Chapter 2 Accounting Answers

Chapter 2 Accounting Answers - An accounting device used to analyze transactions. 1.2 identify users of accounting information and how they apply information; The accounting equation page 42: An accountant who combines accounting. False which of the following accounts would be considered an asset? What are the key financial ratios to analyze the. Special issues for merchants ; Amounts to be received in the future due to the sale of goods or services. Click the card to flip 👆. What are the key financial ratios to analyze the cash flow of an entity?

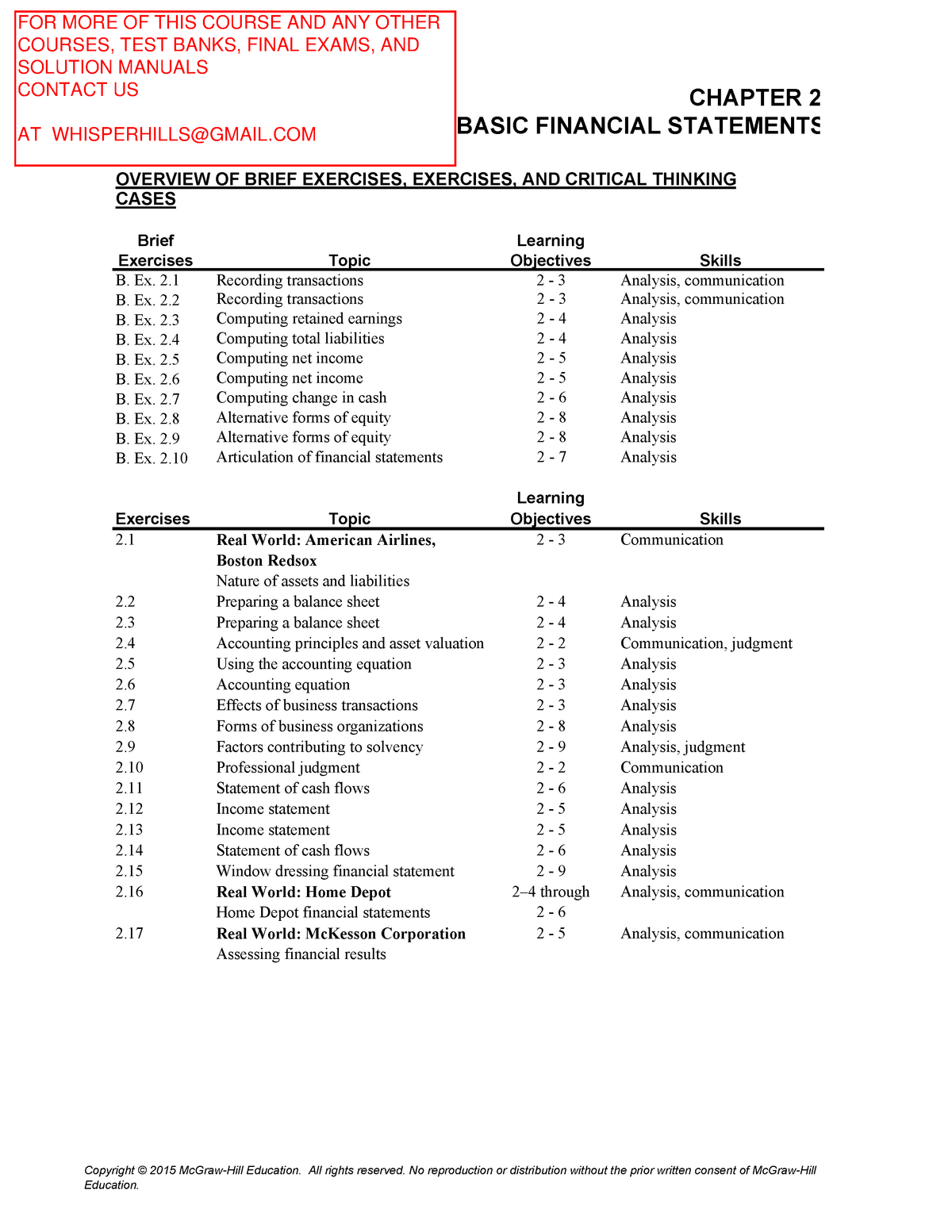

Web answer keys to chapter 2 fa. Balance sheet, income statement, retained earnings statement, or statement of cash flows. What are debits and credits? Therefore, individual accountants must resolve many situations based upon their general knowledge of accounting,. Click the card to flip 👆. Special issues for merchants ; Web the values of all things owned (assets) are on the accounting equation's. Web study with quizlet and memorize flashcards containing terms like an accounting device used to analyze transactions, an amount recorded on the left side of a t account, an amount recorded on the right side of a t. Assets are claims (by creditors) against the company. A physical count of supplies revealed that there was $400 of supplies on hand at the end of the accounting.

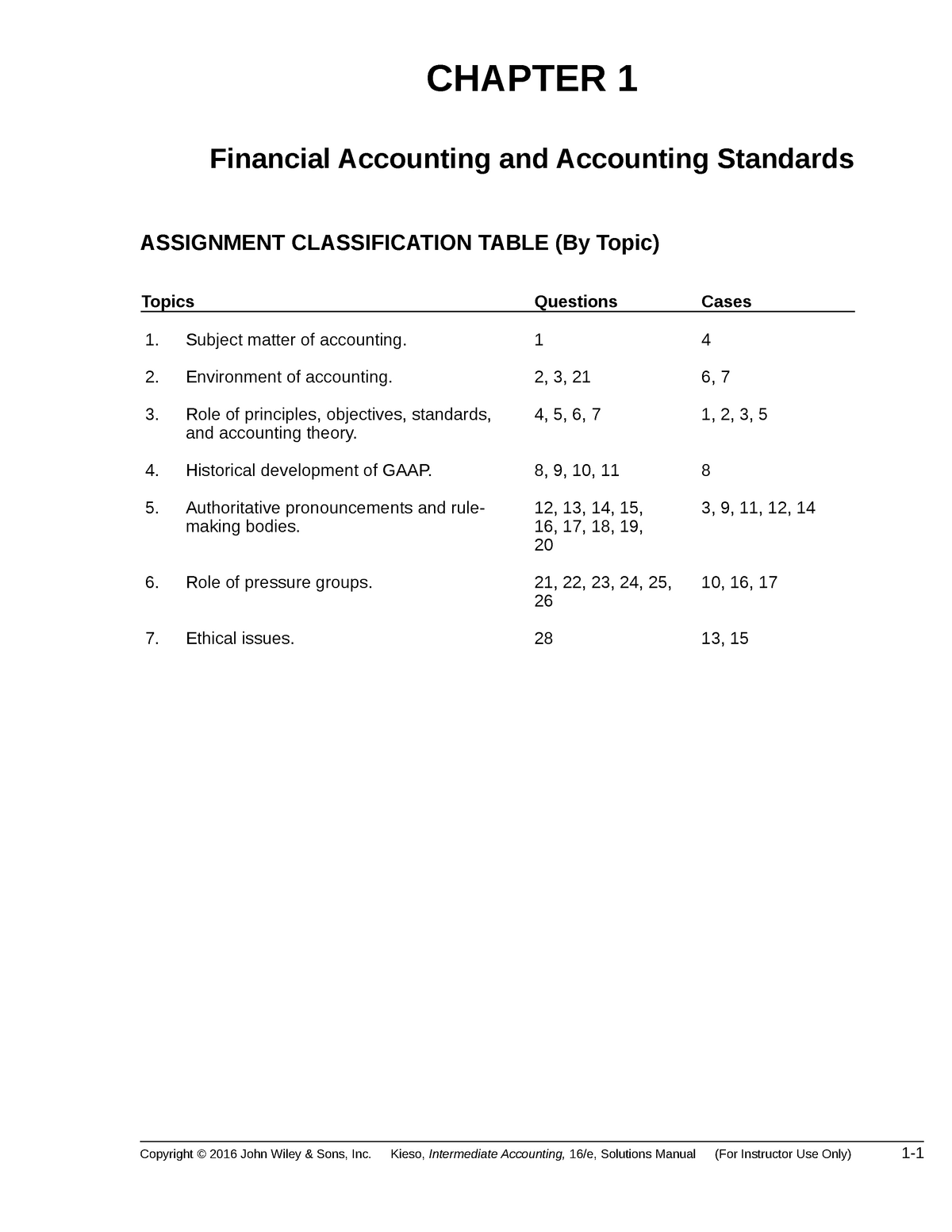

An accountant who combines accounting. What are the key financial ratios to analyze the cash flow of an entity? Web possible reasons for agreeing with the statement: Web the situations encountered in the practice of accounting and auditing are too complex and too varied for all specific answers to be set forth in a body of official rules. Cash building supplies accounts receivable which of the following is the best definition of a source document in the accounting. Web terms in this set (24) an equation showing the relationship among assets, liablities, and owners equity. An accounting device used to analyze transactions. Web a list of accounts used by a business. Principles of accounting, volume 2: The accounting equation page 42:

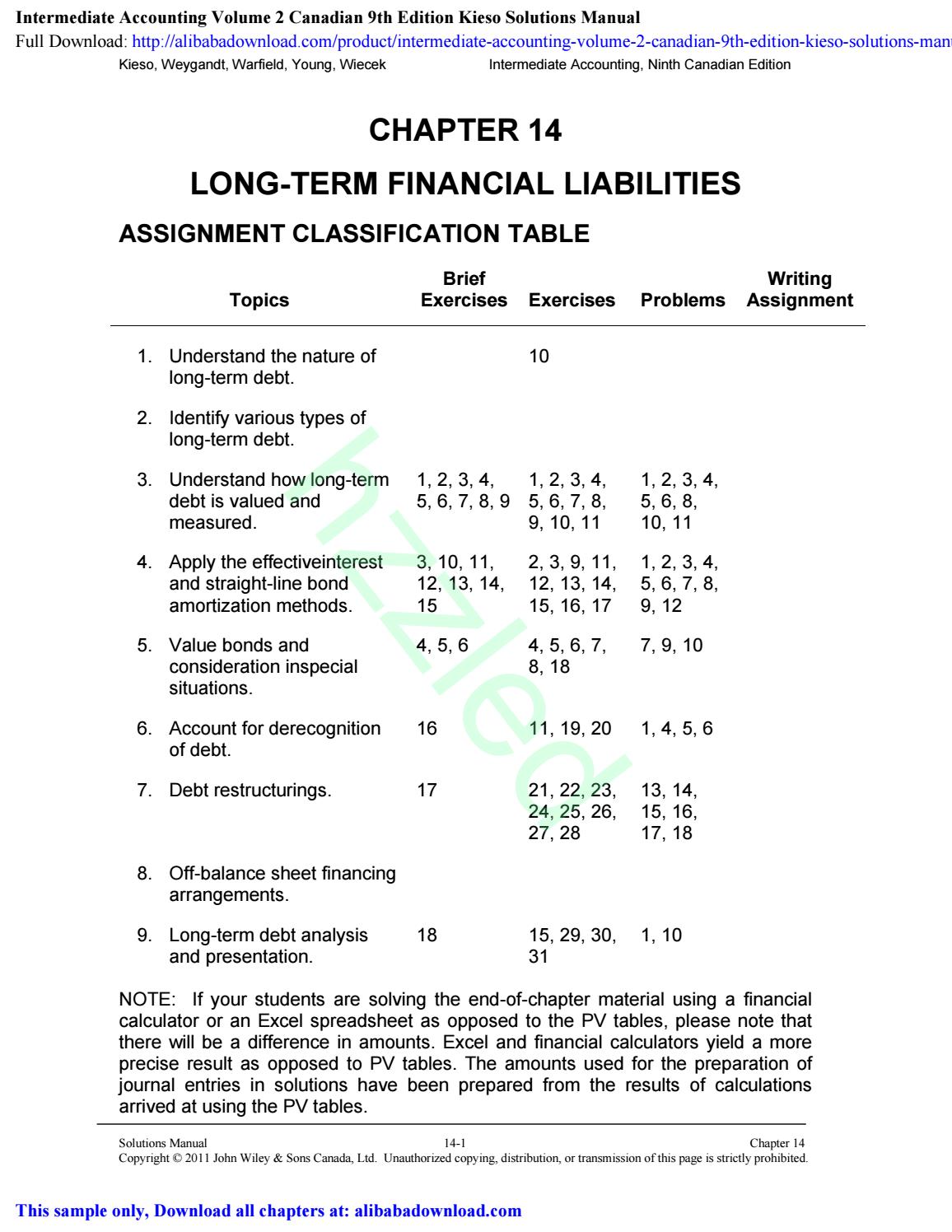

Solution Chapter 14 Advanced Accounting II 2014 by Dayag PDF

The values of all equities or claims against the assets (liabilities and owner's equity) are the are on the accounting equation's. An accountant who combines accounting. Web terms in this set (24) an equation showing the relationship among assets, liablities, and owners equity. An accounting device used to analyze transactions. Web 1.1 explain the importance of accounting and distinguish between.

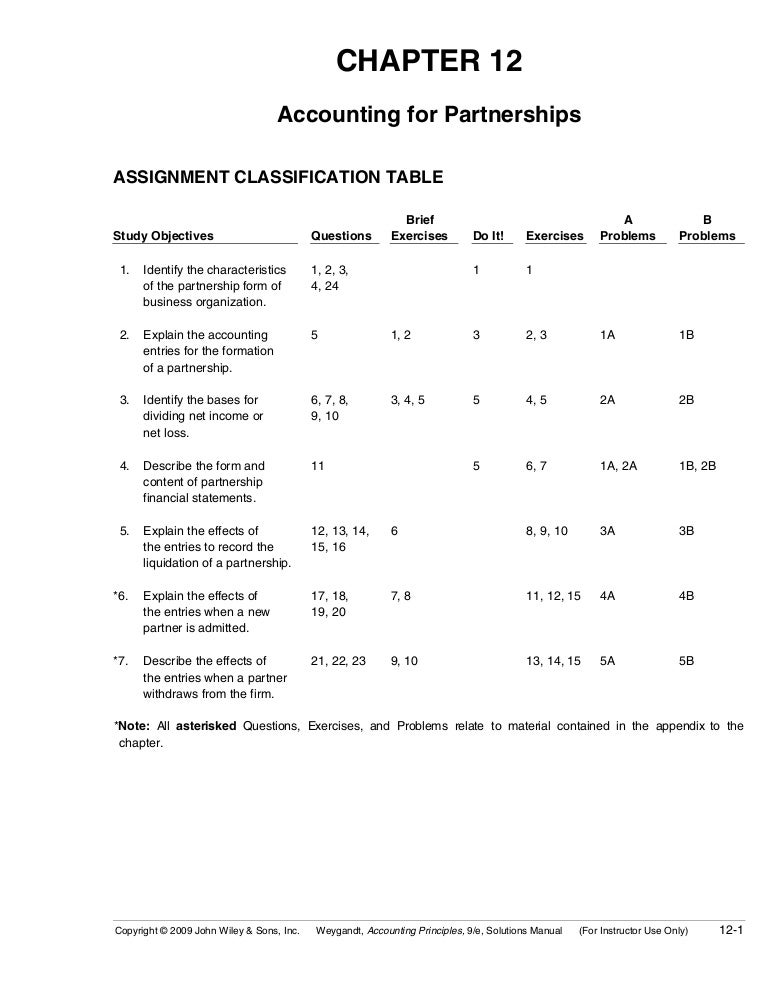

Accounting Chapter 12 Study Guide True And False Study Poster

Web study with quizlet and memorize flashcards containing terms like an accounting device used to analyze transactions, an amount recorded on the left side of a t account, an amount recorded on the right side of a t. False which of the following accounts would be considered an asset? Chapter 2 assignment accounts payable falls under which balance sheet classification?.

33+ Kunci Jawaban Accounting Intermediate Second Edition Chapter 16

The period of time covered by an accounting report. Web study with quizlet and memorize flashcards containing terms like an accounting device used to analyze transactions, an amount recorded on the left side of a t account, an amount recorded on the right side of a t. Long term investments 5.property, plant &. The accounting equation page 42: Set up.

Accounting Principles Weygant Chapter 14 Answers sharaof

Web the situations encountered in the practice of accounting and auditing are too complex and too varied for all specific answers to be set forth in a body of official rules. Amounts to be received in the future due to the sale of goods or services. Balance sheet, income statement, retained earnings statement, or statement of cash flows. 2 managerial.

Century 21 Accounting Chapter 14 Study Guide Answers Study Poster

Web 1.1 explain the importance of accounting and distinguish between financial and managerial accounting; A physical count of supplies revealed that there was $400 of supplies on hand at the end of the accounting. The accounting equation page 42: Principles of accounting, volume 2: The following transactions involving the.

Chapter 2 answers

Cash building supplies accounts receivable which of the following is the best definition of a source document in the accounting. Web prepare a trial balance as of april 30. Web answer keys to chapter 2 fa. Terms in this set (19) accounting period. Web possible reasons for agreeing with the statement:

South Western Accounting Answer Key Chapter 6 homestagingbydesigndfw

Cash building supplies accounts receivable which of the following is the best definition of a source document in the accounting. Amounts to be received in the future due to the sale of goods or services. 2 managerial accounting, 17th edition. Web a list of accounts used by a business. Web answer keys to chapter 2 fa.

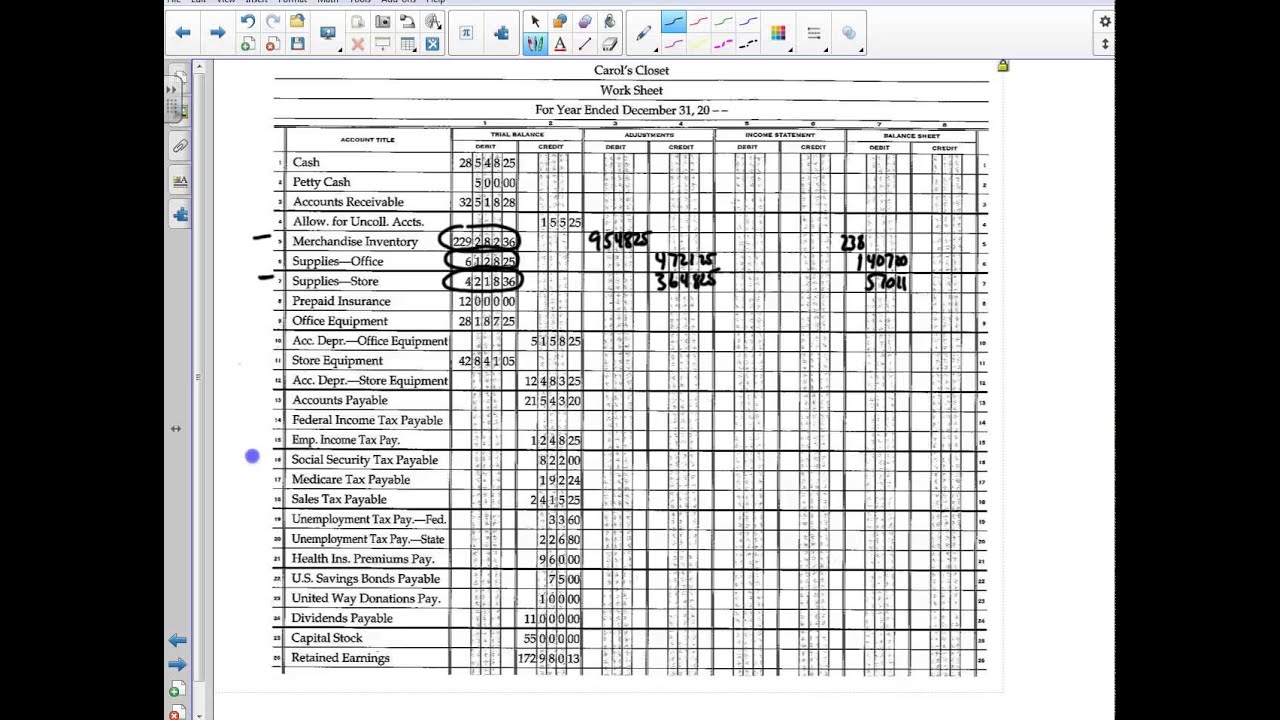

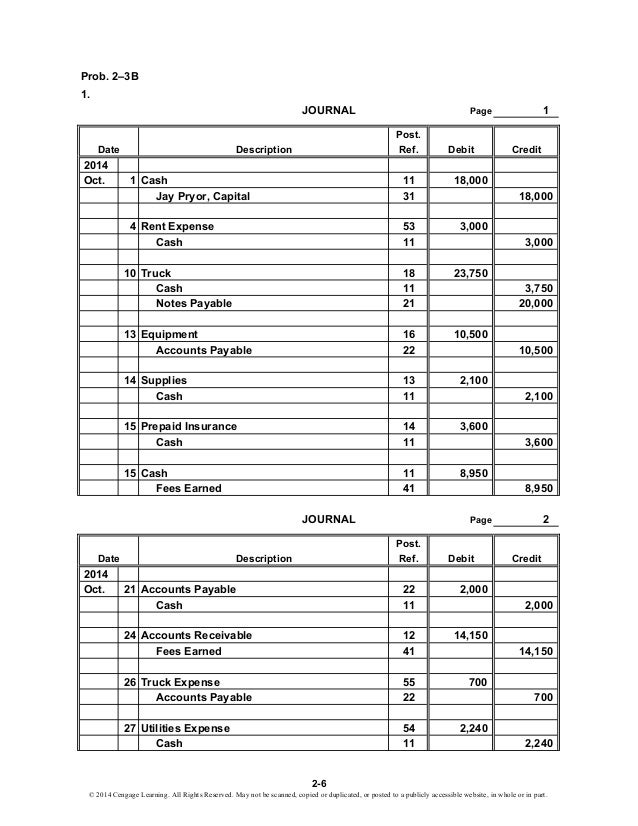

accounting transactions exercises with answers pdf

Set up a petty cash fund for payments of small amounts. False which of the following accounts would be considered an asset? Chapter 2 assignment accounts payable falls under which balance sheet classification? The side of the account that is increased. Web acct1210 chapter 2 cengage homework match each financial statement item with its financial statement:

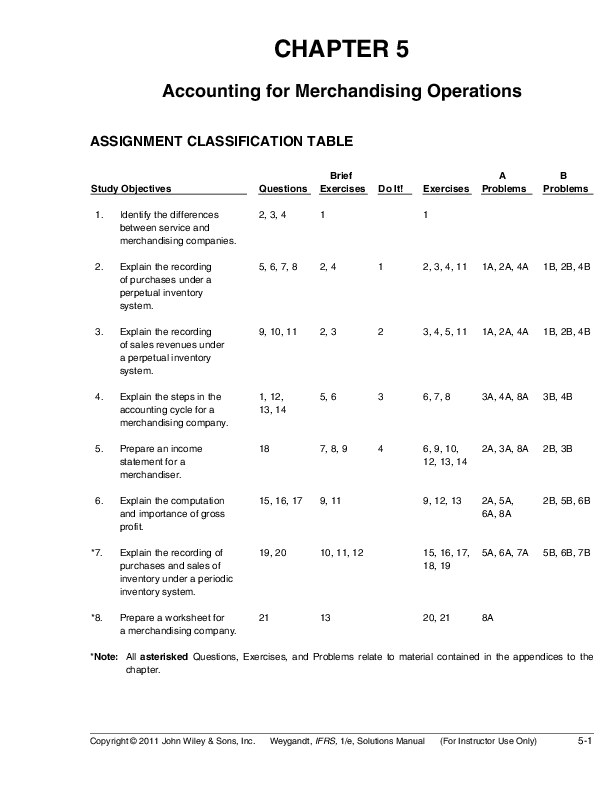

Ch03 Summary Financial Accounting IFRS, 3rd Edition CHAPTER 3

An accounting device used to analyze transactions. An accountant who combines accounting. Web answer keys to chapter 2 fa. Web prepare a trial balance as of april 30. Web chapter 2 accounting homework.

Ch01 Intermediate Accounting Solution Manual CHAPTER 1 Financial

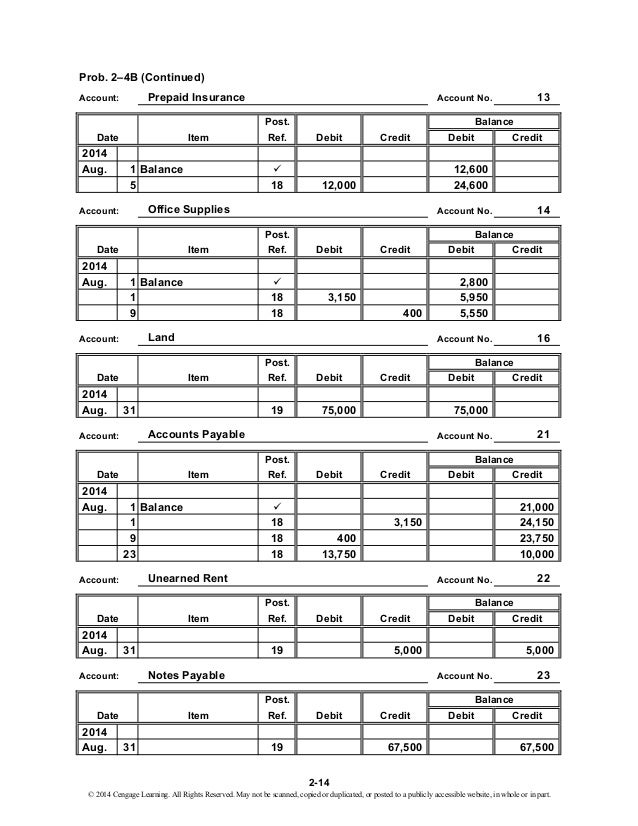

Long term investments 5.property, plant &. During the accounting period, the company purchased $2,000 of supplies. Web possible reasons for agreeing with the statement: Terms in this set (19) accounting period. A physical count of supplies revealed that there was $400 of supplies on hand at the end of the accounting.

What Are Debits And Credits?

Web accounting chapter 2 vocabulary. Web the situations encountered in the practice of accounting and auditing are too complex and too varied for all specific answers to be set forth in a body of official rules. Balance sheet, income statement, retained earnings statement, or statement of cash flows. The accounting equation page 42:

Web The Values Of All Things Owned (Assets) Are On The Accounting Equation's.

1.2 identify users of accounting information and how they apply information; 2 managerial accounting, 17th edition. Web study with quizlet and memorize flashcards containing terms like an accounting device used to analyze transactions, an amount recorded on the left side of a t account, an amount recorded on the right side of a t. Special issues for merchants ;

Web What Are The Components Of The Accounting Equation?

A physical count of supplies revealed that there was $400 of supplies on hand at the end of the accounting. Click the card to flip 👆. Web a list of accounts used by a business. Amounts to be received in the future due to the sale of goods or services.

Web Possible Reasons For Agreeing With The Statement:

Principles of accounting, volume 2: Therefore, individual accountants must resolve many situations based upon their general knowledge of accounting,. Each journal entry must be supported by a source document probing that a. The period of time covered by an accounting report.