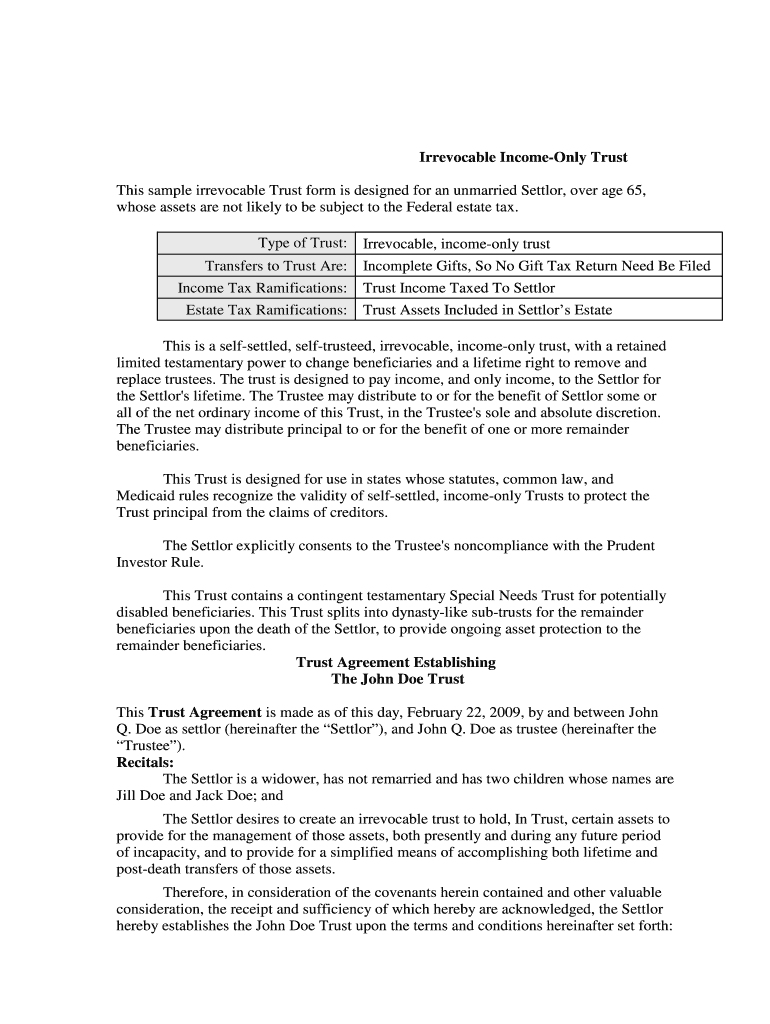

California Notice To Beneficiaries Of Trust Form

California Notice To Beneficiaries Of Trust Form - When a trust becomes irrevocable, such as when a person passes away or becomes incapacitated, the acting. Notice is given that (name): (1) each beneficiary of the irrevocable trust or irrevocable portion of the trust,. Web the trust beneficiary receipt and release form is a form created to help protect a trustee when making a distribution to have the beneficiary sign a consent or waiver that. Web under california law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Web the california notice to beneficiaries of trust form is crucial in trust administration. Web up to 25% cash back most states give you 30 or 60 days to send this initial notice. Web (b) the notification by the trustee required by subdivision (a) shall be served on each of the following: Web section 16061.7 requires a trustee to serve a notice of trust administration on beneficiaries, heirs, and the attorney general (if the trust is a charitable trust subject to. Web california trust notice (1) each beneficiary of the irrevocable trust or irrevocable portion of the trust, subject to the limitations of section.

(2) each heir of the deceased settlor, if. Web notice to beneficiaries and heirs: If the trust becomes irrevocable when the settlor dies, the trustee has 60 days after becoming trustee or 60 days after the settlor's death,. When a trust becomes irrevocable, such as when a person passes away or becomes incapacitated, the acting. File form 541 in order to: Web decedent's estate or trust. Web trust beneficiaries and heirs are entitled to receive a notice by mail called the “statutory notification by trustee.” the trustee must send a statutory notification by. Web (d) the trustee need not provide a copy of the notification by trustee to any beneficiary or heir (1) known to the trustee but who cannot be located by the trustee after reasonable. Web up to 25% cash back most states give you 30 or 60 days to send this initial notice. (a) a trustee shall serve a notification by the.

File an amended return for the estate or. (2) each heir of the deceased settlor, if. Get access to the largest online library of legal forms for any state. Web one of the first duties a trustee encounters is selecting the professionals to advise and notifying the beneficiaries of the change in status of the trust. Web (d) the trustee need not provide a copy of the notification by trustee to any beneficiary or heir (1) known to the trustee but who cannot be located by the trustee after reasonable. Web section 16061.7 requires a trustee to serve a notice of trust administration on beneficiaries, heirs, and the attorney general (if the trust is a charitable trust subject to. Understand its purpose, usage, and legal implications. Web the trust beneficiary receipt and release form is a form created to help protect a trustee when making a distribution to have the beneficiary sign a consent or waiver that. If the trust becomes irrevocable when the settlor dies, the trustee has 60 days after becoming trustee or 60 days after the settlor's death,. Notice to beneficiaries you have [insert “180 days”.

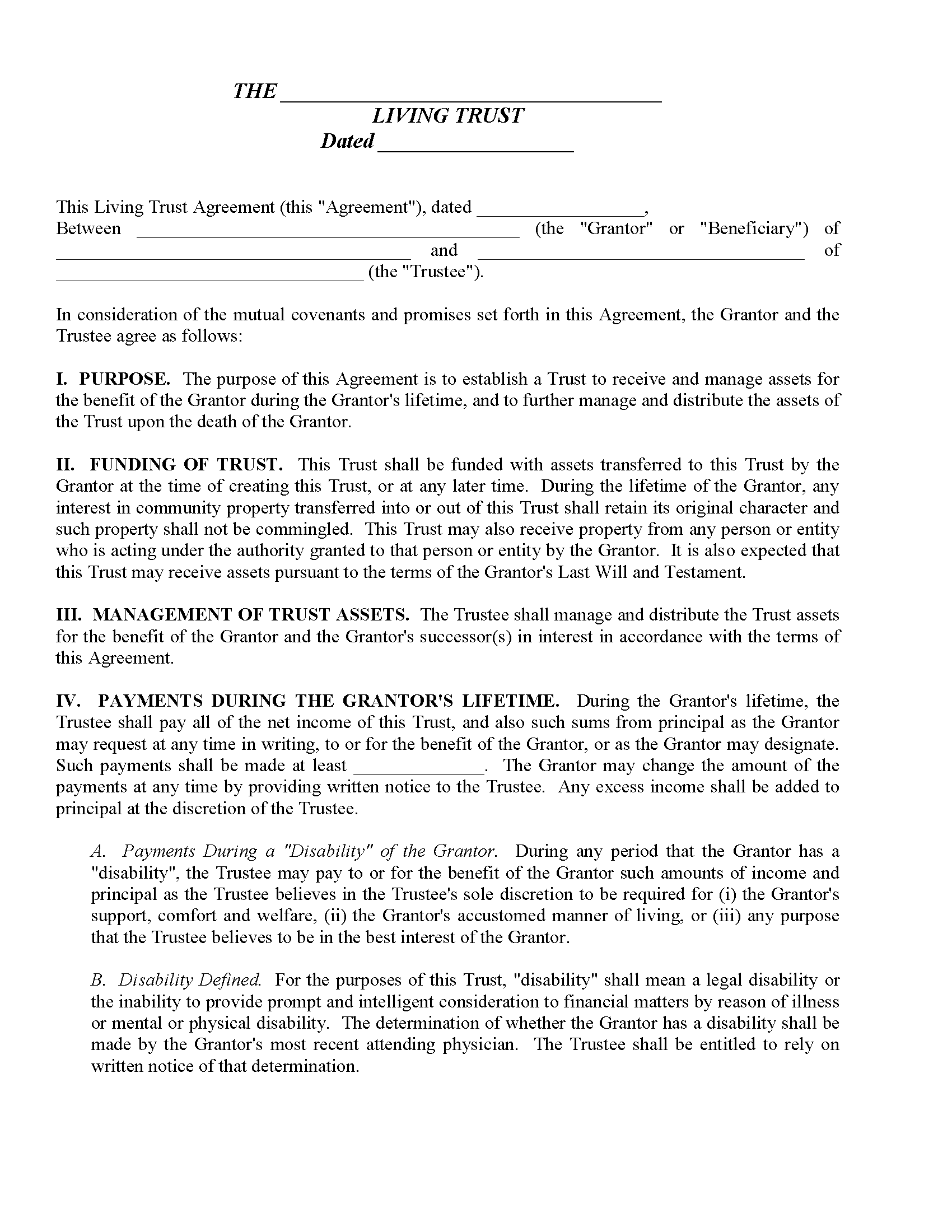

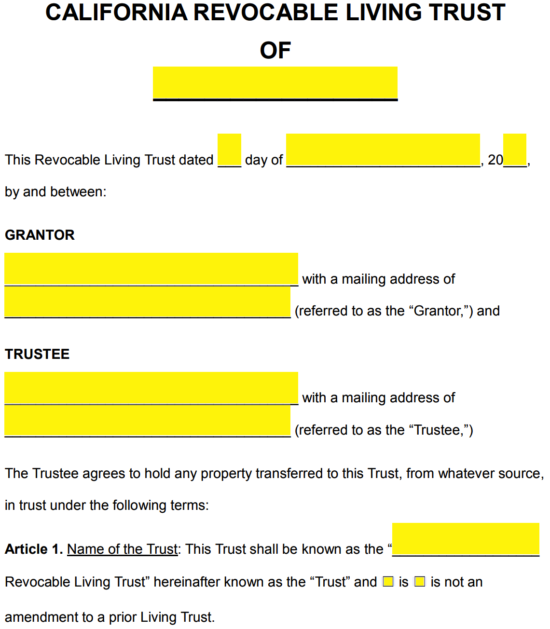

Living Trust California PDF Form Fill Out and Sign Printable PDF

Web decedent's estate or trust. Web under california law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Web what is a probate code section 16061.7 trust notice? File form 541 in order to: Web what form to file.

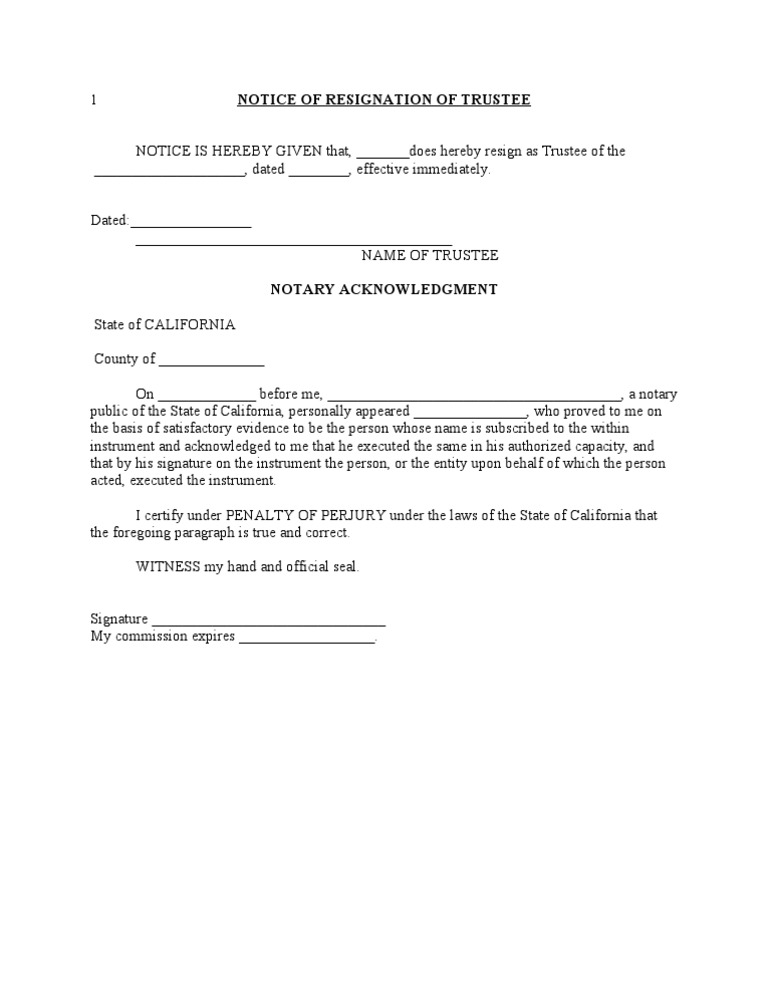

California Notice of Trustee Resignation

Report income received by an estate or trust; Notice to beneficiaries you have [insert “180 days”. Web this notice to beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. File form 541 in order to: Web the california notice to beneficiaries of trust form is crucial in.

Florida Revocable Living Trust Form Free Printable Legal Forms

Report income distributed to beneficiaries; File form 541 in order to: Web up to 25% cash back most states give you 30 or 60 days to send this initial notice. Web (b) the notification by the trustee required by subdivision (a) shall be served on each of the following: Understand its purpose, usage, and legal implications.

Sample Living Trust California Classles Democracy

Get access to the largest online library of legal forms for any state. Web section 16061.7 requires a trustee to serve a notice of trust administration on beneficiaries, heirs, and the attorney general (if the trust is a charitable trust subject to. Web the california notice to beneficiaries of trust form is crucial in trust administration. Web a trustee does.

Letter beneficiaries Fill out & sign online DocHub

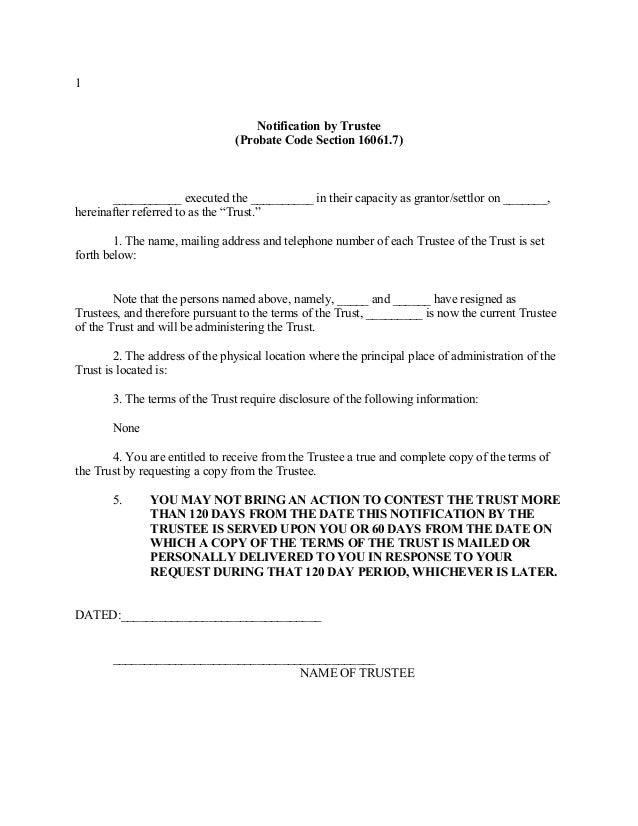

Web what is a probate code section 16061.7 trust notice? File an amended return for the estate or. Web notice to beneficiaries and heirs: Web updated june 01, 2022. Web trust beneficiaries and heirs are entitled to receive a notice by mail called the “statutory notification by trustee.” the trustee must send a statutory notification by.

Termination of Trust Form Fill Out and Sign Printable PDF Template

Web (b) the notification by the trustee required by subdivision (a) shall be served on each of the following: Web (d) the trustee need not provide a copy of the notification by trustee to any beneficiary or heir (1) known to the trustee but who cannot be located by the trustee after reasonable. Get access to the largest online library.

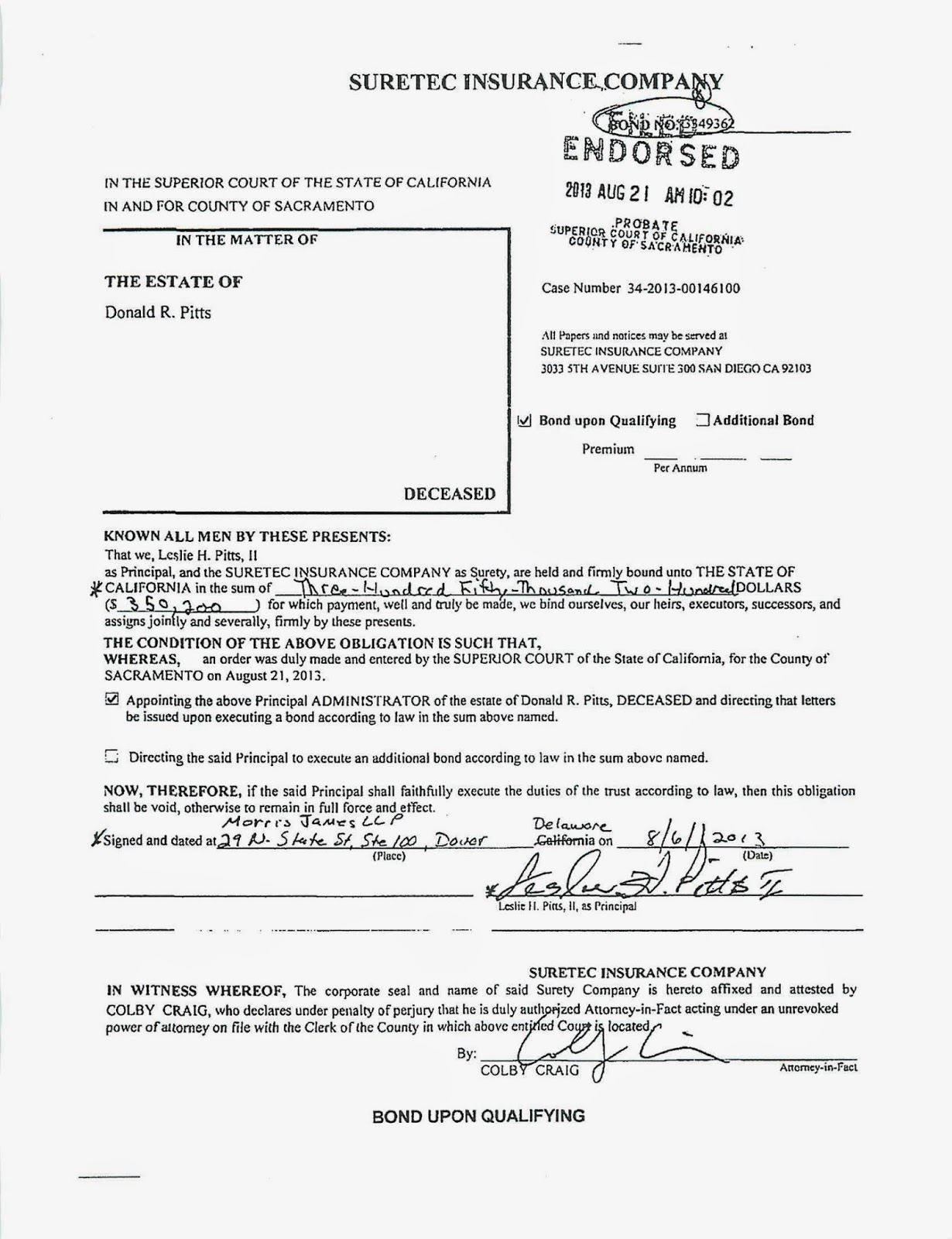

Estate Planning in California Trustee Bond

Web (b) the notification by the trustee required by subdivision (a) shall be served on each of the following: Notice is given that (name): Understand its purpose, usage, and legal implications. Web updated june 01, 2022. Web this notice to beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of.

California trustee notification pursuant to probate code section 16061

Web (d) the trustee need not provide a copy of the notification by trustee to any beneficiary or heir (1) known to the trustee but who cannot be located by the trustee after reasonable. If the trust becomes irrevocable when the settlor dies, the trustee has 60 days after becoming trustee or 60 days after the settlor's death,. Web notice.

Estate Planning in California Transferring Trust Property

Get access to the largest online library of legal forms for any state. Web up to 25% cash back most states give you 30 or 60 days to send this initial notice. Probate code, §§€1211, 1215, 1220, 1230, 12201, 17100, 17203. Report income received by an estate or trust; Web california trust notice (1) each beneficiary of the irrevocable trust.

Az Beneficiaries Notice Word Templates Fill Online, Printable

(2) each heir of the deceased settlor, if. (1) each beneficiary of the irrevocable trust or irrevocable portion of the trust,. File form 541 in order to: Web under california law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Web (b) the notification by the trustee required by.

Report Income Received By An Estate Or Trust;

If the trust becomes irrevocable when the settlor dies, the trustee has 60 days after becoming trustee or 60 days after the settlor's death,. Get access to the largest online library of legal forms for any state. States that require notice to trust beneficiaries arizona arkansas california colorado district of. Notice to beneficiaries you have [insert “180 days”.

Web The California Notice To Beneficiaries Of Trust Form Is Crucial In Trust Administration.

Web under california law, trustees are required to formally notify the beneficiaries of a trust when any significant changes to the trust have transpired. Web this notice to beneficiaries form is for the executor/executrix or personal representative to provide notice to the beneficiaries named in the will of the deceased. Web what is a probate code section 16061.7 trust notice? Web (b) the notification by the trustee required by subdivision (a) shall be served on each of the following:

Web A Trustee Does Have A Duty To Provide A Notice To Heirs And Beneficiaries Of A Trust In A Few Circumstances, But We Will Be Discussing The Two (2) Most Common That.

Web notice to beneficiaries and heirs: Web the trust beneficiary receipt and release form is a form created to help protect a trustee when making a distribution to have the beneficiary sign a consent or waiver that. File form 541 in order to: Web one of the first duties a trustee encounters is selecting the professionals to advise and notifying the beneficiaries of the change in status of the trust.

Understand Its Purpose, Usage, And Legal Implications.

Web section 16061.7 requires a trustee to serve a notice of trust administration on beneficiaries, heirs, and the attorney general (if the trust is a charitable trust subject to. Web up to 25% cash back most states give you 30 or 60 days to send this initial notice. Web california trust notice (1) each beneficiary of the irrevocable trust or irrevocable portion of the trust, subject to the limitations of section. Web (d) the trustee need not provide a copy of the notification by trustee to any beneficiary or heir (1) known to the trustee but who cannot be located by the trustee after reasonable.