Deadline For Form 5500

Deadline For Form 5500 - 15th, but if the filing due date falls on a saturday, sunday or. Web standard filing deadline. Web x 15 / action: Web a schedule sb to the form 5500 for the last 2 years which includes the year of termination and for any other year in which the aftap was below 80 percent (the 80. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Certain foreign retirement plans are also required to file this form (see instructions). Form 5500 must be filed by the last day of the seventh month following the end of the plan year. The filing due date for a form 5500 is seven months after the end of the. Accordingly, the automatic extension does not apply to. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as they submit the form 5558 by the original july 31 st.

Web a schedule sb to the form 5500 for the last 2 years which includes the year of termination and for any other year in which the aftap was below 80 percent (the 80. We mail cp403 15 months after the original due date. Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as they submit the form 5558 by the original july 31 st. Web x 15 / action: The filing due date for a form 5500 is seven months after the end of the. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web this form is required to be filed under section 6058(a) of the internal revenue code. Accordingly, the automatic extension does not apply to.

Web standard filing deadline. Web those on the march 15 th /september 15 th tax filing schedule can still achieve the october due date for their 5500 as long as they submit the form 5558 by the original july 31 st. Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Form 5500 must be filed by the last day of the seventh month following the end of the plan year. Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify. Certain foreign retirement plans are also required to file this form (see instructions). Web a schedule sb to the form 5500 for the last 2 years which includes the year of termination and for any other year in which the aftap was below 80 percent (the 80. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators. We mail cp403 15 months after the original due date.

IRS Extends Deadline for Forms 5500 Due before July 15, 2020

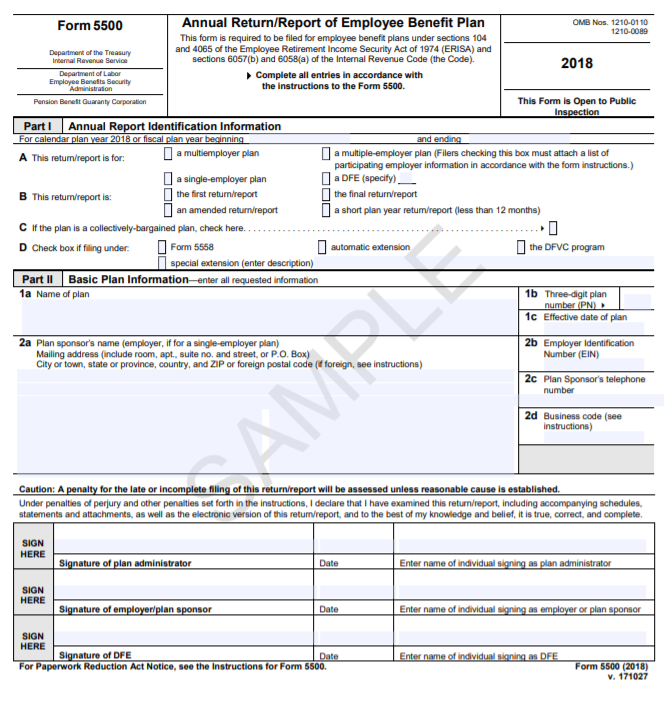

Web x 15 / action: Certain foreign retirement plans are also required to file this form (see instructions). Web a schedule sb to the form 5500 for the last 2 years which includes the year of termination and for any other year in which the aftap was below 80 percent (the 80. Web this form is required to be filed.

Form 5500 Deadline Is it Extended Due to COVID19? Yeo and Yeo

Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. December 15 is the extended deadline to distribute summary annual report (sar) when the form 5500 was filed on october 16. Web x 15 / action: Web missing the final deadline for.

Form 5500 Deadline Is it Extended Due to COVID19? Mitchell Wiggins

Web standard filing deadline. Form 5500 must be filed by the last day of the seventh month following the end of the plan year. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Web those on the march 15 th /september 15 th tax filing schedule can still achieve.

Form 9 Deadline Is Form 9 Deadline Any Good? Ten Ways You Can Be

We mail cp403 15 months after the original due date. Web a schedule sb to the form 5500 for the last 2 years which includes the year of termination and for any other year in which the aftap was below 80 percent (the 80. Web this form is required to be filed under section 6058(a) of the internal revenue code..

What is Form 5500 & What Plan Sponsors Need to Know About It? NESA

Web this form is required to be filed under section 6058(a) of the internal revenue code. Web standard filing deadline. The filing due date for a form 5500 is seven months after the end of the. Certain foreign retirement plans are also required to file this form (see instructions). Web missing the final deadline for filing your form 5500 is.

Certain Form 5500 Filing Deadline Extensions Granted by IRS BASIC

Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. The filing due date for a form 5500 is seven months after the end of the. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. December 15 is the.

Solo 401k Reporting Requirements Solo 401k

Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. 15th, but if the filing due date falls on a saturday, sunday or. Accordingly, the automatic extension does not apply to. Web standard filing deadline.

Form 5500 Deadline Coming Up In August! MyHRConcierge

Department of labor, internal revenue service, and pension benefit guaranty corporation to simplify. Certain foreign retirement plans are also required to file this form (see instructions). 15th, but if the filing due date falls on a saturday, sunday or. Accordingly, the automatic extension does not apply to. Web missing the final deadline for filing your form 5500 is a common.

Form 5500 Deadline For Calendar Year Plans Due July 31, 2021 EBI

We mail cp403 15 months after the original due date. 15th, but if the filing due date falls on a saturday, sunday or. Web this form is required to be filed under section 6058(a) of the internal revenue code. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct. Form.

October 15th Form 5500 Deadline!

Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. Web this form is required to be filed under section 6058(a) of the internal revenue code. We mail cp403 15 months after the original due date. December 15 is the extended deadline to distribute summary annual report (sar) when the.

Accordingly, The Automatic Extension Does Not Apply To.

The filing due date for a form 5500 is seven months after the end of the. Web standard filing deadline. Department of labor’s employee benefits security administration, the irs and the pension benefit guaranty corp. Web typically, the form 5500 is due by july 31st for calendar year plans, with an extension deadline of oct.

Department Of Labor, Internal Revenue Service, And Pension Benefit Guaranty Corporation To Simplify.

Web this form is required to be filed under section 6058(a) of the internal revenue code. Web the due date for 2019 form 5500 filings for calendar year plans is july 31, 2020—outside the relief window. Web a schedule sb to the form 5500 for the last 2 years which includes the year of termination and for any other year in which the aftap was below 80 percent (the 80. December 15 is the extended deadline to distribute summary annual report (sar) when the form 5500 was filed on october 16.

Web Those On The March 15 Th /September 15 Th Tax Filing Schedule Can Still Achieve The October Due Date For Their 5500 As Long As They Submit The Form 5558 By The Original July 31 St.

We mail cp403 15 months after the original due date. Web x 15 / action: Form 5500 must be filed by the last day of the seventh month following the end of the plan year. Web missing the final deadline for filing your form 5500 is a common pitfall for plan administrators.

15Th, But If The Filing Due Date Falls On A Saturday, Sunday Or.

Certain foreign retirement plans are also required to file this form (see instructions).

-1.png?width=938&name=female_news_caster_infront_of_screen_16271 (4)-1.png)