Can You File Form 7004 Late

Can You File Form 7004 Late - Generally, a penalty is charged if a return is filed after the due date (including extensions) unless you can show reasonable cause for not filing on time. Web generally, form 7004 must be filed on or before the due date of the applicable tax return. See the form 7004 instructions for a list of the exceptions. If the year ends on december 31st,. Refer to the form 7004 instructions for additional information on payment of tax and balance due. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Web you can file an irs form 7004 electronically for most returns. Web this penalty is generally 5% of the unpaid taxes for each month or part of month it is late, up to 25% of your unpaid tax. The due dates of the returns can befound in the instructions for the applicable return. Web get your taxes done.

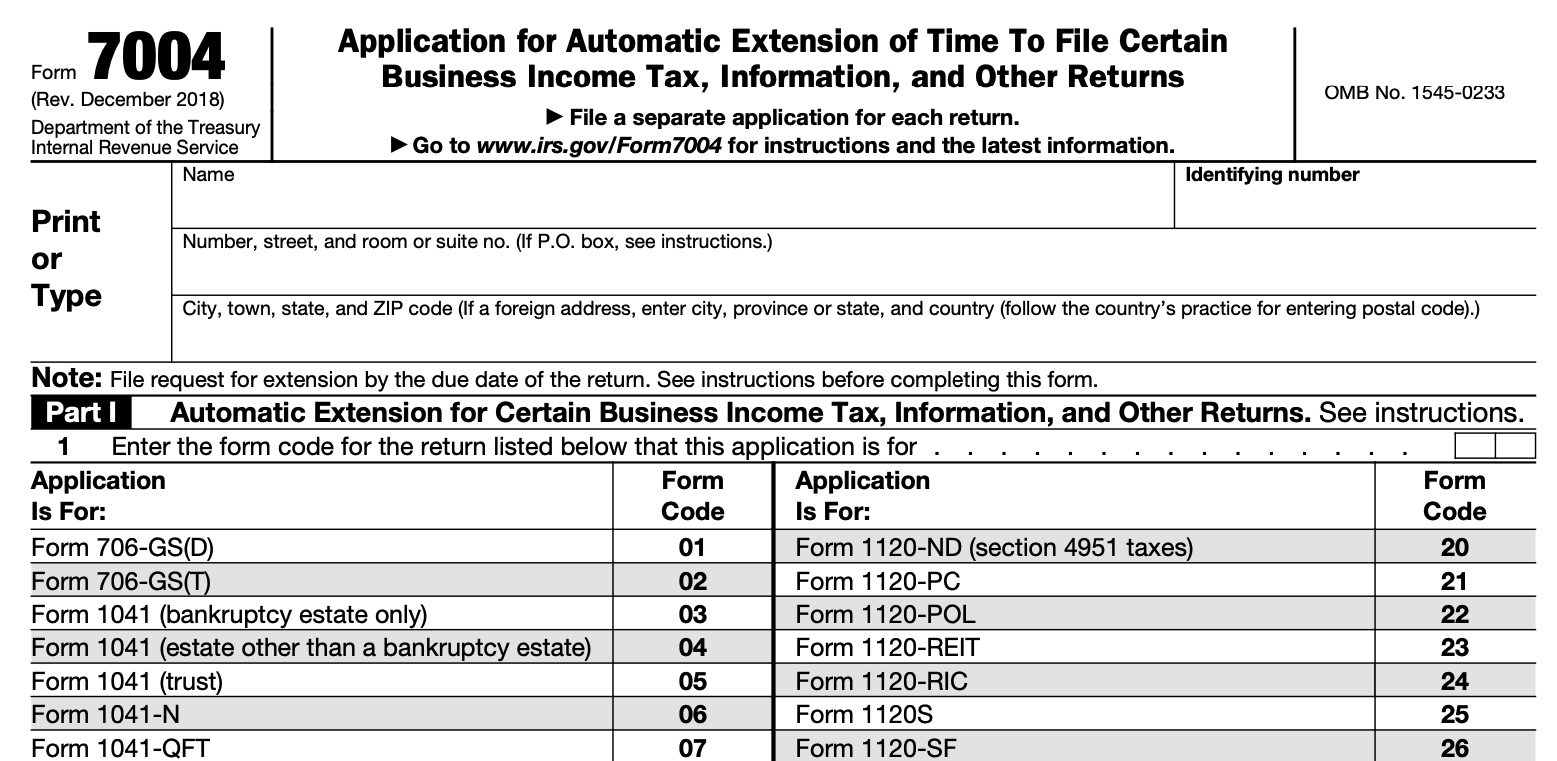

File your 2290 online & get schedule 1 in minutes. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. Page last reviewed or updated: Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web generally, form 7004 must be filed on or before the due date of the applicable tax return. Enter code 25 in the box on form 7004, line 1. ” you must pay taxes due (estimated) by your tax return due date, even if you file an extension. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. Web if you need more time to file form 8804, you may file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns,. Last updated june 04, 2019 11:29 pm.

Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Web there are several ways to submit form 4868. Web penalty for late filing of return. Last updated june 04, 2019 11:29 pm. Web generally, form 7004 must be filed on or before the due date of the applicable tax return. Web deadlines for filing form 7004. Web if you need more time to file form 8804, you may file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns,. See the form 7004 instructions for a list of the exceptions. If the return is more than 60 days lates, the. Taxes for corporations need to be paid by the 15th day of the fourth month after the end of their fiscal year.

File Form 7004 Online 2021 Business Tax Extension Form

If the return is more than 60 days lates, the. Web get your taxes done. Web file form 7004 based on the appropriate tax form shown below: Web if you need more time to file form 8804, you may file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns,. Web the.

can i file form 7004 late Extension Tax Blog

If the return is more than 60 days lates, the. Web file form 7004 based on the appropriate tax form shown below: Enter code 25 in the box on form 7004, line 1. Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web.

This Is Where You Need To Mail Your Form 7004 This Year Blog

Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day. If the return is more than 60 days lates, the. If the year ends on december 31st,. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Generally,.

Get an Extension on Your Business Taxes with Form 7004 Excel Capital

Web the form 7004 does not extend the time for payment of tax. Web this penalty is generally 5% of the unpaid taxes for each month or part of month it is late, up to 25% of your unpaid tax. Web if you need more time to file form 8804, you may file form 7004, application for automatic extension of.

Last Minute Tips To Help You File Your Form 7004 Blog

See the form 7004 instructions for a list of the exceptions. Refer to the form 7004 instructions for additional information on payment of tax and balance due. Web get your taxes done. Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Web you.

When is Tax Extension Form 7004 Due? Tax Extension Online

If the return is more than 60 days lates, the. The due dates of the returns can befound in the instructions for the applicable return. Web there are several ways to submit form 4868. Web you can extend filing form 1120s when you file form 7004. Web the form 7004 does not extend the time for payment of tax.

What Partnerships Need to Know About Form 7004 for Tax Year 2020 Blog

Refer to the form 7004 instructions for additional information on payment of tax and balance due. Web deadlines for filing form 7004. Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Last updated june 04, 2019 11:29 pm. Enter code 25 in the box on form.

Where to file Form 7004 Federal Tax TaxUni

Refer to the form 7004 instructions for additional information on payment of tax and balance due. Web generally, form 7004 must be filed on or before the due date of the applicable tax return. ” you must pay taxes due (estimated) by your tax return due date, even if you file an extension. June 4, 2019 11:29 pm. Web the.

Tax Filing Extension 2022 Latest News Update

If the year ends on december 31st,. Last updated june 04, 2019 11:29 pm. Web you can file an irs form 7004 electronically for most returns. ” you must pay taxes due (estimated) by your tax return due date, even if you file an extension. Web generally, form 7004 must be filed on or before the due date of the.

Irs Form 7004 amulette

Web file form 7004 based on the appropriate tax form shown below: Page last reviewed or updated: Web how do i file form 7004, application for automatic extension of time to file certain business income tax, information, and other returns? Refer to the form 7004 instructions for additional information on payment of tax and balance due. Enter code 25 in.

Generally, A Penalty Is Charged If A Return Is Filed After The Due Date (Including Extensions) Unless You Can Show Reasonable Cause For Not Filing On Time.

Web general instructions purpose of form use form 7004 to request an automatic extension of time to file certain business income tax, information, and other returns. Last updated june 04, 2019 11:29 pm. Web the irs has extended the filing and payment deadlines for businesses in these affected areas from march 15 and april 15, 2021, to june 15, 2021. Taxpayers can file form 4868 by mail, but remember to get your request in the mail by tax day.

Web There Are Several Ways To Submit Form 4868.

File your 2290 online & get schedule 1 in minutes. Web penalty for late filing of return. Web the irs says, “ form 7004 does not extend the time for payment of tax. Web you can extend filing form 1120s when you file form 7004.

Web File Form 7004 Based On The Appropriate Tax Form Shown Below:

Filing an extension only extends the time to file your return and does not extend the time to pay any tax due. Web get your taxes done. Web this penalty is generally 5% of the unpaid taxes for each month or part of month it is late, up to 25% of your unpaid tax. Web the form 7004 does not extend the time for payment of tax.

If The Year Ends On December 31St,.

Page last reviewed or updated: Refer to the form 7004 instructions for additional information on payment of tax and balance due. See the form 7004 instructions for a list of the exceptions. ” you must pay taxes due (estimated) by your tax return due date, even if you file an extension.