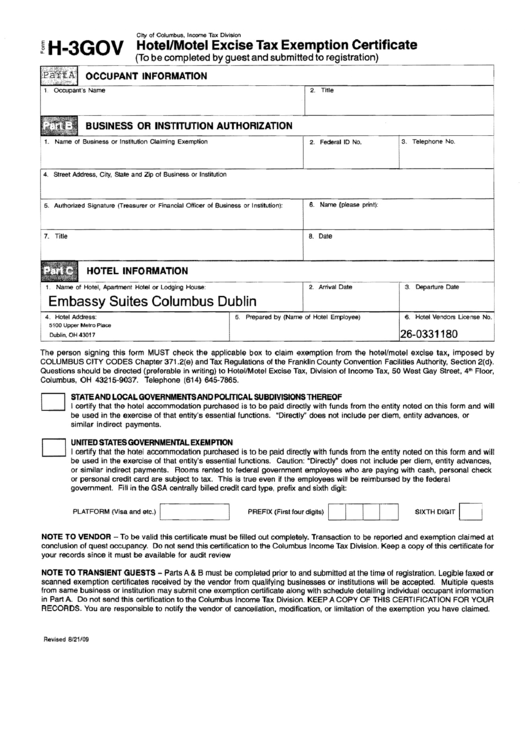

Columbus City Tax Form

Columbus City Tax Form - Web the city auditor's office also recommends that taxpayers keep track of the days worked outside of columbus. The form is used to request a waiver of penalty and interest debts resulting from filing a late quarterly tax return. Web to use the forms provided by the city of columbus income tax division, we recommend you download the forms and open them using the newest version of acrobat reader. Local taxes for columbus residents columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in columbus or another city. Web may be entitled to a credit for taxes paid to the city where your income was earned. 13 marble cliff 14 brice. 16 harrisburg 88 alt columbus. It is quick, secure and convenient! Web the city of columbus income tax division uses adobe fillable pdf forms. Web the most efficient and effective way to file tax returns and make payments for city of columbus income tax is through crisp (columbus revenue information service.

The city's tax formula is based on a work year of. Web we strongly recommend you file and pay with our new online tax portal, crisp. Occupation or nature of business. Web the city of columbus income tax division uses adobe fillable pdf forms. Web the most efficient and effective way to file tax returns and make payments for city of columbus income tax is through crisp (columbus revenue information service. Web employer's quarterly return of city tax withheld. Changes in many modern web browsers mean they are no longer compatible with fillable pdf. Columbus mobile food vendor program; It is quick, secure and convenient! The form is used to request a waiver of penalty and interest debts resulting from filing a late quarterly tax return.

Web deposit of tax withheld from employee wages must electronically deposit municipal taxes withheld with the city of columbus, income tax division at the same time. To request a waiver online, please. It is quick, secure and convenient! 13 marble cliff 14 brice. Changes in many modern web browsers mean they are no longer compatible with fillable pdf. The form is used to request a waiver of penalty and interest debts resulting from filing a late quarterly tax return. It is quick, secure and convenient! 2021 filing and payment information. 10 obetz 11 canal winchester. Web we strongly recommend you file and pay with our new online tax portal crisp ( crisp.columbus.gov ).

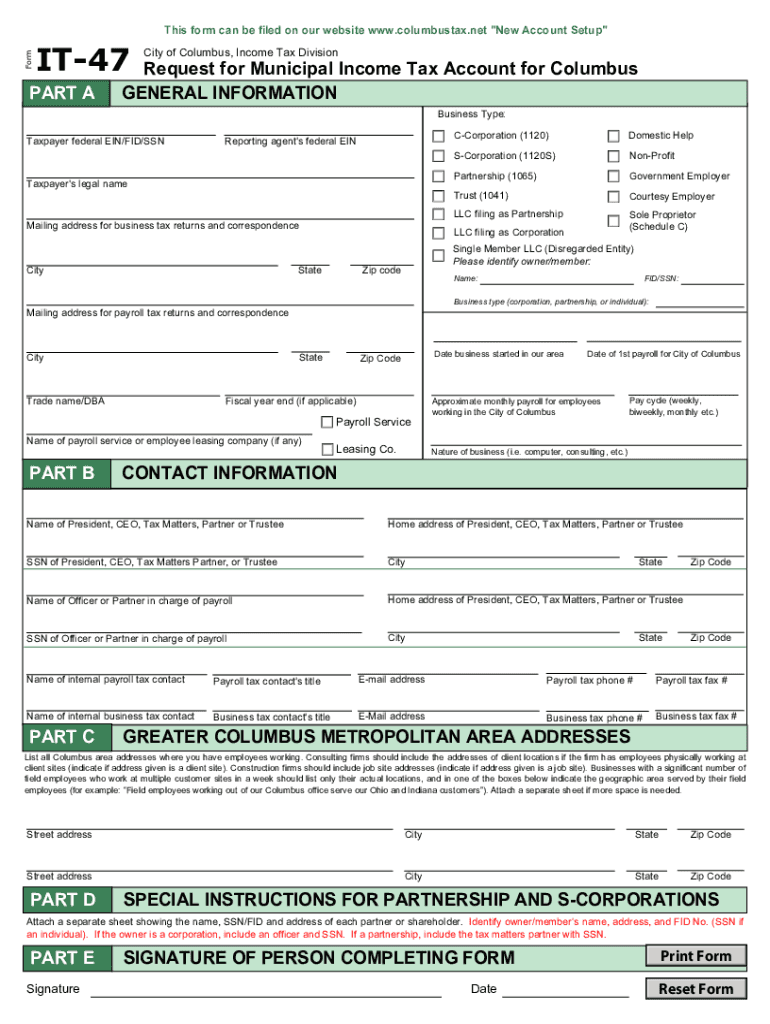

City Of Columbus Tax Division printable pdf download

The form is used to request a waiver of penalty and interest debts resulting from filing a late quarterly tax return. 2021 filing and payment information. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. 16 harrisburg 88 alt columbus. Columbus mobile food vendor program;

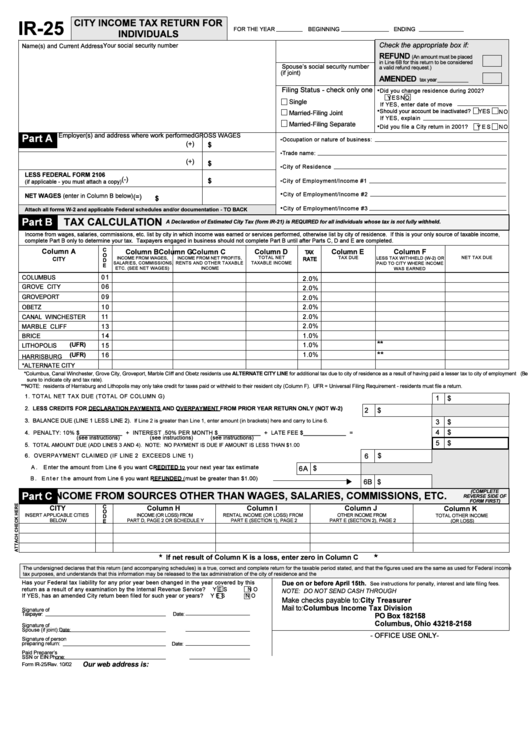

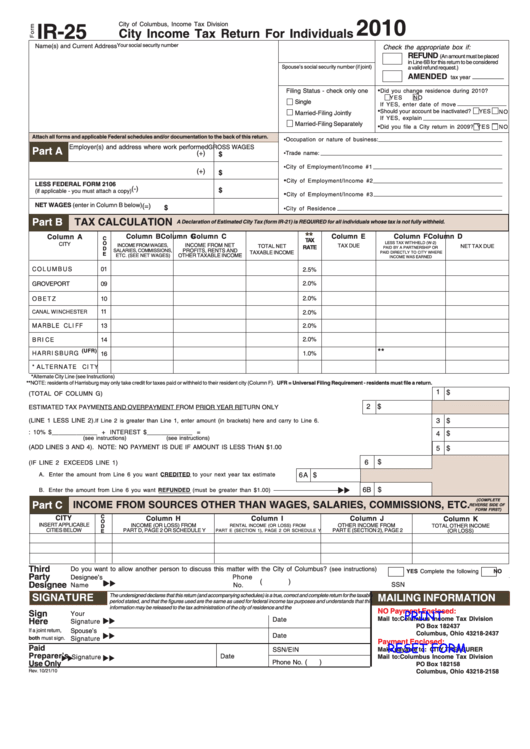

Form Ir25 City Tax Return For Individuals City Of Columbus

It is quick, secure and convenient! 13 marble cliff 14 brice. Web deposit of tax withheld from employee wages must electronically deposit municipal taxes withheld with the city of columbus, income tax division at the same time. Web the city auditor's office also recommends that taxpayers keep track of the days worked outside of columbus. The form is used to.

Columbus City Taxes Collection • Amounts and important data

Web deposit of tax withheld from employee wages must electronically deposit municipal taxes withheld with the city of columbus, income tax division at the same time. Web the city of columbus income tax division uses adobe fillable pdf forms. Web city of columbus income tax division 77 n. It is quick, secure and convenient! Web watch newsmax live for the.

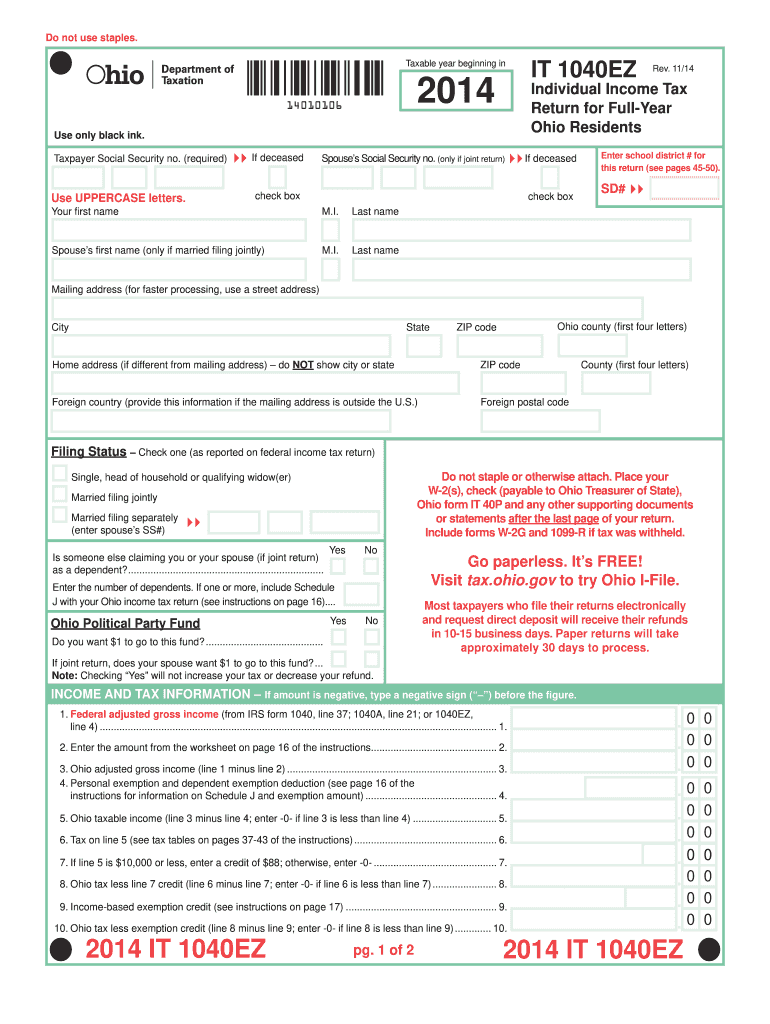

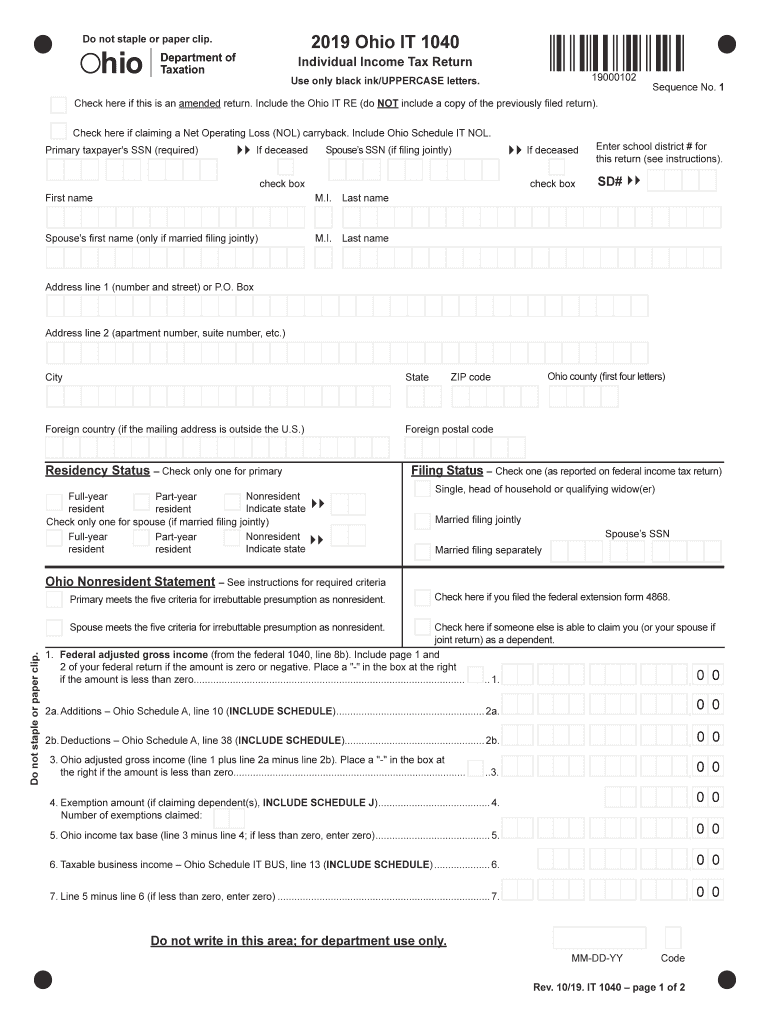

Ohio form 2012 it 1040ez Fill out & sign online DocHub

Web the city auditor's office also recommends that taxpayers keep track of the days worked outside of columbus. You expect to owe more than $200 in columbus tax in 2021, reasonable value of meals, lodging and the like. Changes in many modern web browsers mean they are no longer compatible with fillable pdf. The city's tax formula is based on.

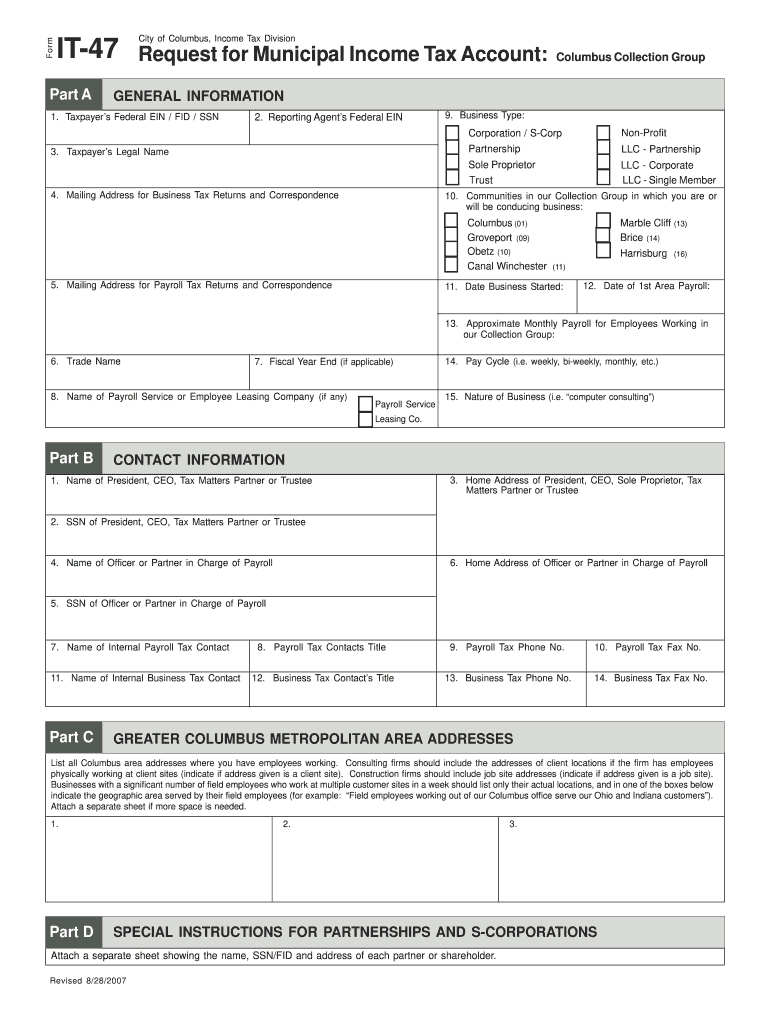

Form IT47 Request for Municipal Tax Account Columbus

Web employer's quarterly return of city tax withheld. The city's tax formula is based on a work year of. Changes in many modern web browsers mean they are no longer compatible with fillable pdf. To request a waiver online, please. Occupation or nature of business.

OH IT47 Columbus City 2017 Fill out Tax Template Online US Legal

Web may be entitled to a credit for taxes paid to the city where your income was earned. It is quick, secure and convenient! Occupation or nature of business. 13 marble cliff 14 brice. Web to use the forms provided by the city of columbus income tax division, we recommend you download the forms and open them using the newest.

20202023 Form OH IT47 Columbus City Fill Online, Printable

It is quick, secure and convenient! Web the most efficient and effective way to file tax returns and make payments for city of columbus income tax is through crisp (columbus revenue information service. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. It is quick, secure and convenient! 2021 filing and.

Form Ir25 City Tax Return For Individuals City Of Columbus

Local taxes for columbus residents columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in columbus or another city. 2021 filing and payment information. The city's tax formula is based on a work year of. Web may be entitled to a credit for taxes paid to the city where your.

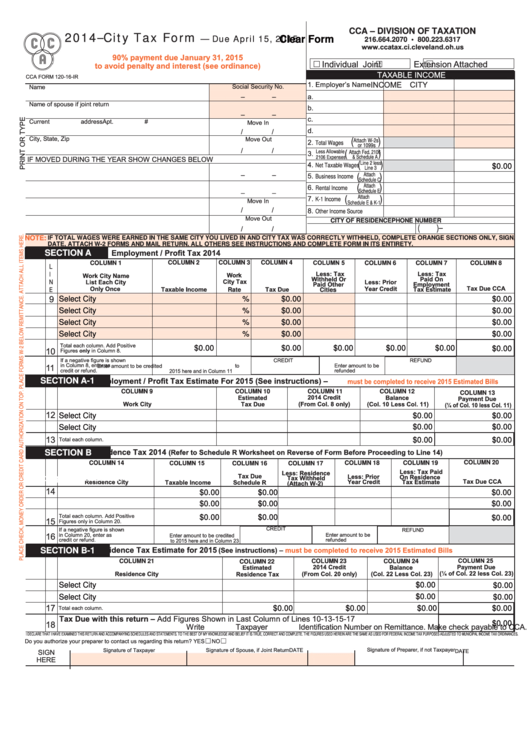

Fillable Cca Division Of Taxation 2014City Tax Form printable pdf

10 obetz 11 canal winchester. Columbus mobile food vendor program; 16 harrisburg 88 alt columbus. Web deposit of tax withheld from employee wages must electronically deposit municipal taxes withheld with the city of columbus, income tax division at the same time. The city's tax formula is based on a work year of.

2019 Ohio It 1040 Fill Out and Sign Printable PDF Template signNow

Web the city auditor's office also recommends that taxpayers keep track of the days worked outside of columbus. You can avoid processing delays and receive your refund faster. If you are a partner in a partnership, you may be entitled to a credit for city taxes paid by the. Web to use the forms provided by the city of columbus.

10 Obetz 11 Canal Winchester.

Local taxes for columbus residents columbus residents pay a total of 2.5% in taxes on all income earned, regardless of whether it was earned in columbus or another city. Web city of columbus income tax division 77 n. The city's tax formula is based on a work year of. Occupation or nature of business.

It Is Quick, Secure And Convenient!

Changes in many modern web browsers mean they are no longer compatible with fillable pdf. You can avoid processing delays and receive your refund faster. You expect to owe more than $200 in columbus tax in 2021, reasonable value of meals, lodging and the like. 13 marble cliff 14 brice.

Web Deposit Of Tax Withheld From Employee Wages Must Electronically Deposit Municipal Taxes Withheld With The City Of Columbus, Income Tax Division At The Same Time.

Web we strongly recommend you file and pay with our new online tax portal, crisp. Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. The form is used to request a waiver of penalty and interest debts resulting from filing a late quarterly tax return. Web we strongly recommend you file and pay with our new online tax portal crisp ( crisp.columbus.gov ).

Web The Most Efficient And Effective Way To File Tax Returns And Make Payments For City Of Columbus Income Tax Is Through Crisp (Columbus Revenue Information Service.

Web the city of columbus income tax division uses adobe fillable pdf forms. It is quick, secure and convenient! Web to use the forms provided by the city of columbus income tax division, we recommend you download the forms and open them using the newest version of acrobat reader. Web may be entitled to a credit for taxes paid to the city where your income was earned.