Broad Causes Of Loss Form

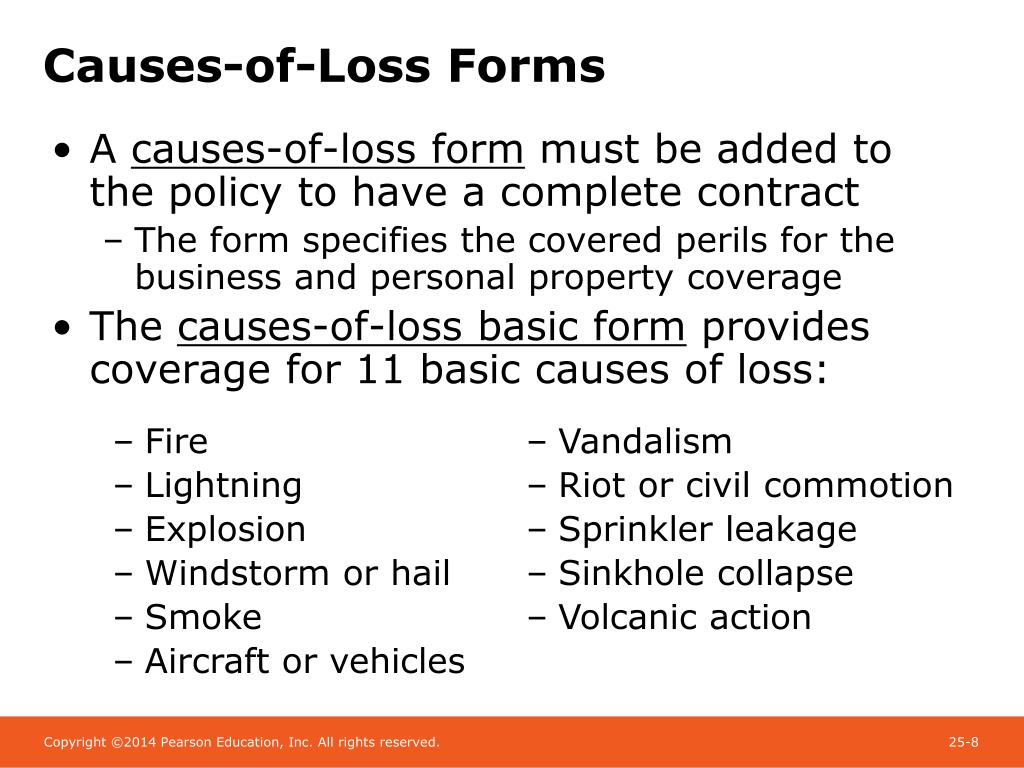

Broad Causes Of Loss Form - Even though the basic and broad causes of loss forms name the perils that are insured,. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: Web special causes of loss eligibility requirements. Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Web there are three commercial property forms (basic, broad and special) that identify the causes of loss (or perils) for which coverage is provided. And (as additional coverage) collapse. Web the following perils are covered under basic causes of loss forms: Web there are three causes of loss forms policyholders can choose from for their commercial property coverage: Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles,. Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,.

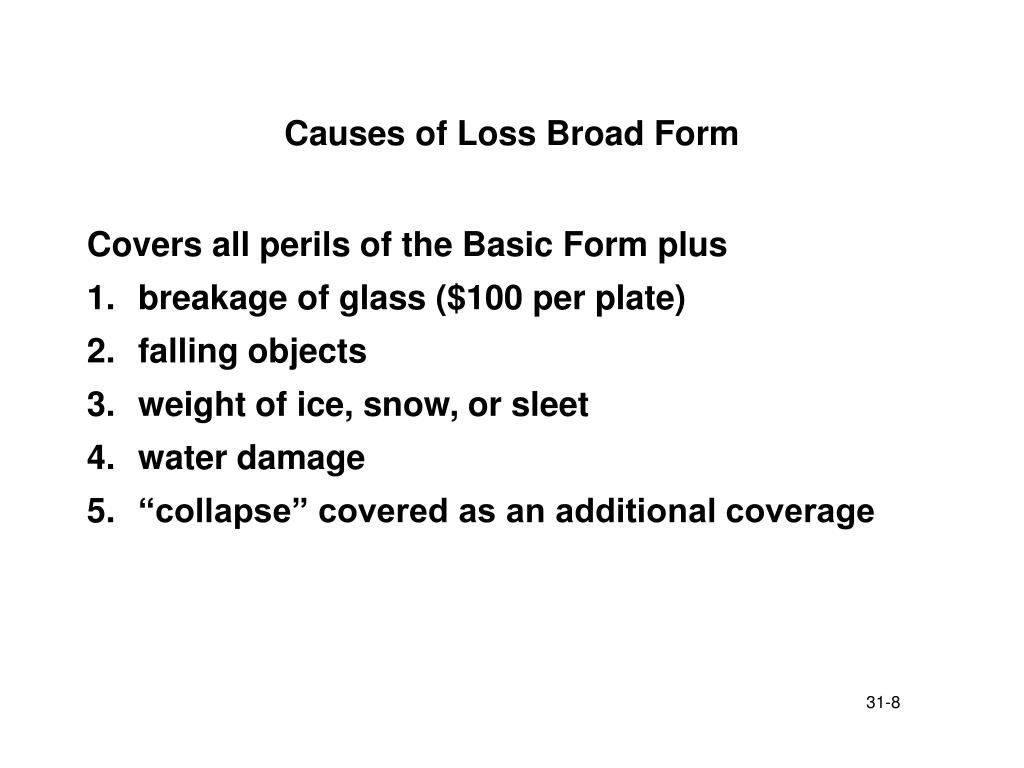

Web a peril is a potential cause of loss, such as fire, windstorm, hail, and flood. Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Even though the basic and broad causes of loss forms name the perils that are insured,. Basic form causes of loss: Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,. Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for glass breakage, unless it is. Web the broad causes of loss form is one of the three insurance services office, inc. Web there are three causes of loss forms policyholders can choose from for their commercial property coverage: Form that covers basic form perils plus falling objects; Web there are three types of causes of loss forms that are named perils:

Web the following perils are covered under basic causes of loss forms: Causes of loss forms causes of loss forms are insurance services office,. Web special causes of loss eligibility requirements. Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles,. Web a peril is a potential cause of loss, such as fire, windstorm, hail, and flood. Web there are three types of causes of loss forms that are named perils: Basic broad earthquake in this approach, the insured must prove that the named peril caused the. Basic form causes of loss: Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for glass breakage, unless it is. Form that covers basic form perils plus falling objects;

Broad Causes/Factors for Part 121 Accidents 19922001 Download

Web the broad causes of loss form is one of the three insurance services office, inc. Basic broad earthquake in this approach, the insured must prove that the named peril caused the. Even though the basic and broad causes of loss forms name the perils that are insured,. Form that covers basic form perils plus falling objects; And (as additional.

Broad categories of common underlying causes of death for those with

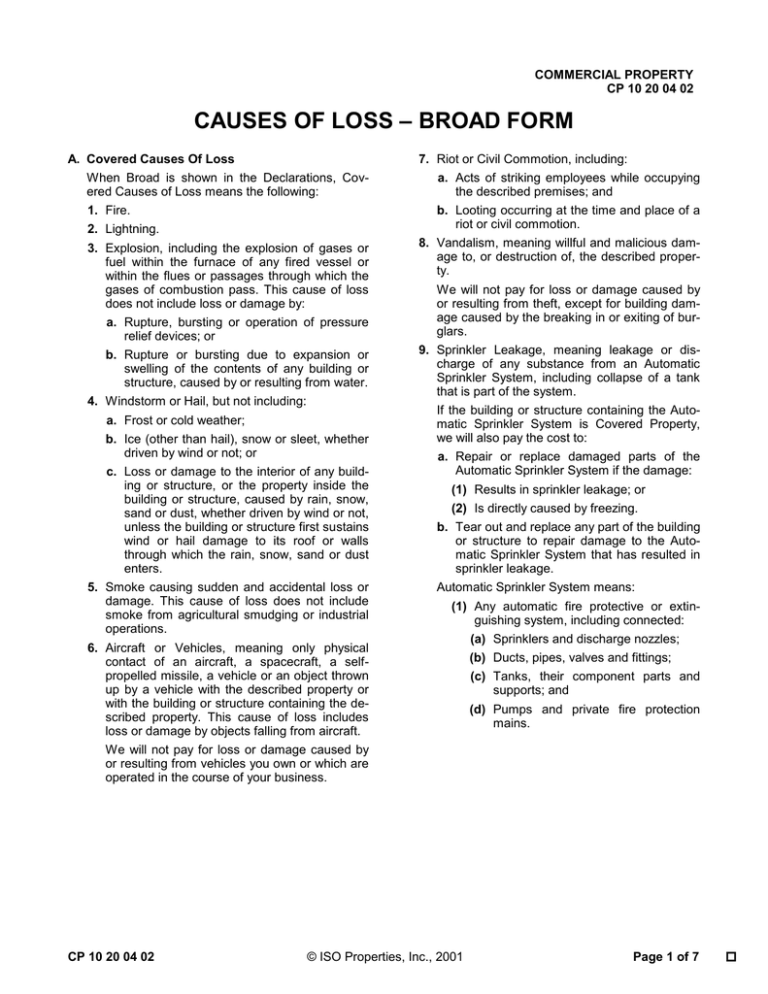

Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Fires lightning explosions windstorms and hail smoke aircraft or vehicle accidents riots or. Covered causes of loss when broad is shown in the declarations, covered causes of loss means the following: Causes of loss forms causes.

causes of loss broad form Midwest Security Insurance Services

Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,. Web there are three types of causes of loss forms that are named perils: Basic broad earthquake in this approach, the insured must prove that the named peril caused the. Weight.

PPT The ISO Commercial Portfolio Program PowerPoint Presentation

Covered causes of loss when basic is shown in the declarations, covered causes of loss means the following: Web the broad causes of loss form is one of the three insurance services office, inc. Web there are three types of causes of loss forms that are named perils: Web the basic causes of loss form (cp 10 10) provides coverage.

Logistic regression results of determinants of poor selfrated health

Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Form that covers basic form perils plus falling objects; Fires lightning explosions windstorms and hail smoke aircraft or vehicle accidents riots or. Basic broad earthquake in this approach, the insured must prove that the named peril.

Proof Of Loss Fill Out and Sign Printable PDF Template signNow

Fires lightning explosions windstorms and hail smoke aircraft or vehicle accidents riots or. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Basic form causes of loss: Covered.

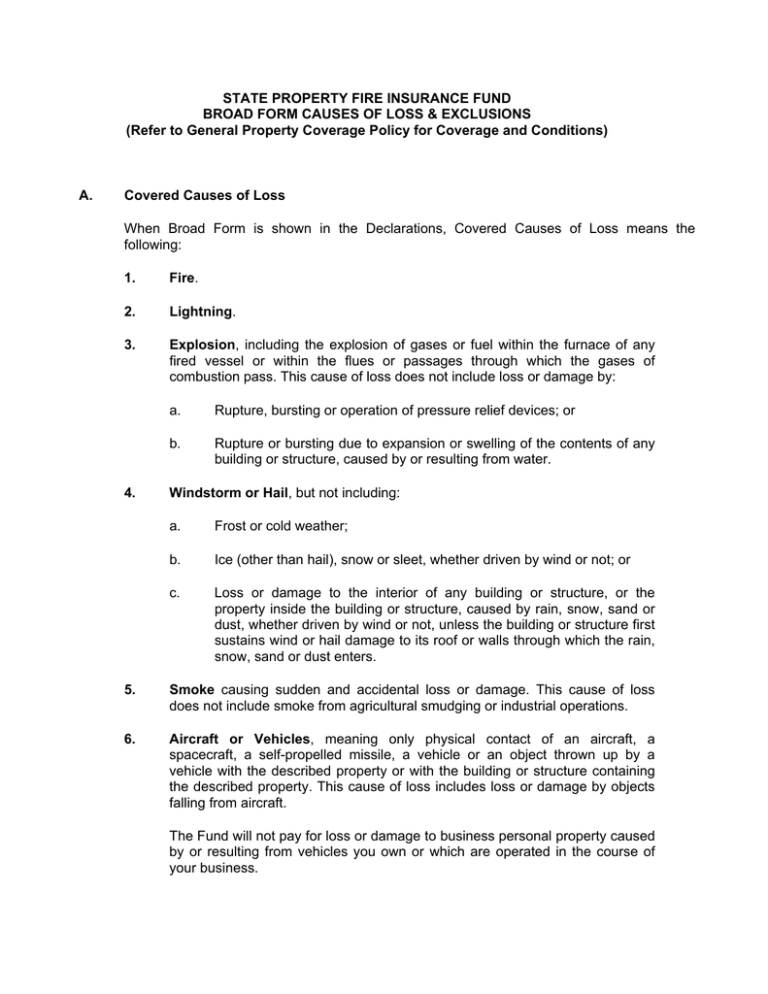

Broad Form Causes Loss Exclusions

Weight of snow, ice, or sleet; Web the broad causes of loss form is one of the three insurance services office, inc. Broad form insurance refers to the causes of loss (or perils) form that dictates what types of losses will be covered under a property. Web with this change, the 2000 edition of the broad causes of loss form.

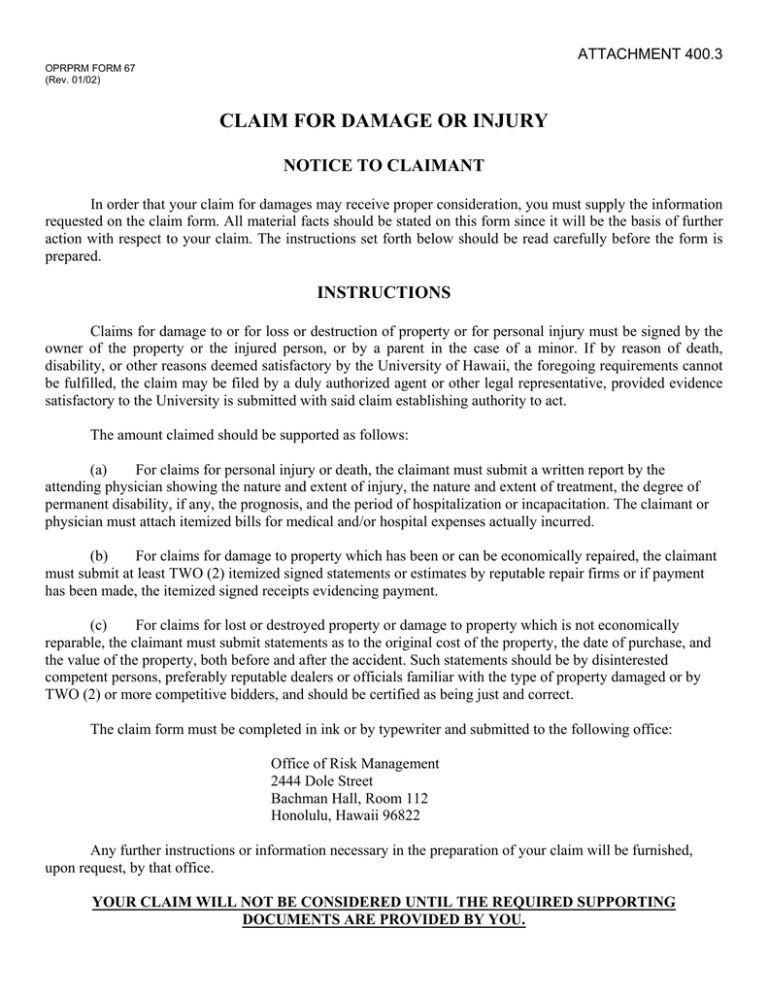

claim for damage or injury

Web the following perils are covered under basic causes of loss forms: Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for glass breakage, unless it is. Causes of loss forms causes of loss forms are insurance services office,. Basic broad earthquake in.

PPT Chapter 25 Commercial Property Insurance PowerPoint Presentation

Web special causes of loss eligibility requirements. Form that covers basic form perils plus falling objects; Web there are three causes of loss forms policyholders can choose from for their commercial property coverage: Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for.

When to Use the Broad Causes of Loss Form WSRB Blog

Web the following perils are covered under basic causes of loss forms: Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,. Covered causes of loss when broad is shown in the declarations, covered causes of loss means the following: Web.

Web Special Causes Of Loss Eligibility Requirements.

And (as additional coverage) collapse. Web the basic causes of loss form (cp 10 10) provides coverage for the following named perils: Web builders risk coverage form indirect damage coverage forms causes of loss forms business income coverage form causes of loss: Web there are three commercial property forms (basic, broad and special) that identify the causes of loss (or perils) for which coverage is provided.

Broad Form Insurance Refers To The Causes Of Loss (Or Perils) Form That Dictates What Types Of Losses Will Be Covered Under A Property.

Web a peril is a potential cause of loss, such as fire, windstorm, hail, and flood. Causes of loss forms causes of loss forms are insurance services office,. Fires lightning explosions windstorms and hail smoke aircraft or vehicle accidents riots or. Basic form causes of loss:

Web There Are Three Causes Of Loss Forms Policyholders Can Choose From For Their Commercial Property Coverage:

Form that covers basic form perils plus falling objects; Fire, lightning, explosion, smoke, windstorm, hail, riot, civil commotion, aircraft, vehicles,. Covered causes of loss when basic is shown in the declarations, covered causes of loss means the following: Web the broad causes of loss form is one of the three insurance services office, inc.

Like On The Broad Causes Of Loss Form, The Special Causes Of Loss Form Requires That Coinsurance Be At Least 80% For Property.

Web the comprehensive factors of loss bilden (cp 10 20) provides namable perils covers for the perils insured against included the basic causes of lost form (fire, lightning, outbreak,. Web there are three types of causes of loss forms that are named perils: Even though the basic and broad causes of loss forms name the perils that are insured,. Web with this change, the 2000 edition of the broad causes of loss form (like the basic causes of loss form) provides no coverage at all for glass breakage, unless it is.