Az Tax Extension Form

Az Tax Extension Form - Web what is the due date for fiduciary tax returns for taxpayers who received an extension?. Web the completed extension form must be filed by april 18, 2023. Web file this form to request an extension to file forms 120, 120a, 120s, 99,. Web application for filing extension for fiduciary returns only. Web make an individual or small business income payment. Web 26 rows arizona corporation income tax return: Sign into your efile.com account and check acceptance by the irs. Web more about the arizona form 204 extension. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web use this form to apply for an automatic 6 month extension of time to file arizona forms.

If you are filing under a federal extension but are making an arizona. Web file this form to request an extension to file forms 120, 120a, 120s, 99,. Web form 2350, application for extension of time to file u.s. For individuals who filed a. Web what is the due date for fiduciary tax returns for taxpayers who received an extension?. Web extended deadline with arizona tax extension: Web general tax return information. Web use this form to apply for an automatic 6 month extension of time to file arizona forms. Web 26 rows arizona corporation income tax return: Web make an individual or small business income payment.

Web 26 rows arizona corporation income tax return: Web the completed extension form must be filed by april 18, 2023. Web more about the arizona form 204 extension. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,. Web use this form to apply for an automatic 6 month extension of time to file arizona forms. Individuals to file federal form 4868 to request an extension with the. If you are filing under a federal extension but are making an arizona. Web if you pay your taxes online, you do not have to submit form 120ext unless you are. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use.

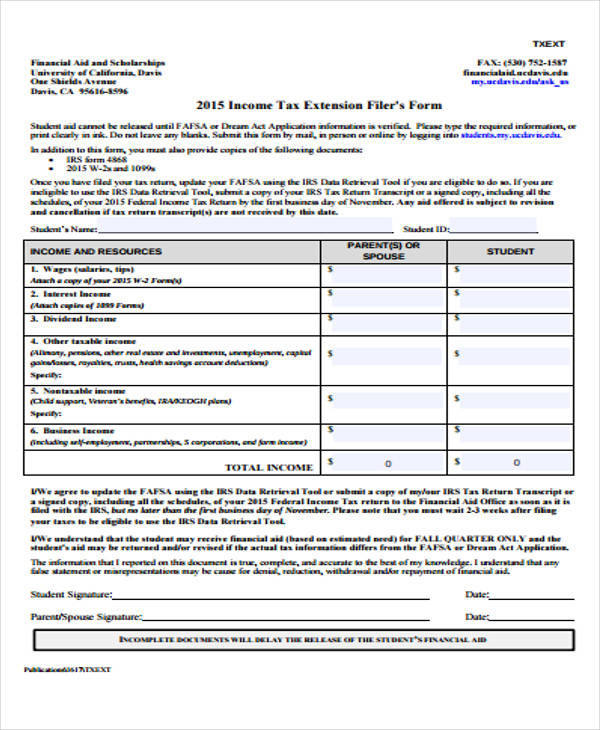

LastMinute Tax Advice for 2021 Wow Gallery eBaum's World

If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,. Individuals to file federal form 4868 to request an extension with the. Web more about the arizona form 204 extension. Web aztaxes.gov allows electronic filing and payment of transaction privilege.

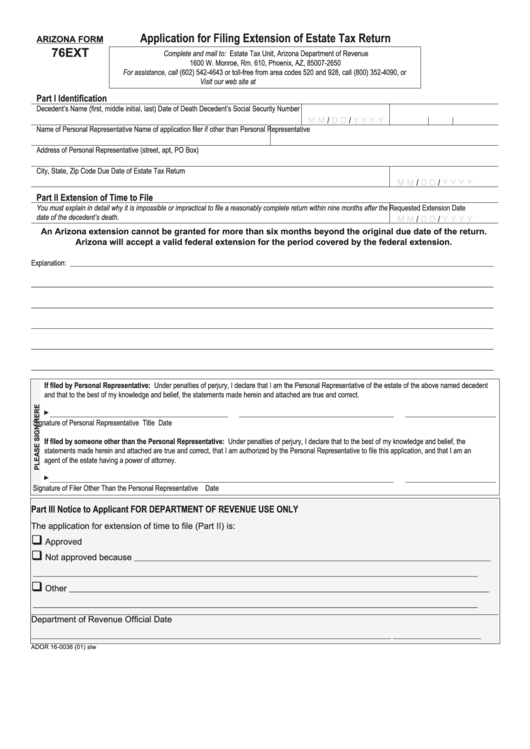

Form 76ext Application For Filing Extension Of Estate Tax Return

Individuals to file federal form 4868 to request an extension with the. If you do not owe arizona income taxes by the tax deadline of april 18, 2023,. Web make an individual or small business income payment. Web what is the due date for fiduciary tax returns for taxpayers who received an extension?. Web use this form to apply for.

AZ ADEQ Out of State Exemption Form 20172022 Fill and Sign Printable

Web 26 rows individual income tax forms. Individuals to file federal form 4868 to request an extension with the. Web how to file business tax extension with arizona using expressextension? Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,. If you are filing under a federal extension but are making an arizona.

AZ Form 5000A 2017 Fill out Tax Template Online US Legal Forms

Web use this form to apply for an automatic 6 month extension of time to file arizona forms. Web what is the due date for fiduciary tax returns for taxpayers who received an extension?. Web make an individual or small business income payment. Web how to file business tax extension with arizona using expressextension? If you do not owe arizona.

FREE 20+ Service Form Formats in PDF MS Word

Web make an individual or small business income payment. If you are filing under a federal extension but are making an arizona. We last updated arizona form 204 in. Web 26 rows arizona corporation income tax return: Web use this form to apply for an automatic 6 month extension of time to file arizona forms.

How Long Is An Extension For Business Taxes Business Walls

Web extended deadline with arizona tax extension: For individuals who filed a. Web if you pay your taxes online, you do not have to submit form 120ext unless you are. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Sign into your efile.com account and check acceptance by the irs.

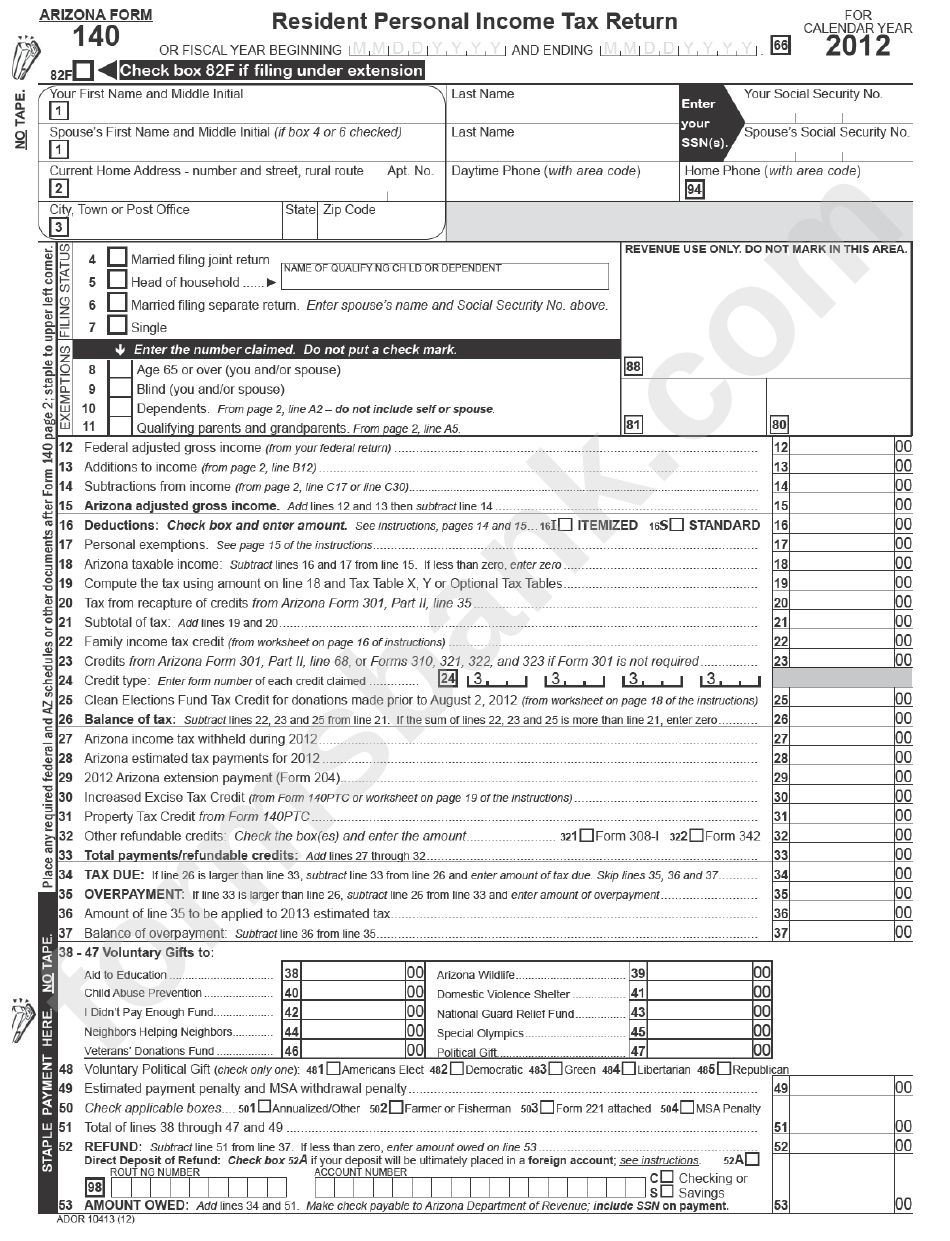

Printable Az 140 Tax Form Printable Form 2022

Individuals to file federal form 4868 to request an extension with the. The arizona department of revenue will follow. Web 26 rows arizona corporation income tax return: Web how to file business tax extension with arizona using expressextension? Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,.

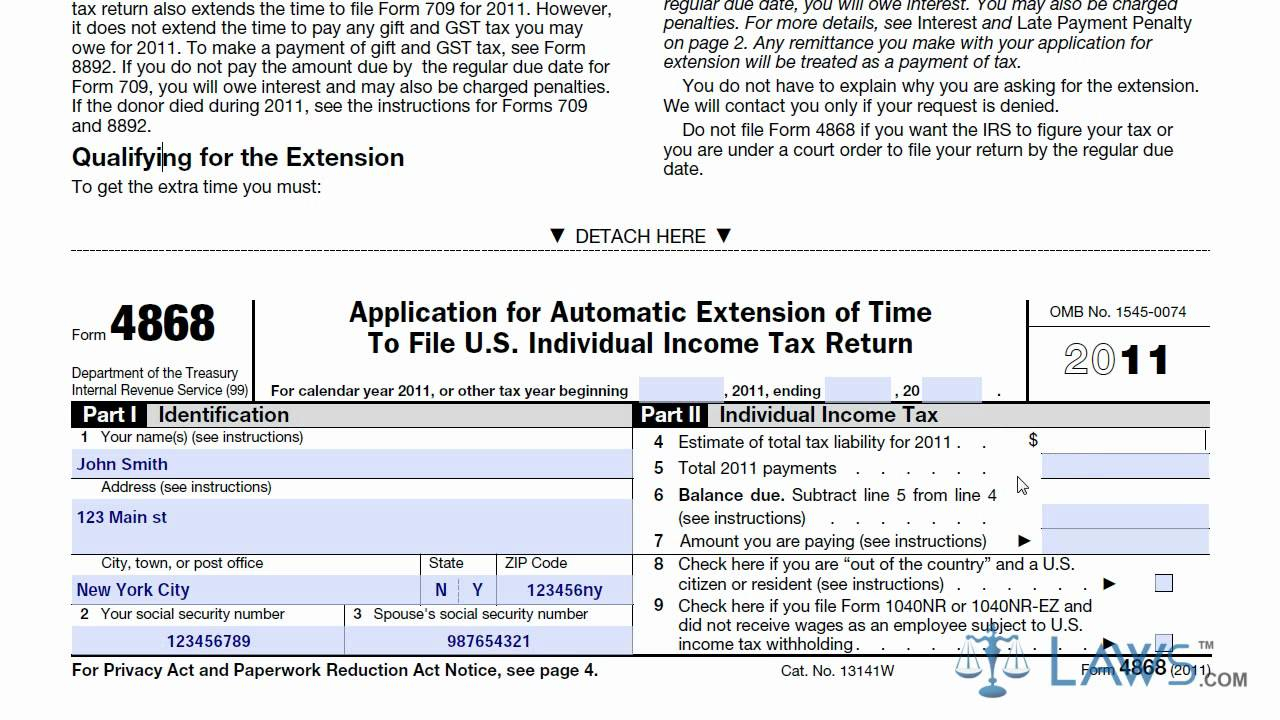

Print Irs Extension Form 4868 2021 Calendar Printables Free Blank

If you are filing under a federal extension but are making an arizona. Web more about the arizona form 204 extension. Web 26 rows arizona corporation income tax return: For individuals who filed a. Web use this form to apply for an automatic 6 month extension of time to file arizona forms.

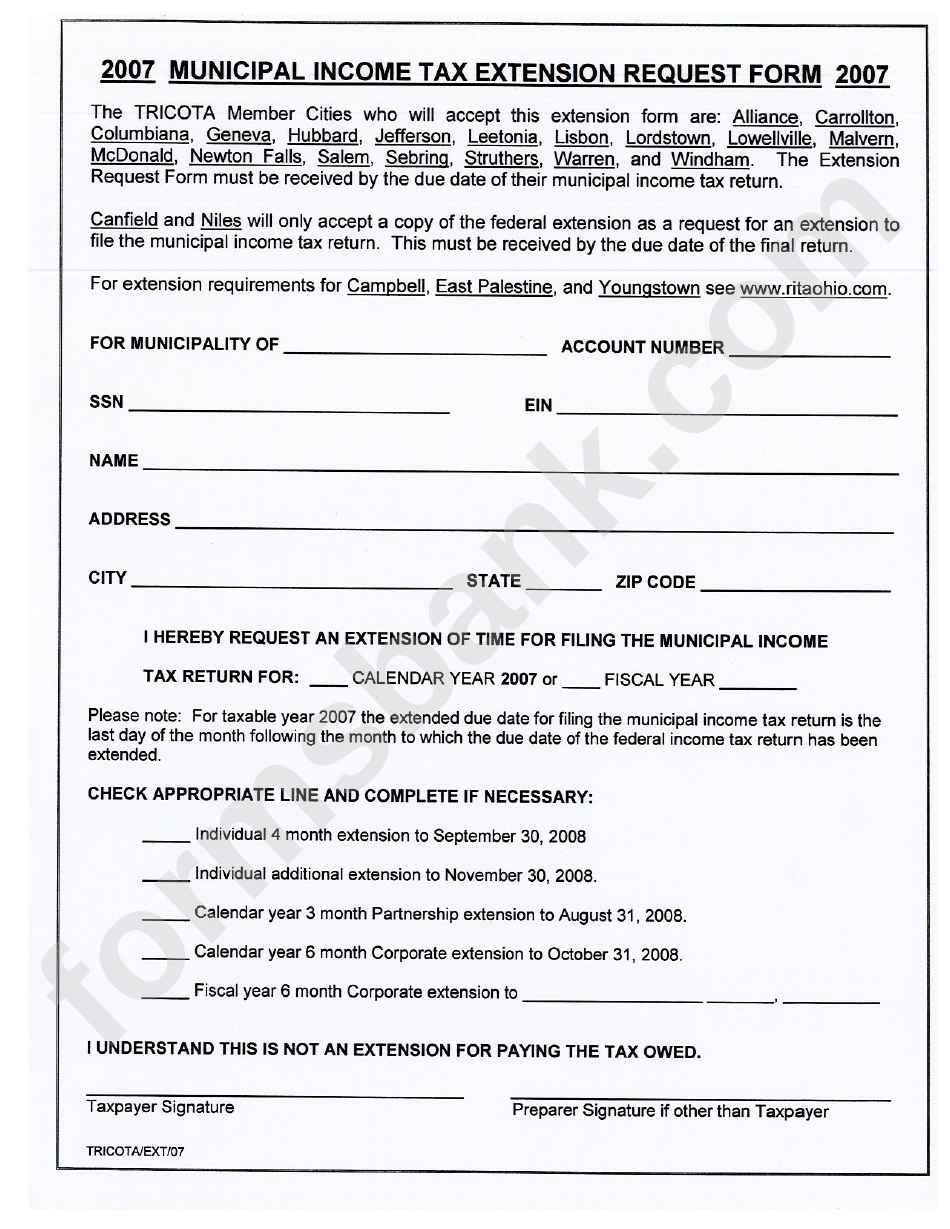

Municipal Tax Extension Request Form 2007 printable pdf download

We last updated arizona form 204 in. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Web extended deadline with arizona tax extension: Web how to file business tax extension with arizona using expressextension? Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,.

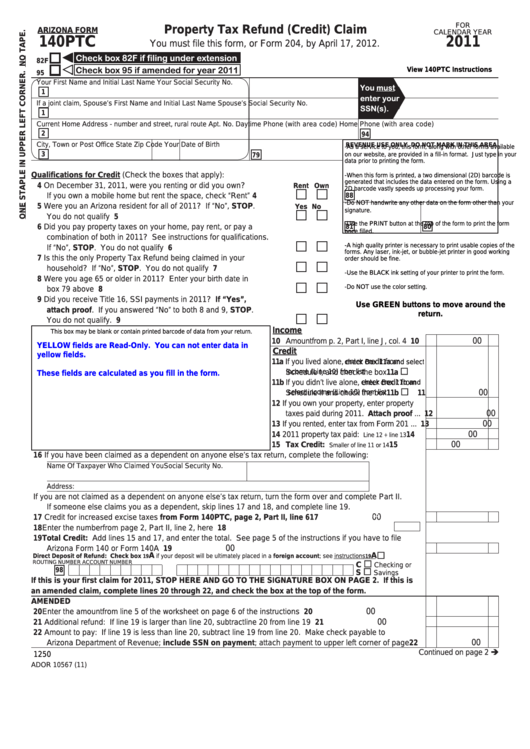

Fillable Arizona Form 140ptc Property Tax Refund (Credit) Claim

Web 26 rows individual income tax forms. If you are filing under a federal extension but are making an arizona. Web make an individual or small business income payment. Web 26 rows arizona corporation income tax return: Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use.

Web 26 Rows Arizona Corporation Income Tax Return:

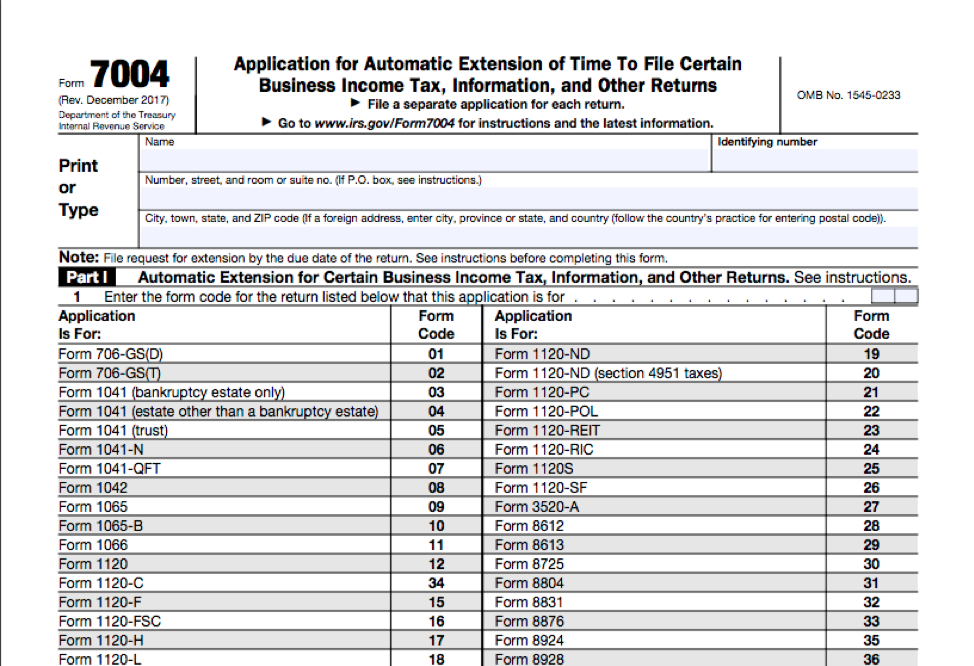

Web what is the due date for fiduciary tax returns for taxpayers who received an extension?. Web file this form to request an extension to file forms 120, 120a, 120s, 99,. For individuals who filed a. Web how to file business tax extension with arizona using expressextension?

Web 26 Rows Individual Income Tax Forms.

Web more about the arizona form 204 extension. Web extended deadline with arizona tax extension: Web arizona will grant an extension to individuals filing forms 140, 140a, 140ez, 140nr,. Individuals to file federal form 4868 to request an extension with the.

If You Do Not Owe Arizona Income Taxes By The Tax Deadline Of April 18, 2023,.

The arizona department of revenue will follow. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use. Web use this form to apply for an automatic 6 month extension of time to file arizona forms. Web if you pay your taxes online, you do not have to submit form 120ext unless you are.

Web Make An Individual Or Small Business Income Payment.

Web general tax return information. Web application for filing extension for fiduciary returns only. Sign into your efile.com account and check acceptance by the irs. Web form 2350, application for extension of time to file u.s.