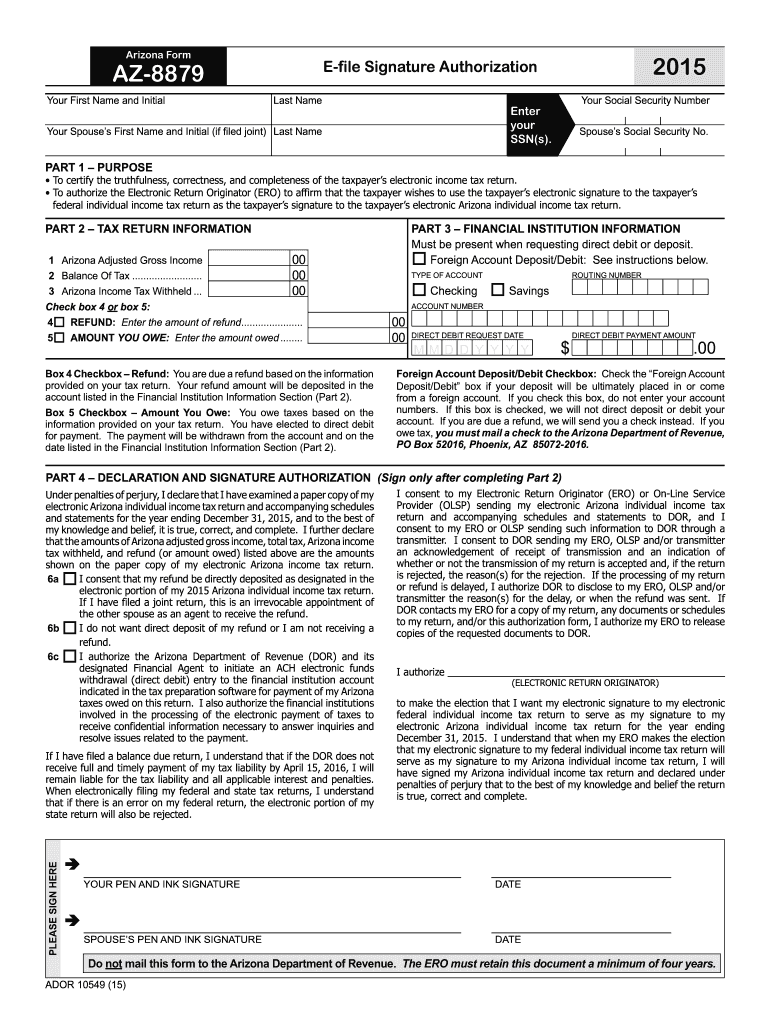

Az Form 8879

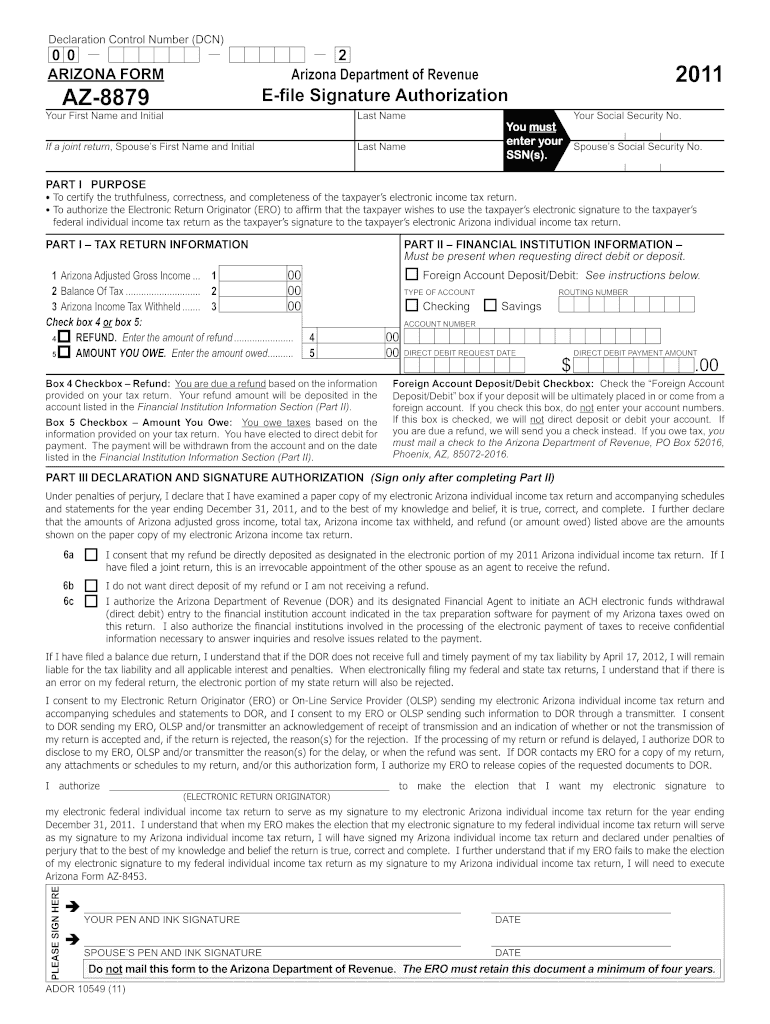

Az Form 8879 - To begin the blank, utilize the fill camp; Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. This form is to certify the truthfulness, correctness and completeness of the taxpayer’s electronic income tax return. Web how to fill out and sign arizona form 8879 online? Arizona requires the date the. Your first name and initial last name your social security. Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an alternative tax for arizona small. Get your online template and fill it in using progressive features. Sign online button or tick the preview image of the blank. Web signature requirements for electronic filing.

Web signature requirements for electronic filing. Sign online button or tick the preview image of the blank. Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an alternative tax for arizona small. Web 26 rows arizona s corporation income tax return. Arizona requires the date the. Get your online template and fill it in using progressive features. Taxpayers can begin filing individual income tax returns. Web how to fill out and sign arizona form 8879 online? Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Did the information on this page answer your question?

Web how to fill out and sign arizona form 8879 online? Web 26 rows arizona s corporation income tax return. Sign online button or tick the preview image of the blank. This form is to certify the truthfulness, correctness and completeness of the taxpayer’s electronic income tax return. Web 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. Arizona requires the date the. Taxpayers can begin filing individual income tax returns. Get your online template and fill it in using progressive features. Complete, edit or print tax forms instantly. To begin the blank, utilize the fill camp;

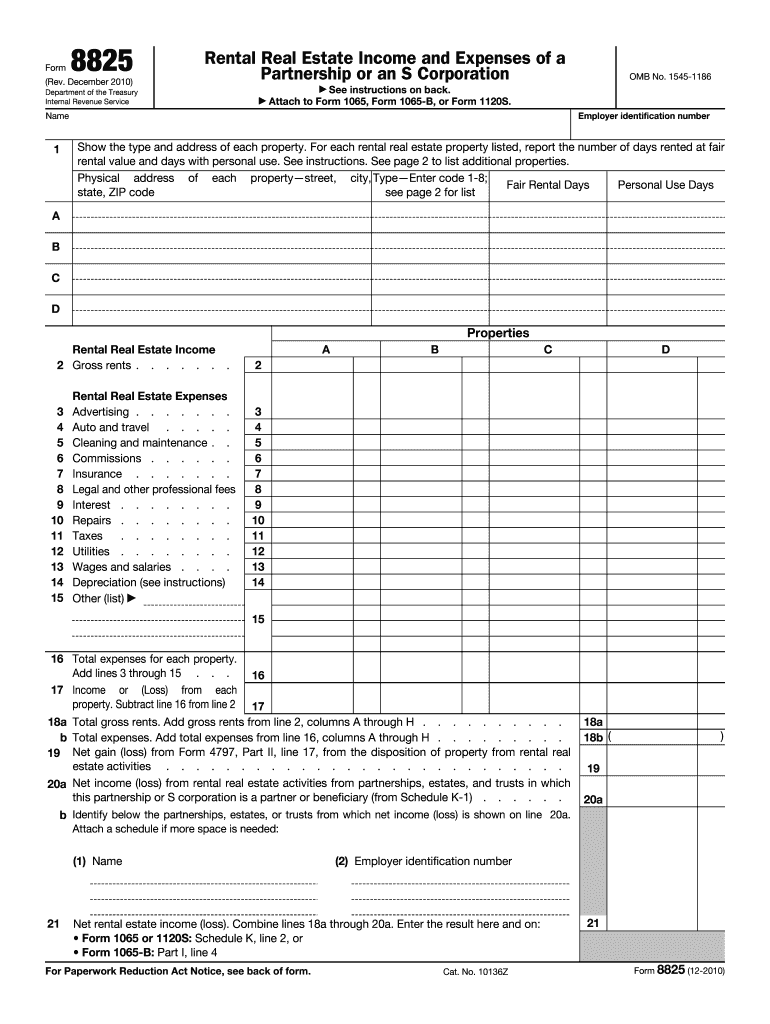

2010 Form IRS 8825 Fill Online, Printable, Fillable, Blank pdfFiller

Web 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Web 26 rows arizona s corporation income tax return. Taxpayers can begin filing individual income tax returns. Complete, edit or print tax forms.

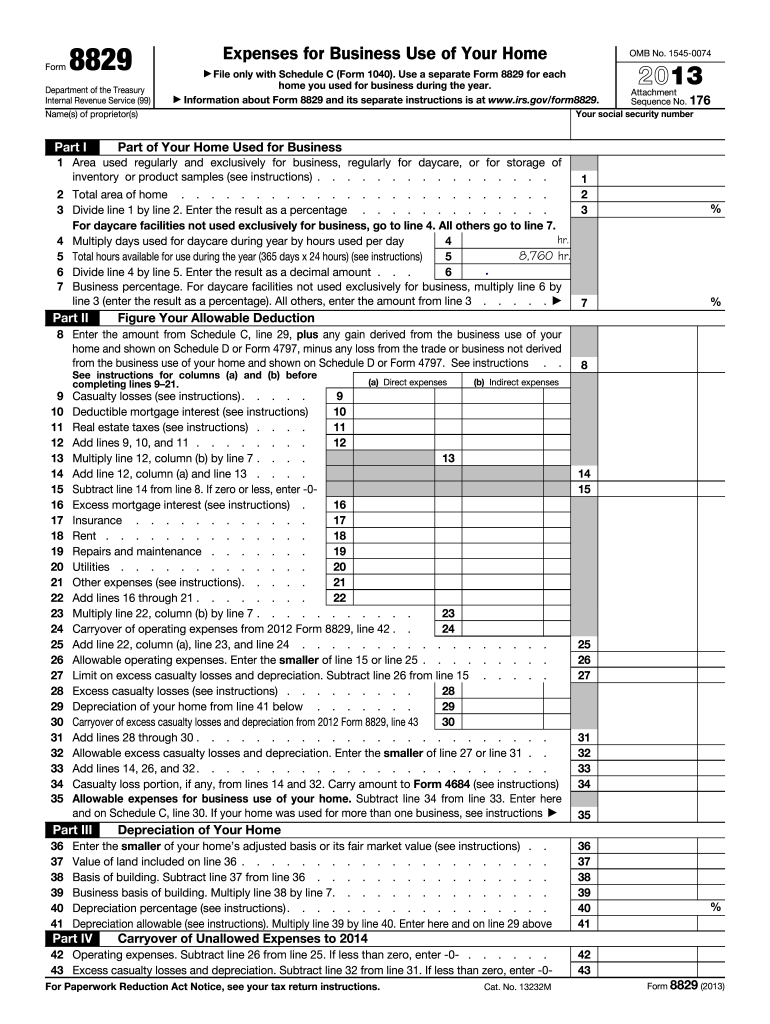

2013 Form IRS 8829 Fill Online, Printable, Fillable, Blank pdfFiller

Sign online button or tick the preview image of the blank. Arizona requires the date the. Web signature requirements for electronic filing. Web 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. Enjoy smart fillable fields and interactivity.

2011 Form AZ ADOR AZ8879 Fill Online, Printable, Fillable, Blank

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Enjoy smart fillable fields and interactivity. Web what is an az 8879 form? Get your online template and fill it in using progressive features. Complete, edit or print tax forms instantly.

form 8879 california 2018 Fill Online, Printable, Fillable Blank

Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web what is an az 8879 form? To begin the blank, utilize the fill camp; Complete, edit or print tax forms instantly. Web 26 rows remember, the starting point of the arizona individual income tax return is the.

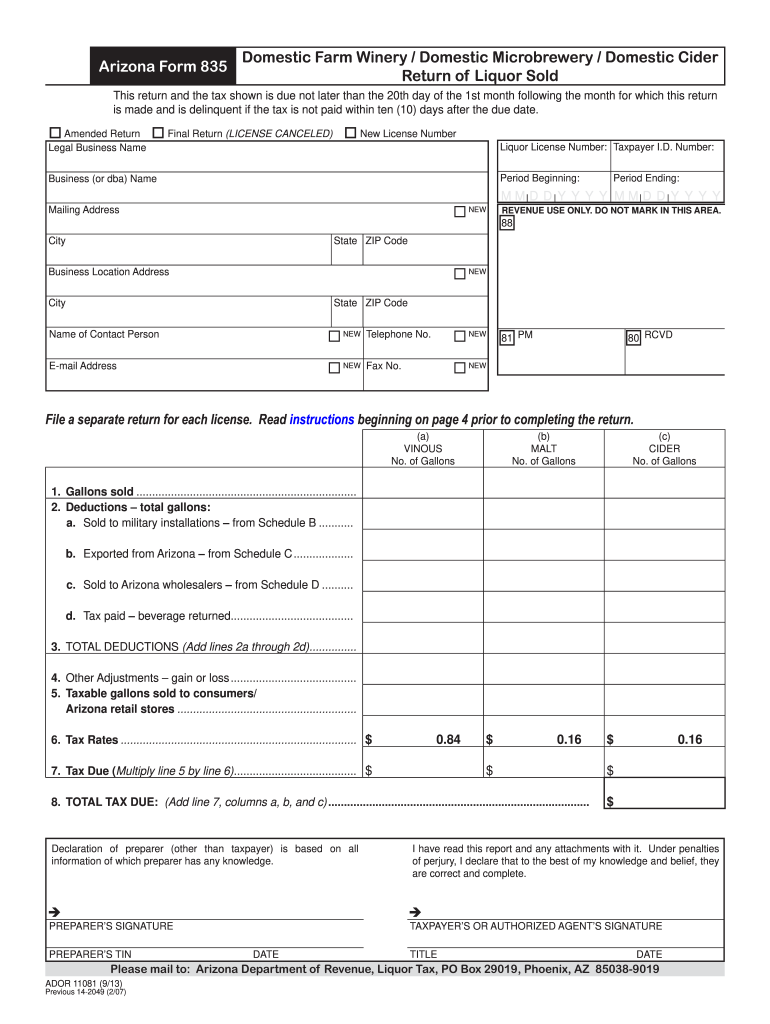

AZ Form 835 2013 Fill out Tax Template Online US Legal Forms

This form is to certify the truthfulness, correctness and completeness of the taxpayer’s electronic income tax return. Web 26 rows arizona s corporation income tax return. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Web what is an az 8879 form? Arizona requires the date the.

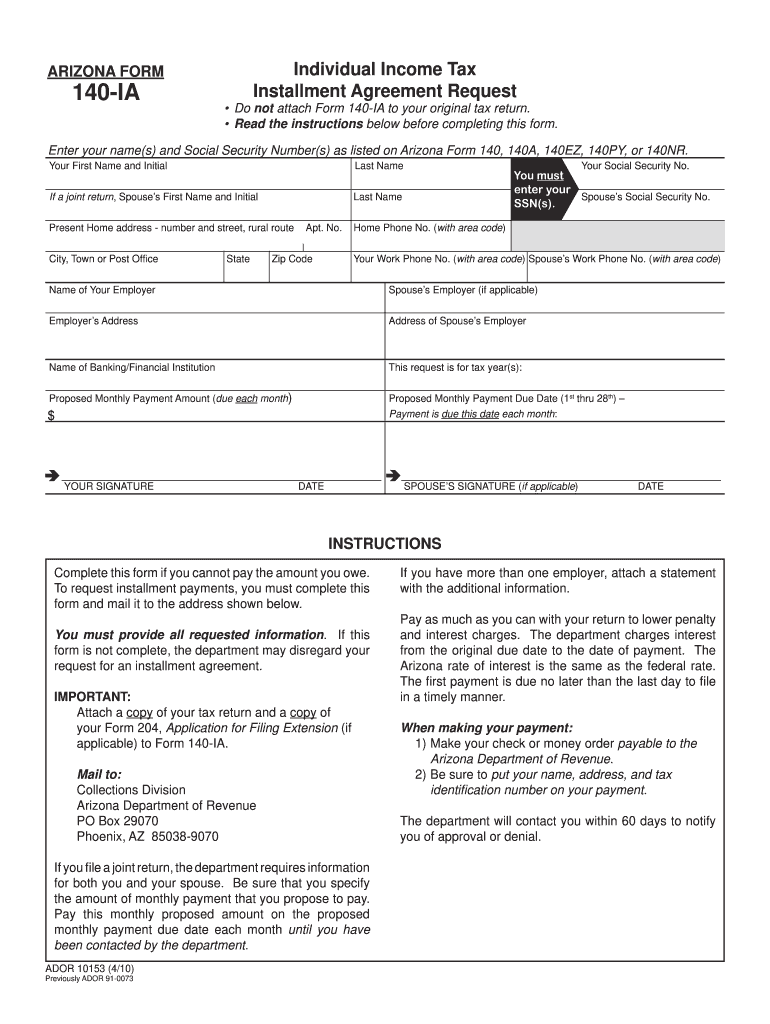

Arizona Form 140IA Arizona Department Of Revenue Fill and Sign

Web signature requirements for electronic filing. Your first name and initial last name your social security. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Complete, edit or print tax forms instantly. To begin the blank, utilize the fill camp;

2016 Form 8879 Edit, Fill, Sign Online Handypdf

Sign online button or tick the preview image of the blank. Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an alternative tax for arizona small. To begin the blank, utilize the fill camp; Enjoy smart fillable fields and interactivity. Did the information on this page.

Form 8879S IRS efile Signature Authorization for Form 1120S (2014

To begin the blank, utilize the fill camp; Web on july 9, 2021 governor ducey signed into law senate bill 1783 establishing title 43 chapter 17 (small businesses, which provides for an alternative tax for arizona small. Enjoy smart fillable fields and interactivity. Web 26 rows remember, the starting point of the arizona individual income tax return is the federal.

Az 8879 Fill Out and Sign Printable PDF Template signNow

This form is to certify the truthfulness, correctness and completeness of the taxpayer’s electronic income tax return. Sign online button or tick the preview image of the blank. Web signature requirements for electronic filing. Arizona has a state income tax that ranges between 2.59% and 4.5% , which is administered by the arizona department of revenue. Type text, complete fillable.

Form 8879F IRS efile Signature Authorization for Form 1041 (2015

Enjoy smart fillable fields and interactivity. Sign online button or tick the preview image of the blank. Get your online template and fill it in using progressive features. Your first name and initial last name your social security. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Web On July 9, 2021 Governor Ducey Signed Into Law Senate Bill 1783 Establishing Title 43 Chapter 17 (Small Businesses, Which Provides For An Alternative Tax For Arizona Small.

Web 26 rows remember, the starting point of the arizona individual income tax return is the federal adjusted gross income. Web 26 rows arizona s corporation income tax return. Your first name and initial last name your social security. Sign online button or tick the preview image of the blank.

Arizona Has A State Income Tax That Ranges Between 2.59% And 4.5% , Which Is Administered By The Arizona Department Of Revenue.

This form is to certify the truthfulness, correctness and completeness of the taxpayer’s electronic income tax return. Arizona requires the date the. Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more. Complete, edit or print tax forms instantly.

Enjoy Smart Fillable Fields And Interactivity.

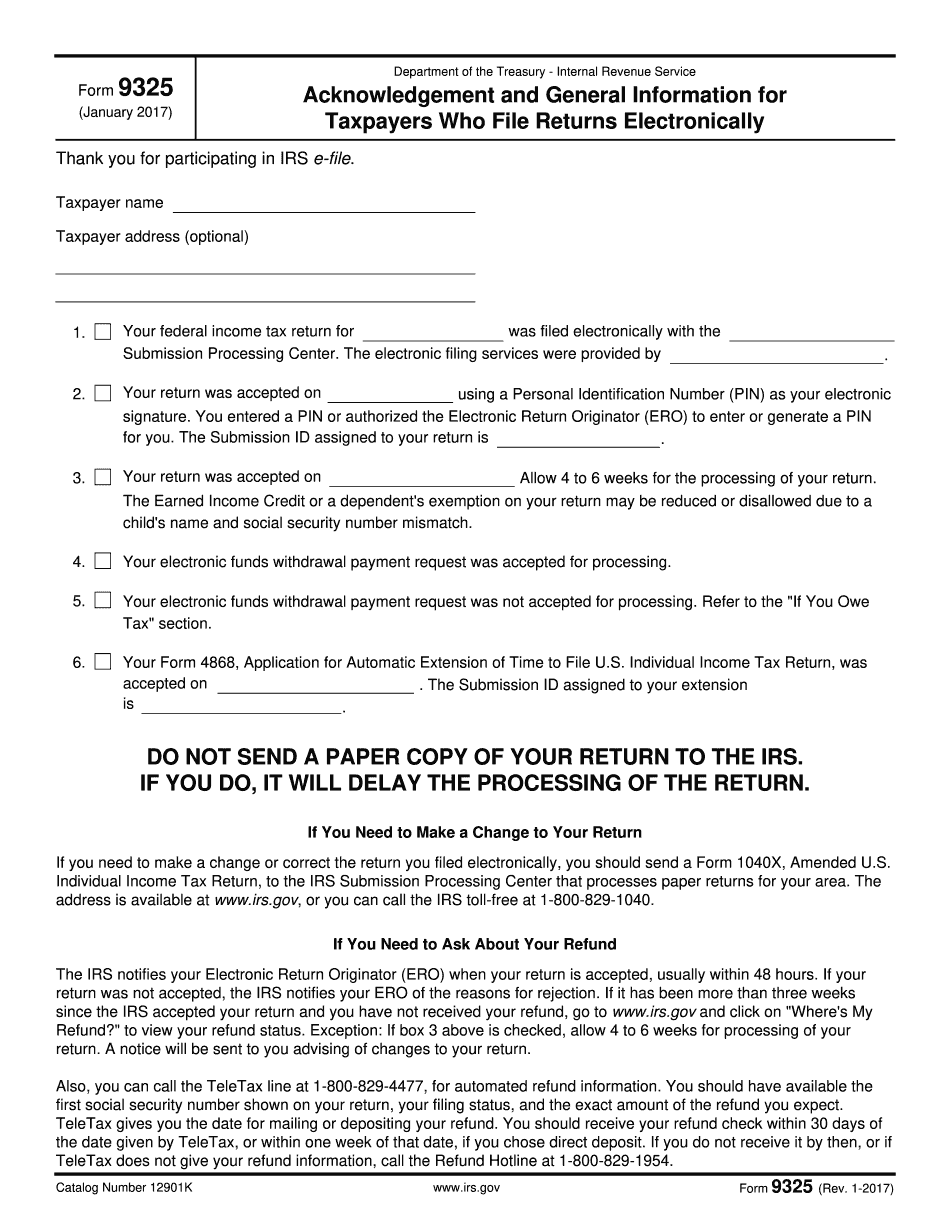

Web how to fill out and sign arizona form 8879 online? Web signature requirements for electronic filing. Did the information on this page answer your question? Web what is an az 8879 form?

To Begin The Blank, Utilize The Fill Camp;

Get your online template and fill it in using progressive features. Taxpayers can begin filing individual income tax returns.