Deed Of Trust Form Pdf

Deed Of Trust Form Pdf - (a) interest due under the note; Title 20, chapter 77 of the pennsylvania statutes governs trusts in the state of pennsylvania. A trust is a wealth management tool commonly used in estate planning. Trustees use an official document called a certificate of trust to validate the trust's existence and confirm. Web pennsylvania trustee deed information. Certain rules regard ing the usage of words. A deed of trust officially recognizes a legally binding relationship between the borrower, lender, and trustee. A trustee is a person or entity who holds title to a trust's assets on behalf of a settlor. Web pennsylvania certificate of trust information. And estate file number in the space provided.

Provide the name of the decedent. Consideration to a trust is exempt from tax when the (b) principal due under the note; Trustees use an official document called a certificate of trust to validate the trust's existence and confirm. Web updated july 17, 2023. The settlor, who funds the trust by conveying assets into it; Web the trustee shall reconvey all or any part of the property covered by this deed of trust to the person entitled thereto, on written request of the grantor(s) and the beneficiary, or upon satisfaction of the obligation secured and written request for reconveyance made by the beneficiary or the person entitled thereto. Find the laws regarding certificates of trust at section 7790.3 of the pennsylvania statutes. And estate file number in the space provided. Title 20, chapter 77 of the pennsylvania statutes governs trusts in the state of pennsylvania.

Certain rules regard ing the usage of words. Web pennsylvania certificate of trust information. There are three main parties to a trust: A trustee is a person or entity who holds title to a trust's assets on behalf of a settlor. Deed of trust definitions words used in multiple sections of this document are defined below and other words are defined in sections 3, 11, 13, 18, 20 and 21. Web this deed of trust (security instrument) is made on the trustor is (borrower). (b) principal due under the note; It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. Consideration to a trust is exempt from tax when the Web updated july 17, 2023.

Download Sample Deed of Trust for Free FormTemplate

And estate file number in the space provided. (a) interest due under the note; Web updated july 17, 2023. A trust is a wealth management tool commonly used in estate planning. Trustees use an official document called a certificate of trust to validate the trust's existence and confirm.

CA Short Form Deed of Trust PDF Deed Of Trust (Real Estate) Real

Web this deed of trust (security instrument) is made on the trustor is (borrower). Deed of trust definitions words used in multiple sections of this document are defined below and other words are defined in sections 3, 11, 13, 18, 20 and 21. It is the deed that shows that the lender has an interest in the property while the.

Deed of Trust Form StepbyStep Guide & PDF Sample FormSwift

The trustee holds this title in trust for. (a) interest due under the note; (b) principal due under the note; Consideration to a trust is exempt from tax when the Web this deed of trust (security instrument) is made on the trustor is (borrower).

Trust Deed Form PDF Trust Law Trustee

Web the trustee shall reconvey all or any part of the property covered by this deed of trust to the person entitled thereto, on written request of the grantor(s) and the beneficiary, or upon satisfaction of the obligation secured and written request for reconveyance made by the beneficiary or the person entitled thereto. A trustee is a person or entity.

10+ Sample Deed of Trust Forms Sample Templates

Web a deed of trust is used to secure a loan for real property, such as land or a house by transferring the title to a trustee until the loan is repaid. Trustees use an official document called a certificate of trust to validate the trust's existence and confirm. (b) principal due under the note; Find the laws regarding certificates.

FREE 16+ Sample Will and Trust Forms in PDF MS Word

It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. And estate file number in the space provided. Certain rules regard ing the usage of words. (c) amounts due for escrow items. (b) principal due under the note;

2023 Deed of Trust Form Fillable, Printable PDF & Forms Handypdf

Certain rules regard ing the usage of words. The trustee holds this title in trust for. Print or download your customized form for free. Nominal consideration, or under the intestate succession. Provide the name of the decedent.

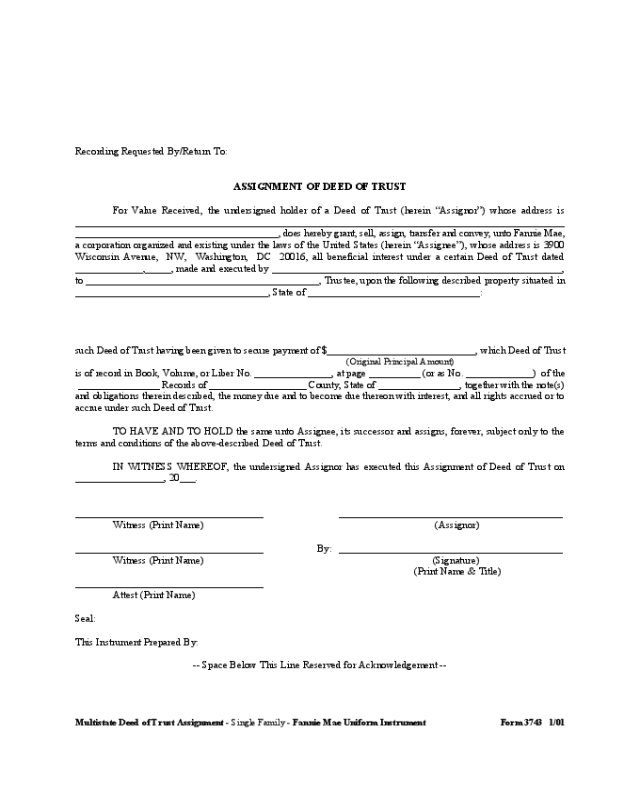

Missouri Assignment of Deed of Trust by Individual Mortgage Holder

The settlor, who funds the trust by conveying assets into it; Web pennsylvania certificate of trust information. Provide the name of the decedent. Find the laws regarding certificates of trust at section 7790.3 of the pennsylvania statutes. Web a deed of trust is used to secure a loan for real property, such as land or a house by transferring the.

Deed of Trust Assignment Form Edit, Fill, Sign Online Handypdf

Web the trustee shall reconvey all or any part of the property covered by this deed of trust to the person entitled thereto, on written request of the grantor(s) and the beneficiary, or upon satisfaction of the obligation secured and written request for reconveyance made by the beneficiary or the person entitled thereto. The trustee holds this title in trust.

FREE 9+ Sample Deed of Trust Form in PDF MS Word

Deed of trust definitions words used in multiple sections of this document are defined below and other words are defined in sections 3, 11, 13, 18, 20 and 21. It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. A california deed of trust is a deed used.

(B) Principal Due Under The Note;

Web except as otherwise described in this trust deed, all payments accepted by lender shall be applied in the following order of priority: It is the deed that shows that the lender has an interest in the property while the landowner is paying the mortgage. There are three main parties to a trust: Provide the name of the decedent.

Web Updated July 17, 2023.

A california deed of trust is a deed used in connection with a mortgage loan. Nominal consideration, or under the intestate succession. Laws, is exempt from tax. Title 20, chapter 77 of the pennsylvania statutes governs trusts in the state of pennsylvania.

A Trustee Is A Person Or Entity Who Holds Title To A Trust's Assets On Behalf Of A Settlor.

Web the trustee shall reconvey all or any part of the property covered by this deed of trust to the person entitled thereto, on written request of the grantor(s) and the beneficiary, or upon satisfaction of the obligation secured and written request for reconveyance made by the beneficiary or the person entitled thereto. Find the laws regarding certificates of trust at section 7790.3 of the pennsylvania statutes. Consideration to a trust is exempt from tax when the A trust is a wealth management tool commonly used in estate planning.

(A) Interest Due Under The Note;

(c) amounts due for escrow items. Trustees use an official document called a certificate of trust to validate the trust's existence and confirm. Certain rules regard ing the usage of words. The settlor, who funds the trust by conveying assets into it;