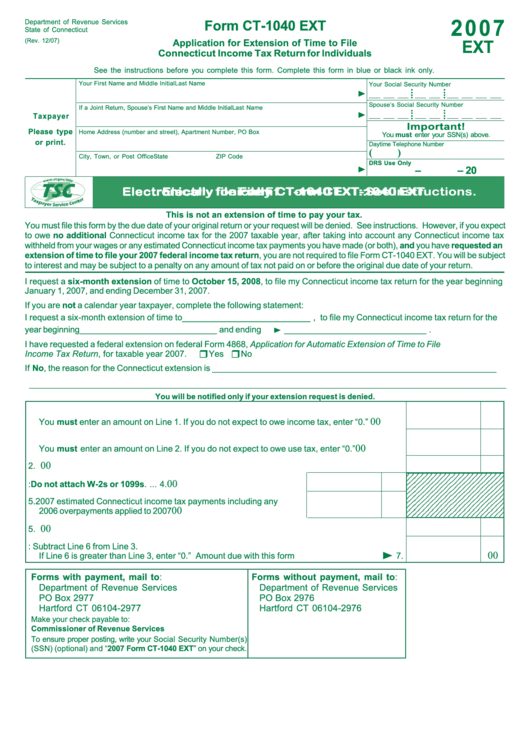

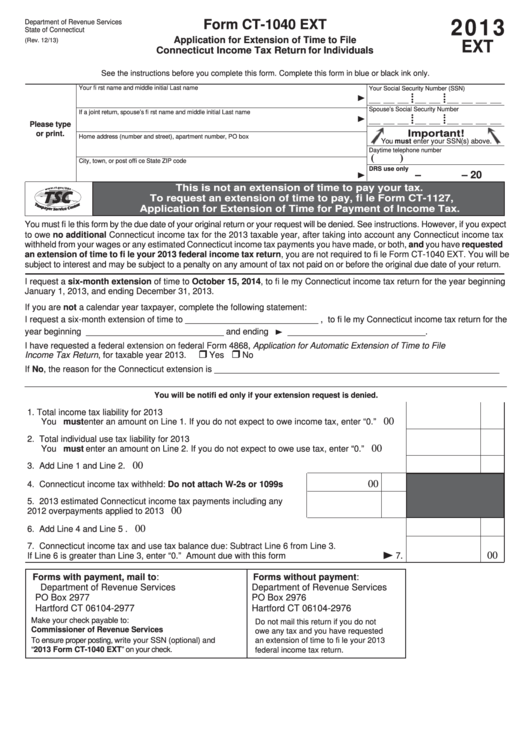

Ct Form 1040 Ext

Ct Form 1040 Ext - Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf. Web filed connecticut income tax return or extension. Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Claiming an extension of the time to file a connecticut income tax return. Extending the time to file an individual. This is a fillable form that extends the time to file an income tax return. Rules governing practice before irs Benefits to electronic filing include: Apply for an itin circular 230; 16, 2023 and the connecticut paper filing due date is october 16, 2023.

Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year: Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Simple, secure, and can be completed from the comfort of your home. This is a fillable form that extends the time to file an income tax return. Claiming an extension of the time to file a connecticut income tax return. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf. 16, 2023 and the connecticut paper filing due date is october 16, 2023. Apply for an itin circular 230; Rules governing practice before irs The form is used for:

This is a fillable form that extends the time to file an income tax return. 16, 2023 and the connecticut paper filing due date is october 16, 2023. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. Extending the time to file an individual. Benefits to electronic filing include: Web file your 2022 connecticut income tax return online! Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Claiming an extension of the time to file a connecticut income tax return. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf. Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year:

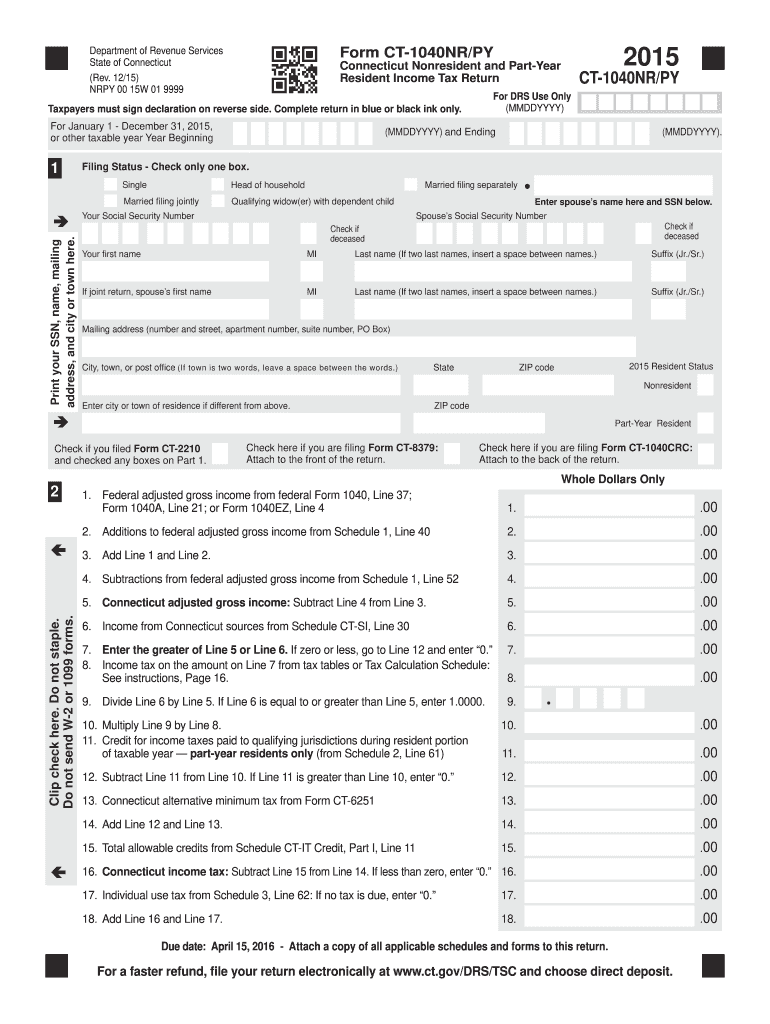

2014 Form CT DRS CT1040NR/PY Fill Online, Printable, Fillable, Blank

Apply for an itin circular 230; Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. Simple, secure, and can be completed from the comfort of your home. Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Web.

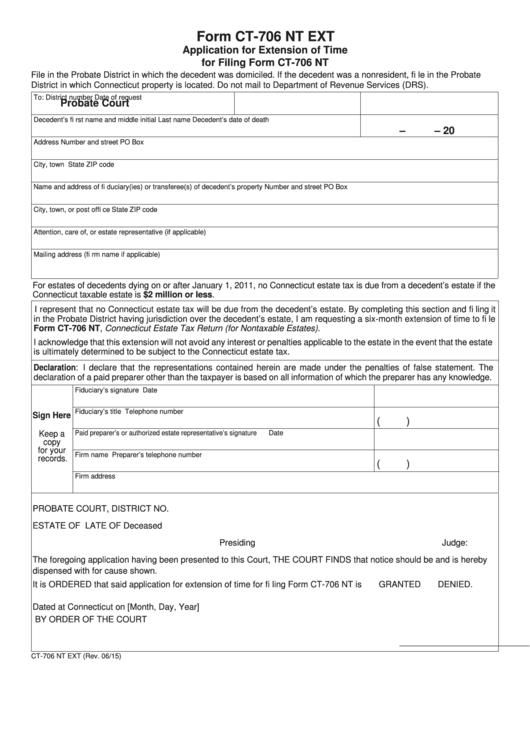

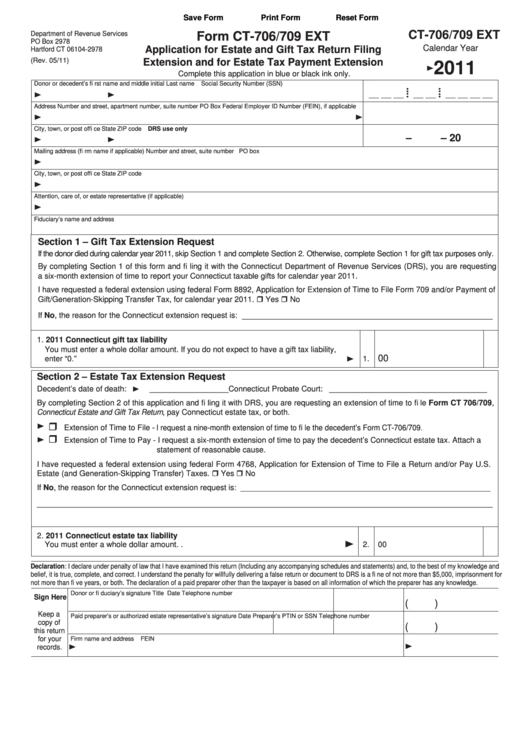

Form Ct706 Nt Ext Application For Extension Of Time For Filing Form

Apply for an itin circular 230; Web filed connecticut income tax return or extension. The form is used for: Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. 16, 2023 and the connecticut paper filing due date is october 16,.

2015 Form CT DRS CT1040NR/PY Fill Online, Printable, Fillable, Blank

Apply for an itin circular 230; Extending the time to file an individual. This is a fillable form that extends the time to file an income tax return. Claiming an extension of the time to file a connecticut income tax return. Web for a faster refund, fi le your return electronically at www.ct.gov/drs.

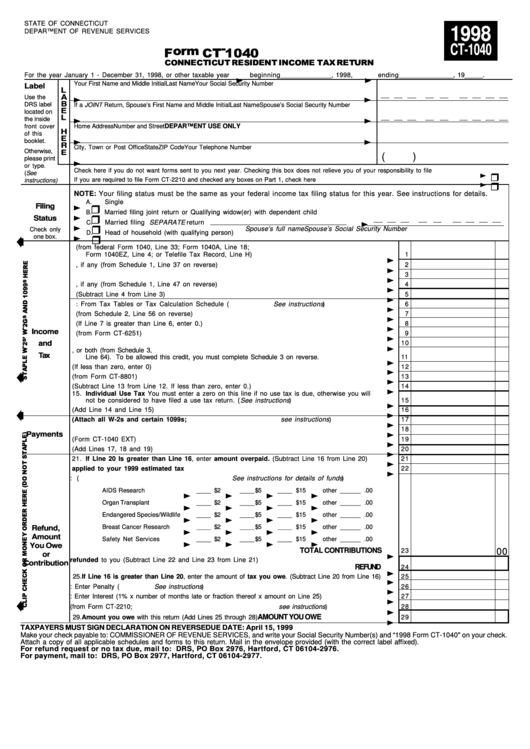

Fillable Form Ct1040 Connecticut Resident Tax Return

Benefits to electronic filing include: Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf. We last updated the connecticut resident income tax return in january 2023, so this is the. Apply for an itin circular 230; Claiming an extension of.

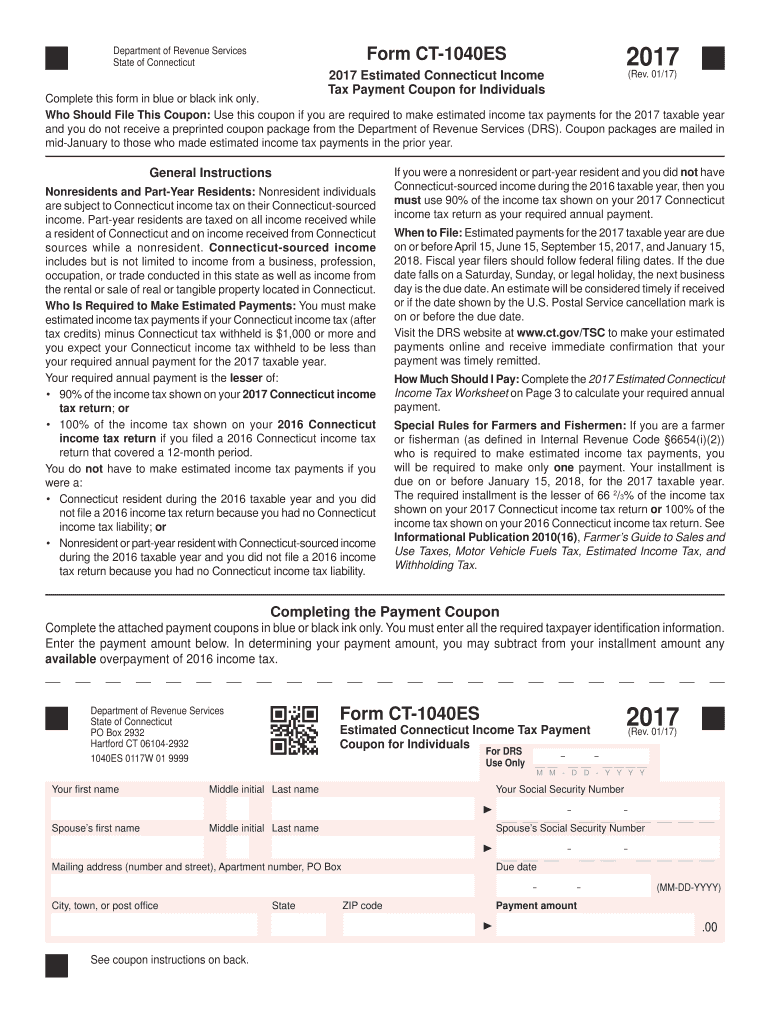

Ct 1040Es Fill Out and Sign Printable PDF Template signNow

Benefits to electronic filing include: Rules governing practice before irs Web file your 2022 connecticut income tax return online! We last updated the connecticut resident income tax return in january 2023, so this is the. Claiming an extension of the time to file a connecticut income tax return.

Form Ct1040 Ext Application For Extension Of Time To File

16, 2023 and the connecticut paper filing due date is october 16, 2023. This is a fillable form that extends the time to file an income tax return. The form is used for: Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have.

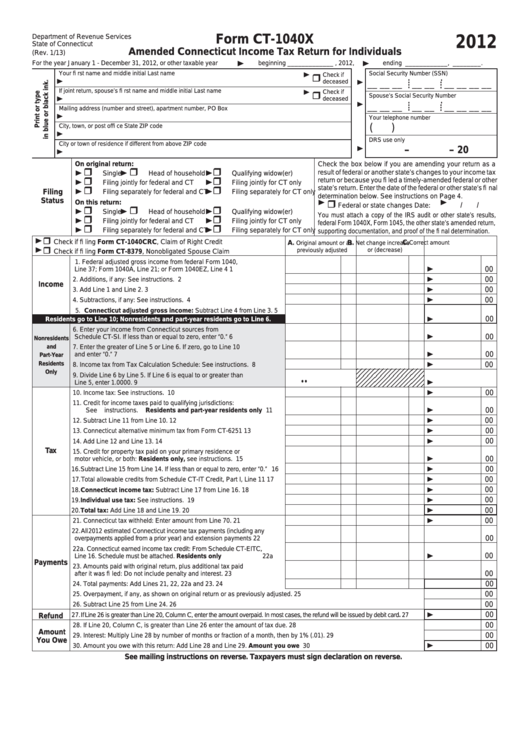

Form Ct1040x Amended Connecticut Tax Return For Individuals

Claiming an extension of the time to file a connecticut income tax return. Web connecticut — application for extension of time to file connecticut income tax return for individuals download this form print this form it appears you don't have a pdf. This is a fillable form that extends the time to file an income tax return. We last updated.

Fillable Form Ct706/709 Ext Application For Estate And Gift Tax

Extending the time to file an individual. Web file your 2022 connecticut income tax return online! Web for a faster refund, fi le your return electronically at www.ct.gov/drs. The form is used for: Simple, secure, and can be completed from the comfort of your home.

Fillable Form Ct1040 Ext Application For Extension Of Time To File

Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Claiming an extension of the time to file a connecticut income tax return. Extending the time to file an individual. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return.

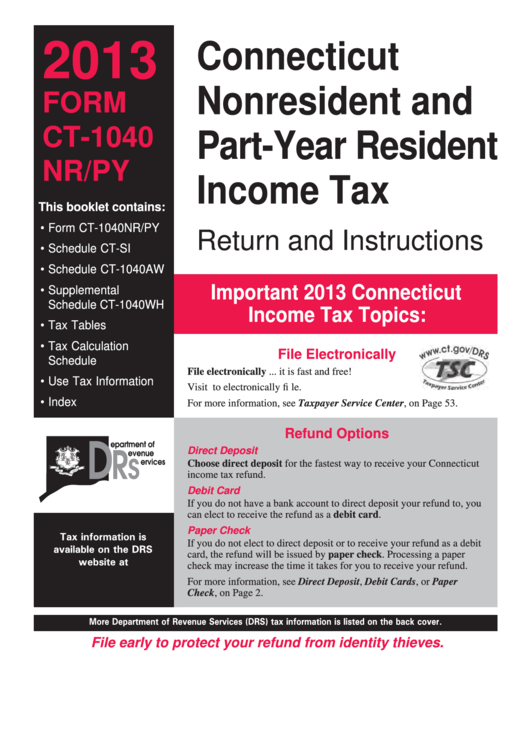

Form Ct1040 Nr/py Connecticut Nonresident And PartYear Resident

Simple, secure, and can be completed from the comfort of your home. Rules governing practice before irs Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. Extending the time to file an individual. Web you must file a connecticut (ct).

Apply For An Itin Circular 230;

Simple, secure, and can be completed from the comfort of your home. The form is used for: Claiming an extension of the time to file a connecticut income tax return. Benefits to electronic filing include:

This Is A Fillable Form That Extends The Time To File An Income Tax Return.

Web for a faster refund, fi le your return electronically at www.ct.gov/drs. Web to request an extension of time to file your return, you must file form ct‑1040 ext, application for extension of time to file connecticut income tax return for. 16, 2023 and the connecticut paper filing due date is october 16, 2023. Web you must file a connecticut (ct) state income tax return if any of the following is true for the 2022 tax year:

Web Connecticut — Application For Extension Of Time To File Connecticut Income Tax Return For Individuals Download This Form Print This Form It Appears You Don't Have A Pdf.

Rules governing practice before irs Web filed connecticut income tax return or extension. Extending the time to file an individual. Web file your 2022 connecticut income tax return online!