Cancellation Of Debt Form 982

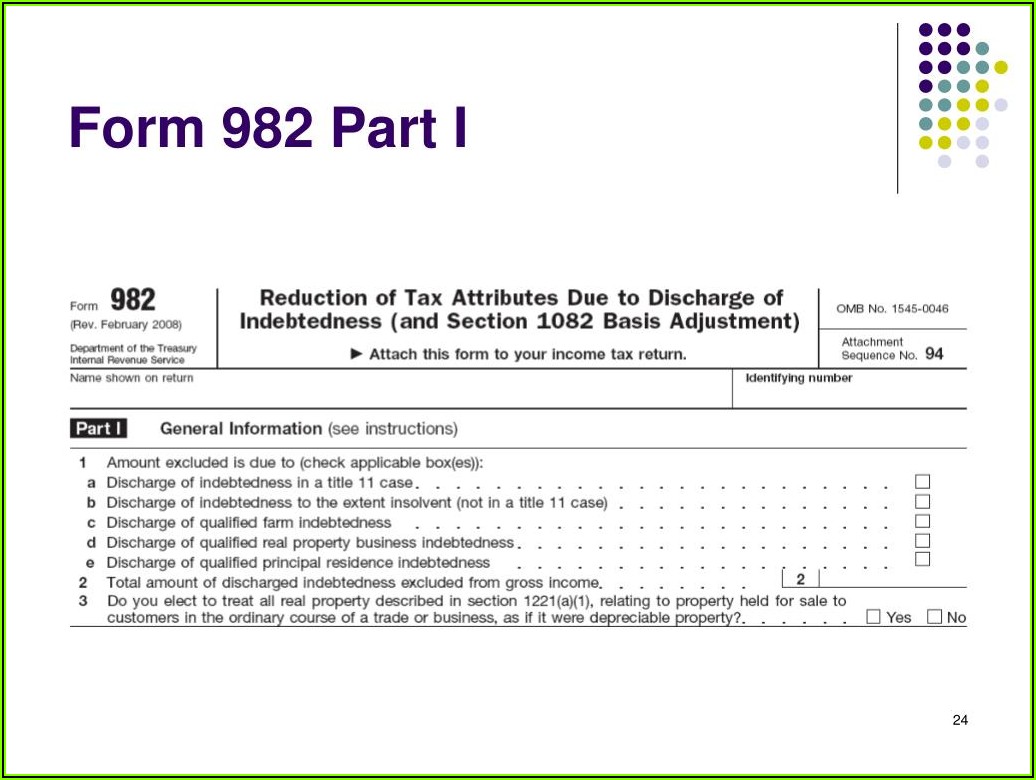

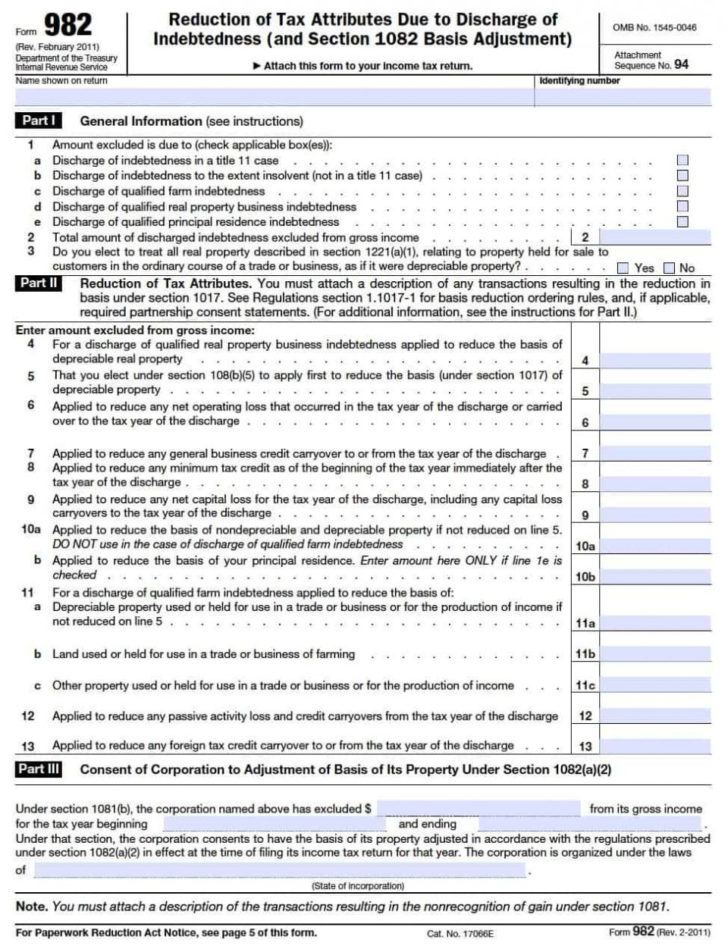

Cancellation Of Debt Form 982 - 431to determine whether a debt cancelation is taxable. Web to exclude the cod amounts from taxable income, the taxpayer must complete an irs form 982 and attach it to their form 1040 tax return. The irs has a tool called the interactive tax assistant that can help determine if cancelled. A qualified person includes any federal, state, or local government or agency or instrumentality thereof. You might report other items on form 982 such as. Web even if a canceled debt isn’t taxable income, you may need to complete irs form 982, reduction of tax attributes due to discharge of indebtedness (and section. Complete, edit or print tax forms instantly. Refer to this articlefor instructions on generating form 982, reduction of tax attributes. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Web department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982.

If you can exclude the income, file form 982 to report the exclusion. The irs has a tool called the interactive tax assistant that can help determine if cancelled. Web this publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.” sometimes a. A qualified person includes any federal, state, or local government or agency or instrumentality thereof. Web to enter form 982 in keystone tax solutions from the main menu of the tax return (form 1040) select: Web step 1 determine if the forgiveness of your debt is related to a qualifying event. Web the cancellation of debt must be included in your income. Web however, when using an exception and it relates to property that you own, you may need to file a form 982 to reduce your tax basis, or cost, in the underlying property. Complete, edit or print tax forms instantly. Web department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982.

Web step 1 determine if the forgiveness of your debt is related to a qualifying event. Web even if a canceled debt isn’t taxable income, you may need to complete irs form 982, reduction of tax attributes due to discharge of indebtedness (and section. Web the cancellation of debt must be included in your income. This is because you received a benefit. Web the amount of debt forgiven must be reported on a irs form 982 (pdf) and this form must be attached to your tax return. Web the debt was qualified real property business indebtedness. Web department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982. If you can exclude the income, file form 982 to report the exclusion. A qualified person includes any federal, state, or local government or agency or instrumentality thereof. Complete, edit or print tax forms instantly.

Cancellation Of Debt Form 982 Instructions Form Resume Examples

Complete, edit or print tax forms instantly. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Ad access irs tax forms. Web to enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web step 1 determine if the forgiveness of your debt is related.

Cancellation Of Debt Form 8582 Form Resume Examples Rg8DAQNW1M

Web however, when using an exception and it relates to property that you own, you may need to file a form 982 to reduce your tax basis, or cost, in the underlying property. This is because you received a benefit. Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including.

Debt Form 982 Form 982 Insolvency Worksheet —

Refer to this articlefor instructions on generating form 982, reduction of tax attributes. 431to determine whether a debt cancelation is taxable. Ad access irs tax forms. Web step 1 determine if the forgiveness of your debt is related to a qualifying event. Web the debt was qualified real property business indebtedness.

Cancellation Of Debt Form 1099 C Form Resume Examples N8VZpKM9we

Web this publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.” sometimes a. A qualified person includes any federal, state, or local government or agency or instrumentality thereof. You might report other items on form 982 such as. Web to enter form 982 in taxslayer pro,.

How to Use IRS Form 982 and 1099C Cancellation of Debt

431to determine whether a debt cancelation is taxable. This is because you received a benefit. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. If you can exclude the income, file form 982 to report the exclusion. Web refer to irs topic no.

How To Deal With The IRS Regarding Cancellation Of Debt

A qualified person includes any federal, state, or local government or agency or instrumentality thereof. Web to enter form 982 in keystone tax solutions from the main menu of the tax return (form 1040) select: Web to exclude the cod amounts from taxable income, the taxpayer must complete an irs form 982 and attach it to their form 1040 tax.

Cancellation Of Debt Form Irs Form Resume Examples 9x8ra94Z3d

Web this publication generally refers to debt that is canceled, forgiven, or discharged for less than the full amount of the debt as “canceled debt.” sometimes a. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web refer to irs topic no. The irs has a tool called the interactive tax assistant.

Cancellation Of Debt Form 982 Instructions Form Resume Examples

Web to enter form 982 in keystone tax solutions from the main menu of the tax return (form 1040) select: Web step 1 determine if the forgiveness of your debt is related to a qualifying event. Web refer to irs topic no. If you can exclude the income, file form 982 to report the exclusion. Web information about form 982,.

Cancellation Of Debt Form 982 Instructions Form Resume Examples

Web step 1 determine if the forgiveness of your debt is related to a qualifying event. Web to enter form 982 in taxslayer pro, from the main menu of the tax return (form 1040) select: Web to enter form 982 in keystone tax solutions from the main menu of the tax return (form 1040) select: Web the debt was qualified.

Form 982 Insolvency Worksheet —

Complete irs tax forms online or print government tax documents. Refer to this articlefor instructions on generating form 982, reduction of tax attributes. Web department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982. 431to determine whether a debt cancelation is taxable. Web the.

The Irs Has A Tool Called The Interactive Tax Assistant That Can Help Determine If Cancelled.

This is because you received a benefit. Ad access irs tax forms. Web however, when using an exception and it relates to property that you own, you may need to file a form 982 to reduce your tax basis, or cost, in the underlying property. A qualified person includes any federal, state, or local government or agency or instrumentality thereof.

Web This Publication Generally Refers To Debt That Is Canceled, Forgiven, Or Discharged For Less Than The Full Amount Of The Debt As “Canceled Debt.” Sometimes A.

If you can exclude the income, file form 982 to report the exclusion. Web in order to report the exclusion, the taxpayer must file form 982 with their tax return. Web the debt was qualified real property business indebtedness. Web department of the treasury internal revenue service reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment) (for use with form 982.

Typically, The Only Qualifying Reasons For The Forgiveness Of Nonbusiness Bad Debts, Such As Credit.

Web information about form 982, reduction of tax attributes due to discharge of indebtedness (and section 1082 basis adjustment), including recent updates, related. Complete irs tax forms online or print government tax documents. Complete, edit or print tax forms instantly. Web to exclude the cod amounts from taxable income, the taxpayer must complete an irs form 982 and attach it to their form 1040 tax return.

Web Step 1 Determine If The Forgiveness Of Your Debt Is Related To A Qualifying Event.

Web even if a canceled debt isn’t taxable income, you may need to complete irs form 982, reduction of tax attributes due to discharge of indebtedness (and section. You might report other items on form 982 such as. Web refer to irs topic no. Web the cancellation of debt must be included in your income.