California Probate Form 13100

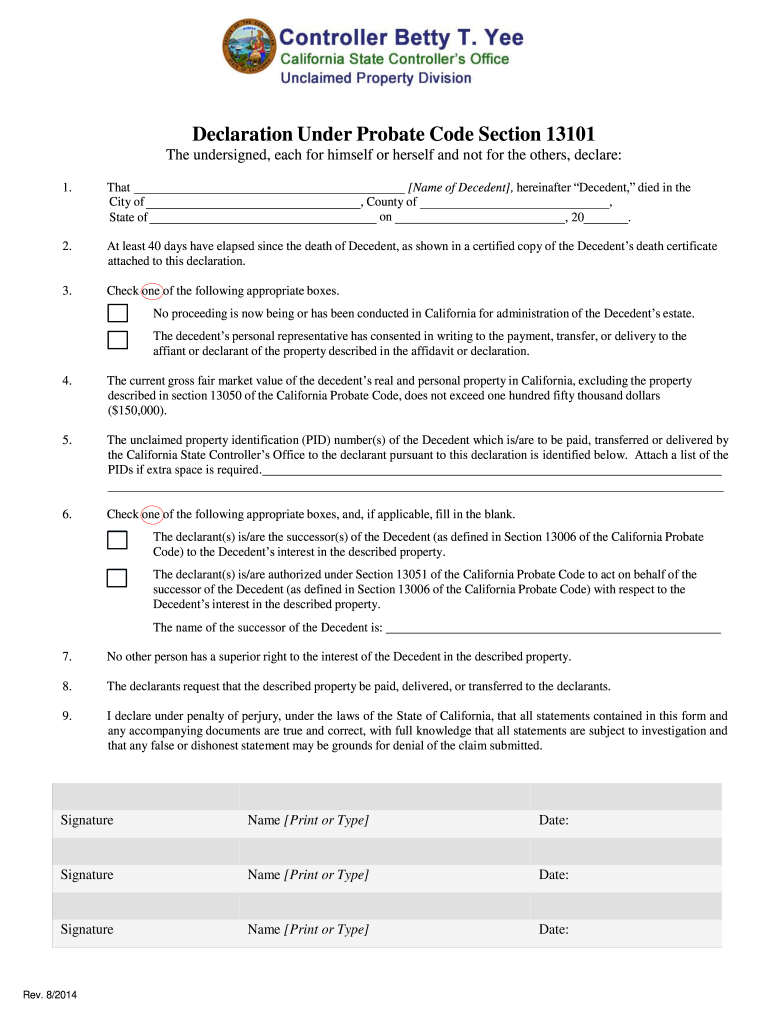

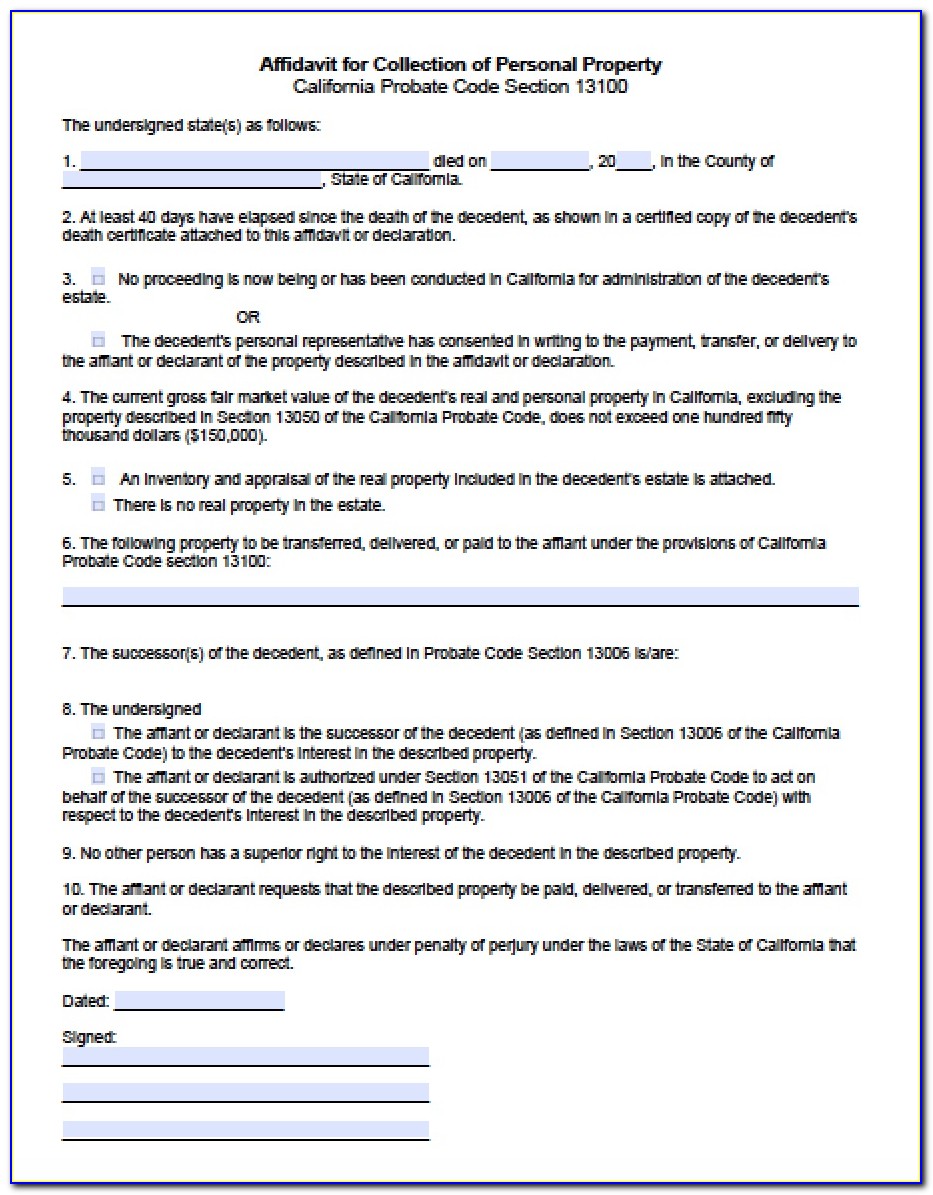

California Probate Form 13100 - Web probate code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will. This form must be completed. Web either of the following, as appropriate: The undersigned state(s) as follows: No proceeding is now being or has been conducted in california for administration of the decedent’s estate. (b) receive any particular item of property that is tangible personal property of the decedent. Web california probate form sb 13100 is an application for appointment of a personal representative for estates with a value of $166,250 or less. Web codes division 8, disposition of estate without administration; _____ died on _____, 20____, in the county of _____, state of california. Web california probate code section 13100.

(b) receive any particular item of property that is tangible personal property of the decedent. _____ died on _____, 20____, in the county of _____, state of california. The undersigned state(s) as follows: Save time editing pdf documents online. The undersigned state(s) as follows: Web california probate code section 13100. Web probate code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will. Web cite this article: _____ died on _____, 20 ____, in the county of _____, state of california. Web california probate form sb 13100 is an application for appointment of a personal representative for estates with a value of $166,250 or less.

Web california probate code section 13100. (b) receive any particular item of property that is tangible personal property of the decedent. Died on , 20 , in the county of , state of california. Web either of the following, as appropriate: Web a) no proceeding is now being or has been conducted in california for administration of the decedent’s estate. _____ died on _____, 20 ____, in the county of _____, state of california. Web affidavit for collection of personal property california probate code section 13100 the undersigned state(s) as follows: If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. No proceeding is now being or has been conducted in california for administration of the decedent’s estate. Web up to 25% cash back california offers several probate shortcuts for small estates.

Download Affidavit to Comply With California Probate Code 1310013115

Web california law allows for a simple process to transfer personal property to the decedent’s successors without having to go through a formal probate court process. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web for a complete list, see california probate code section 13050. Web.

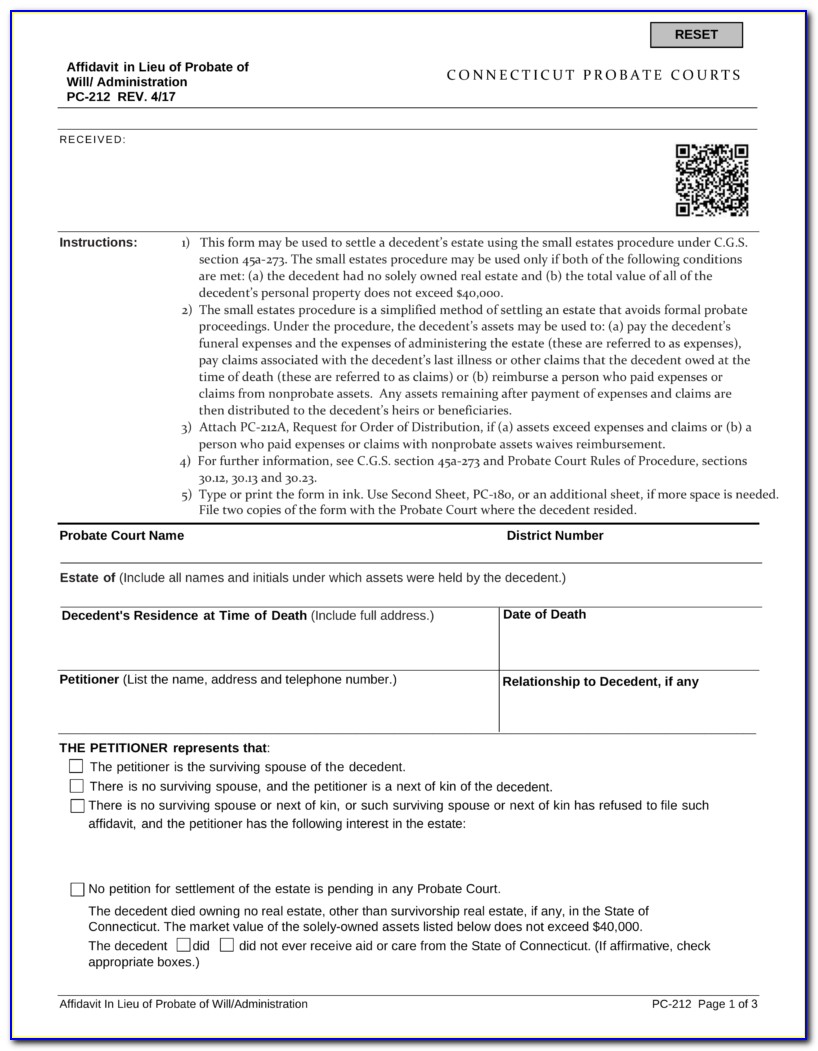

State Of California Probate Form 13100 Universal Network

Web declaration of transfer of personal property without probate (probate code 13100) declaration/affidavit of transfer of personal property without probate; No proceeding is now being or has been conducted in california for administration of the decedent’s estate. If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Died.

State Of California Probate Form 13100 Universal Network

Web affidavit for collection of personal property california probate code section 13100 the undersigned state(s) as follows: B) the decedent’s personal representative has consented in writing. _____ died on _____, 20____, in the county of _____, state of california. No proceeding is now being or has been conducted in california for administration of the decedent’s estate. At least 40 days.

State Of California Probate Form 13100 Universal Network

Web find your court forms. Web either of the following, as appropriate: Web codes division 8, disposition of estate without administration; Web an estate is a small estate when the gross value of real and personal property in california after statutory exclusions does not exceed $166,250. _____ died on _____, 20 ____, in the county of _____, state of california.

Probate Form 13100 Affidavit For Small Estates Universal Network

At least 40 days have. (b) receive any particular item of property that is tangible personal property of the decedent. Web (a) collect any particular item of property that is money due the decedent. Web an estate is a small estate when the gross value of real and personal property in california after statutory exclusions does not exceed $166,250. Web.

Probate Form 13100 Free Form Resume Examples gzOeQ6MOWq

At least 40 days have. Web up to 25% cash back california offers several probate shortcuts for small estates. Web probate code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will. At least 40 days have. Web declaration of transfer of personal property without probate.

Small Estate Affidavit California Probate Code 13100 Form Resume

Web california probate code section 13100. The undersigned state(s) as follows: Web california law allows for a simple process to transfer personal property to the decedent’s successors without having to go through a formal probate court process. The undersigned state(s) as follows: Web an estate is a small estate when the gross value of real and personal property in california.

Small Estate Affidavit California Form 13101 Fill Online, Printable

Web either of the following, as appropriate: Web california probate code section 13100. Web the current gross value of the decedent’s real and personal property in california, excluding the property described in probate code § 13050, does not exceed $100,000. Web find your court forms. Web an estate is a small estate when the gross value of real and personal.

Small Estate Affidavit California Form 13100 Form Resume Examples

Web california probate code section 13100. Save time editing pdf documents online. No proceeding is now being or has been conducted in california for administration of the decedent’s estate. The undersigned state(s) as follows: Web california probate code section 13100.

California Probate Code 13100 Form Form Resume Examples gzOeBWjkWq

Web for a complete list, see california probate code section 13050. Web (a) collect any particular item of property that is money due the decedent. Web california probate code section 13100. (b) receive any particular item of property that is tangible personal property of the decedent. Web the current gross value of the decedent’s real and personal property in california,.

(B) Receive Any Particular Item Of Property That Is Tangible Personal Property Of The Decedent.

Web california probate form sb 13100 is an application for appointment of a personal representative for estates with a value of $166,250 or less. Web probate code section 13100 provides for the collection or transfer of a decedent's personal property without the administration of the estate or probate of the will. B) the decedent’s personal representative has consented in writing. Web codes division 8, disposition of estate without administration;

Web California Law Allows For A Simple Process To Transfer Personal Property To The Decedent’s Successors Without Having To Go Through A Formal Probate Court Process.

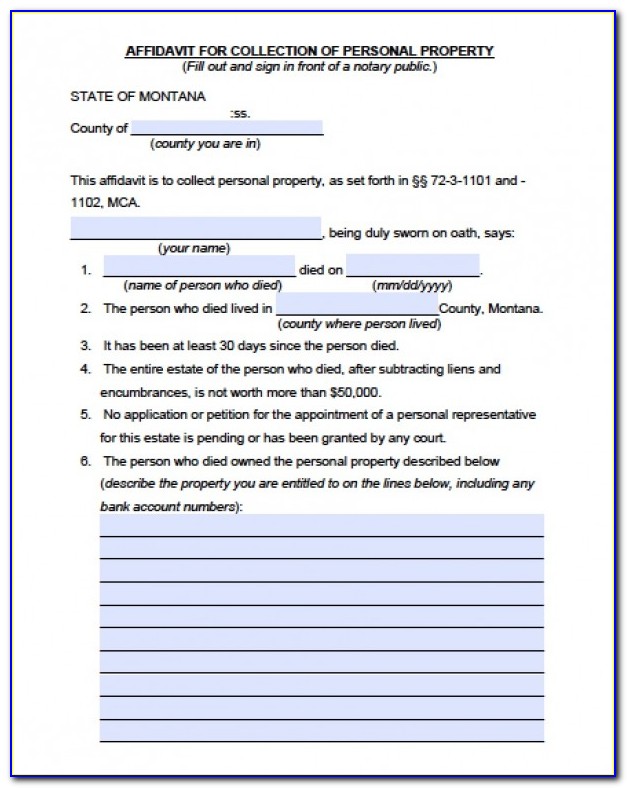

Web affidavit for collection of personal property california probate code section 13100 the undersigned state(s) as follows: At least 40 days have. Web find your court forms. Died on , 20 , in the county of , state of california.

Web Cite This Article:

Web california probate code section 13100. The undersigned state(s) as follows: If the total value of these assets is $166,250 or less and 40 days have passed since the death, you can transfer. Web up to 25% cash back california offers several probate shortcuts for small estates.

This Form Must Be Completed.

Part 1, collection or transfer of small estate without administration; The undersigned state(s) as follows: Web (a) collect any particular item of property that is money due the decedent. _____ died on _____, 20 ____, in the county of _____, state of california.