Ca Form 592-Pte

Ca Form 592-Pte - Corporation name, street address, city, state code, corporation telephone number. Click the links below to see the form instructions. Start completing the fillable fields and carefully. If the partnership has foreign partners, the withholding tax must be paid using. General information, check if total withholding at end of year. Web form 592 is also used to report withholding payments for a resident payee. Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Web how it works open the form 592 pte and follow the instructions easily sign the california state tax form with your finger send filled & signed california state tax or save rate the. No payment, distribution or withholding occurred. 2021 california 3804 and 3893.

Use get form or simply click on the template preview to open it in the editor. 2021 california 3804 and 3893. Do not use form 592 if any of the following apply: Web form 592 is also used to report withholding payments for a resident payee. 2023 ca form 592, resident and nonresident. Corporation name, street address, city, state code, corporation telephone number. General information, check if total withholding at end of year. Web how it works open the form 592 pte and follow the instructions easily sign the california state tax form with your finger send filled & signed california state tax or save rate the. If the partnership has foreign partners, the withholding tax must be paid using. Cch axcess™ tax and cch® prosystem fx® tax:

Do not use form 592 if any of the following apply: Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding. Corporation name, street address, city, state code, corporation telephone number. Use get form or simply click on the template preview to open it in the editor. No payment, distribution or withholding occurred. Web how it works open the form 592 pte and follow the instructions easily sign the california state tax form with your finger send filled & signed california state tax or save rate the. Web form 592 is also used to report withholding payments for a resident payee. 2021 california 3804 and 3893. Cch axcess™ tax and cch® prosystem fx® tax: Web form 592 is also used to report withholding payments for a resident payee.

Standard Form 592 T Fill Online, Printable, Fillable, Blank pdfFiller

No payment, distribution or withholding occurred. 2021 california 3804 and 3893. General information, check if total withholding at end of year. Corporation name, street address, city, state code, corporation telephone number. Click the links below to see the form instructions.

2011 Form CA FTB 592A Fill Online, Printable, Fillable, Blank pdfFiller

Start completing the fillable fields and carefully. Cch axcess™ tax and cch® prosystem fx® tax: If the partnership has foreign partners, the withholding tax must be paid using. Corporation name, street address, city, state code, corporation telephone number. Web how it works open the form 592 pte and follow the instructions easily sign the california state tax form with your.

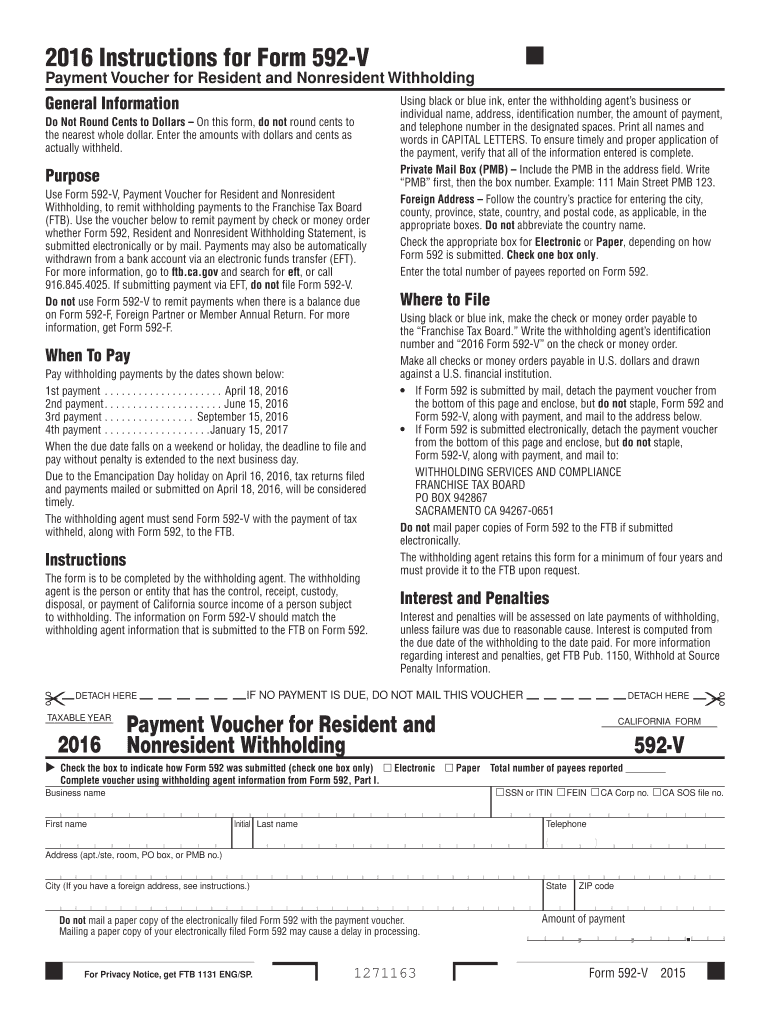

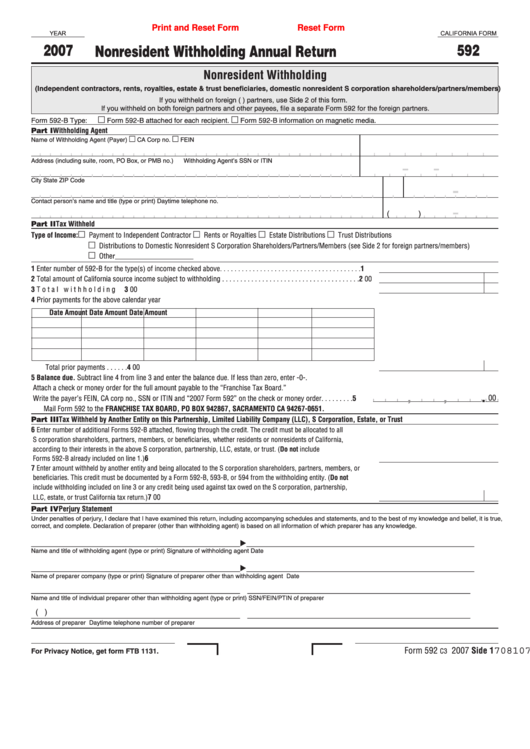

Form 592 Draft Nonresident Withholding Annual Return 2007 printable

No payment, distribution or withholding occurred. If the partnership has foreign partners, the withholding tax must be paid using. Use get form or simply click on the template preview to open it in the editor. Do not use form 592 if any of the following apply: Web form 592 is also used to report withholding payments for a resident payee.

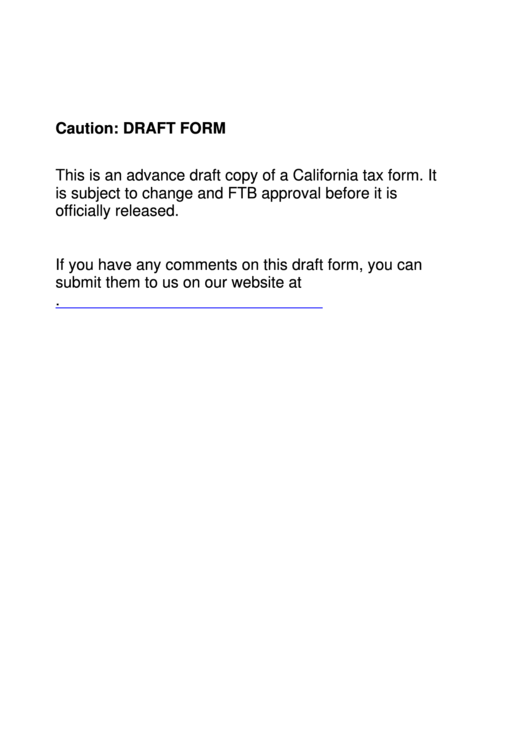

California Form 592B Draft Resident And Nonresident Withholding Tax

2021 california 3804 and 3893. Corporation name, street address, city, state code, corporation telephone number. Cch axcess™ tax and cch® prosystem fx® tax: Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Click the links below to see the form instructions.

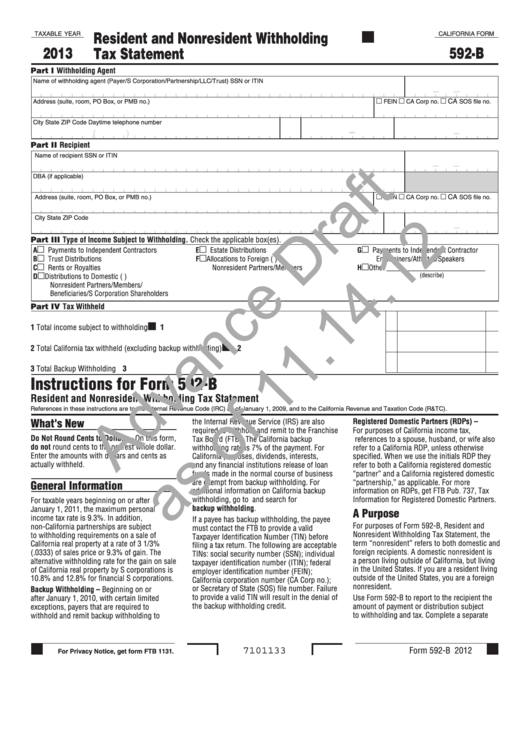

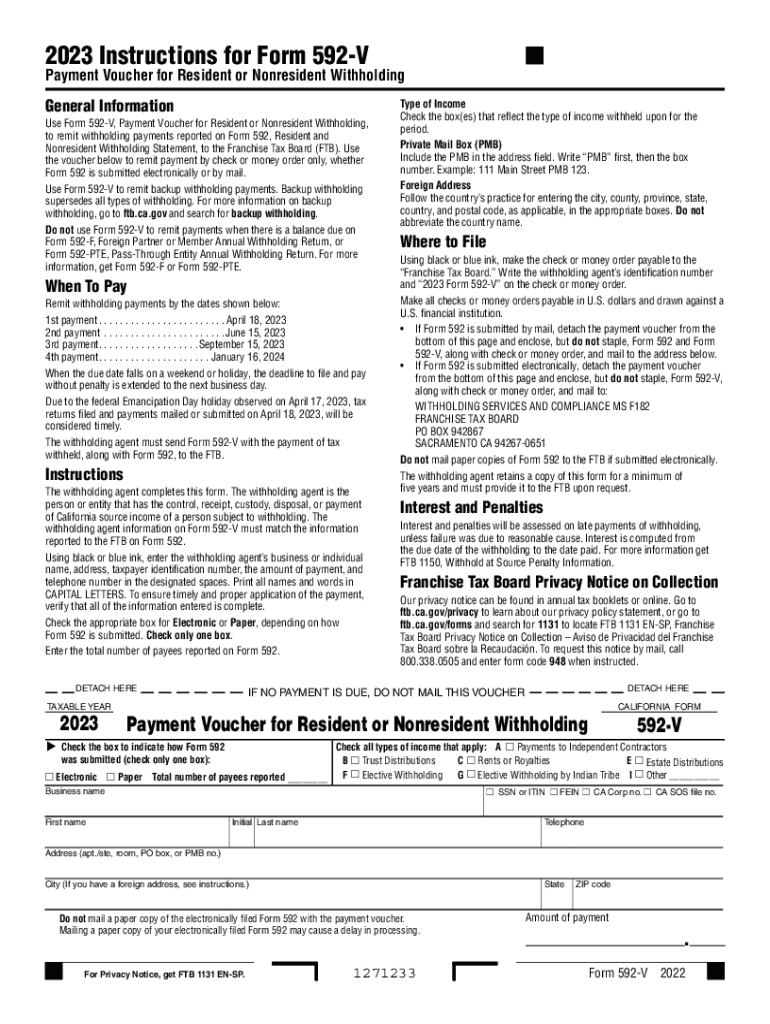

592 V Fill Out and Sign Printable PDF Template signNow

Web form 592 is also used to report withholding payments for a resident payee. General information, check if total withholding at end of year. Web form 592 is also used to report withholding payments for a resident payee. Click the links below to see the form instructions. Web form 592 includes a schedule of payees section, on side 2, that.

California Form 592 Nonresident Withholding Annual Return printable

Start completing the fillable fields and carefully. Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Use get form or simply click on the template preview to open it in the editor. Web form 592 is also used to report withholding payments for a resident payee. Either state form 565.

2013 Form CA FTB 592 Fill Online, Printable, Fillable, Blank pdfFiller

2021 california 3804 and 3893. Start completing the fillable fields and carefully. No payment, distribution or withholding occurred. Click the links below to see the form instructions. Do not use form 592 if any of the following apply:

California Form 592 Nonresident Withholding Annual Return 2007

Cch axcess™ tax and cch® prosystem fx® tax: Web form 592 is also used to report withholding payments for a resident payee. If the partnership has foreign partners, the withholding tax must be paid using. 2023 ca form 592, resident and nonresident. No payment, distribution or withholding occurred.

Form 592 Pte Fill Online, Printable, Fillable, Blank pdfFiller

No payment, distribution or withholding occurred. No payment, distribution or withholding occurred. 2021 california 3804 and 3893. Web form 592 is also used to report withholding payments for a resident payee. Web form 592 includes a schedule of payees section, on side 2, that requires the withholding agent to identify the payees, the income amounts, and the withholding.

Form 592 Pte Fill Out and Sign Printable PDF Template signNow

If the partnership has foreign partners, the withholding tax must be paid using. Use get form or simply click on the template preview to open it in the editor. Web in order to pay the withholding tax to the state of california, form 592 needs to be completed. Either state form 565 or 568 should be generated. 2023 ca form.

Web Form 592 Includes A Schedule Of Payees Section, On Side 2, That Requires The Withholding Agent To Identify The Payees, The Income Amounts, And The Withholding.

Web form 592 is also used to report withholding payments for a resident payee. No payment, distribution or withholding occurred. 2023 ca form 592, resident and nonresident. General information, check if total withholding at end of year.

Web Form 592 Is Also Used To Report Withholding Payments For A Resident Payee.

Corporation name, street address, city, state code, corporation telephone number. Cch axcess™ tax and cch® prosystem fx® tax: Either state form 565 or 568 should be generated. Web in order to pay the withholding tax to the state of california, form 592 needs to be completed.

2021 California 3804 And 3893.

If the partnership has foreign partners, the withholding tax must be paid using. Click the links below to see the form instructions. Web how it works open the form 592 pte and follow the instructions easily sign the california state tax form with your finger send filled & signed california state tax or save rate the. Do not use form 592 if any of the following apply:

No Payment, Distribution Or Withholding Occurred.

Do not use form 592 if any of the following apply: Start completing the fillable fields and carefully. Use get form or simply click on the template preview to open it in the editor.