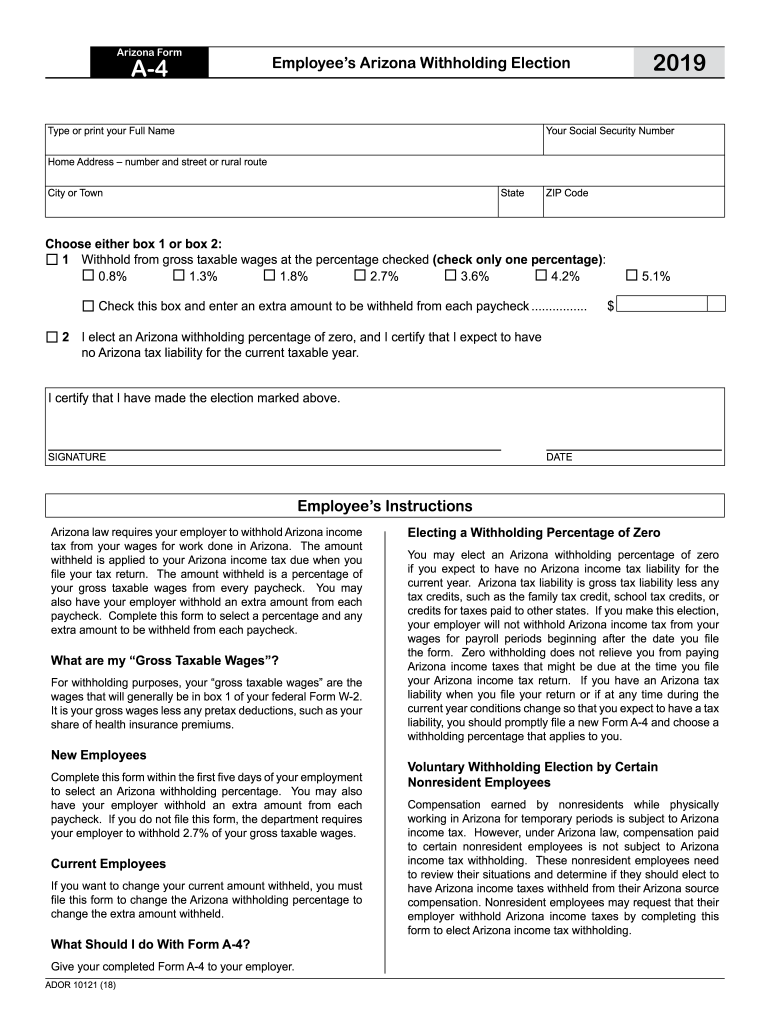

Az Form A 4

Az Form A 4 - State employees on the hris. Request for reduced withholding to designate for tax. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Log in to the editor using your credentials or click on create. Register and log in to your account. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. You can use your results. This form is submitted to the. This form is for income earned in tax year 2022, with tax returns due in april. Electing a withholding percentage of zero you may elect an arizona withholding.

Log in to the editor using your credentials or click on create. Request for reduced withholding to designate for tax. You can use your results. Are al l emp l o yees req u i red to tu rn i n a n ew ari zo n a. You can download or print. Electing a withholding percentage of zero you may elect an arizona withholding. Register and log in to your account. This form is submitted to the. Web make these fast steps to modify the pdf arizona a 4 form online free of charge: State employees on the hris.

Log in to the editor using your credentials or click on create. You can download or print. Web make these fast steps to modify the pdf arizona a 4 form online free of charge: Register and log in to your account. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Are al l emp l o yees req u i red to tu rn i n a n ew ari zo n a. State employees on the hris. This form is submitted to the. This form is for income earned in tax year 2022, with tax returns due in april. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks.

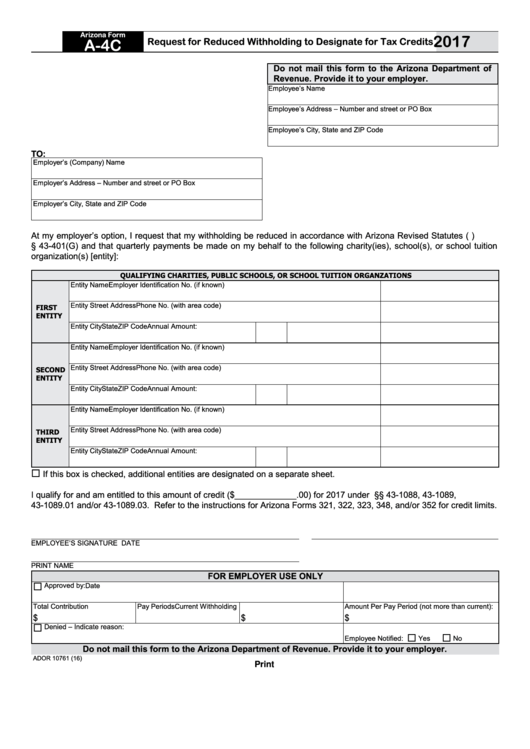

Fillable Arizona Form A4c Request For Reduced Withholding To

You can use your results. Request for reduced withholding to designate for tax. This form is submitted to the. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Electing a withholding percentage of zero you may elect an arizona withholding.

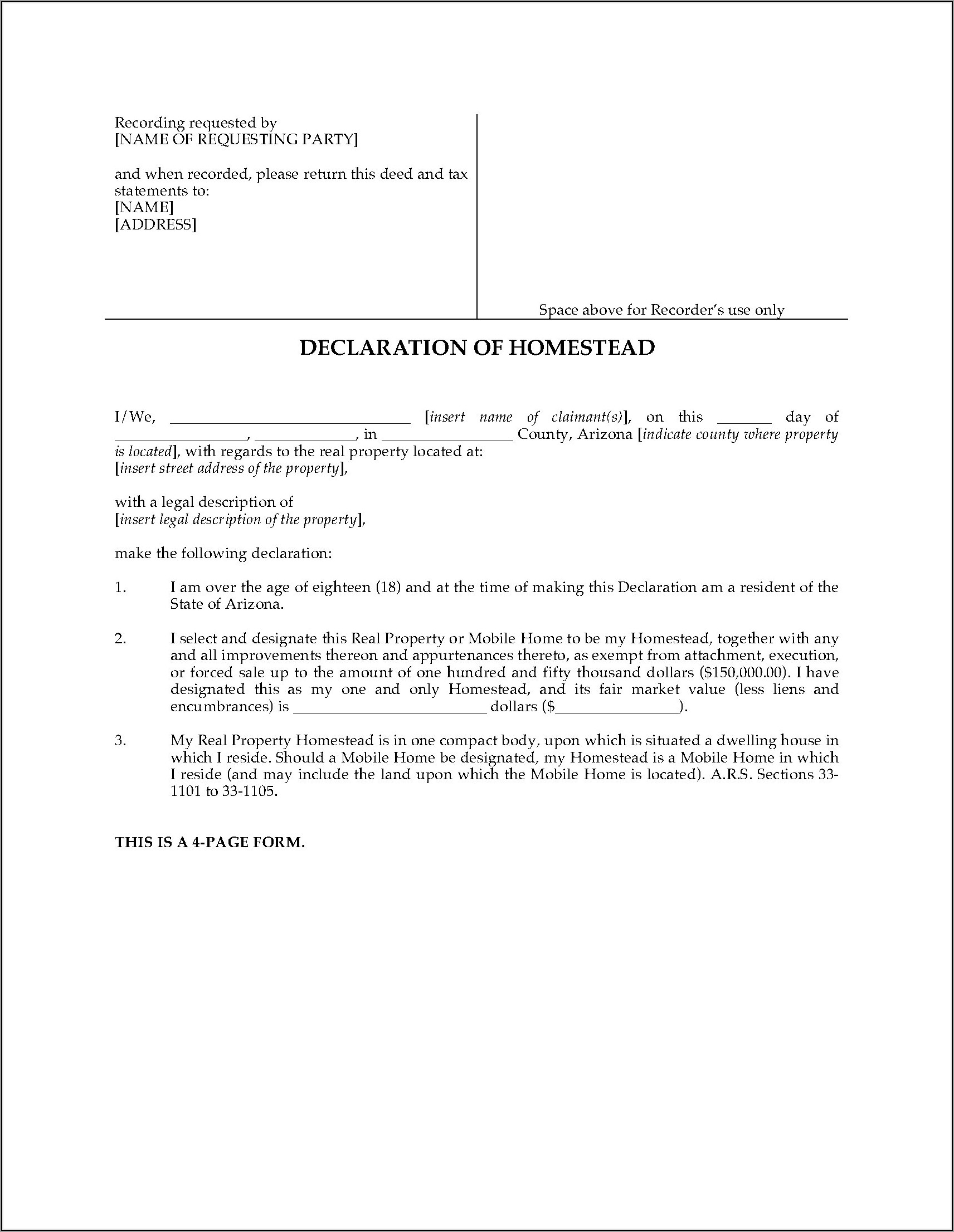

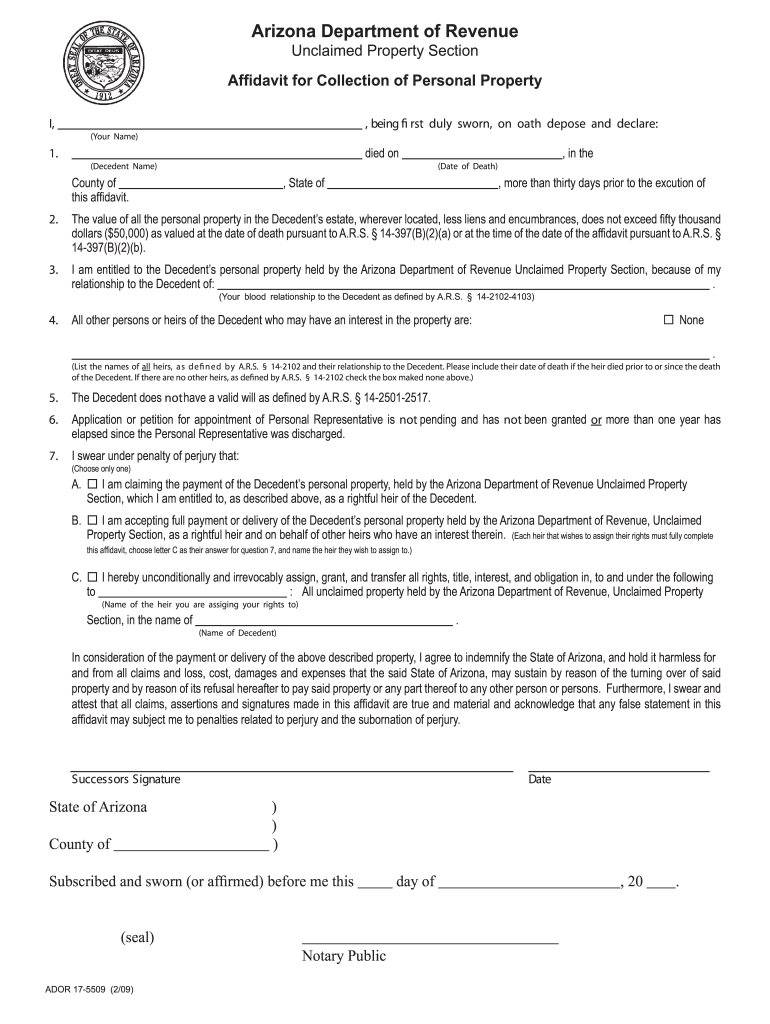

Inheritance Tax Waiver Form Az Form Resume Examples N8VZwyM2we

This form is submitted to the. Request for reduced withholding to designate for tax. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Register and log in to your account. Are al l emp l o yees req u i red to tu rn i n a n.

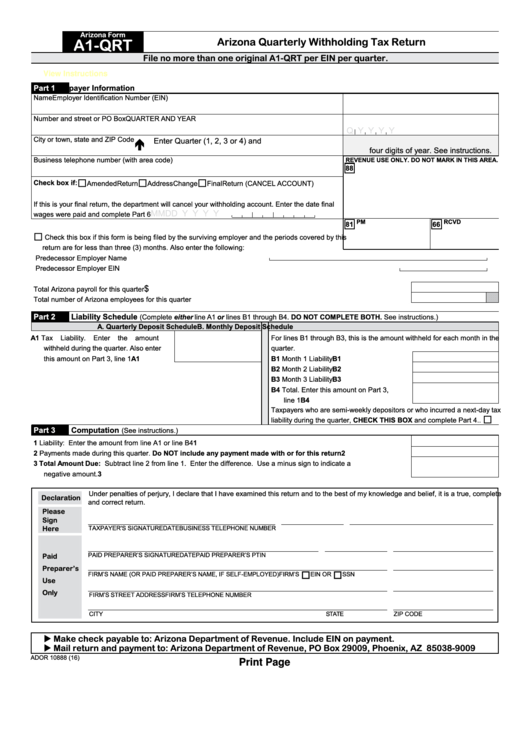

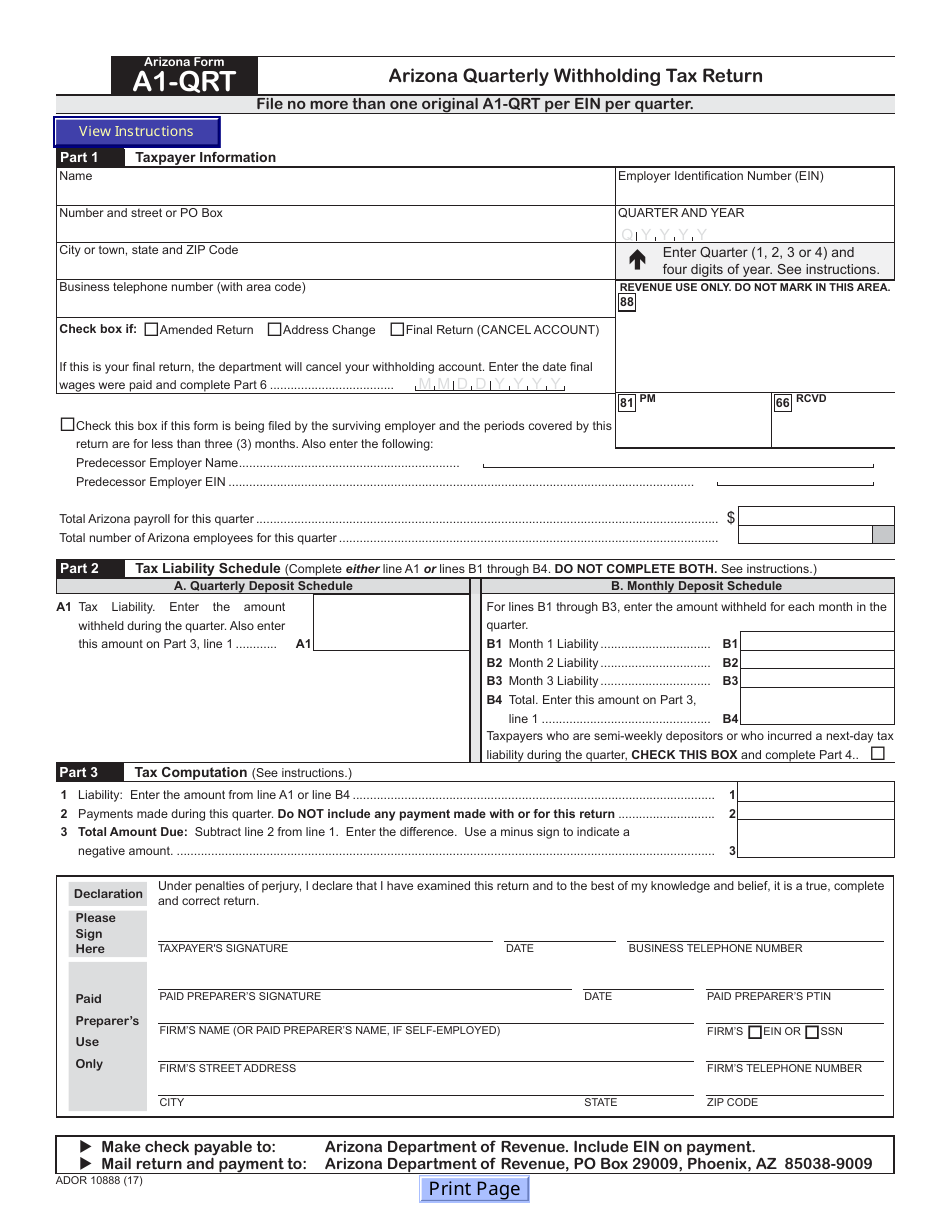

Fillable Arizona Quarterly Withholding Tax Return (Arizona Form A1Qrt

This form is submitted to the. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. This form is for income earned in tax year 2022, with tax returns due in april. You can download or print. Web make these fast steps to modify the pdf arizona a 4 form online free of charge:

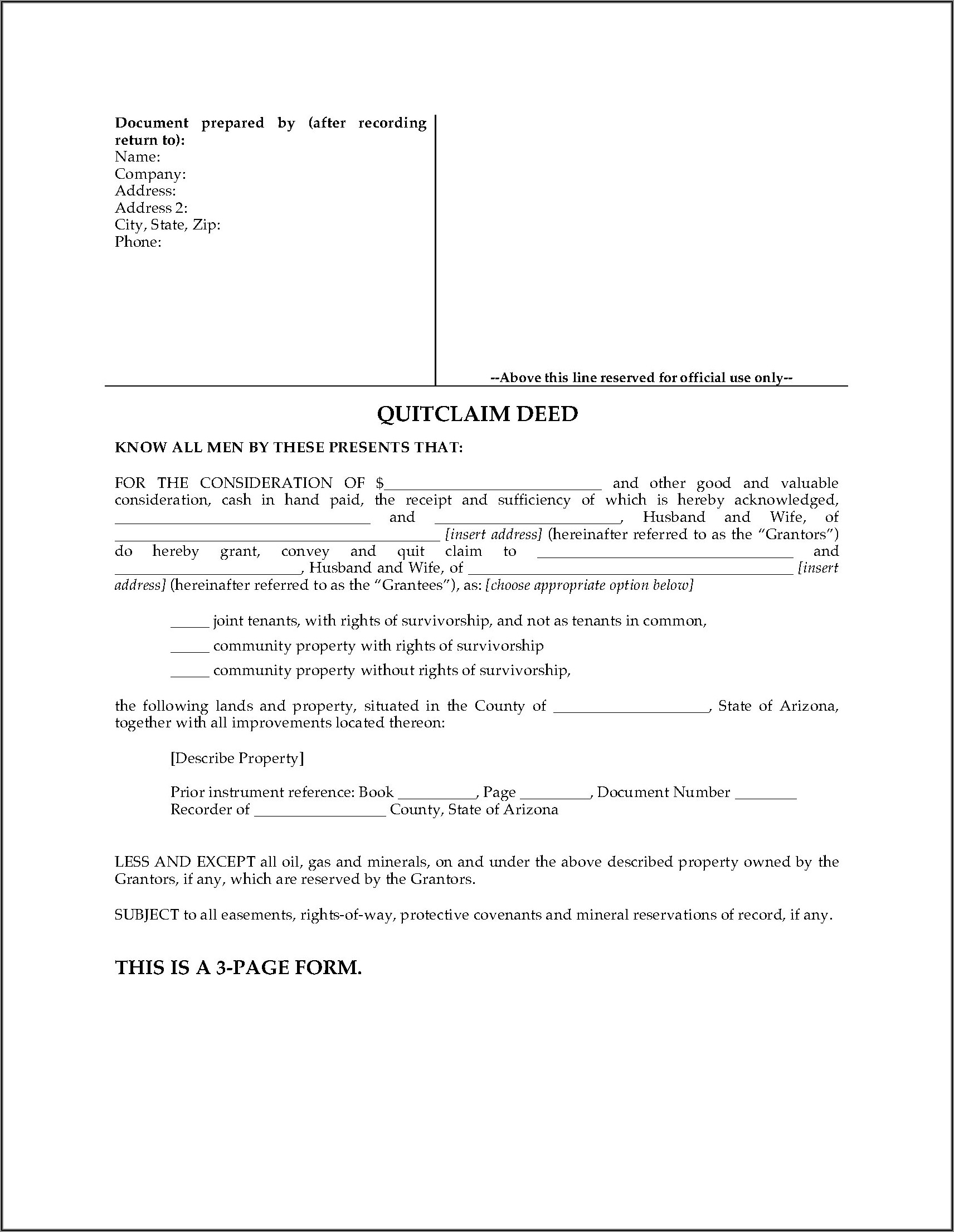

Quitclaim Deed Az Form Form Resume Examples MeVRBv66VD

You can use your results. This form is submitted to the. State employees on the hris. Register and log in to your account. Electing a withholding percentage of zero you may elect an arizona withholding.

2019 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

This form is submitted to the. Log in to the editor using your credentials or click on create. You can use your results. Web make these fast steps to modify the pdf arizona a 4 form online free of charge: This form is for income earned in tax year 2022, with tax returns due in april.

Arizona Form A1QRT (ADOR10888) Download Fillable PDF or Fill Online

Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. Request for reduced withholding to designate for tax. State employees on the hris. You can use your results. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks.

Form 17 5509 Fill Online, Printable, Fillable, Blank pdfFiller

State employees on the hris. Are al l emp l o yees req u i red to tu rn i n a n ew ari zo n a. This form is for income earned in tax year 2022, with tax returns due in april. This form is submitted to the. Request for reduced withholding to designate for tax.

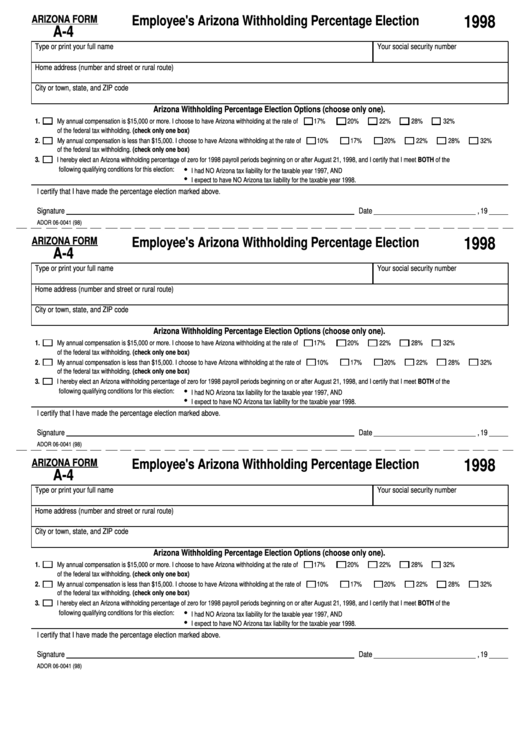

Download Arizona Form A4 (2013) for Free FormTemplate

Electing a withholding percentage of zero you may elect an arizona withholding. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. Request for reduced withholding to designate for tax. State employees on the hris. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona.

Fillable Arizona Form A4 Employee'S Arizona Withholding Percentage

This form is for income earned in tax year 2022, with tax returns due in april. Web arizona residents employed outside of arizona complete this form to elect to have arizona income tax withheld from their paychecks. You can use your results. Electing a withholding percentage of zero you may elect an arizona withholding. Log in to the editor using.

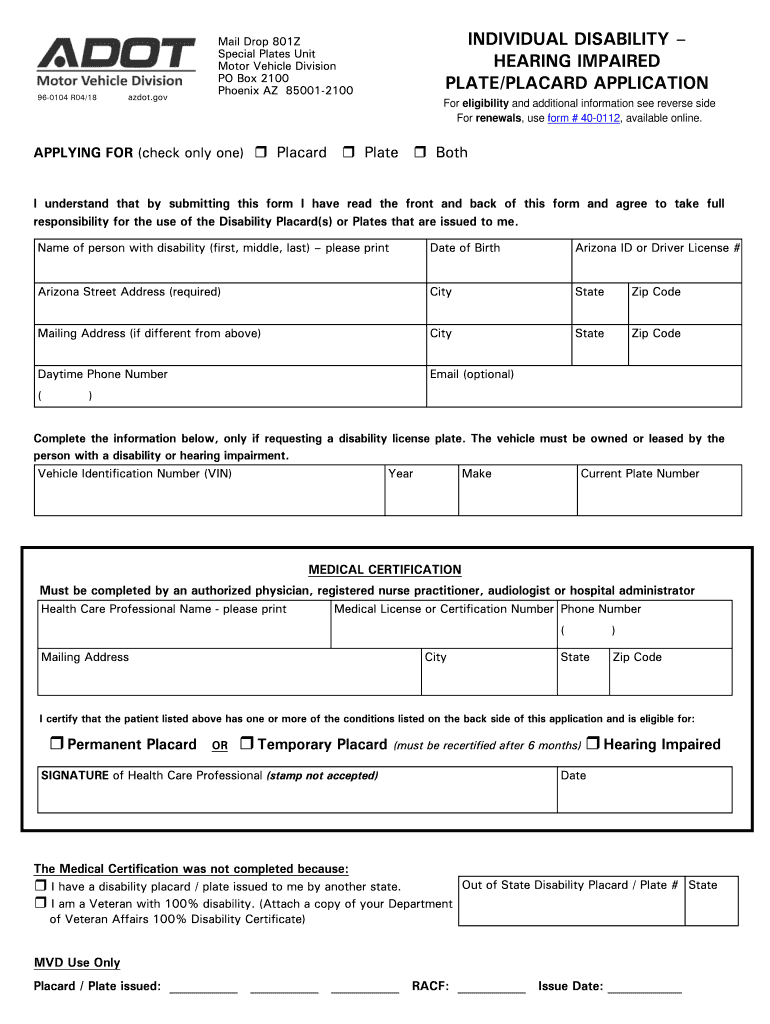

Adot form 96 0104 Fill out & sign online DocHub

This form is submitted to the. Register and log in to your account. Electing a withholding percentage of zero you may elect an arizona withholding. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. You can download or print.

Web Make These Fast Steps To Modify The Pdf Arizona A 4 Form Online Free Of Charge:

This form is submitted to the. Are al l emp l o yees req u i red to tu rn i n a n ew ari zo n a. State employees on the hris. You can use your results.

Electing A Withholding Percentage Of Zero You May Elect An Arizona Withholding.

Request for reduced withholding to designate for tax. Register and log in to your account. Ador 10121 (12) electing a withholding percentage of zero you may elect an arizona. You can download or print.

Web Arizona Residents Employed Outside Of Arizona Complete This Form To Elect To Have Arizona Income Tax Withheld From Their Paychecks.

Log in to the editor using your credentials or click on create. This form is for income earned in tax year 2022, with tax returns due in april.