Chapter 13 Bankruptcy Buying A House

Chapter 13 Bankruptcy Buying A House - Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. A chapter 13 bankruptcy is less serious than a chapter 7. Instead of wiping away debt, chapter 13 involves a. Web how to buy a house while in chapter 13 bankruptcy step 1: Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200. But don’t give up, hopeful home buyer. Web buying a house after chapter 13 bankruptcy. Making a thorough assessment of your current financial situation is the first.

But don’t give up, hopeful home buyer. Instead of wiping away debt, chapter 13 involves a. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200. Web how to buy a house while in chapter 13 bankruptcy step 1: Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores. Web buying a house after chapter 13 bankruptcy. A chapter 13 bankruptcy is less serious than a chapter 7. Making a thorough assessment of your current financial situation is the first.

Instead of wiping away debt, chapter 13 involves a. Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores. Web how to buy a house while in chapter 13 bankruptcy step 1: Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200. Web buying a house after chapter 13 bankruptcy. But don’t give up, hopeful home buyer. A chapter 13 bankruptcy is less serious than a chapter 7. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. Making a thorough assessment of your current financial situation is the first.

Everything You Need to Know About Chapter 13 Bankruptcy

Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores. Instead of wiping away debt, chapter 13 involves a. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. Web how to buy a house while in chapter 13 bankruptcy step 1: But don’t give.

Buying a House While in Chapter 13 Bankruptcy Oaktree Law

Making a thorough assessment of your current financial situation is the first. But don’t give up, hopeful home buyer. Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores. Web how to buy a house while in chapter 13 bankruptcy step 1: Web buying a house after chapter 13 bankruptcy.

Chapter 13 Bankruptcy Wetherington Hamilton Law Firm

Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores. But don’t give up, hopeful home buyer. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. Web how to buy a house while in chapter 13 bankruptcy step 1: Web buying a house after.

What Is Chapter 13 Bankruptcy and Is It Worth It? TheStreet

Web buying a house after chapter 13 bankruptcy. Making a thorough assessment of your current financial situation is the first. Web how to buy a house while in chapter 13 bankruptcy step 1: A chapter 13 bankruptcy is less serious than a chapter 7. Instead of wiping away debt, chapter 13 involves a.

deluxedesign Buying A House In Chapter 13 Bankruptcy

Web how to buy a house while in chapter 13 bankruptcy step 1: Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200. Instead of wiping away debt, chapter 13 involves a. Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores. Making a thorough assessment of.

Life after Chapter 13 Bankruptcy Can You Buy a House?

Web how to buy a house while in chapter 13 bankruptcy step 1: But don’t give up, hopeful home buyer. Making a thorough assessment of your current financial situation is the first. Instead of wiping away debt, chapter 13 involves a. Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200.

Chapter 13 bankruptcy explained YouTube

Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. Web buying a house after chapter 13 bankruptcy. Making a thorough assessment of your current financial situation is the first. Instead of wiping away debt, chapter 13 involves a. Web how to buy a house while in chapter 13.

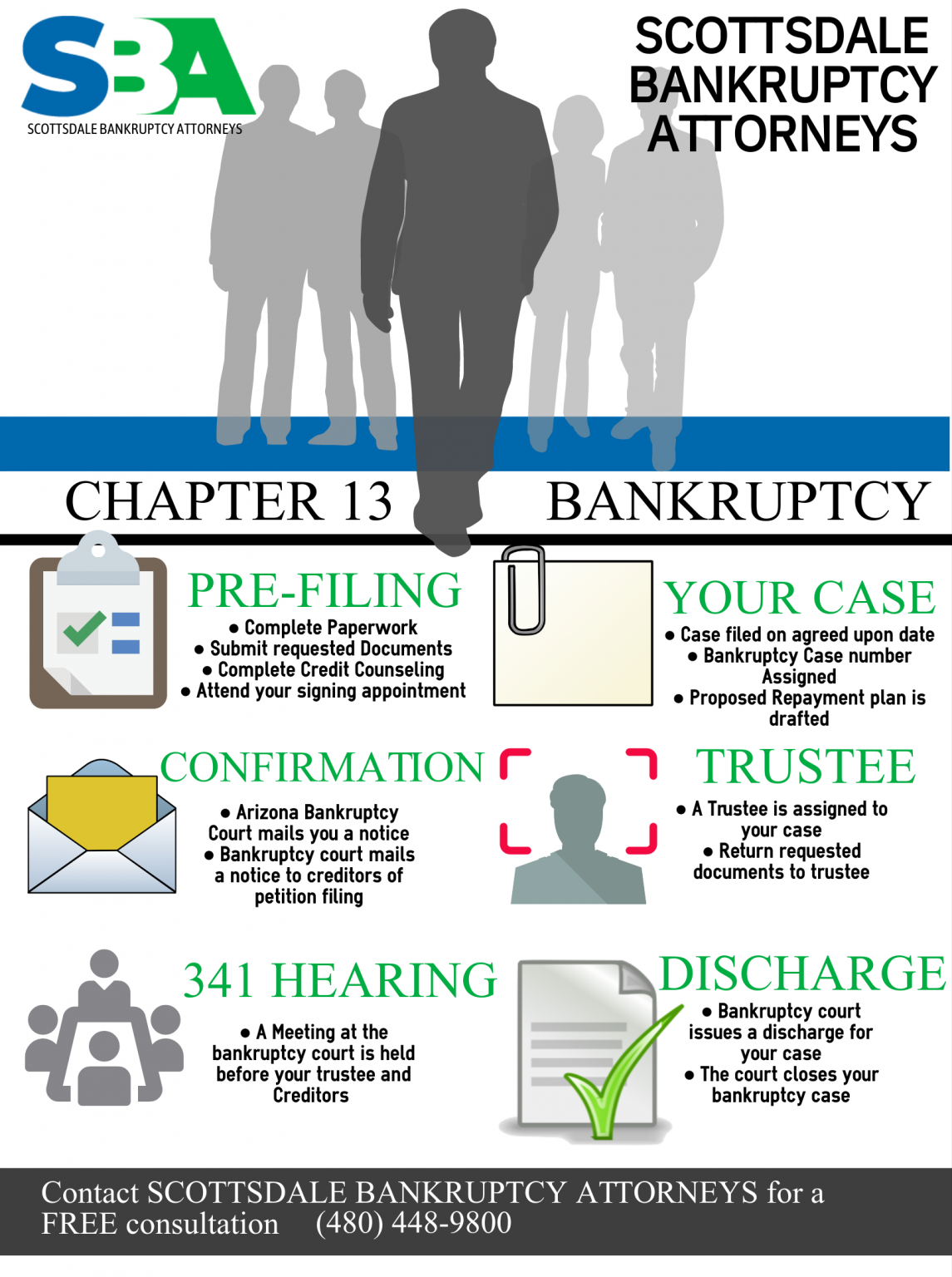

Chapter 13 Bankruptcy Attorney in Scottsdale Low Cost Bankruptcy

Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. But don’t give up, hopeful home buyer. Instead of wiping away debt, chapter 13 involves a. Making a thorough assessment.

Buying House While In Chapter 13 Bankruptcy Mortgage Guidelines

Making a thorough assessment of your current financial situation is the first. A chapter 13 bankruptcy is less serious than a chapter 7. But don’t give up, hopeful home buyer. Web buying a house after chapter 13 bankruptcy. Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200.

Chapter 13 Bankruptcy Free of Charge Creative Commons Chalkboard image

Making a thorough assessment of your current financial situation is the first. But don’t give up, hopeful home buyer. Web it’s available to anyone whose unsecured debts are less than $394,725 and secured debts are less than $1,184,200. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. Instead.

Web It’s Available To Anyone Whose Unsecured Debts Are Less Than $394,725 And Secured Debts Are Less Than $1,184,200.

But don’t give up, hopeful home buyer. Web “for instance, depending on the situation, one can apply for a mortgage immediately after being released from chapter 13 bankruptcy. Web how to buy a house while in chapter 13 bankruptcy step 1: Web unfortunately, both chapter 7 and chapter 13 bankruptcies will adversely affect credit scores.

Web Buying A House After Chapter 13 Bankruptcy.

Instead of wiping away debt, chapter 13 involves a. A chapter 13 bankruptcy is less serious than a chapter 7. Making a thorough assessment of your current financial situation is the first.