Connecticut Income Tax Form

Connecticut Income Tax Form - Web $15,000 for single filers, $19,000 for heads of household, and $24,000 for married couples filing jointly or surviving spouses. Web 2023 connecticut quarterly reconciliation of withholding: While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web department of revenue services. 38th out of 51 download connecticut tax information. Complete, edit or print tax forms instantly. Web the 2023 chevrolet bolt. It added income limits, price caps and. Amended connecticut reconciliation of withholding: Web underpayment of estimated income tax by individuals, trusts, and estates.

Web 2023 connecticut quarterly reconciliation of withholding: Web individual use tax, gift tax, and other income tax returns 301 individual use tax 302 gift tax 303 income tax on trusts and estates 304 s corporation information. Complete, edit or print tax forms instantly. How is taxable income calculated? This form is for income earned in tax year 2022, with tax returns due. Web the 2023 chevrolet bolt. The average family pays $800.00 in connecticut income taxes. Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services. Complete, edit or print tax forms instantly. Web underpayment of estimated income tax by individuals, trusts, and estates.

Complete, edit or print tax forms instantly. Select the filing status as. Web department of revenue services. Web efiling information income tax refunds quickfact: Use this calculator to determine your connecticut income tax. Web individual use tax, gift tax, and other income tax returns 301 individual use tax 302 gift tax 303 income tax on trusts and estates 304 s corporation information. Amended connecticut reconciliation of withholding: Web 2023 connecticut quarterly reconciliation of withholding: While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web $15,000 for single filers, $19,000 for heads of household, and $24,000 for married couples filing jointly or surviving spouses.

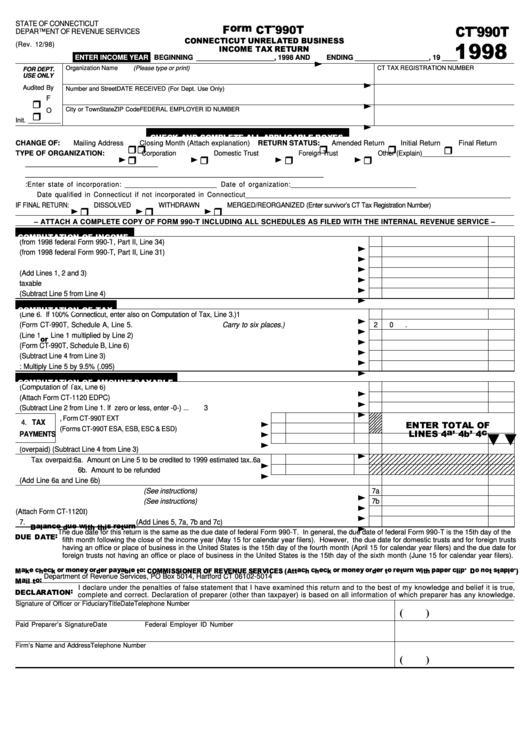

Fillable Form Ct990t Connecticut Unrelated Business Tax

Web the 2023 chevrolet bolt. Web 2023 connecticut quarterly reconciliation of withholding: This form is for income earned in tax year 2022, with tax returns due. Web department of revenue services. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500.

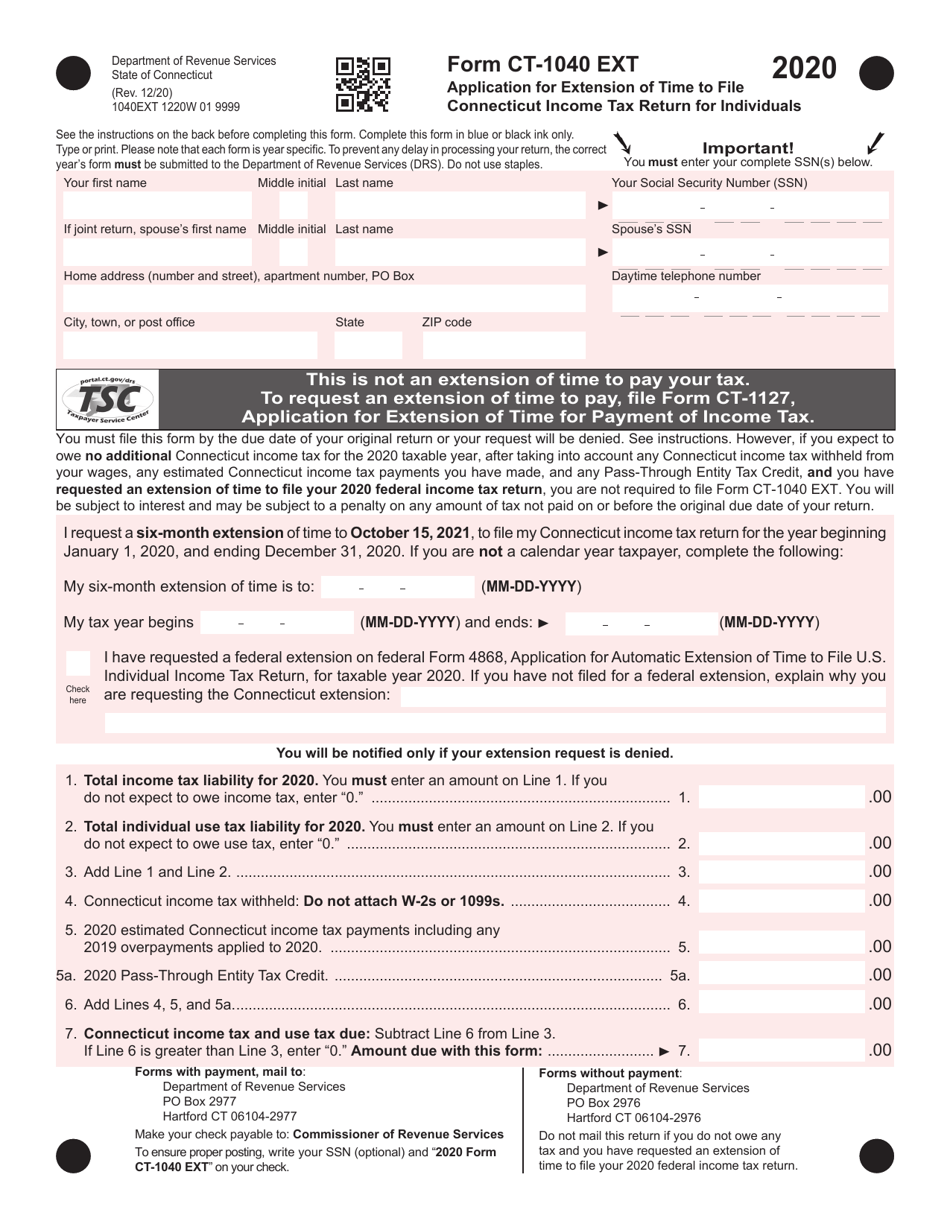

Form CT1040 EXT Download Printable PDF or Fill Online Application for

Web 2023 connecticut quarterly reconciliation of withholding: How is taxable income calculated? 38th out of 51 download connecticut tax information. Amended connecticut reconciliation of withholding: Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services.

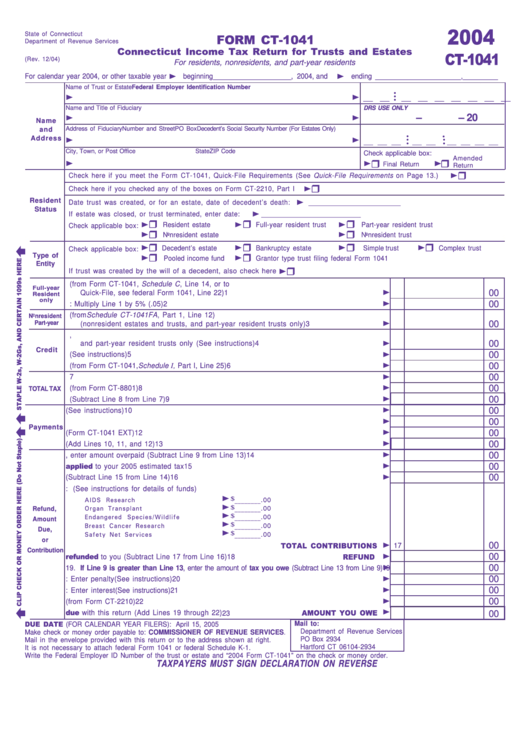

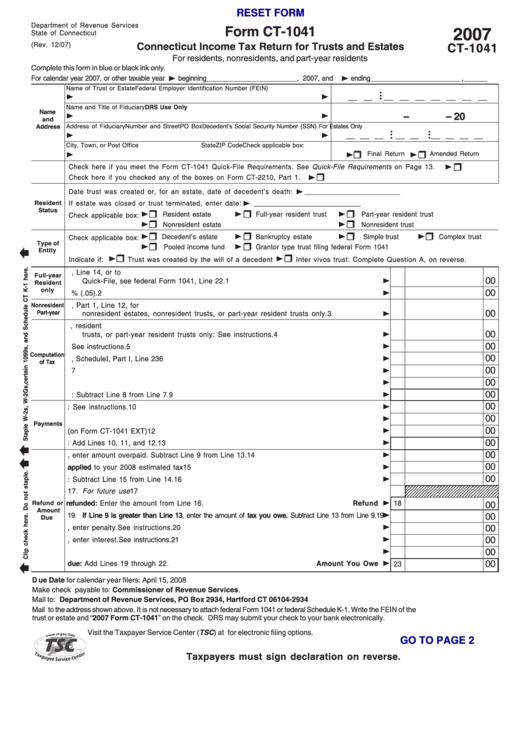

Form Ct1041 Connecticut Tax Return For Trusts And Estates

Use this calculator to determine your connecticut income tax. Web the 2023 chevrolet bolt. Web connecticut has a state income tax that ranges between 3% and 6.99%. Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services. It added income limits, price caps and.

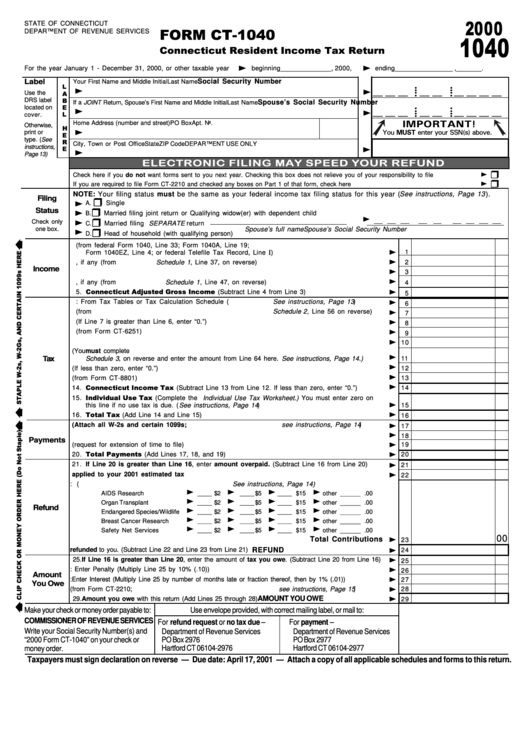

Form Ct1040 Connecticut Resident Tax Return 2000 printable

38th out of 51 download connecticut tax information. Web $15,000 for single filers, $19,000 for heads of household, and $24,000 for married couples filing jointly or surviving spouses. Web the 2023 chevrolet bolt. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Select the filing status as.

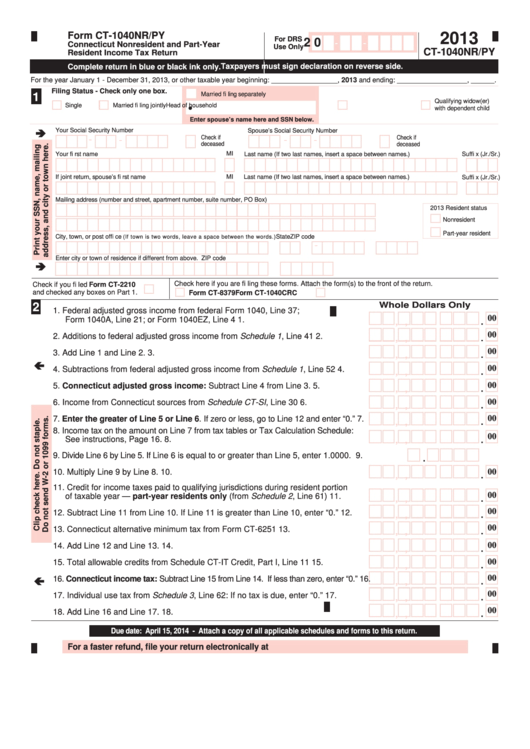

Form Ct1040nr/py Connecticut Nonresident And PartYear Resident

Complete, edit or print tax forms instantly. How is taxable income calculated? Web $15,000 for single filers, $19,000 for heads of household, and $24,000 for married couples filing jointly or surviving spouses. 38th out of 51 download connecticut tax information. Web connecticut has a state income tax that ranges between 3% and 6.99%.

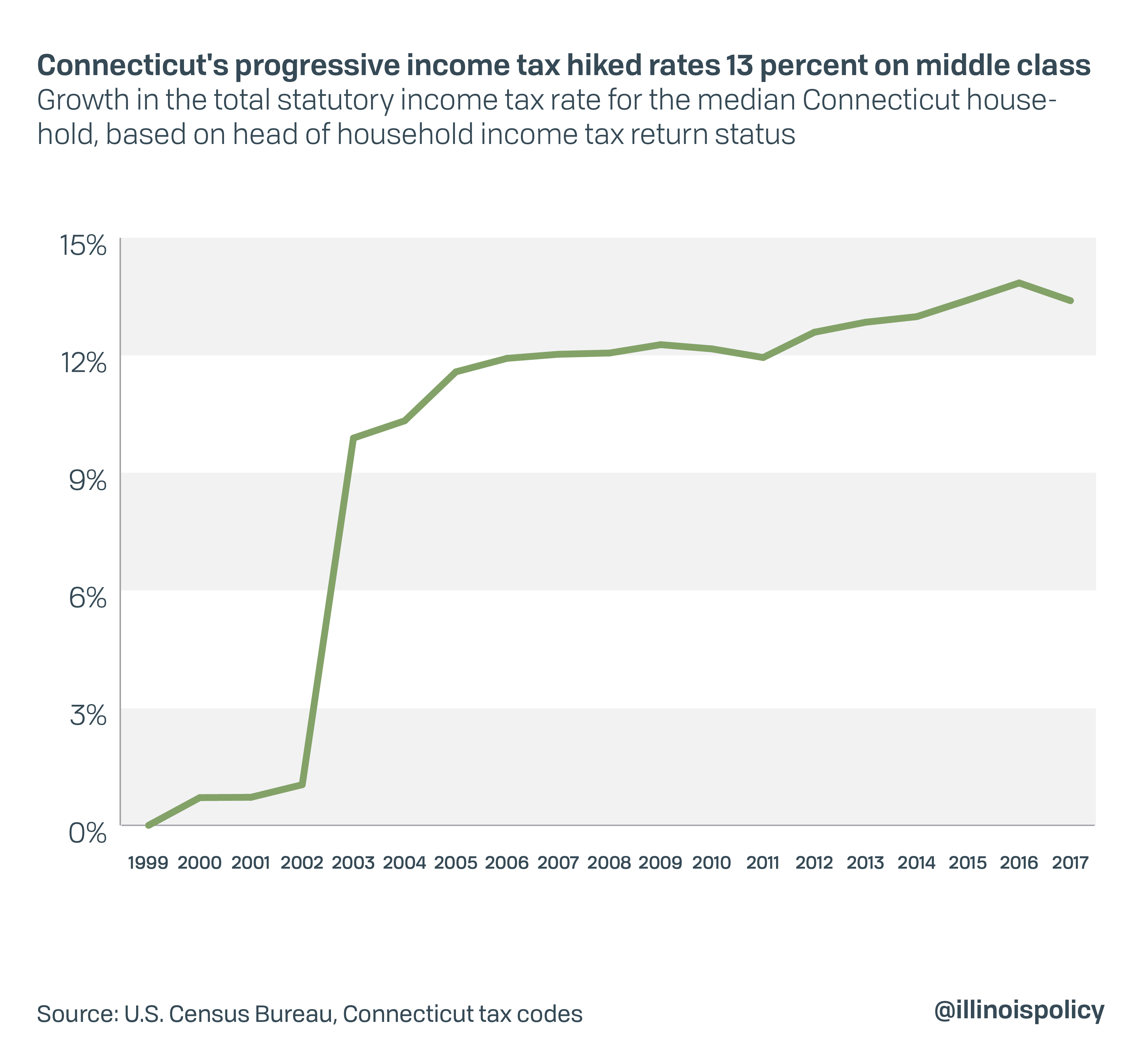

How Connecticut’s ‘tax on the rich’ ended in middleclass tax hikes

Web individual use tax, gift tax, and other income tax returns 301 individual use tax 302 gift tax 303 income tax on trusts and estates 304 s corporation information. How is taxable income calculated? 38th out of 51 download connecticut tax information. Web underpayment of estimated income tax by individuals, trusts, and estates. Amended connecticut reconciliation of withholding:

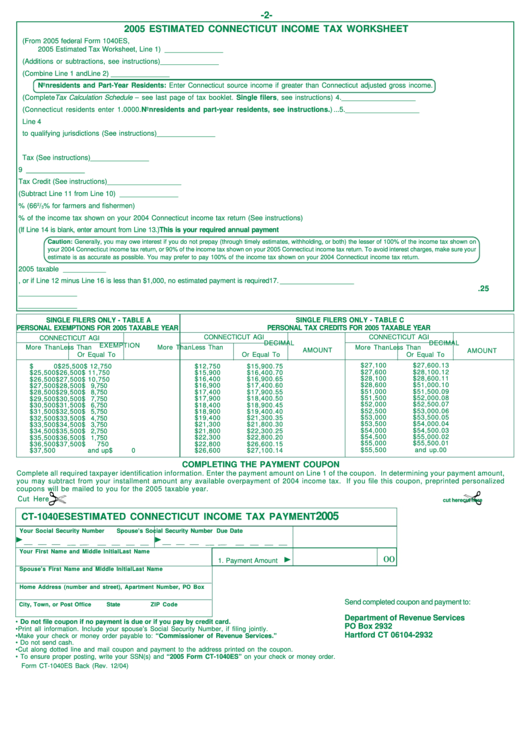

Form Ct 1040es Estimated Connecticut Tax Payment 2005

Select the filing status as. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. It added income limits, price caps and. Web connecticut has a state income tax that ranges between 3% and 6.99%. This form is for income earned in tax year 2022, with tax returns due.

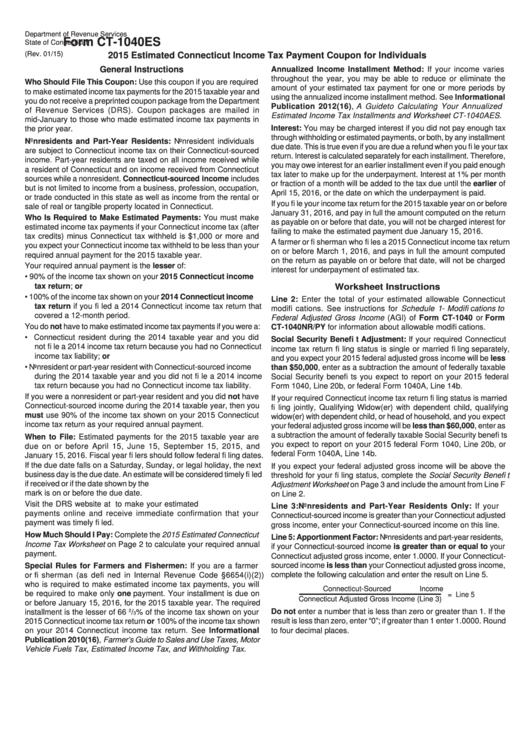

Fillable Form Ct1040es Estimated Connecticut Tax Payment

How is taxable income calculated? Web efiling information income tax refunds quickfact: Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services. Web connecticut has a state income tax that ranges between 3% and 6.99%. It added income limits, price caps and.

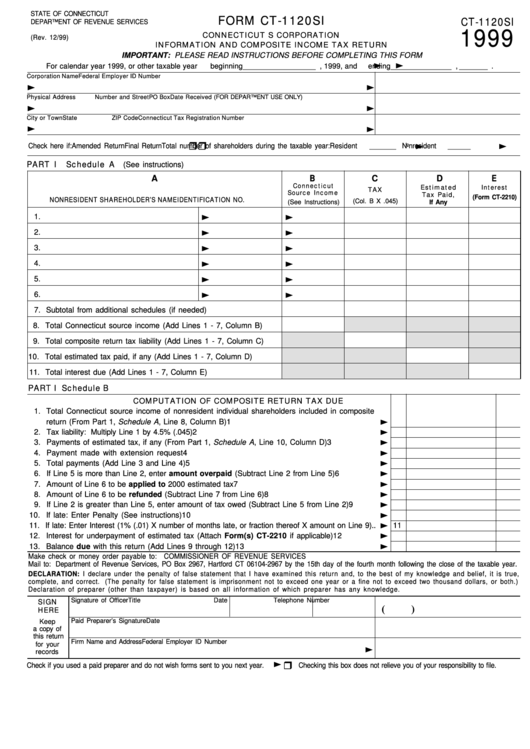

Form Ct1120si Connecticut S Corporation Information And Composite

The average family pays $800.00 in connecticut income taxes. It added income limits, price caps and. Use this calculator to determine your connecticut income tax. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Select the filing status as.

Fillable Form Ct1041 Connecticut Tax Return For Trusts And

Web connecticut has a state income tax that ranges between 3% and 6.99%. Web underpayment of estimated income tax by individuals, trusts, and estates. Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services. 38th out of 51 download connecticut tax information. How is taxable income.

38Th Out Of 51 Download Connecticut Tax Information.

Web connecticut has a state income tax that ranges between 3% and 6.99% , which is administered by the connecticut department of revenue services. Complete, edit or print tax forms instantly. The inflation reduction act of 2022 overhauled the ev tax credit, worth up to $7,500. Web $15,000 for single filers, $19,000 for heads of household, and $24,000 for married couples filing jointly or surviving spouses.

Web Underpayment Of Estimated Income Tax By Individuals, Trusts, And Estates.

Web individual use tax, gift tax, and other income tax returns 301 individual use tax 302 gift tax 303 income tax on trusts and estates 304 s corporation information. It added income limits, price caps and. Use this calculator to determine your connecticut income tax. The average family pays $800.00 in connecticut income taxes.

This Form Is For Income Earned In Tax Year 2022, With Tax Returns Due.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Web efiling information income tax refunds quickfact: Select the filing status as. How is taxable income calculated?

Web Connecticut Has A State Income Tax That Ranges Between 3% And 6.99%.

Complete, edit or print tax forms instantly. Web department of revenue services. Web the 2023 chevrolet bolt. Amended connecticut reconciliation of withholding: