Cp2000 Response Form Pdf

Cp2000 Response Form Pdf - Web you have two options on how you can respond to a cp2000 notice. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on your federal tax return doesn’t match the income. Review the information on the cp2000 carefully for accuracy. Fax your documents to the fax number in the notice using. If you have received a cp2000 notice from the irs, it helps to understand. Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in. Web what is a cp2000 notice? Web the first step toward taking control is to open that envelope and see what sort of letter it is. Response to cp2000 notice dated month, xx, year.

To whom it may concern, i received your notice dated month, xx,. Web what is a cp2000 notice? Review the information on the cp2000 carefully for accuracy. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on your federal tax return doesn’t match the income. If you have received a cp2000 notice from the irs, it helps to understand. Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. If it is correct and you excluded a source of income, sign the response letter provided by the. Web your cp2000 might come with a response letter or form which explains the steps you need to take to approve and submit the proposed changes. Mail using the return address on the enclosed envelope, or.

Fax your documents to the fax number in the notice using. Web you have two options on how you can respond to a cp2000 notice. If a timely response can’t be made, taxpayers need to call the. You can submit your response by: Web complete the form on page seven of your letter cp 2000 to show whether you agree or disagree with the changes the irs is proposing in the letter. Web what is a cp2000 notice? Web the first step toward taking control is to open that envelope and see what sort of letter it is. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. Web an installment plan, send in your response form and a completed installment agreement request (form 9465). Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in.

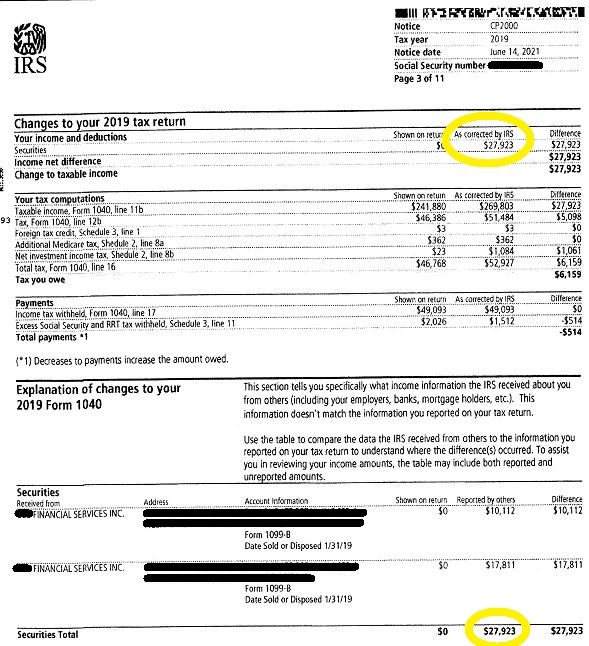

Understanding Your CP2000 Notice

Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Web complete the form on page seven of your letter cp 2000 to show whether you agree or disagree with the changes the irs is proposing in the letter. Response to cp2000 notice dated month,.

ads/responsive.txt Irs Cp2000 Response form Pdf Awesome Outstanding

Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on your federal tax return doesn’t match the income. Web respond to the notice. Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form..

About Privacy Policy Copyright TOS Contact Sitemap

Mail using the return address on the enclosed envelope, or. Response to cp2000 notice dated month, xx, year. Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Web you have two options on how you can respond to a cp2000 notice. Web an installment.

Index of /EveryWhichWayButLoose/GK

Response to cp2000 notice dated month, xx, year. Determine if you agree or disagree. Fax your documents to the fax number in the notice using. Web your cp2000 might come with a response letter or form which explains the steps you need to take to approve and submit the proposed changes. Web the cp2000 notice means that the income and.

IRS Audit Letter CP2000 Sample 1

Web what is a cp2000 notice? Web your cp2000 might come with a response letter or form which explains the steps you need to take to approve and submit the proposed changes. If a timely response can’t be made, taxpayers need to call the. Web taxpayers should respond to the cp2000, usually within 30 days from the date printed on.

Watch Out for IRS CP2000 Mendoza & Company, Inc.

Web complete the form on page seven of your letter cp 2000 to show whether you agree or disagree with the changes the irs is proposing in the letter. If you have received a cp2000 notice from the irs, it helps to understand. Under the internal revenue code, in many types of income, persons paying you amounts are required to.

Irs Cp2000 Example Response Letter amulette

Mail using the return address on the enclosed envelope, or. Web complete the form on page seven of your letter cp 2000 to show whether you agree or disagree with the changes the irs is proposing in the letter. Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind.

IRS Audit Letter CP2000 Sample 4

Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in. Response to cp2000 notice dated month, xx, year. Review the information on the cp2000 carefully for accuracy. Web the first step toward taking control is to open that envelope and see what sort of letter it.

[View 44+] Sample Letter Format To Irs LaptrinhX / News

Web review the proposed changes and compare them to your tax return. Web complete the form on page seven of your letter cp 2000 to show whether you agree or disagree with the changes the irs is proposing in the letter. Web a response form, payment voucher, and an envelope. Web you have the right to contest penalties and appeal.

IRS Audit Letter CP2000 Sample 5

Web read the information in the cp2000 carefully so you know why you have been issued the notice. Web return (form 1040x), write “cp2000” on the top of your amended federal tax return (form 1040x) and attach it behind your completed response form. Web taxpayers should respond to the cp2000, usually within 30 days from the date printed on the.

Web Complete The Form On Page Seven Of Your Letter Cp 2000 To Show Whether You Agree Or Disagree With The Changes The Irs Is Proposing In The Letter.

Web review the proposed changes and compare them to your tax return. Web an irs cp2000 notice is a form automatically generated by the irs if it seems that the income you reported on your federal tax return doesn’t match the income. Fax your documents to the fax number in the notice using. Web respond to the notice.

Web Return (Form 1040X), Write “Cp2000” On The Top Of Your Amended Federal Tax Return (Form 1040X) And Attach It Behind Your Completed Response Form.

If a timely response can’t be made, taxpayers need to call the. Web you have two options on how you can respond to a cp2000 notice. Web you have the right to contest penalties and appeal an irs decision about your cp2000 notice. Under the internal revenue code, in many types of income, persons paying you amounts are required to report such an income to irs in.

To Whom It May Concern, I Received Your Notice Dated Month, Xx,.

Web taxpayers should respond to the cp2000, usually within 30 days from the date printed on the notice. Checking the box on the irs form may not effectively protect. If you have received a cp2000 notice from the irs, it helps to understand. Web read the information in the cp2000 carefully so you know why you have been issued the notice.

Web A Response Form, Payment Voucher, And An Envelope.

If it is correct and you excluded a source of income, sign the response letter provided by the. Response to cp2000 notice dated month, xx, year. Web the cp2000 notice means that the income and payment information the irs has on file for you doesn't match the information you reported in your return. You can submit your response by:

![[View 44+] Sample Letter Format To Irs LaptrinhX / News](https://www.hrblock.com/tax-center/wp-content/uploads/2018/01/Letter-2840C.png)