Can Form 3520 Be Filed Electronically

Can Form 3520 Be Filed Electronically - There are certain filing threshold. The forms are available at irs.gov and through professional tax software. The heading at the top of the late. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Web foreign trust with a u.s. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Send form 3520 to the. Ad talk to our skilled attorneys by scheduling a free consultation today.

Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. The forms are available at irs.gov and through professional tax software. Web form 3520 does not have to be filed to report the following transactions. Person to file a form 3520 to report the transactions. Form 8802, application for u.s. The heading at the top of the late. Web foreign trust with a u.s. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Does it cause any issues with reconciling form 3520 with one's income tax return?

Person receives a gift from a foreign person, the irs may require the u.s. Send form 3520 to the. Ad talk to our skilled attorneys by scheduling a free consultation today. The forms are available at irs.gov and through professional tax software. Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Form 8802, application for u.s. There are certain filing threshold. Web foreign trust with a u.s.

Form 3520A Annual Information Return of Foreign Trust with a U.S

Web can i file income tax return electronically and mail form 3520? Person to file a form 3520 to report the transactions. Form 8802, application for u.s. Web form 3520 does not have to be filed to report the following transactions. Ad talk to our skilled attorneys by scheduling a free consultation today.

What is IRS Form 3520A? When is it required? How is one filed? YouTube

There are certain filing threshold. Web foreign trust with a u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain.

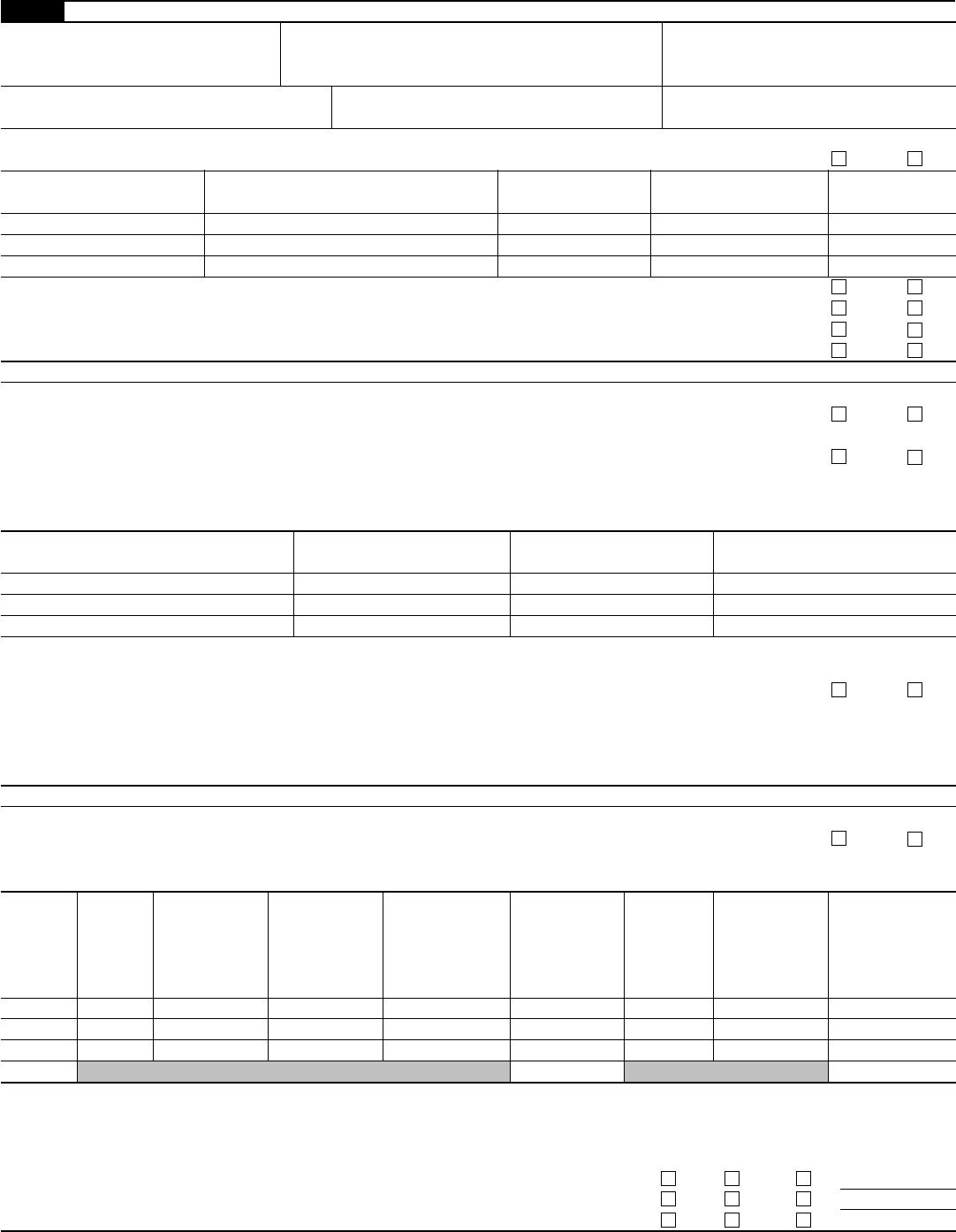

Filing 20686047 Electronically Filed 11/18/2014 114328 AM

The forms are available at irs.gov and through professional tax software. Ad talk to our skilled attorneys by scheduling a free consultation today. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Web an income tax return, the due date for filing.

Forms 3520 and 3520A What You Need to Know

Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Owner to satisfy its annual information reporting requirements under section 6048(b). Send form 3520 to the. Person receives a gift from a foreign person, the.

IRS Form 4868 Online File 2020 IRS 4868

Form 8802, application for u.s. Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Person to file a form 3520 to report the transactions. Owner to satisfy its annual information reporting requirements under section 6048(b). Web form 3520, annual return to.

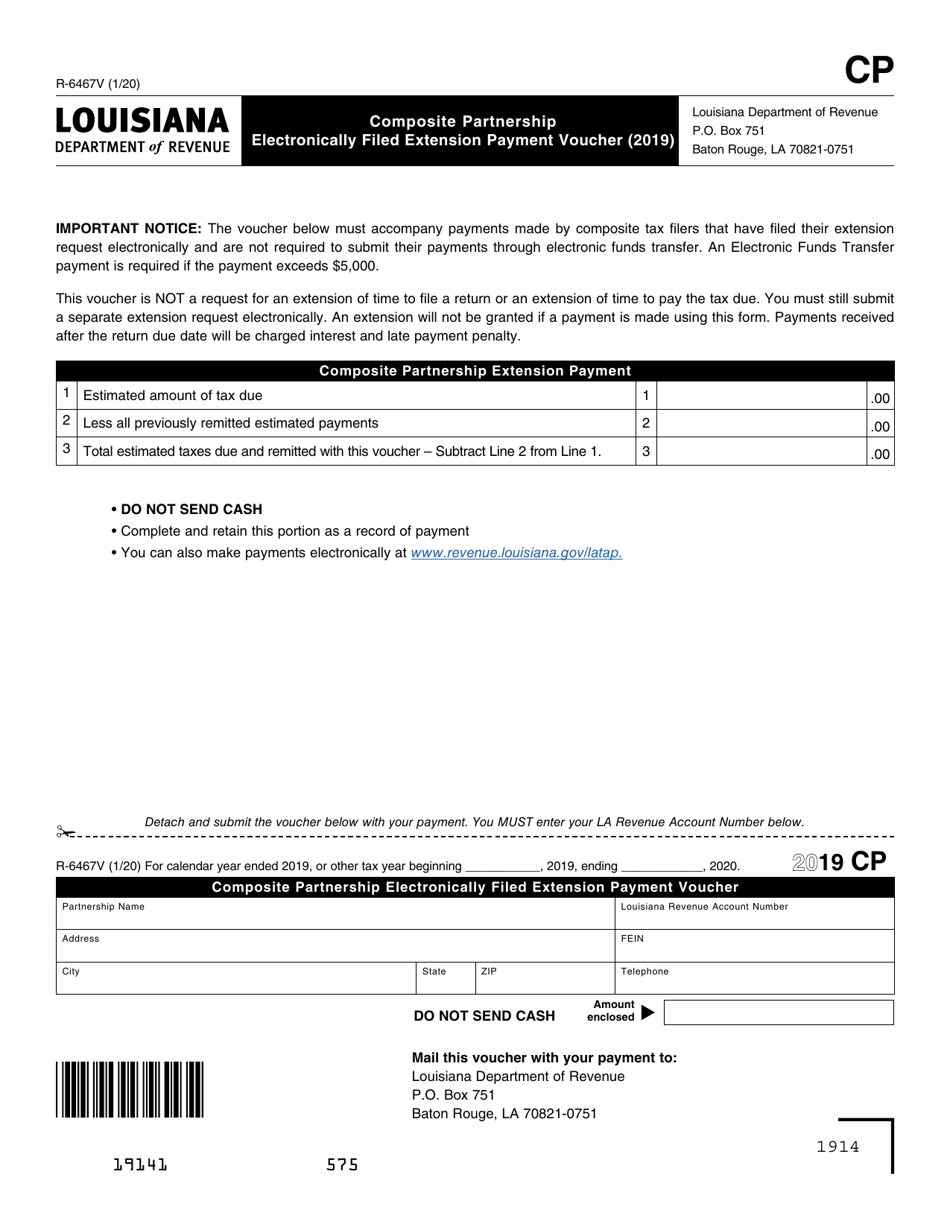

Form R6467V Download Fillable PDF or Fill Online Composite Partnership

Person to file a form 3520 to report the transactions. There are certain filing threshold. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a. Web form 3520 does not have to be filed to report the following transactions. Does it cause any issues with reconciling form 3520 with one's income tax return?

2020 Form IRS 3520 Fill Online, Printable, Fillable, Blank pdfFiller

Web can i file income tax return electronically and mail form 3520? Does it cause any issues with reconciling form 3520 with one's income tax return? Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of.

Form 3520 Blank Sample to Fill out Online in PDF

Person to file a form 3520 to report the transactions. Does it cause any issues with reconciling form 3520 with one's income tax return? Owner to satisfy its annual information reporting requirements under section 6048(b). Web foreign trust with a u.s. Send form 3520 to the.

Which IRS Form Can Be Filed Electronically?

Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Owner to satisfy its annual information reporting requirements under section 6048(b). Web foreign trust with a u.s. Person to file a form 3520 to report the transactions. Ad talk to our skilled attorneys.

Form 3520 Edit, Fill, Sign Online Handypdf

Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. The heading at the top of the late. Web an income tax return, the due date.

Person To File A Form 3520 To Report The Transactions.

The forms are available at irs.gov and through professional tax software. Web can i file income tax return electronically and mail form 3520? Web an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the u.s. Send form 3520 to the.

There Are Certain Filing Threshold.

The heading at the top of the late. Web to help reduce burden for the tax community, the irs allows taxpayers to use electronic or digital signatures on certain paper forms they cannot file electronically. Person is granted an extension of time to file an income tax return, the due date for filing form 3520 is the 15th day of the 10th month (october 15) following the end of the. Transfers to foreign trusts described in section 402 (b), 404 (a) (4), or 404a.

Does It Cause Any Issues With Reconciling Form 3520 With One's Income Tax Return?

Web form 3520, annual return to report transactions with foreign trusts and receipt of certain foreign gifts; Web form 3520 does not have to be filed to report the following transactions. Form 8802, application for u.s. Ad talk to our skilled attorneys by scheduling a free consultation today.

Web Foreign Trust With A U.s.

Don’t feel alone if you’re dealing with irs form 3520 penalty abatement issues. Owner to satisfy its annual information reporting requirements under section 6048(b). Person receives a gift from a foreign person, the irs may require the u.s.