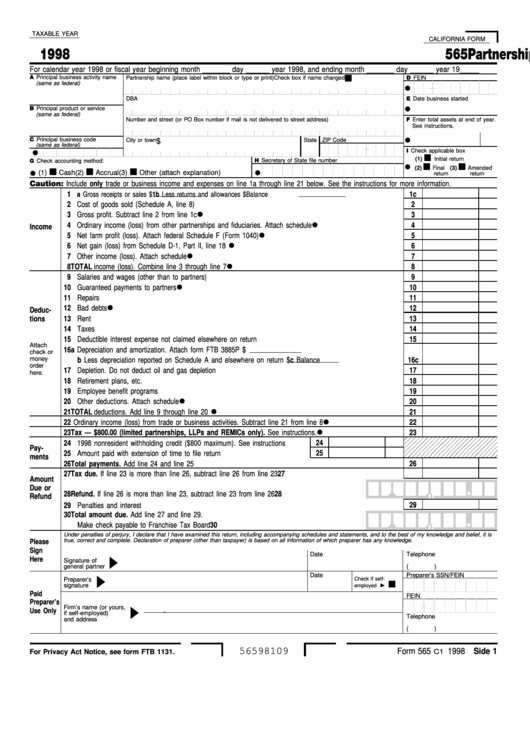

California Form 565

California Form 565 - 540 form (pdf) | 540 booklet. This form is for income earned in tax year 2022, with tax returns due in april. Web 565 form (pdf) | 565 booklet; 568 form (pdf) | 568 booklet; This article will help you balance the. 2022 personal income tax returns due and tax due. Solve all your pdf problems. Web up to $40 cash back please, check the box to confirm you’re not a robot. Web ca form 565, partnership return of income. These changes resulted in an additional page to form 565.

Go to billing > bills & payments > payment methods. Form 565 is due on the 15th day of the fourth month after the close of the year. 1 general partnership 2 lp required to pay annual tax (is doing business in ca, is. Web when is form 565 due? Gross receipts or sales $ _____ b. This article will help you balance the. Form 565 is due on the 15th day of the fourth month after the close of the year. Solve all your pdf problems. You can download or print. Web when is form 565 due?

K what type of entity is filing this return? Web 565 form (pdf) | 565 booklet; Gross receipts or sales $ _____ b. (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this. 540 form (pdf) | 540 booklet. Limited liability partnerships file form 565, partnership return of income. Web ca form 565, partnership return of income. Web sign in to the microsoft 365 admin center with your admin credentials. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. You can download or print.

California Form 3538 (565) Payment Voucher For Automatic Extension

See the links below for the california ftb form instructions. Web up to $40 cash back please, check the box to confirm you’re not a robot. 1 general partnership 2 lp required to pay annual tax (is doing business in ca, is. This article will help you balance the. Web include the partner’s distributive share of the cost of goods.

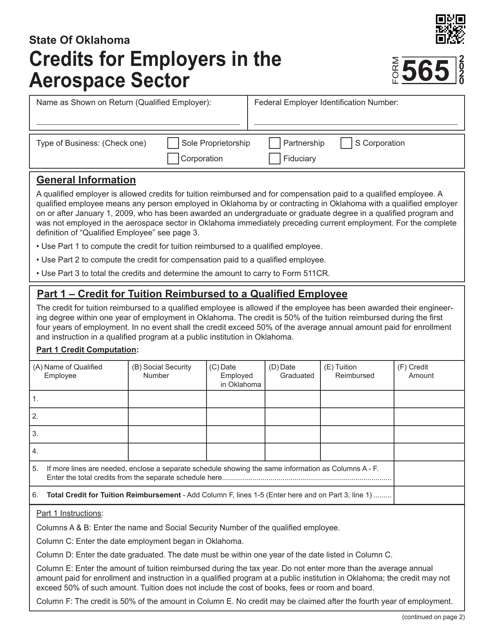

Form 565 Download Fillable PDF or Fill Online Credits for Employers in

Web include the partner’s distributive share of the cost of goods sold and deductions, as adjusted for california law, from any ordinary income (loss) of your trade or. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. Web before trying to file a tax return,.

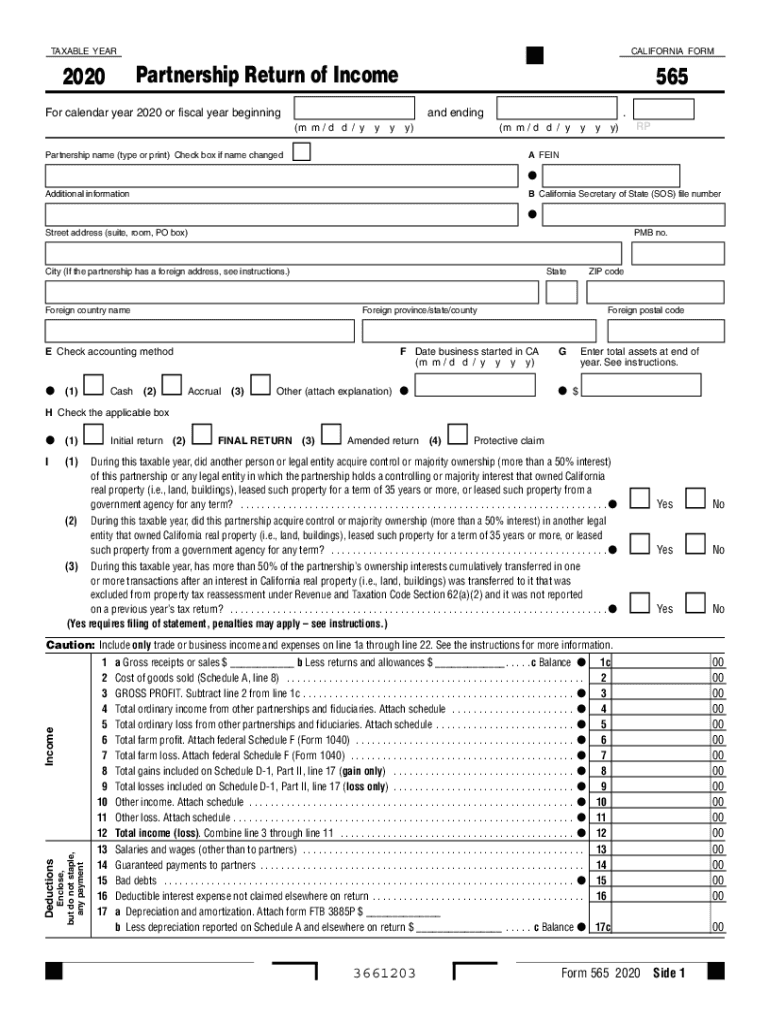

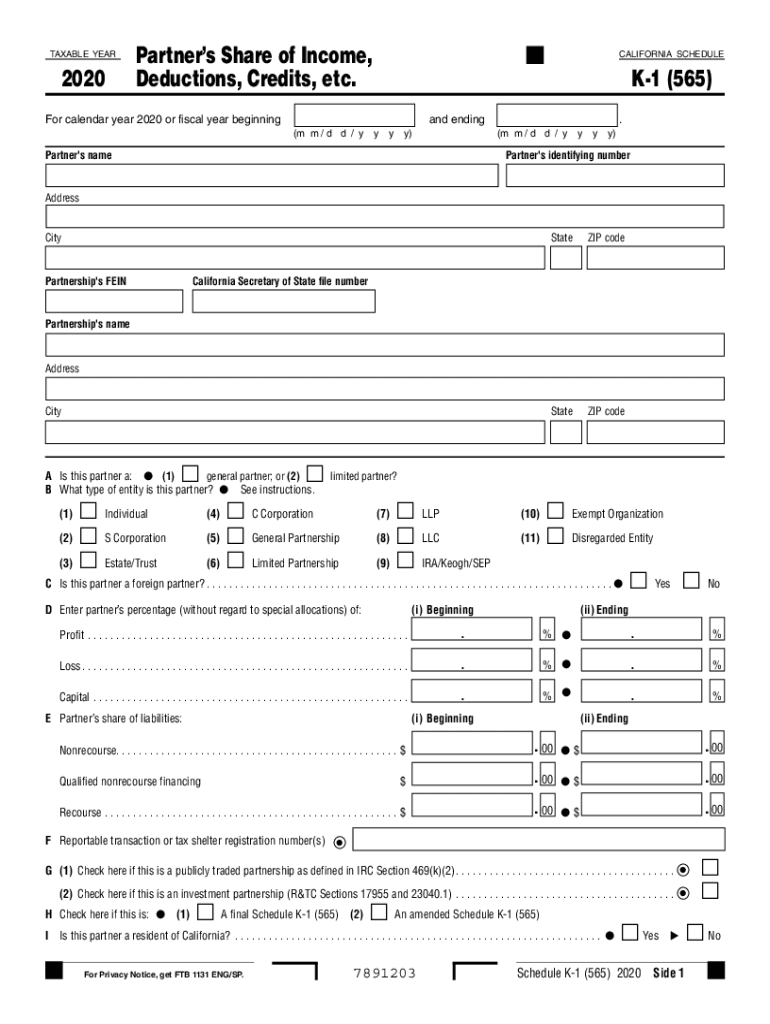

2020 Form CA FTB 565 Fill Online, Printable, Fillable, Blank pdfFiller

These changes resulted in an additional page to form 565. (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this. This form is for income earned in tax year 2022, with tax returns due in april. Web 565 form (pdf) | 565 booklet; Web ca form 565,.

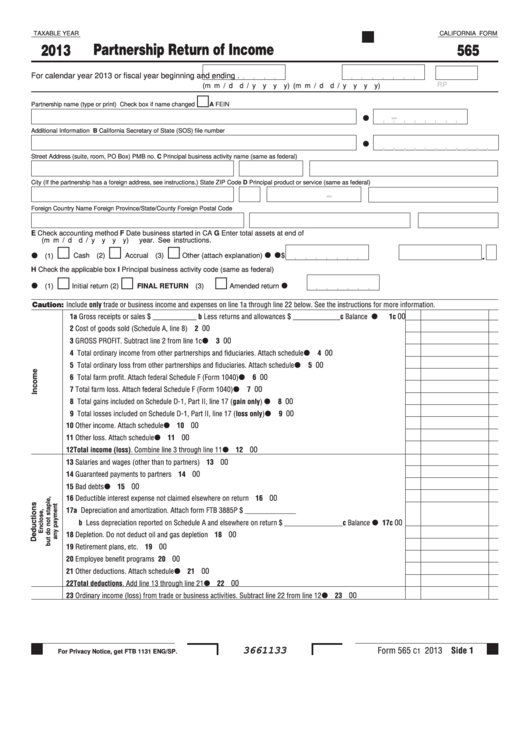

Fillable California Form 565 Partnership Return Of 2013

358, california ending balance sheet. Form 565 is due on the 15th day of the fourth month after the close of the year. Go to billing > bills & payments > payment methods. Aside from a few exceptions, llcs categorized as partnerships should file. 1 general partnership 2 lp required to pay annual tax (is doing business in ca, is.

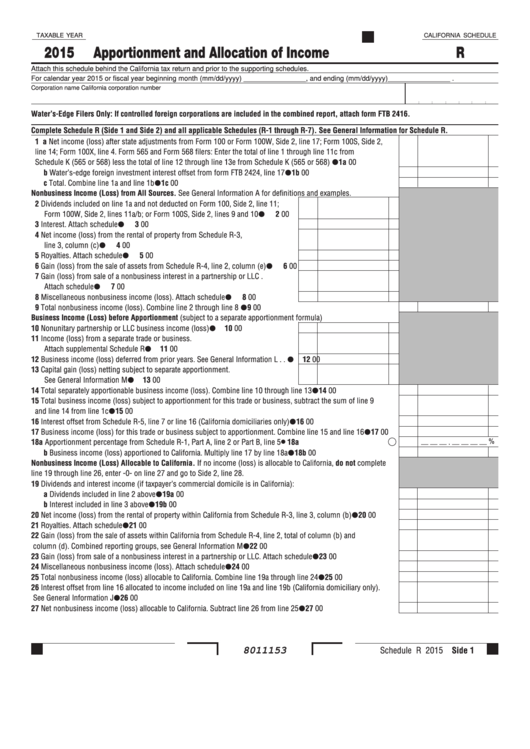

California Schedule R Apportionment And Allocation Of 2015

Web include the partner’s distributive share of the cost of goods sold and deductions, as adjusted for california law, from any ordinary income (loss) of your trade or. Web 565 form (pdf) | 565 booklet; Web sign in to the microsoft 365 admin center with your admin credentials. Web the notice provides that the 2022 california forms 565 and form.

20202022 Form CA LLC5 Fill Online, Printable, Fillable, Blank pdfFiller

Web when is form 565 due? See the links below for the california ftb form instructions. Web sign in to the microsoft 365 admin center with your admin credentials. Web what form do i file for my limited liability partnership? Web when is form 565 due?

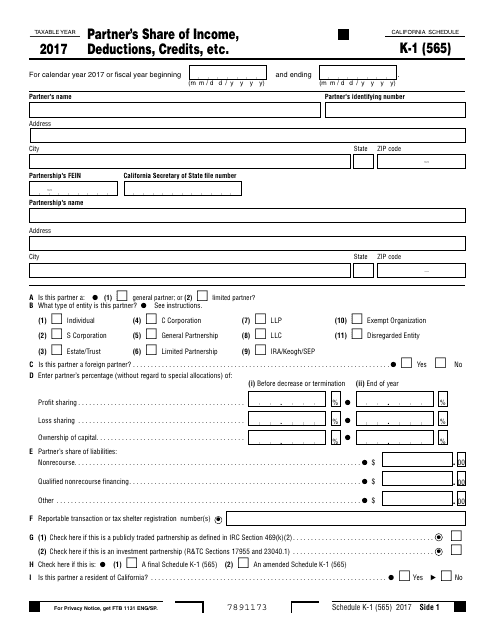

California Schedule K 1 565 Partner's Share Of Fill Out and

Web when is form 565 due? This form is for income earned in tax year 2022, with tax returns due in april. Aside from a few exceptions, llcs categorized as partnerships should file. (1) during this taxable year, did another person or legal entity acquire control or majority ownership (more than a 50% interest) of this. Select add a payment.

Fillable Form 565 Partnership Return Of 1998 printable pdf

Web what form do i file for my limited liability partnership? If the due date falls on a saturday, sunday, or a legal holiday, the filing date. Form 565 is due on the 15th day of the fourth month after the close of the year. Web when is form 565 due? Limited liability partnerships file form 565, partnership return of.

California Form 3538 (565) Draft Payment For Automatic Extension For

Web ca form 565, partnership return of income. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. Web up to $40 cash back please, check the box to confirm you’re not a robot. K what type of entity is filing this return? If the due.

California Schedule D 1 carfare.me 20192020

1 general partnership 2 lp required to pay annual tax (is doing business in ca, is. Web the notice provides that the 2022 california forms 565 and form 568 instructions, for partnership and limited liability companies, provide methods to compute. Web what form do i file for my limited liability partnership? Web we last updated california form 565 in january.

Web When Is Form 565 Due?

Select add a payment method. Solved•by intuit•32•updated january 17, 2023. Gross receipts or sales $ _____ b. If the due date falls on a saturday, sunday, or a legal holiday, the filing date.

(1) During This Taxable Year, Did Another Person Or Legal Entity Acquire Control Or Majority Ownership (More Than A 50% Interest) Of This.

Web ca form 565, partnership return of income. 568 form (pdf) | 568 booklet; Web what form do i file for my limited liability partnership? 540 form (pdf) | 540 booklet.

If The Due Date Falls On A Saturday, Sunday, Or Legal Holiday, The Filing Date Is.

Web • form 565, partnership return of income • form 568, limited liability company return of income • form 100, california corporation franchise or income tax return, including. 358, california ending balance sheet. 2022 personal income tax returns due and tax due. To qualify for the reduced.

Web We Last Updated The Partnership Return Of Income In January 2023, So This Is The Latest Version Of Form 565, Fully Updated For Tax Year 2022.

Aside from a few exceptions, llcs categorized as partnerships should file. Web ca 565/568 implemented many of the changes that took place with the 2020 irs form 1065 changes. Web before trying to file a tax return, you have to find out what tax form is right for your organization. Limited liability partnerships file form 565, partnership return of income.