Colorado Estimated Tax Form 2023

Colorado Estimated Tax Form 2023 - Web related to the use of sick leave. 505, tax withholding and estimated tax. Web the colorado department of revenue, division of taxation, will host a public rulemaking hearing on the sales tax rules listed below at 10:00 a.m. Web in general, an electing entity will pay estimated tax if its colorado income tax liability will exceed $5,000 for 2023. These impacts have not been estimated. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. You may claim exemption from. Estimated 2020 colorado taxable income $ 00 2. This is intended for nonresident individuals who are included in a form 106 composite filing. Required payments in general, payments are required.

Web estimated tax payments are due on a quarterly basis; This form is for income earned in tax year 2022, with tax returns due in april. Web july 20, 2023. These impacts have not been estimated. Web we last updated colorado form 104ep in february 2023 from the colorado department of revenue. 505, tax withholding and estimated tax. 2022 tax year return calculator in 2023; Web income tax forms for the state of colorado. Web file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Be sure to verify that the form.

This is intended for nonresident individuals who are included in a form 106 composite filing. You may claim exemption from. Web file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Web income tax forms for the state of colorado. Be sure to verify that the form. Required payments in general, payments are required. In most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2023, after subtracting any withholding or credits you might have. Web general rule in most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2021, after subtracting any withholding or credits you might have. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Web beautiful custom designed and built kitchens and furniture throughout colorado.

Pa Estimated Tax Form Fill Online, Printable, Fillable, Blank pdfFiller

505, tax withholding and estimated tax. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Web you can see a record of your estimated tax payments in your revenue online account. 2022 tax year return calculator in 2023; Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll.

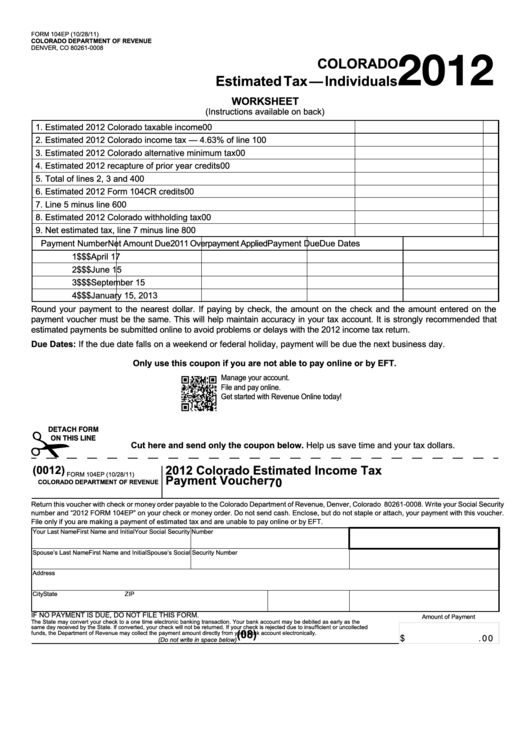

Form 104ep Colorado TaxIndividuals Worksheet 2012 printable pdf

Web real gross domestic product (gdp) increased at an annual rate of 2.4 percent in the second quarter of 2023 (table 1), according to the advance estimate released by. Web file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Required payments in general, payments are required. Web beautiful custom designed and built kitchens and.

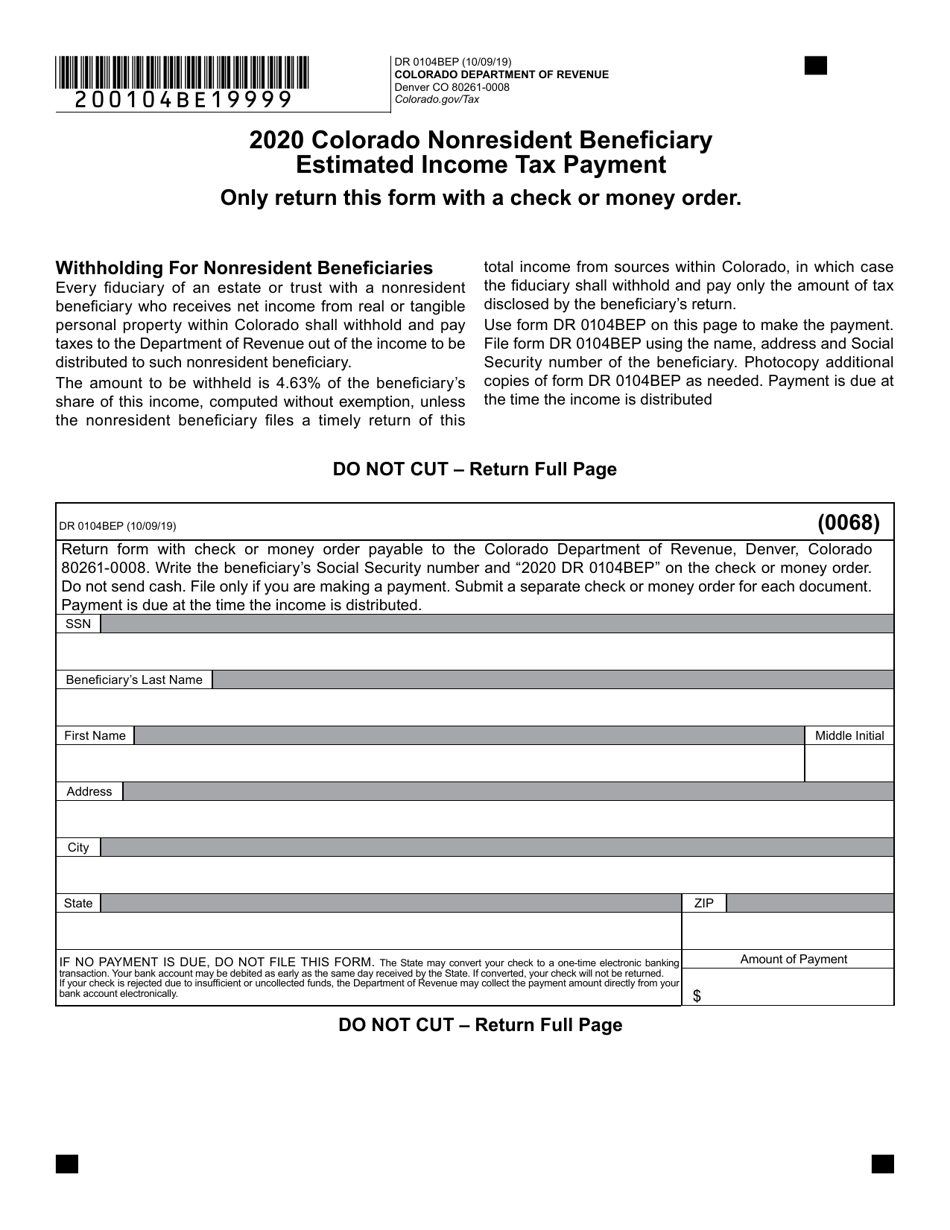

Form DR0104BEP Download Fillable PDF or Fill Online Colorado

Web watch newsmax live for the latest news and analysis on today's top stories, right here on facebook. Web use our income tax calculator to estimate how much tax you might pay on your taxable income. Snohomish county tax preparer pleads guilty to assisting in the. Web we last updated the individual estimated income tax payment form in february 2023,.

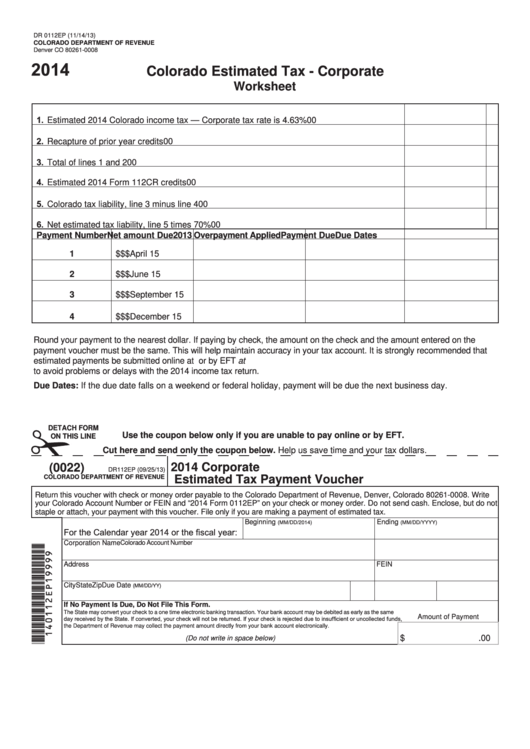

Fillable Form 0112ep Colorado Estimated Tax Corporate Worksheet

You may claim exemption from. This is intended for nonresident individuals who are included in a form 106 composite filing. Web general rule in most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2021, after subtracting any withholding or credits you might have. Web income tax forms for the state.

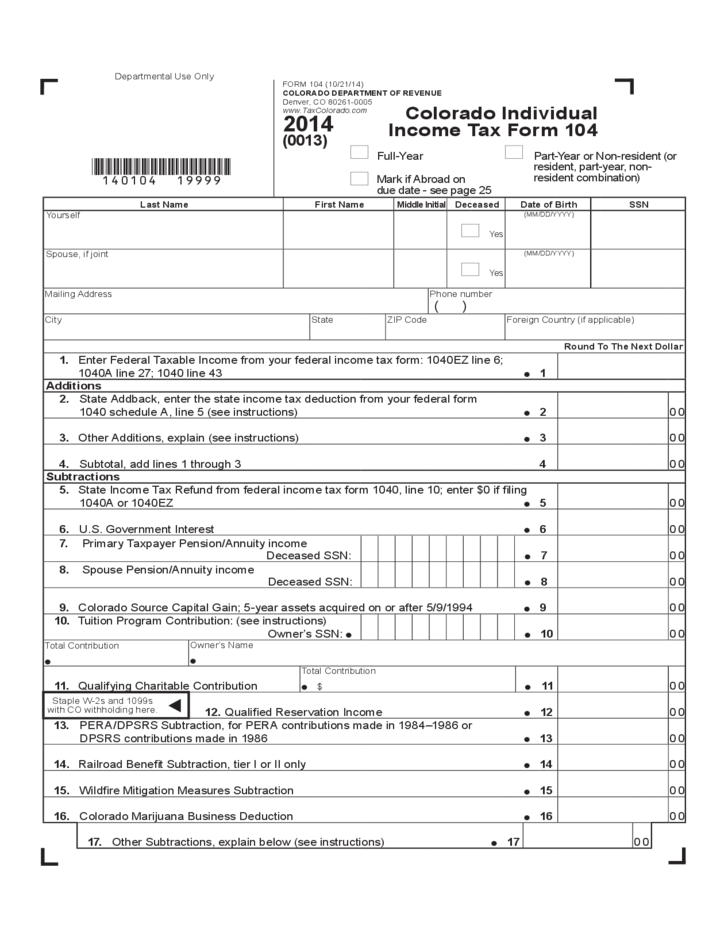

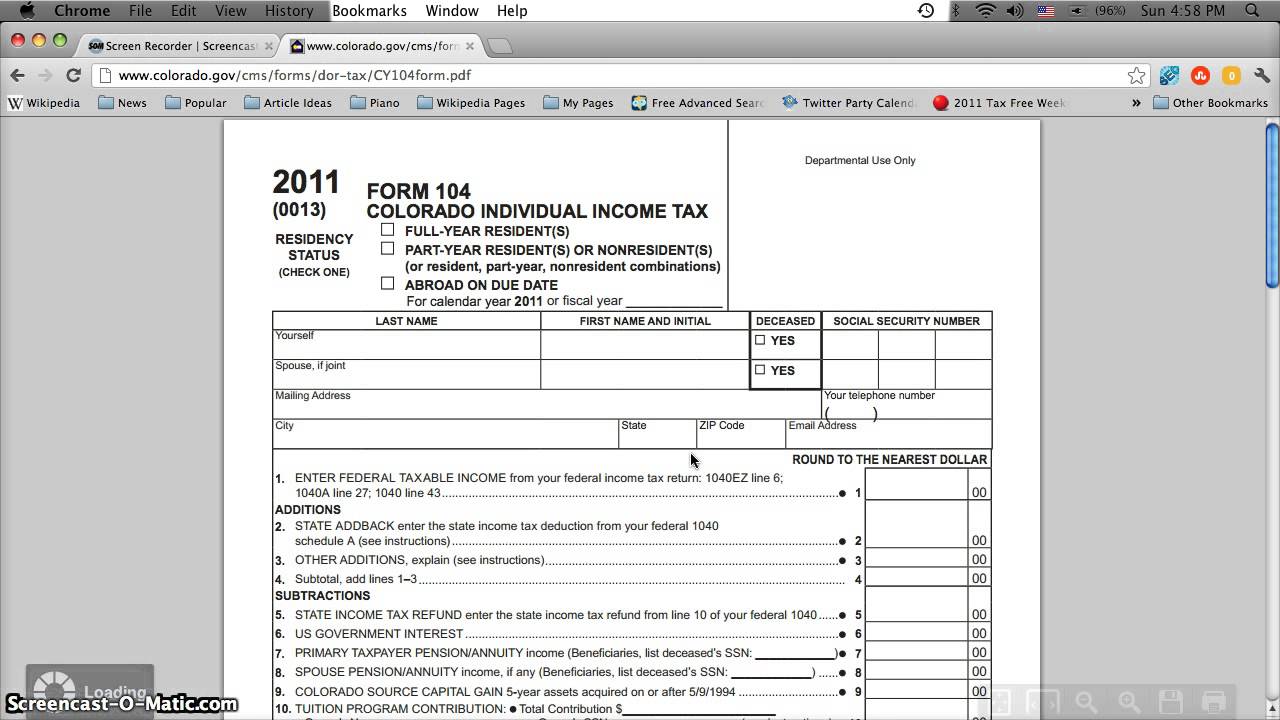

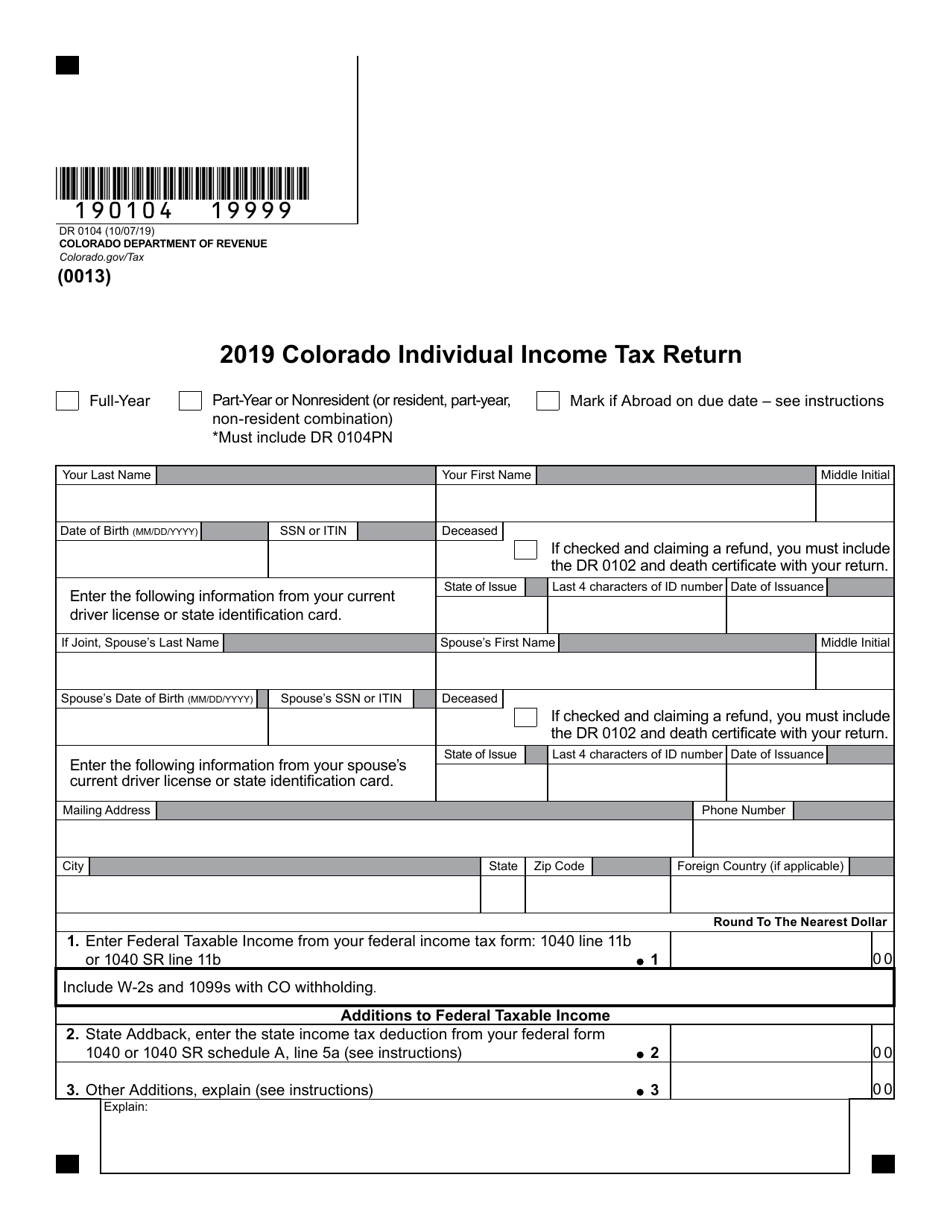

Printable Colorado Tax Form 104 Printable Form 2022

Web use our income tax calculator to estimate how much tax you might pay on your taxable income. Web related to the use of sick leave. Be sure to verify that the form. Web we last updated colorado form 104ep in february 2023 from the colorado department of revenue. Web general rule in most cases, you must pay estimated tax.

Colorado Printable Tax Forms 2012 Form 104 Online Printable or Fill

Web file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Be sure to verify that the form. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the. 505, tax withholding and estimated tax. Web.

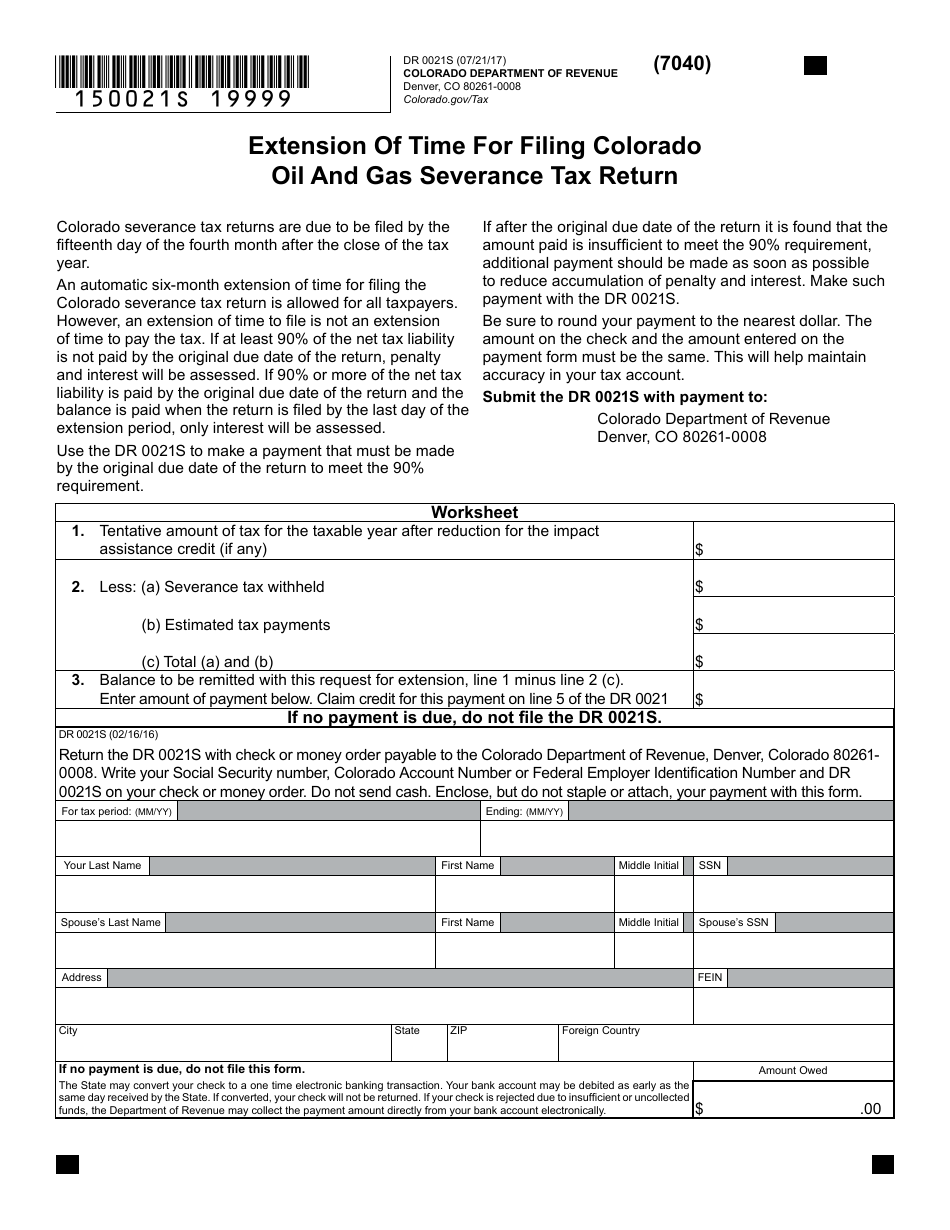

Formdr0021w 2018 Fill out & sign online DocHub

Web beautiful custom designed and built kitchens and furniture throughout colorado. Web income tax forms for the state of colorado. Web file your individual income tax return, submit documentation electronically, or apply for a ptc rebate. Web estimated tax payments are due on a quarterly basis; In most cases, you must pay estimated tax if you expect to owe more.

Revenue Canada Tax Forms 2018

April 15 (first calender quarter), june 15 (second calender quarter), september 15 for more. These impacts have not been estimated. Web estimated tax payments are due on a quarterly basis; Required payments in general, payments are required. Estimated tax payments are claimed when you file your colorado individual income tax.

Form DR0021S Download Fillable PDF or Fill Online Extension of Time for

Web beautiful custom designed and built kitchens and furniture throughout colorado. April 15 (first calender quarter), june 15 (second calender quarter), september 15 for more. Effective date the bill was signed into law by the governor on june 2, 2023, and takes effect on august 7,. Web income tax forms for the state of colorado. Omaha man sentenced for tax.

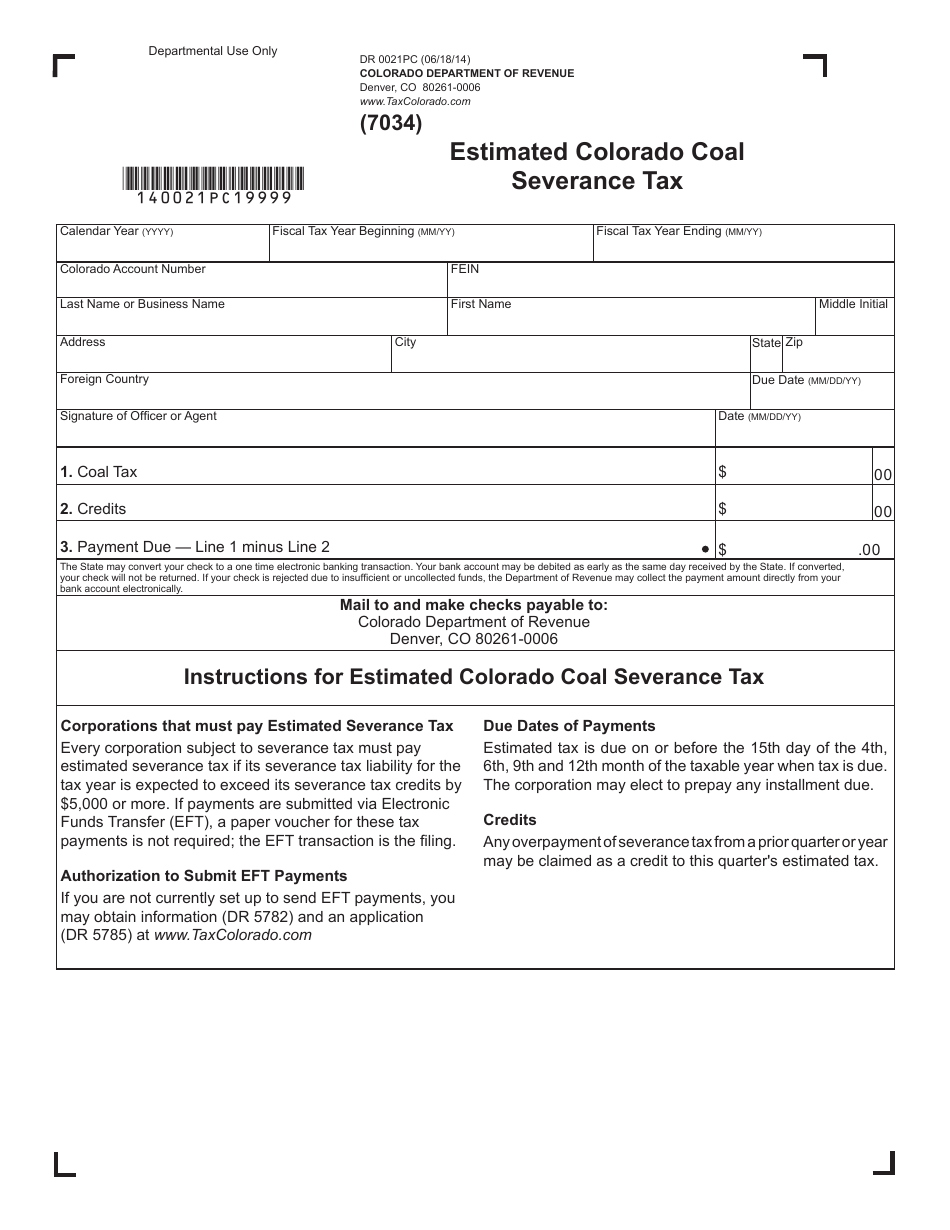

Form DR0021PC Download Printable PDF or Fill Online Estimated Colorado

Web we last updated the individual estimated income tax payment form in february 2023, so this is the latest version of form 104ep, fully updated for tax year 2022. Web estimated tax payments are due on a quarterly basis; Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets.

These Impacts Have Not Been Estimated.

Web the colorado department of revenue, division of taxation, will host a public rulemaking hearing on the sales tax rules listed below at 10:00 a.m. Web related to the use of sick leave. Estimated tax is the method used to pay tax on income that isn’t subject to withholding (for example, earnings. Web forbes advisor's capital gains tax calculator helps estimate the taxes you'll pay on profits or losses on sale of assets such as real estate, stocks & bonds for the.

Estimated Tax Payments Are Claimed When You File Your Colorado Individual Income Tax.

This is intended for nonresident individuals who are included in a form 106 composite filing. Web the colorado income tax estimator will let you calculate your state taxes for the tax year. Omaha man sentenced for tax evasion and role in multimillion dollar embezzlement. Snohomish county tax preparer pleads guilty to assisting in the.

2022 Tax Year Return Calculator In 2023;

You may claim exemption from. Required payments in general, payments are required. Be sure to verify that the form. Web we last updated colorado form 104ep in february 2023 from the colorado department of revenue.

Web Watch Newsmax Live For The Latest News And Analysis On Today's Top Stories, Right Here On Facebook.

Web you can see a record of your estimated tax payments in your revenue online account. April 15 (first calender quarter), june 15 (second calender quarter), september 15 for more. Web general rule in most cases, you must pay estimated tax if you expect to owe more than $1,000 in net tax for 2021, after subtracting any withholding or credits you might have. Web file your individual income tax return, submit documentation electronically, or apply for a ptc rebate.