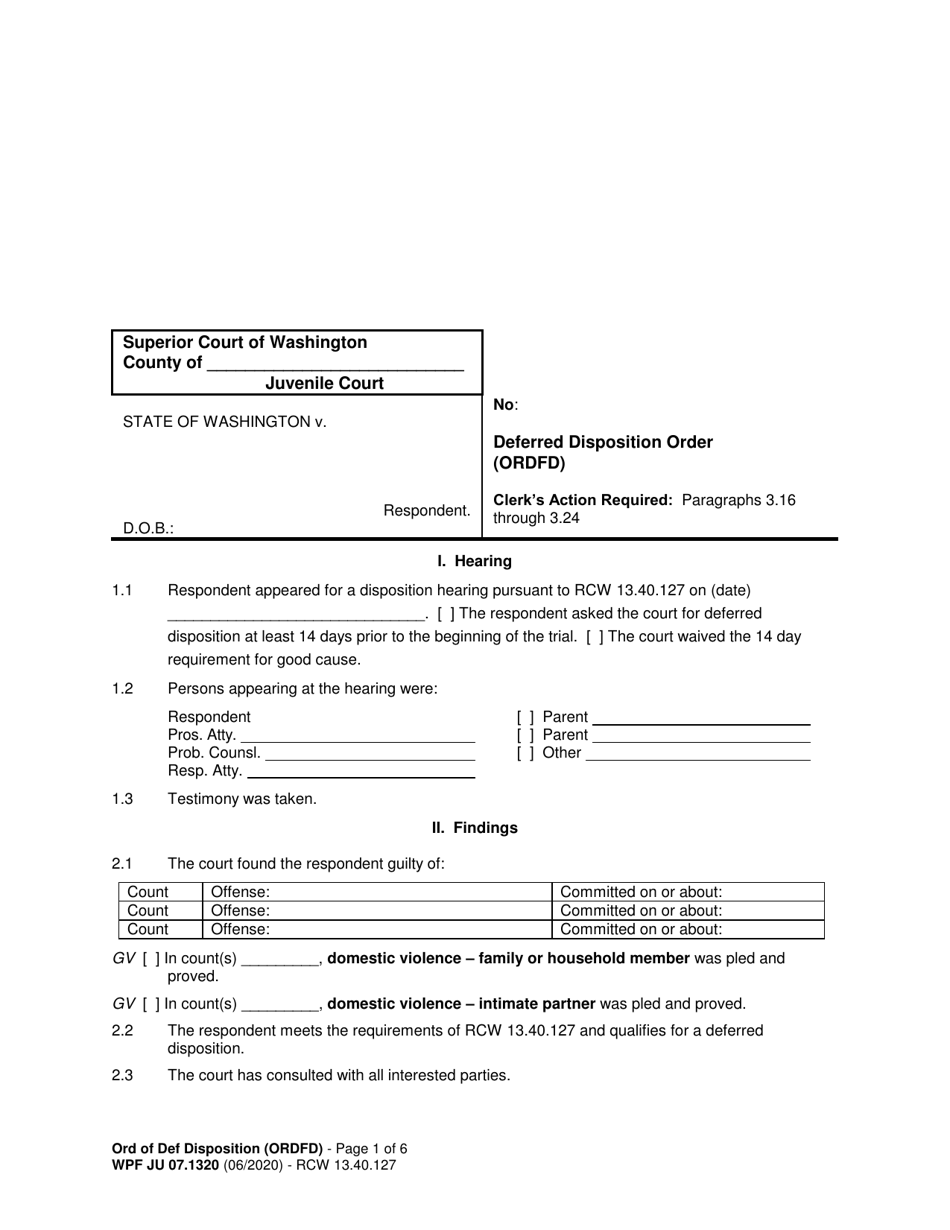

Form WPF JU07.1320 Download Printable PDF or Fill Online Deferred

Installment sale of assets in fixed assets disposition of assets on the fixed assets form should be reported only on the disposition tab of the fixed assets form. Sign online button or tick the preview image of the document. After may 14, 1980, (n), [c], or (3) was not reported in a separate form 6252 for any property other than.

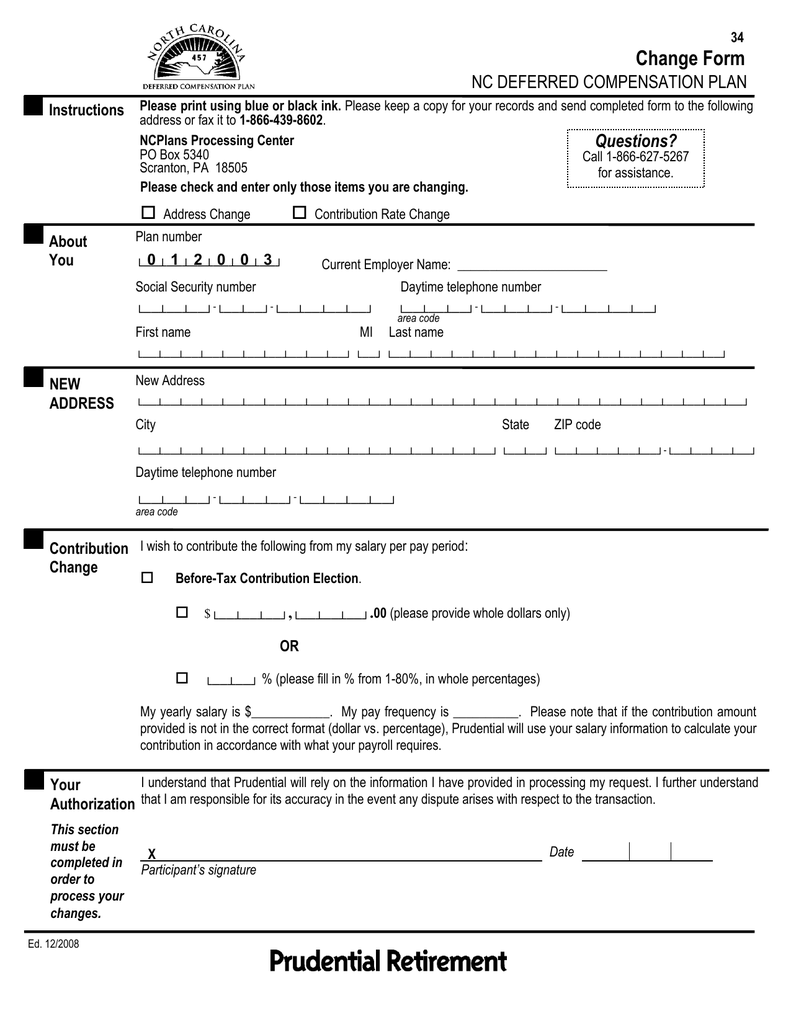

Change Form NC DEFERRED COMPENSATION PLAN Instructions

Complete the general information smart worksheet. Ad download or email form 6252 & more fillable forms, try for free now! Installment sale of assets in fixed assets disposition of assets on the fixed assets form should be reported only on the disposition tab of the fixed assets form. Scroll down to the current year installment sale. This form is filed.

American Axle Sells 10 U.S. Iron Foundries Foundry Management

Web an installment sale is reported on form 6252, installment sale income, and completed for each year of the installment agreement. This home is currently not for sale, this home is estimated to be. I found this way more helpful in. Web as i understand, this is related to section 453a (c) deferred obligation and i have the partner's share.

Fill Free fillable Installment Sale Form 6252 PDF form

This method uses the automatic sale feature. Web form 6252, line 7, selling price less liabilities assumed: Web how to complete the dd 2652 form on the internet: Create legally binding electronic signatures on any device. Web as i understand, this is related to section 453a (c) deferred obligation and i have the partner's share of this obligation which, as.

Genworth Deferred Annuity Claim Form Fill Online, Printable, Fillable

Web form 6252 is used to report income from the sale of real or personal property coming from an installment sale. Generally, an installment sale is a. I found this way more helpful in. Use this form to report income from an installment sale on the installment method. When you sell something for more than you paid for it, you.

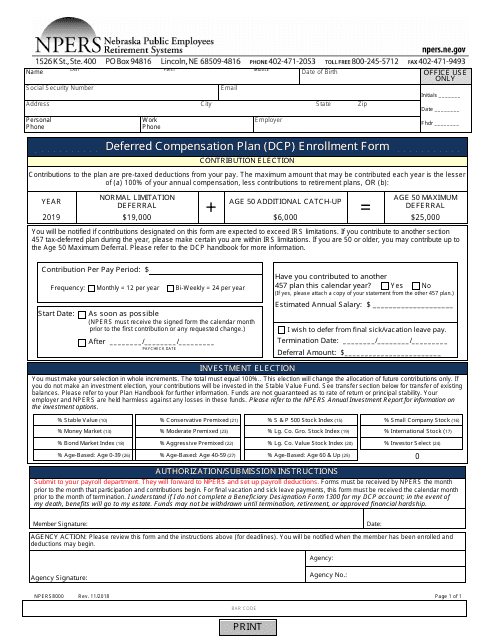

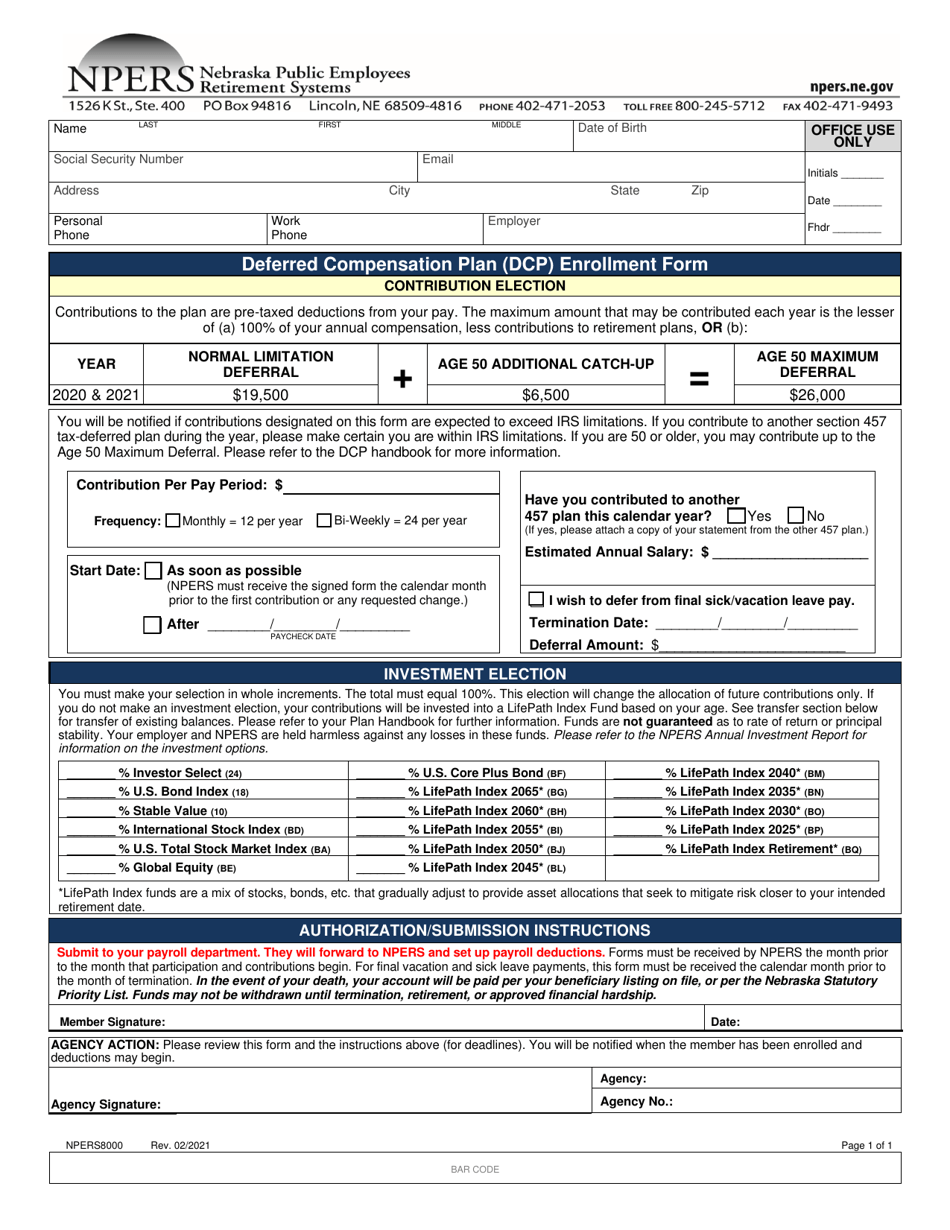

Form NPERS8000 Download Fillable PDF or Fill Online Deferred

To begin the blank, use the fill camp; Create legally binding electronic signatures on any device. I found this way more helpful in. Web scroll down to the form 4797 section. When you sell something for more than you paid for it, you report the income on your taxes for the.

Form NPERS8000 Download Fillable PDF or Fill Online Deferred

Web as i understand, this is related to section 453a (c) deferred obligation and i have the partner's share of this obligation which, as per irs instructions, i think needs. Web you can download free dd 2752 form in many formats from our site: Web irs tax form 6252 is a form that you must use to report income you've.

Under The Installment Method, The Seller.

Web you can download free dd 2752 form in many formats from our site: Web how to complete the dd 2652 form on the internet: Generally, an installment sale is a. After may 14, 1980, (n), [c], or (3) was not reported in a separate form 6252 for any property other than properties to which paragraph.

The Advanced Tools Of The.

Open the asset entry worksheet for the property involved in the. Web an installment sale is reported on form 6252, installment sale income, and completed for each year of the installment agreement. Web scroll down to the form 4797 section. 2362 highway 52, is a single family home, built in 2004, at 2,280 sqft.

This Method Uses The Automatic Sale Feature.

I found this way more helpful in. Scroll down to the current year installment sale. Ad download or email form 6252 & more fillable forms, try for free now! Web irs tax form 6252 is a form that you must use to report income you've acquired from selling something for a price higher than what you originally paid for the item.

If You Can’t View The Army.

When you sell something for more than you paid for it, you report the income on your taxes for the. Dd 2752 fillable pdf, dd 2752 fillable word, blank dd 2752 (ibm lotus) : Create legally binding electronic signatures on any device. To begin the blank, use the fill camp;