Dave Ramsey Snowball Template

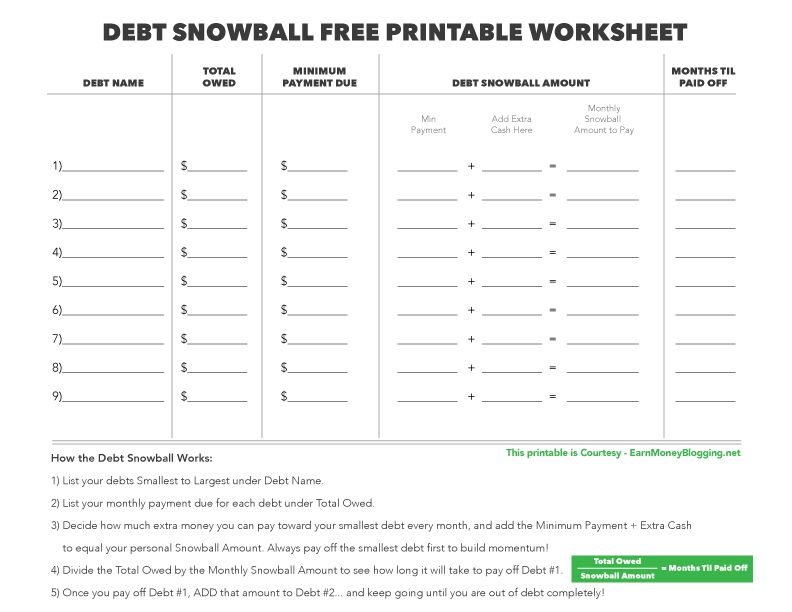

Dave Ramsey Snowball Template - This is the exact debt snowball form that we used to get out debt in that short period of time. Download major components of a healthy financial plan Then, take what you were paying on that debt and add it to the payment of your next smallest debt. Web start fpu now what is the debt snowball? The debt snowball method is the best way to get out of debt. Here are the basic steps if the debt snowball method. Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. Getting rid of your student loans guide. With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months.

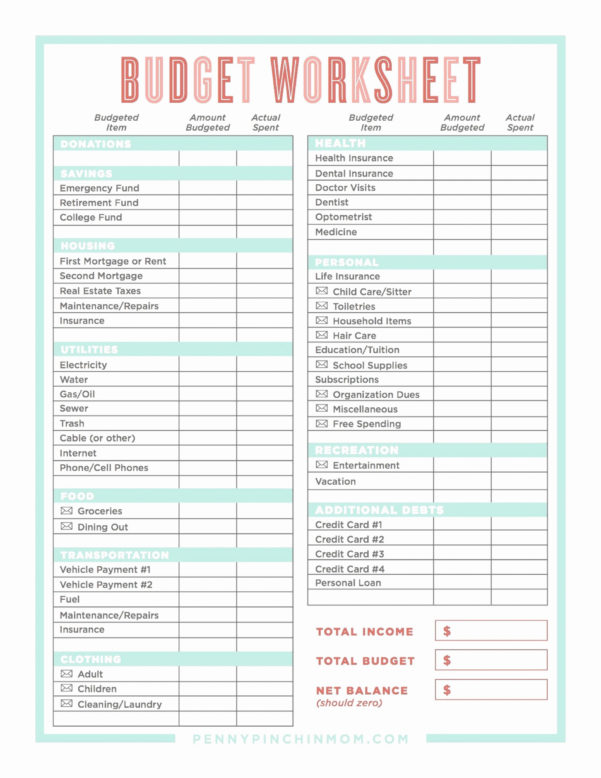

Web what is the debt snowball? The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Web what is the debt snowball method? Web this form outlines dave's recommended percentages for each category, making it easier to set up your budget. Getting rid of your student loans guide. The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Here are the basic steps if the debt snowball method. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. Web how to use the debt snowball method with free debt snowball worksheet.

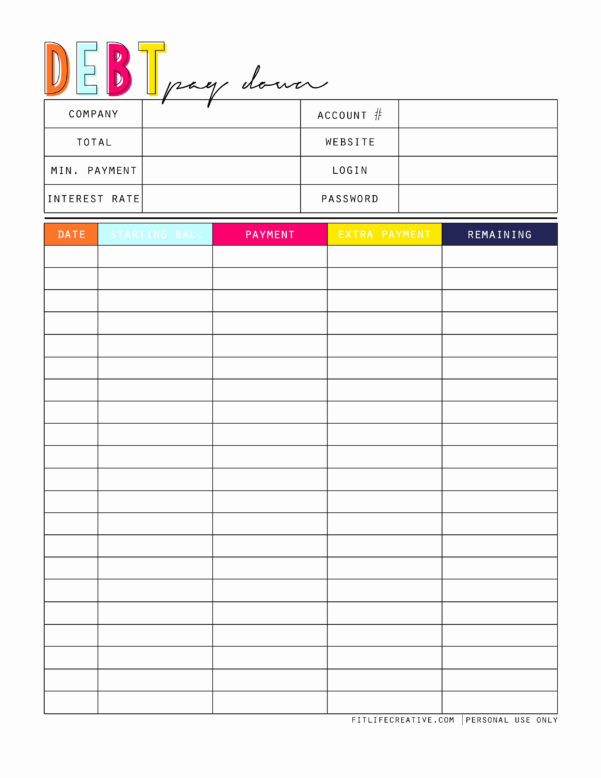

Then, take what you were paying on that debt and add it to the payment of your next smallest debt. With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re making. Document your debts and include their balances. To get things rolling, you can easily use dave ramsey’s debt snowball form to create and track your debt payoff progress. Web let’s discuss the different templates to use. Here are the basic steps if the debt snowball method. The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Dave ramsey debt snowball form. Web how to use the debt snowball method with free debt snowball worksheet.

20 Luxury Dave Ramsey Snowball Excel Spreadsheet

With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. Web let’s discuss the different templates to use. Show details how it works open the debt snowball worksheet pdf and follow the instructions easily sign the dave ramsey snowball pdf with your finger send filled & signed debt snowball spreadsheet pdf or.

Dave Ramsey Snowball Worksheet Pdf Qualads

Web what is the debt snowball? Web this form outlines dave's recommended percentages for each category, making it easier to set up your budget. Not only does the debt snowball help you get rid of debt fast, it’s also designed to help you change your behavior with money—so you never go into debt again. Download major components of a healthy.

Ramsey Snowball Spreadsheet in Dave Ramsey Budget Form Pdf New

To get things rolling, you can easily use dave ramsey’s debt snowball form to create and track your debt payoff progress. Web what is the debt snowball? Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. Web this form outlines dave's recommended percentages for each category, making it easier to set up your.

Dave Ramsey Snowball Sheet Printable room

The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. This is the exact debt snowball form that we used to get out debt in that short period of time. Web this form outlines dave's recommended percentages for each category, making it easier to.

Dave Ramsey Debt Snowball Spreadsheet Spreadsheets

Web what is the debt snowball method? Getting rid of your student loans guide. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. The debt snowball method is the best way to get out of debt. Web start fpu now what is.

Dave Ramsey Debt Snowball Calculator Excel Budget Planner Etsy

Web what is the debt snowball? Web let’s discuss the different templates to use. Here are the basic steps if the debt snowball method. Knock out the smallest debt first. The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates.

21 Awesome Dave Ramsey Snowball Worksheet Pdf

Web this form outlines dave's recommended percentages for each category, making it easier to set up your budget. Dave ramsey debt snowball form. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Web what is the debt snowball? Getting rid of your.

Download Dave Ramsey Debt Snowball Gantt Chart Excel Template

These worksheets ensure that it’s easy to clear off your debt promptly and visibly see the progress you’re making. Dave ramsey debt snowball form. With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. Getting rid of your student loans guide. Knock out the smallest debt first.

Dave Ramsey Inspired Debt Snowball Spreadsheet Excel Etsy

The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates. Here are the basic steps if the debt snowball method. Not only does the debt snowball help you get rid of debt fast, it’s also designed to help you change your behavior with money—so.

Ramsey Snowball Spreadsheet Spreadsheet Downloa dave ramsey snowball

With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance. Here are the basic steps if the debt snowball method. Not only does the debt snowball help you get rid of debt fast, it’s also designed to help you change your behavior with money—so you never go into debt again. The debt.

Download Major Components Of A Healthy Financial Plan

Not only does the debt snowball help you get rid of debt fast, it’s also designed to help you change your behavior with money—so you never go into debt again. Web what is the debt snowball method? Web let’s discuss the different templates to use. Web how to use the debt snowball method with free debt snowball worksheet.

Web The Debt Snowball Is A Methodology To Pay Off Debt Developed By David Ramsey.

Show details how it works open the debt snowball worksheet pdf and follow the instructions easily sign the dave ramsey snowball pdf with your finger send filled & signed debt snowball spreadsheet pdf or save The debt snowball is a debt payoff method where you pay your debts from smallest to largest, regardless of interest rate. Here are the basic steps if the debt snowball method. The debt snowball method is a debt reduction strategy where you pay off your debts in order of smallest to largest, regardless of the interest rates.

Getting Rid Of Your Student Loans Guide.

Web use a debt snowball worksheet printable 0 template to make your document workflow more streamlined. The debt snowball, made famous for being part of dave ramsey’s baby steps, helped me and my wife pay off over $52,000 in debt in 18 months. Web what is the debt snowball? With the debt snowball method, you pay off your debt from the smallest balance to the lowest balance.

This Is The Exact Debt Snowball Form That We Used To Get Out Debt In That Short Period Of Time.

The debt snowball method is the best way to get out of debt. Knock out the smallest debt first. Web this form outlines dave's recommended percentages for each category, making it easier to set up your budget. Document your debts and include their balances.