Chapter 2 Net Income Answer Key

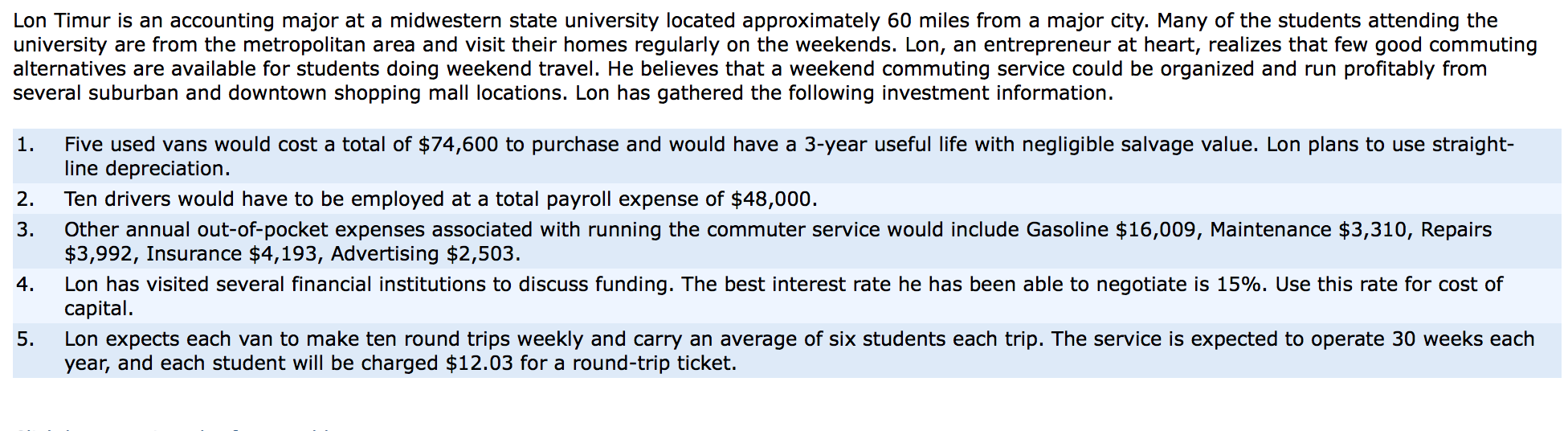

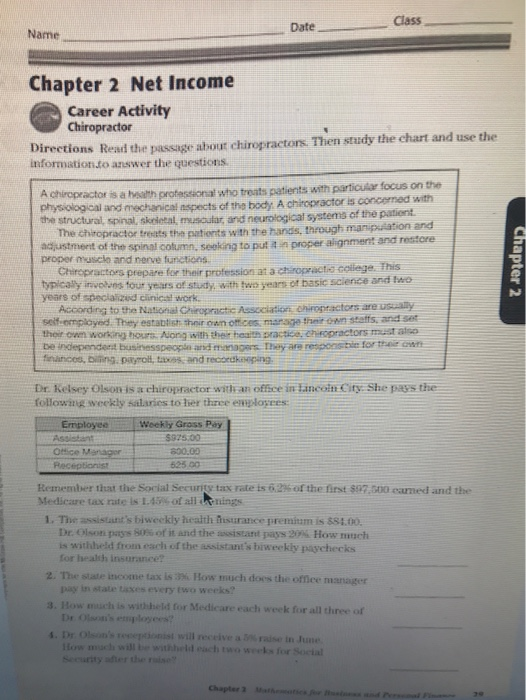

Chapter 2 Net Income Answer Key - Money withheld by an employer from an employee's paycheck to pay federal government. Statement of owner’s equity shows the change in net worth of a business for a period of time; Click the card to flip 👆. The earnings statement attached to your paychecklists all your dedue tions, your gross pay, and your net. The total amount of money you earn. Web mathematics for business and personal finance chapter 2: The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. Web this is a answer key for chapter 2 net income lesson 2.2 answer key, it is a pdf that is easy to access and it. Web test yourself is an opportunity for you to assess your ability to handle the big ideas of chapter 2. State income tax rate is 1.5 percent of taxable income.

The amount of money you receive after deductions are subtracted from your gross income. The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. The earnings statement attached to your paychecklists all your dedue tions, your gross pay, and your net. Web study with quizlet and memorize flashcards containing terms like federal income tax, withholding allowances, exemption and more. The total amount of money you earn. Web mathematics for business and personal finance chapter 2: Click the card to flip 👆. How much does she take home per week after taxes? Income statement shows the financial performance of a business for a period of time; 1626.12 / 52 = $31.27 f.

1626.12 / 52 = $31.27 f. Use the table below to determine how much his employer deducts for state income. Web 120 chapter 2 net income concept check check your answers at the end of the chapter. The crossword solver finds answers to classic crosswords and cryptic crossword puzzles. Income tax worksheet and tax table. How much does she take home per week after taxes? The amount of money that is taken away in the form of taxes. Money withheld by an employer from an employee's paycheck to pay federal government. Web mathematics for business and personal finance chapter 2: Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee.

Chapter 2 net stmt and retained earning help YouTube

The earnings statement attached to your paychecklists all your dedue tions, your gross pay, and your net. Web find and create gamified quizzes, lessons, presentations, and flashcards for students, employees, and everyone else. She is married and claims no allowances. Income tax worksheet and tax table. Income statement shows the financial performance of a business for a period of time;

Solved A.) Determine the annual (1) net and (2) net

Web mathematics for business and personal finance chapter 2: Click the card to flip 👆. The amount of money that is taken away in the form of taxes. Money withheld by an employer from an employee's paycheck to pay federal government. The amount of money you receive after deductions are subtracted from your gross income.

Chapter 2

Web the crossword solver found 20 answers to net income, 18 letters crossword clue. How much does she take home per week after taxes? Find the taxable wages and the annual tax withheld. Net income in this chapter: The amount of money you receive after deductions are subtracted from your gross income.

Taxation Answer Key Chapter 3

Web study with quizlet and memorize flashcards containing terms like federal income tax, withholding allowances, exemption and more. Web this is a answer key for chapter 2 net income lesson 2.2 answer key, it is a pdf that is easy to access and it. Enter the length or pattern for better results. The amount of money that is taken away.

6. Presented below is the statement of Cowan, Inc. Sales

Use the table below to determine how much his employer deducts for state income. Find the taxable wages and the annual tax withheld. Net income in this chapter: Web test yourself is an opportunity for you to assess your ability to handle the big ideas of chapter 2. Web mathematics for business and personal finance chapter 2:

Class _ Date Chapter 2 Net Lesson 2.6

Use the table below to determine how much his employer deducts for state income. Enter the length or pattern for better results. 5.0 (1 review) gross profit: How much does she take home per week after taxes? Web 120 chapter 2 net income concept check check your answers at the end of the chapter.

Class _ Date Chapter 2 Net Lesson 2.6

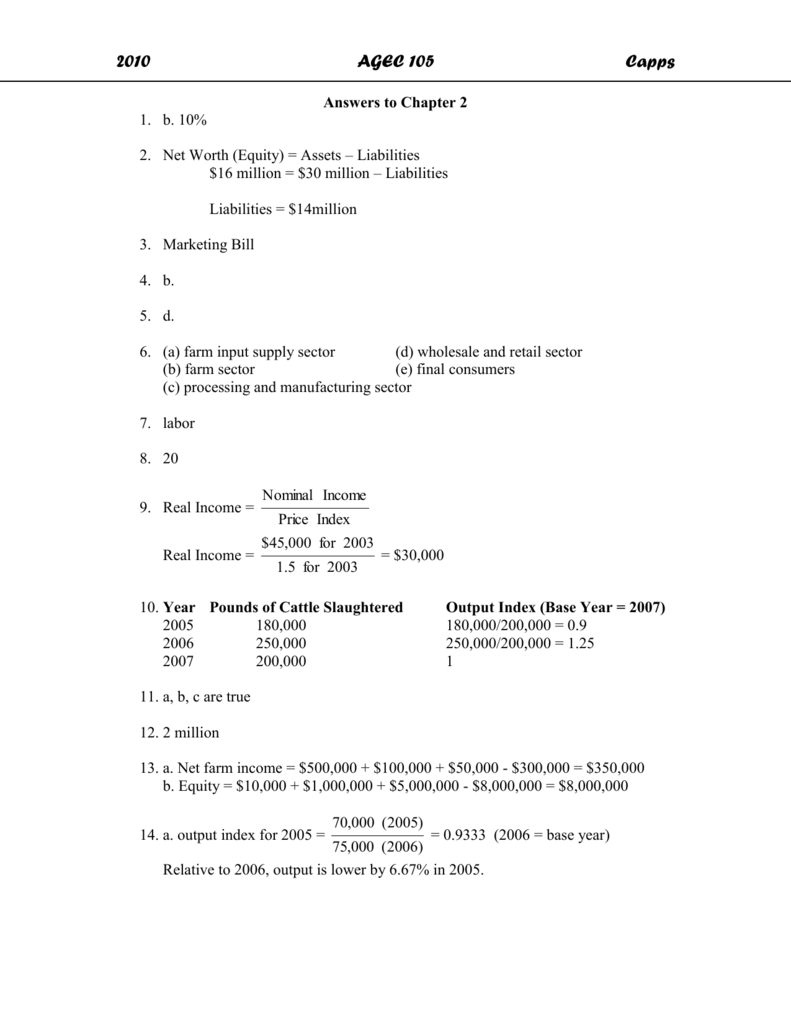

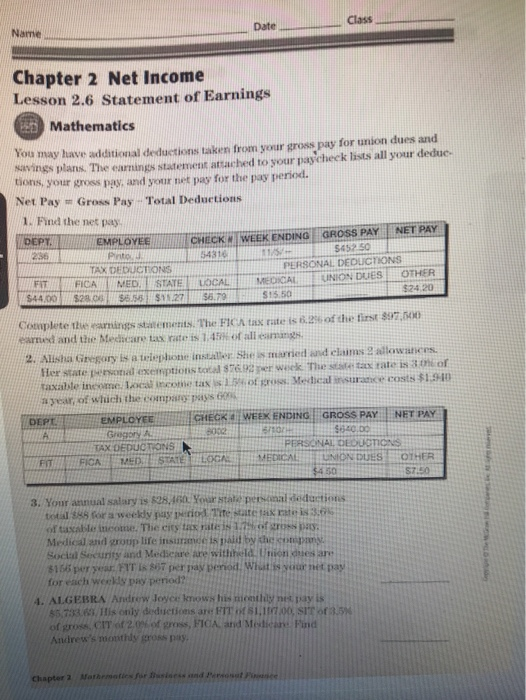

Web finance finance questions and answers class _ date chapter 2 net income lesson 2.6 statement of earnings e mathematics you may have additional deductions taken from your gross pay for union dues and savings plans. Web test yourself is an opportunity for you to assess your ability to handle the big ideas of chapter 2. The crossword solver finds.

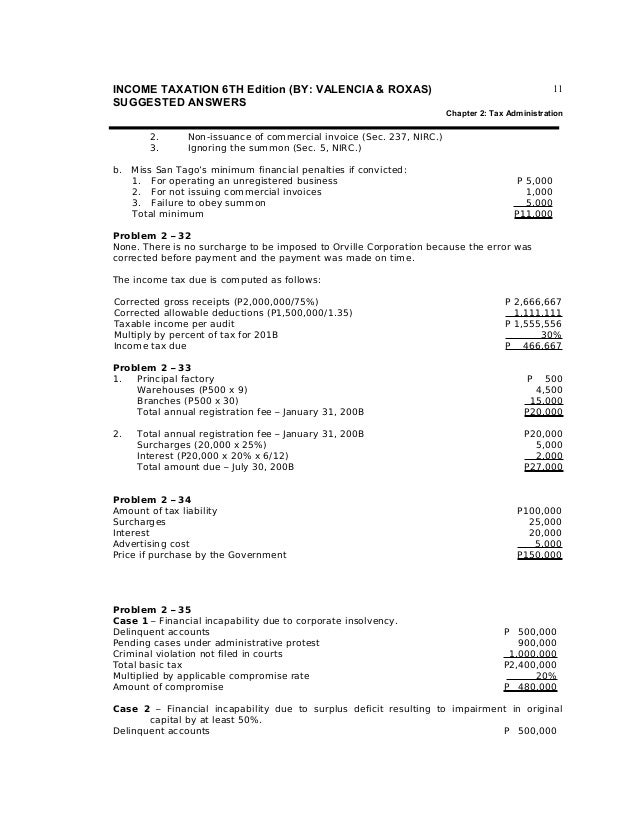

Taxation Answer key (6th Edition by Valencia) Chapter 2

Statement of owner’s equity shows the change in net worth of a business for a period of time; Web a strong income statement is one that has significantly more dollars of revenue than expenses, resulting in net income that is a relatively high percentage of the revenue figure. State income tax rate is 1.5 percent of taxable income. Deduction per.

Taxation Answer key (6th Edition by Valencia) Chapter 4

Use the table below to determine how much his employer deducts for state income. Deduction per pay period = total amount paid by employee /. 1626.12 / 52 = $31.27 f. Web 120 chapter 2 net income concept check check your answers at the end of the chapter. 5.0 (1 review) gross profit:

The Amount Of Money That Is Taken Away In The Form Of Taxes.

Find the taxable wages and the annual tax withheld. 5.0 (1 review) gross profit: The earnings statement attached to your paychecklists all your dedue tions, your gross pay, and your net. How much does she take home per week after taxes?

Web Find And Create Gamified Quizzes, Lessons, Presentations, And Flashcards For Students, Employees, And Everyone Else.

Web 120 chapter 2 net income concept check check your answers at the end of the chapter. Web this is a answer key for chapter 2 net income lesson 2.2 answer key, it is a pdf that is easy to access and it. Income tax worksheet and tax table. Click the card to flip 👆.

Enter The Length Or Pattern For Better Results.

What is her weekly state income tax? Web test yourself is an opportunity for you to assess your ability to handle the big ideas of chapter 2. Use the table below to determine how much his employer deducts for state income. Money withheld by an employer from an employee's paycheck to pay federal government.

Web Finance Finance Questions And Answers Class _ Date Chapter 2 Net Income Lesson 2.6 Statement Of Earnings E Mathematics You May Have Additional Deductions Taken From Your Gross Pay For Union Dues And Savings Plans.

Health insurance offered by many businesses to employees, paid in part by the business and in part by the employee. Web a strong income statement is one that has significantly more dollars of revenue than expenses, resulting in net income that is a relatively high percentage of the revenue figure. Web mathematics for business and personal finance chapter 2: State income tax rate is 1.5 percent of taxable income.