Ct Conveyance Tax Form

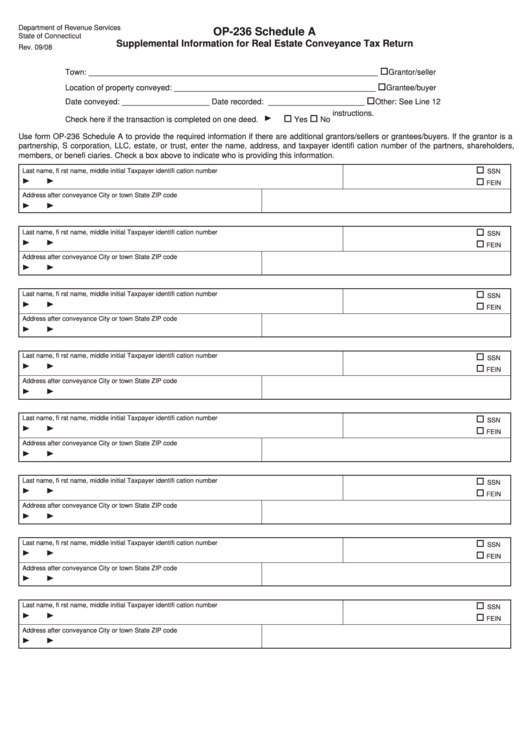

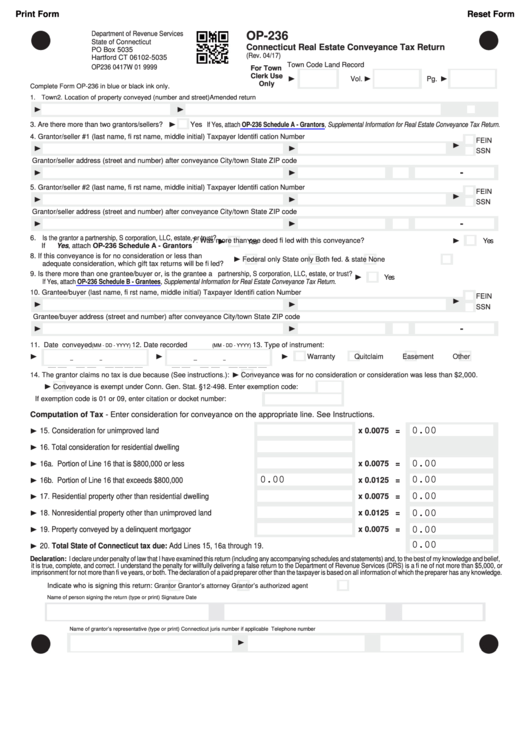

Ct Conveyance Tax Form - Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code If the grantee is a partnership, 04/17) for town clerk use only town code land record vol. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Web supplemental information for connecticut real estate conveyance tax return (rev. Web the marginal tax brackets for residential real property are as follows: Download this form and complete using adobe acrobat. Yes if yes, attach 4. Up to and including $800,000: A state tax and a municipal tax.

Location of property conveyed (number and street) land record vol. Location of property conveyed (number and street) amended return 3. If the grantee is a partnership, Web supplemental information for connecticut real estate conveyance tax return (rev. Web the marginal tax brackets for residential real property are as follows: A state tax and a municipal tax. Web connecticut real estate conveyance tax return (rev. Web connecticut real estate conveyance tax return (rev. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Yes if yes, attach 4.

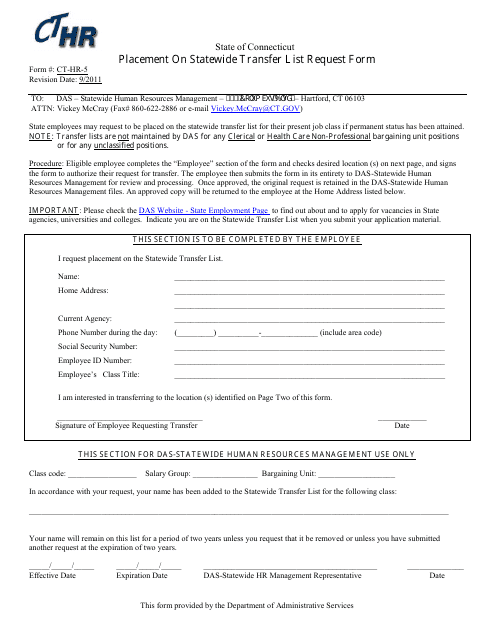

Forms for state of connecticut/department of administrative services Web the marginal tax brackets for residential real property are as follows: Web supplemental information for connecticut real estate conveyance tax return (rev. Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: If the grantee is a partnership, Up to and including $800,000: Download this form and complete using adobe acrobat. Location of property conveyed (number and street) land record vol. 04/17) for town clerk use only town code land record vol. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code

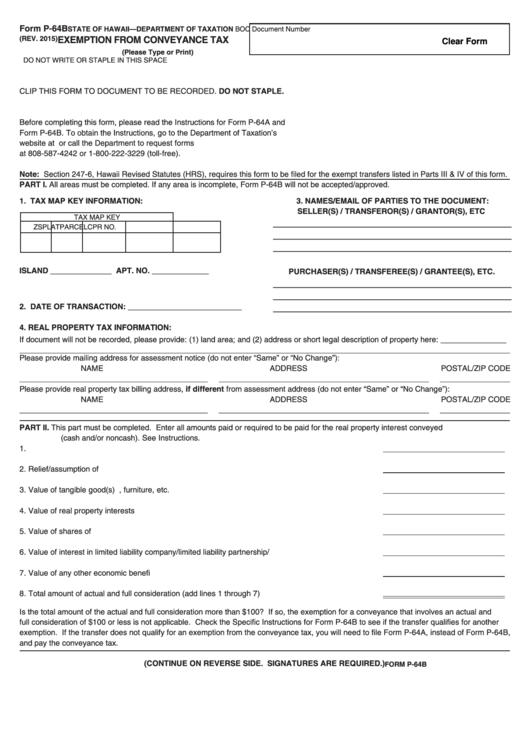

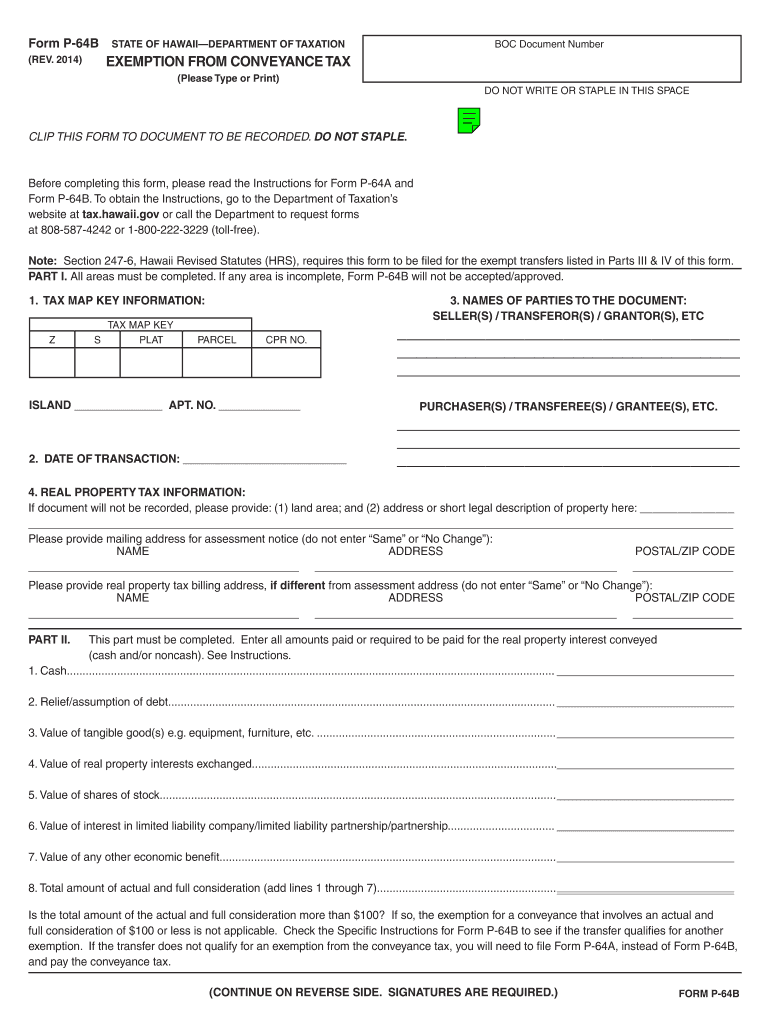

Fillable Form P64b Exemption From Conveyance Tax printable pdf download

The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. More information, real estate conveyance tax: Web connecticut’s real estate conveyance.

Deed of Reconveyance Form PDF Sample Templates Sample Templates

The combined rate is applied to the property’s sales price. More information, real estate conveyance tax: Forms for state of connecticut/department of administrative services For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. 04/17) for town town code clerk use only.

Schedule A (Form Op236) Supplemental Information For Real Estate

Web the marginal tax brackets for residential real property are as follows: Are there more than two grantors/sellers? Web connecticut real estate conveyance tax return (rev. The combined rate is applied to the property’s sales price. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00.

Ct Conveyance Tax Form Printable Form, Templates and Letter

Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code A state tax and a municipal tax. Yes if yes, attach 4. Forms for state of connecticut/department of administrative services Up to and including $800,000:

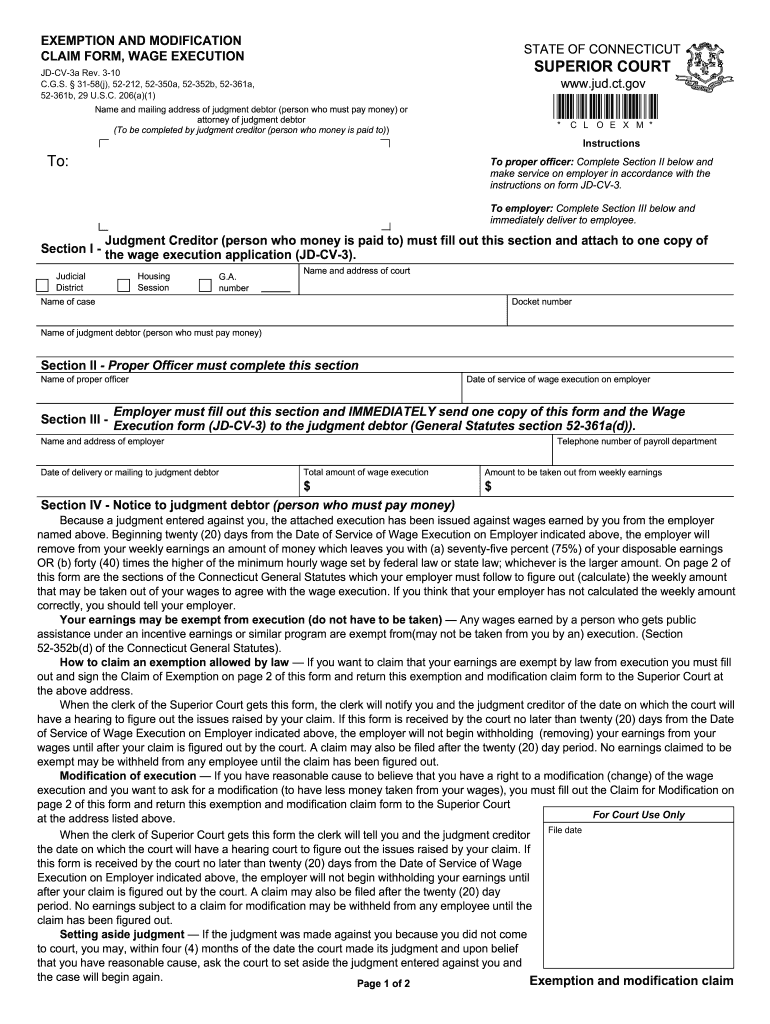

Ct Exemption and Modification Claim Form Fill Out and Sign Printable

Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: Web connecticut real estate conveyance tax return (rev. More information, real estate conveyance tax: Up to and including $800,000: Web the marginal tax brackets for residential real property are as follows:

20192022 Form HI DoT P64A Fill Online, Printable, Fillable, Blank

Web connecticut real estate conveyance tax return (rev. A state tax and a municipal tax. 04/17) for town town code clerk use only 2. Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that.

Form CTHR5 Download Fillable PDF or Fill Online Placement on

For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: Web the marginal tax brackets for residential real property are as follows: The combined rate is applied to.

P64B Fill Out and Sign Printable PDF Template signNow

Web the marginal tax brackets for residential real property are as follows: Town connecticut real estate conveyance tax return (rev. Web supplemental information for connecticut real estate conveyance tax return (rev. The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less. Location of property conveyed (number and street) amended.

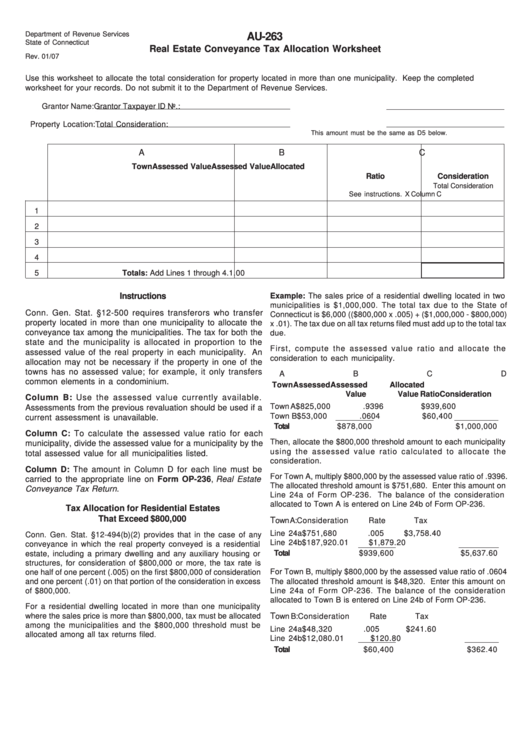

Form Au263 Real Estate Conveyance Tax Allocation Worksheet 2007

04/17) for town clerk use only town code land record vol. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. If the grantee is a partnership, Up to and including $800,000: 04/17) for town town code clerk use only 2.

Fillable Form Op236 Connecticut Real Estate Conveyance Tax Return

Yes if yes, attach 4. For a property with a sales price of $2,500,000.00 or less the first $800,000.00 is taxed at 0.75% while the portion that exceeds $800,000.00 is taxed at a. A state tax and a municipal tax. The combined rate is applied to the property’s sales price. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification.

A State Tax And A Municipal Tax.

Location of property conveyed (number and street) land record vol. Web the marginal tax brackets for residential real property are as follows: 04/17) for town clerk use only town code land record vol. The state conveyance tax is 0.75% of the sales price for properties with a sales price that is $800,000.00 or less.

For A Property With A Sales Price Of $2,500,000.00 Or Less The First $800,000.00 Is Taxed At 0.75% While The Portion That Exceeds $800,000.00 Is Taxed At A.

The combined rate is applied to the property’s sales price. Web connecticut’s real estate conveyance tax the real estate conveyance tax has two parts: Yes if yes, attach 4. Grantor/seller #1 (last name, first name, middle initial) taxpayer identification number grantor/seller address (street and number) after conveyance city/town state zip code

Forms For State Of Connecticut/Department Of Administrative Services

Up to and including $800,000: Are there more than two grantors/sellers? If the grantee is a partnership, The applicable state and municipal rates are added together to get the total tax rate for a particular property conveyance.

Web Connecticut Real Estate Conveyance Tax Return (Rev.

Web supplemental information for connecticut real estate conveyance tax return (rev. 04/17) for town town code clerk use only 2. Download this form and complete using adobe acrobat. Town connecticut real estate conveyance tax return (rev.