Chapter 13 Expenses Worksheet

Chapter 13 Expenses Worksheet - To do so you must check the “supplement” box at the top of the form and fill in the date. Payment to catch up 1st mortgage $ 100.00: This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13. Chapter 13 allows a debtor to keep property and pay debts over time,. Expenses for food, clothing, household supplies, personal care products and other miscellaneous items can be counted as a living expense under your chapter 13 paperwork. Gross income for a reporting period: This article discusses the chapter 13 bankruptcy process, describes how it differs from a chapter. Web if you can afford to make your proposed chapter 13 plan payments, and whether you're paying enough in chapter 13. How to figure your tax. The plan will pay a fixed amount for trustee fees depending on the amount distributed to creditors;

Gross income for a reporting period: Web chapter 13 calculation of your disposable income. Web bankruptcy expense worksheet and chapter 13 bankruptcy worksheet forms. Web if, after filing schedule j, you need to file an estimate of expenses in a chapter 13 case for a date after your bankruptcy, you may complete a supplemental schedule j. Payment to catch up 1st mortgage $ 100.00: To do so you must check the “supplement” box at the top of the form and fill in the date. This is an official bankruptcy form. How to figure your tax. Figuring your taxes, and refundable and nonrefundable credits. Web if you can afford to make your proposed chapter 13 plan payments, and whether you're paying enough in chapter 13.

Web chapter 13 bankruptcy is an excellent way for people with too much debt to wipe the slate clean and get a fresh start. The plan will pay a fixed amount for trustee fees depending on the amount distributed to creditors; Download form (pdf, 409.92 kb) form number: Gross income for a reporting period: Enter the amount of all income received during. Your expenses (individuals) download form (pdf, 77.37 kb) form number: To do so you must check the “supplement” box at the top of the form and fill in the date. The chapter 7 bankruptcy trustee, whose job it is to find funds for creditors, will check the reasonableness of your expenses. Payment to catch up 1st mortgage $ 100.00: We tried to find some amazing references about bankruptcy expense worksheet and chapter 13 bankruptcy worksheet.

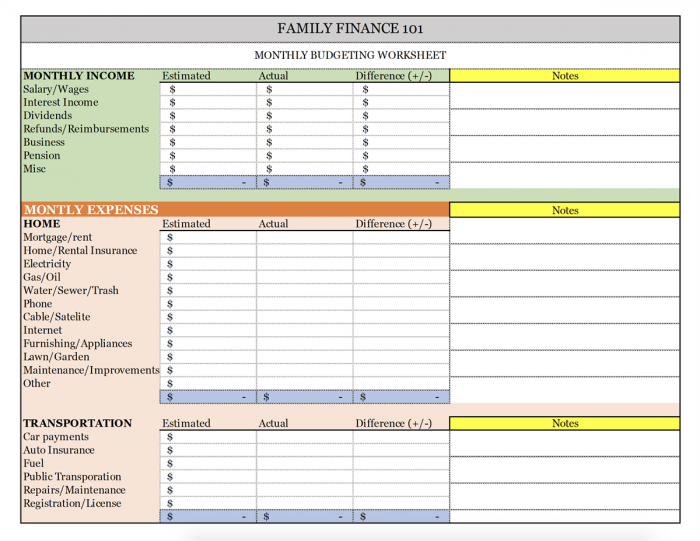

Household Budget Worksheet Pdf Fill Online, Printable, Fillable

Chapter 13 allows a debtor to keep property and pay debts over time,. Child tax credit and credit for other dependents. This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13. Figuring your taxes, and refundable and nonrefundable credits. Gross income for a reporting period:

Fixed Expenses Worksheet1 The Budget Mom

We tried to find some amazing references about bankruptcy expense worksheet and chapter 13 bankruptcy worksheet. Web your chapter 13 repayment plan will pay the filing fee of $310; Web chapter 13 calculation of your disposable income. Payment to catch up 1st mortgage $ 100.00: Web chapter 13 bankruptcy is an excellent way for people with too much debt to.

3 Chapter Expenses 7_8 YouTube

Payment to catch up 1st mortgage $ 100.00: Child tax credit and credit for other dependents. Your expenses (individuals) download form (pdf, 77.37 kb) form number: Web if you can afford to make your proposed chapter 13 plan payments, and whether you're paying enough in chapter 13. This calculator estimates your minimum monthly chapter 13 payment by calculating your secured.

business expenses worksheet —

Web chapter 13 calculation of your disposable income. Web chapter 13 bankruptcy is an excellent way for people with too much debt to wipe the slate clean and get a fresh start. Web as specified by the chapter 13 trustee’s request (for example, the request may be for a monthly, quarterly, or yearly reporting) 1. Web this is the chapter.

Pin by Dawn Paleno on Printables Budgeting worksheets, Family budget

This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13. This is an official bankruptcy form. It contains all the formulas needed to propose a chapter 13 plan that complies the the rules and regulations set forth in the federal. Child tax credit and credit for other dependents. Web.

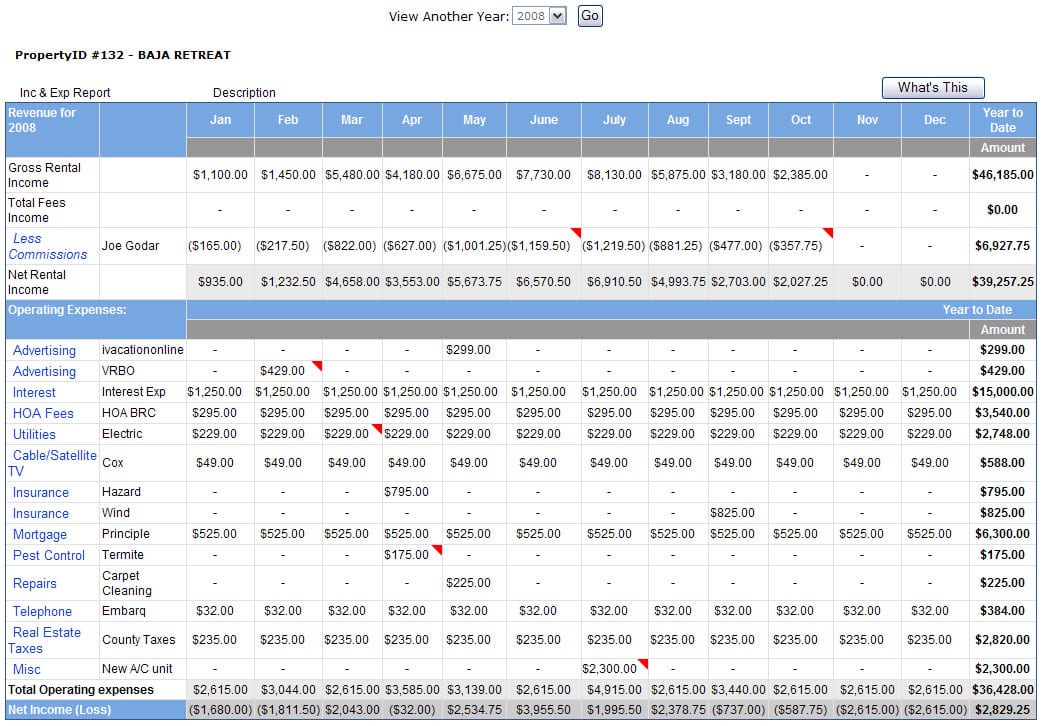

And Expense Worksheets 99Worksheets

Gross income for a reporting period: We tried to find some amazing references about bankruptcy expense worksheet and chapter 13 bankruptcy worksheet. Payment to catch up 1st mortgage $ 100.00: To do so you must check the “supplement” box at the top of the form and fill in the date. How to figure your tax.

Bankruptcy Chapter 13 Worksheet And Personal Bankruptcy Worksheet

Gross income for a reporting period: You can download a budgeting worksheet. Chapter 13 allows a debtor to keep property and pay debts over time,. Web if, after filing schedule j, you need to file an estimate of expenses in a chapter 13 case for a date after your bankruptcy, you may complete a supplemental schedule j. Web this is.

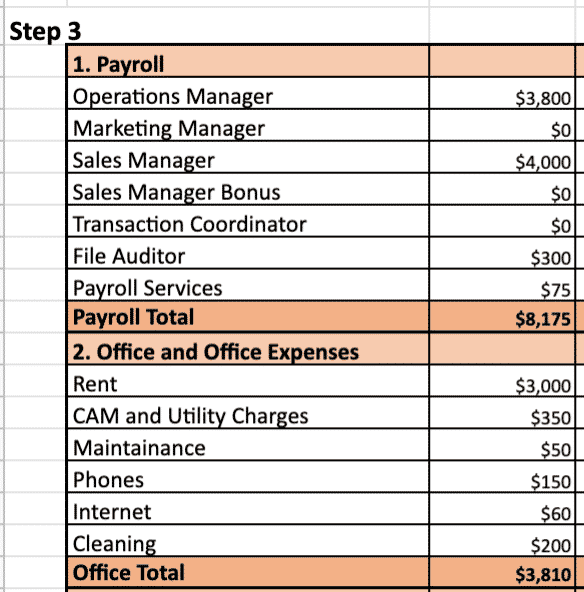

How to Create A Real Estate Brokerage Budget in 6 Steps

We tried to find some amazing references about bankruptcy expense worksheet and chapter 13 bankruptcy worksheet. Figuring your taxes, and refundable and nonrefundable credits. You can download a budgeting worksheet. Your expenses (individuals) download form (pdf, 77.37 kb) form number: Web chapter 13 calculation of your disposable income.

How To Categorize Expenses How to Track Your Expenses Believe in a

Enter the amount of all income received during. This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13. Expenses for food, clothing, household supplies, personal care products and other miscellaneous items can be counted as a living expense under your chapter 13 paperwork. This chapter of the bankruptcy code.

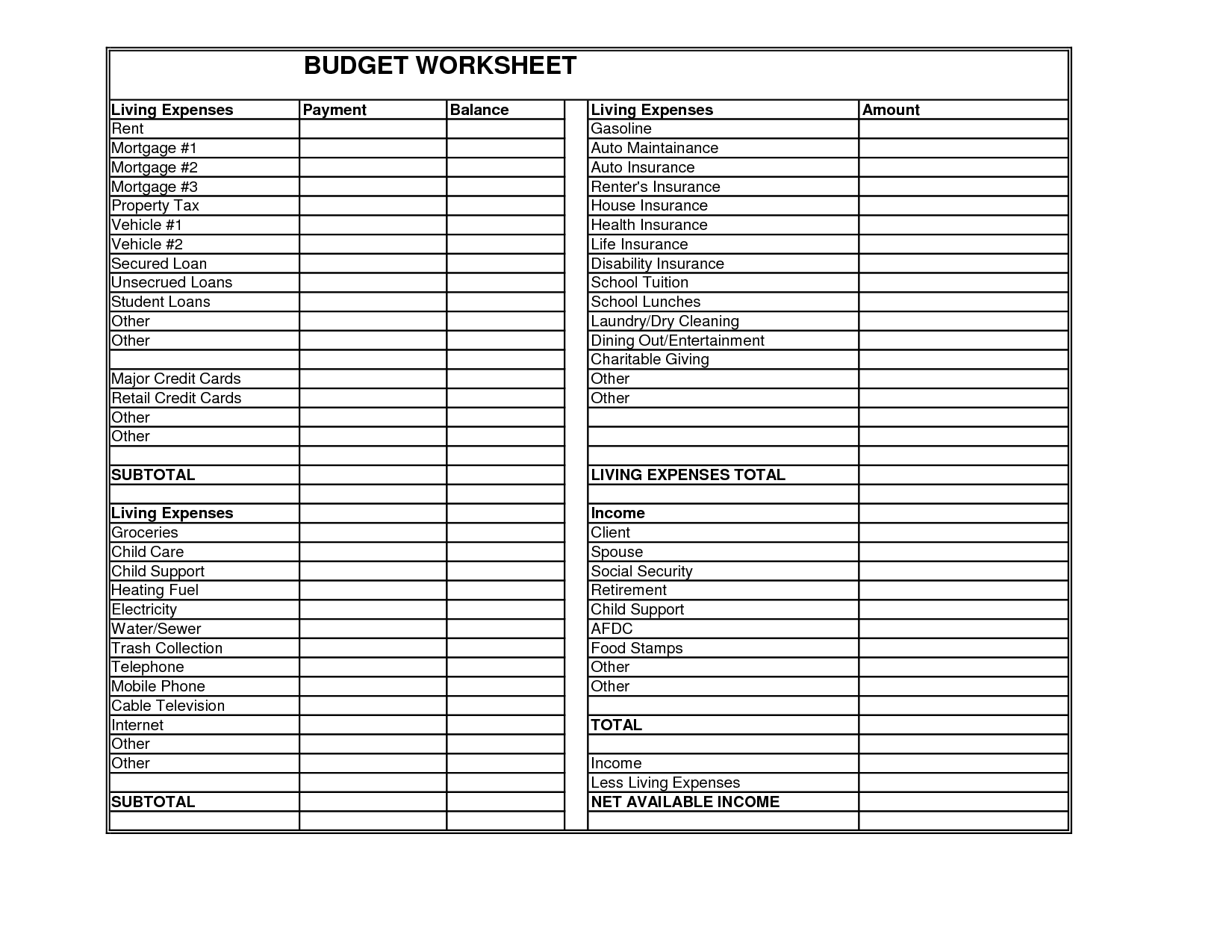

12 Best Images of Living Budget Worksheet College Student Budget

Payment to catch up 1st mortgage $ 100.00: How to figure your tax. Web chapter 13 calculation of your disposable income. Web if, after filing schedule j, you need to file an estimate of expenses in a chapter 13 case for a date after your bankruptcy, you may complete a supplemental schedule j. Your expenses (individuals) download form (pdf, 77.37.

It Contains All The Formulas Needed To Propose A Chapter 13 Plan That Complies The The Rules And Regulations Set Forth In The Federal.

Download form (pdf, 409.92 kb) form number: Web bankruptcy expense worksheet and chapter 13 bankruptcy worksheet forms. Payment to catch up 1st mortgage $ 100.00: Web your chapter 13 repayment plan will pay the filing fee of $310;

This Chapter Of The Bankruptcy Code Provides For Adjustment Of Debts Of An Individual With Regular Income.

Web chapter 13 bankruptcy is an excellent way for people with too much debt to wipe the slate clean and get a fresh start. Figuring your taxes, and refundable and nonrefundable credits. Expenses for food, clothing, household supplies, personal care products and other miscellaneous items can be counted as a living expense under your chapter 13 paperwork. To do so you must check the “supplement” box at the top of the form and fill in the date.

The Chapter 7 Bankruptcy Trustee, Whose Job It Is To Find Funds For Creditors, Will Check The Reasonableness Of Your Expenses.

Web as specified by the chapter 13 trustee’s request (for example, the request may be for a monthly, quarterly, or yearly reporting) 1. This article discusses the chapter 13 bankruptcy process, describes how it differs from a chapter. Web this is the chapter 13 worksheet we use to formulate a proposed chapter 13 plan. Web chapter 13 calculation of your disposable income.

The Plan Will Pay A Fixed Amount For Trustee Fees Depending On The Amount Distributed To Creditors;

Child tax credit and credit for other dependents. This calculator estimates your minimum monthly chapter 13 payment by calculating your secured and priority payments —amounts that all chapter 13. Chapter 13 allows a debtor to keep property and pay debts over time,. Enter the amount of all income received during.