Ca Withholding Form

Ca Withholding Form - Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Employee withholding amount required for remittal: Web state withholding, use the worksheets on this form. Purposes if you wish to claim the same marital status, number of regular. Web simplified income, payroll, sales and use tax information for you and your business Use the calculator or worksheet to determine the number of. Web go to ftb.ca.gov to view, download, and print withholding forms, publications (including additional copies of ftb publication 1017) and california tax forms. Therefore, all newly hired employees. Items of income that are subject to withholding are. Web landlord tenant lawyer.

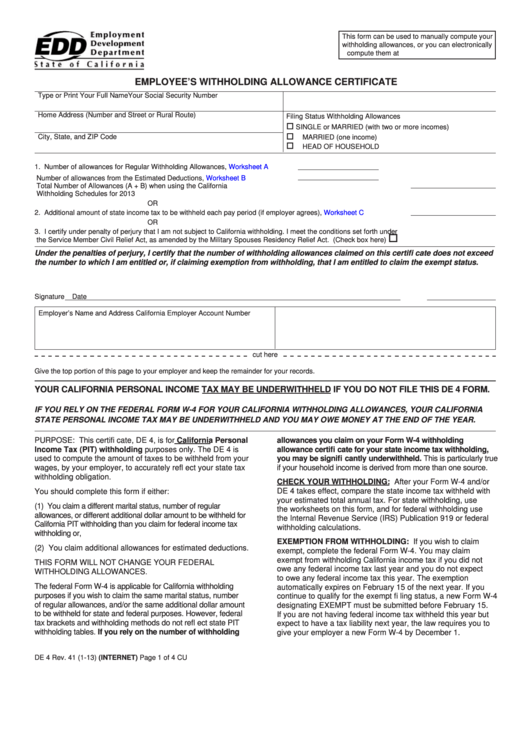

Arrasmith founder and chief legal counsel of the law offices. Items of income that are subject to withholding are. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Form 590 does not apply to payments of backup withholding. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Therefore, all newly hired employees. Use the calculator or worksheet to determine the number of. Web employee’s withholding allowance certificate complete this form so that your employer can withhold the correct california state income tax from your paycheck. Information for local jurisdictions and districts.

Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Information for local jurisdictions and districts. Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web landlord tenant lawyer. Web forms & publications; Use the calculator or worksheet to determine the number of. Web go to ftb.ca.gov to view, download, and print withholding forms, publications (including additional copies of ftb publication 1017) and california tax forms. Employee withholding amount required for remittal: Web need to withhold less money from your paycheck for taxes, increase the number of allowances you claim. Therefore, all newly hired employees.

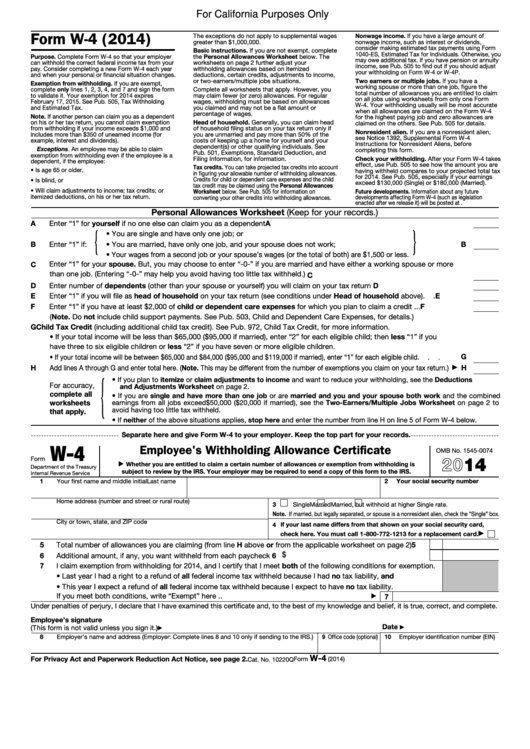

Form W4 (2014) California Employee'S Withholding Allowance

Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the. Web simplified income, payroll, sales and use tax information for you and your business Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and.

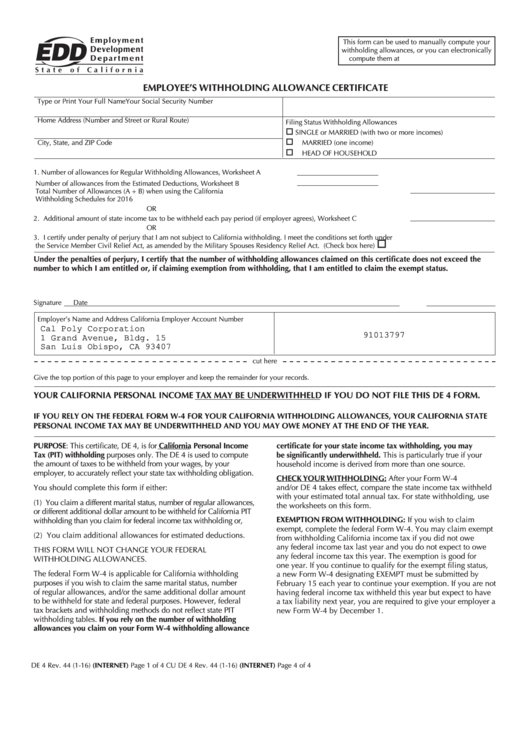

Fillable Employee Development Department State Of California Employee

Use the calculator or worksheet to determine the number of. Web go to ftb.ca.gov to view, download, and print withholding forms, publications (including additional copies of ftb publication 1017) and california tax forms. Web by checking the appropriate box below, the payee certifies the reason for the exemption from the california income tax withholding requirements on payment(s) made to the..

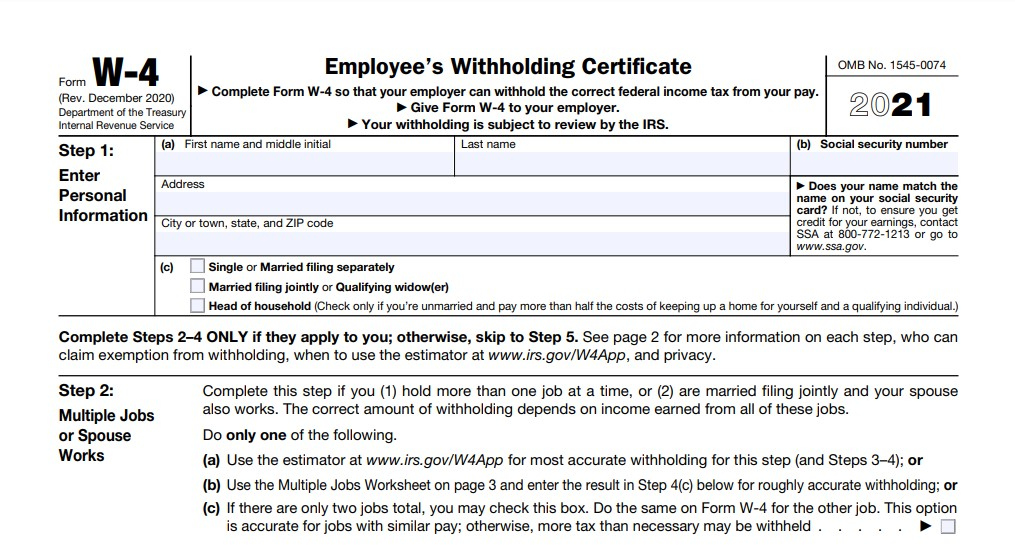

California W4 Form 2021 2022 W4 Form

Use the calculator or worksheet to determine the number of. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Use this form to certify exemption from withholding; Items of.

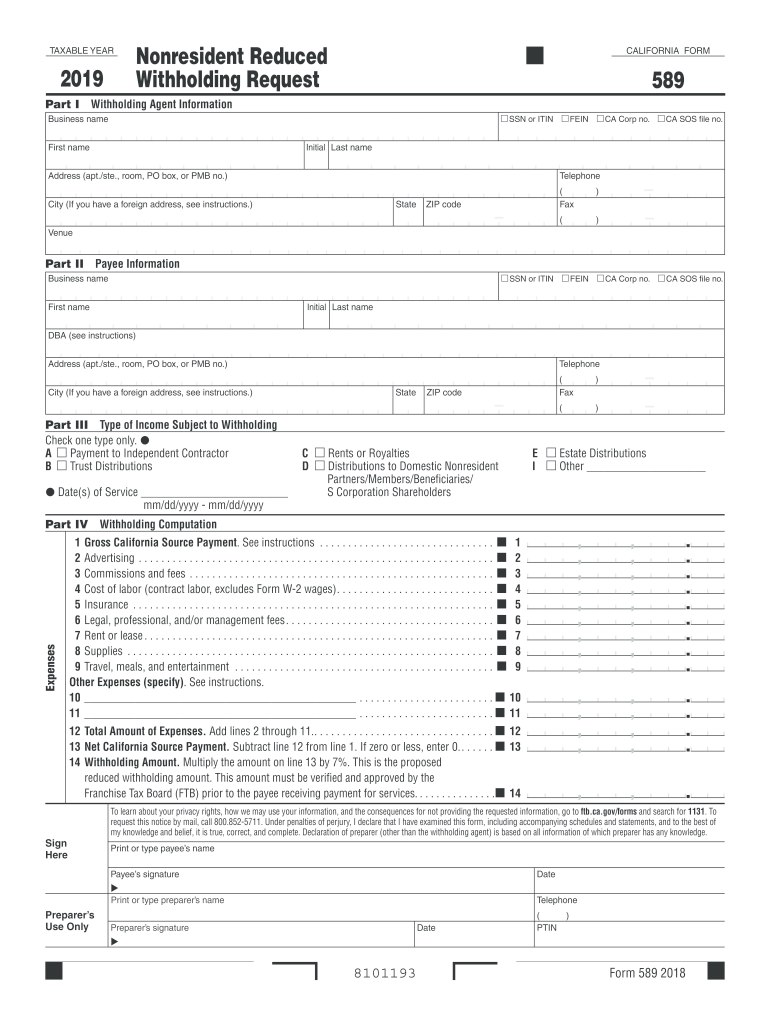

CA FTB 589 2019 Fill out Tax Template Online US Legal Forms

Arrasmith founder and chief legal counsel of the law offices. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Withholding exemption certificate (form 590) submit form 590 to your withholding agent; Purposes if you wish to claim the same marital status, number of.

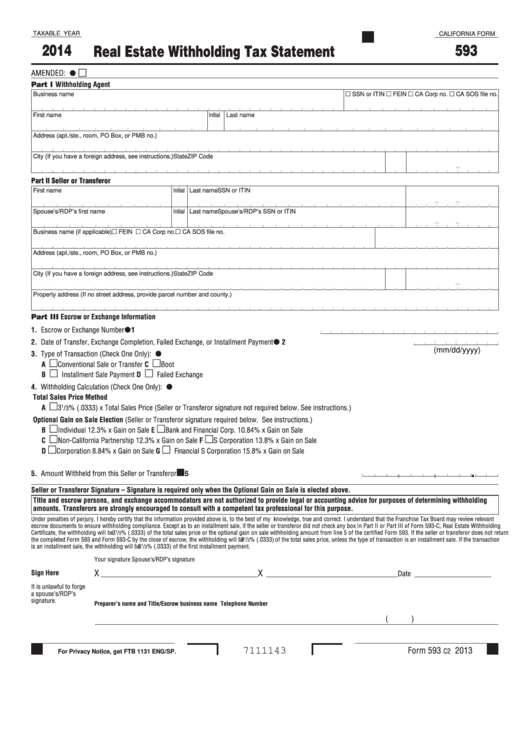

Fillable California Form 593 Real Estate Withholding Tax Statement

Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web state withholding, use the worksheets on this form. Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Web california withholding schedules for 2023 california provides two methods for determining.

1+ California State Tax Withholding Forms Free Download

Form 590 does not apply to payments of backup withholding. Purposes if you wish to claim the same marital status, number of regular. Web employee’s withholding allowance certificate complete this form so that your employer can withhold the correct california state income tax from your paycheck. Information for local jurisdictions and districts. Web state withholding, use the worksheets on this.

California Worksheet A Withholding 2022 Calendar Tripmart

Withholding exemption certificate (form 590) submit form 590 to your withholding agent; Information for local jurisdictions and districts. Web go to ftb.ca.gov to view, download, and print withholding forms, publications (including additional copies of ftb publication 1017) and california tax forms. Purposes if you wish to claim the same marital status, number of regular. Items of income that are subject.

Form myCalPERS1289 Download Fillable PDF or Fill Online Tax

Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Items of income that are subject to withholding are. Web go to ftb.ca.gov to view, download, and print withholding forms, publications (including additional copies of ftb publication 1017) and california tax forms. Web employee’s withholding allowance certificate complete this form so.

Download California Form DE 4 for Free Page 4 FormTemplate

Employee withholding amount required for remittal: Web employee’s withholding allowance certificate complete this form so that your employer can withhold the correct california state income tax from your paycheck. Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Arrasmith founder and chief legal counsel of the law offices. Withholding.

Employee's Withholding Allowance Certificate printable pdf download

Use the calculator or worksheet to determine the number of. Purposes if you wish to claim the same marital status, number of regular. Web go to ftb.ca.gov to view, download, and print withholding forms, publications (including additional copies of ftb publication 1017) and california tax forms. Therefore, all newly hired employees. Web need to withhold less money from your paycheck.

Withholding Exemption Certificate (Form 590) Submit Form 590 To Your Withholding Agent;

Web use form 592 to report the total withholding under california revenue and taxation code (r&tc) sections 18662 and 18664. Web state withholding, use the worksheets on this form. Web forms & publications; Employee withholding amount required for remittal:

Web Simplified Income, Payroll, Sales And Use Tax Information For You And Your Business

Web california withholding schedules for 2023 california provides two methods for determining the amount of wages and salaries to be withheld for state personal. Web for state withholding, use the worksheets on this form, and for federal withholding use the internal revenue service (irs) publication 919 or federal withholding calculations. Information for local jurisdictions and districts. Therefore, all newly hired employees.

Web Employee’s Withholding Allowance Certificate Complete This Form So That Your Employer Can Withhold The Correct California State Income Tax From Your Paycheck.

Web california provides two methods for determining the withholding amount from wages and salaries for state personal income tax. Web use form 590, withholding exemption certificate, to certify an exemption from nonresident withholding. Form 590 does not apply to payments of backup withholding. Use the calculator or worksheet to determine the number of.

Web By Checking The Appropriate Box Below, The Payee Certifies The Reason For The Exemption From The California Income Tax Withholding Requirements On Payment(S) Made To The.

Use this form to certify exemption from withholding; Web go to ftb.ca.gov to view, download, and print withholding forms, publications (including additional copies of ftb publication 1017) and california tax forms. Arrasmith founder and chief legal counsel of the law offices. Purposes if you wish to claim the same marital status, number of regular.