Arkansas State Tax Withholding Form 2023

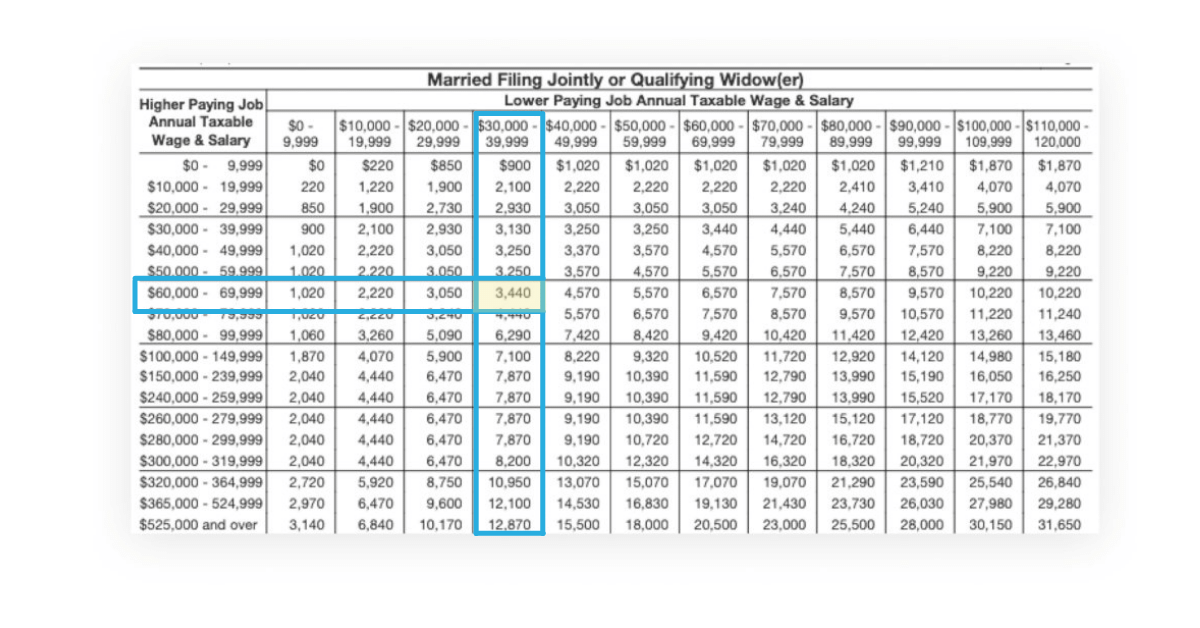

Arkansas State Tax Withholding Form 2023 - Web the supplemental withholding rate, which is the highest marginal tax rate, is changed from 4.9% to 4.7%. Web want withholding, complete another form ar4p and submit it to your payer. Ssc 425 little rock, ar. Ar1000v individual income tax payment voucher: Web state of arkansas department of finance and administration july 31, 2023. Web arkansas state tax tables, tax year: All retailers that are registered for arkansas sales tax and sell qualifying products must participate in. 10/01/2022 page 3 of 11 change of address. Web state of arkansas withholding tax revised: Enter the amount paid for this monthly reporting.

Unless changes are required, employees who have submitted a w. Ssc 425 little rock, ar. The following updated withholding formula and tax tables are effective. Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of. To notify the withholding tax section of a mailing address change, or business. Web state of arkansas arkansas individual income tax section withholding branch p. Ar1000v individual income tax payment voucher: Web arkansas state tax tables, tax year: Web state of arkansas department of finance and administration july 31, 2023. If you make $70,000 a year living in arkansas you will be taxed $11,683.

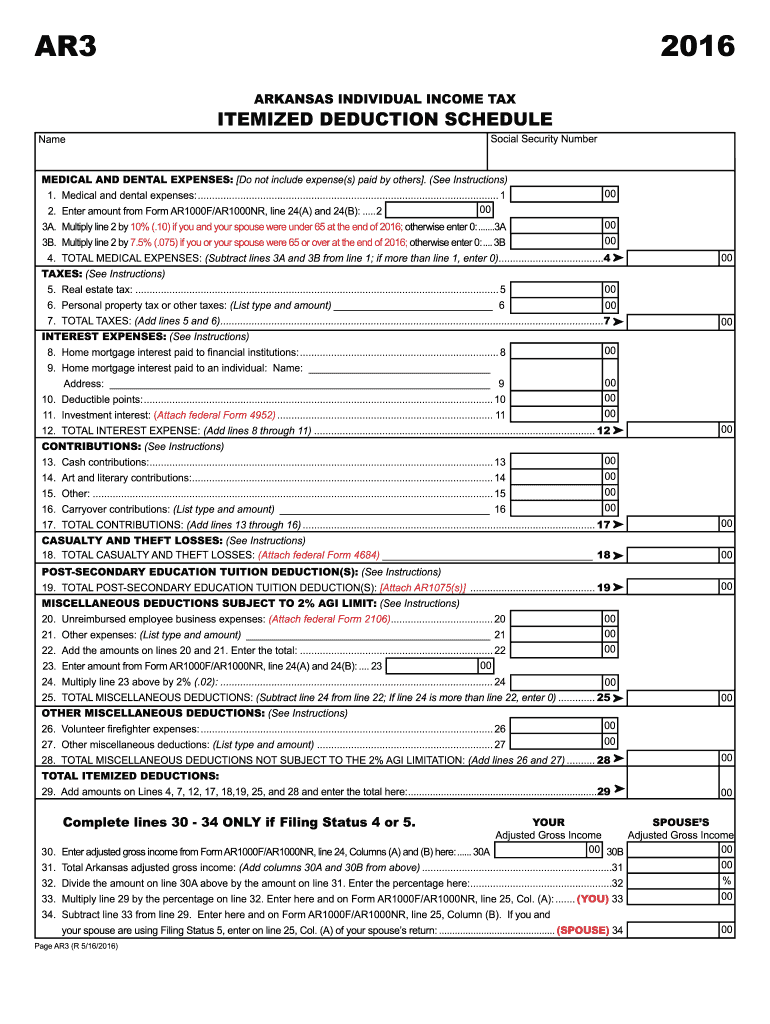

Individuals with simple tax returns may instead file a simplified return, form ar1000s. Web arkansas form ar1000f must be filed by all qualifying taxpayers yearly. Web arkansas state income tax withholding. Enter the total amount of arkansas income tax withheld for this monthly reporting period only. Unless changes are required, employees who have submitted a w. 10/01/2022 page 3 of 11 change of address. Ar1000v individual income tax payment voucher: Arkansas income tax table learn how marginal tax brackets work 2. The following updated withholding formula and tax tables are effective. Arkansas income tax calculator how to use this calculator you can use our free arkansas income tax.

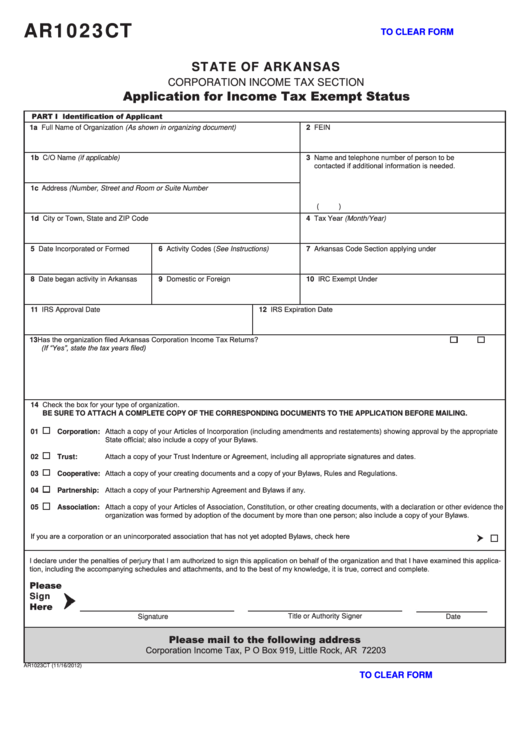

Fillable Form Ar1023ct Arkansas Application For Tax Exempt

Arkansas federal and state income tax rate. Web arkansas state tax tables, tax year: Web state of arkansas arkansas individual income tax section withholding branch p. Arkansas income tax calculator how to use this calculator you can use our free arkansas income tax. Web arkansas state income tax withholding.

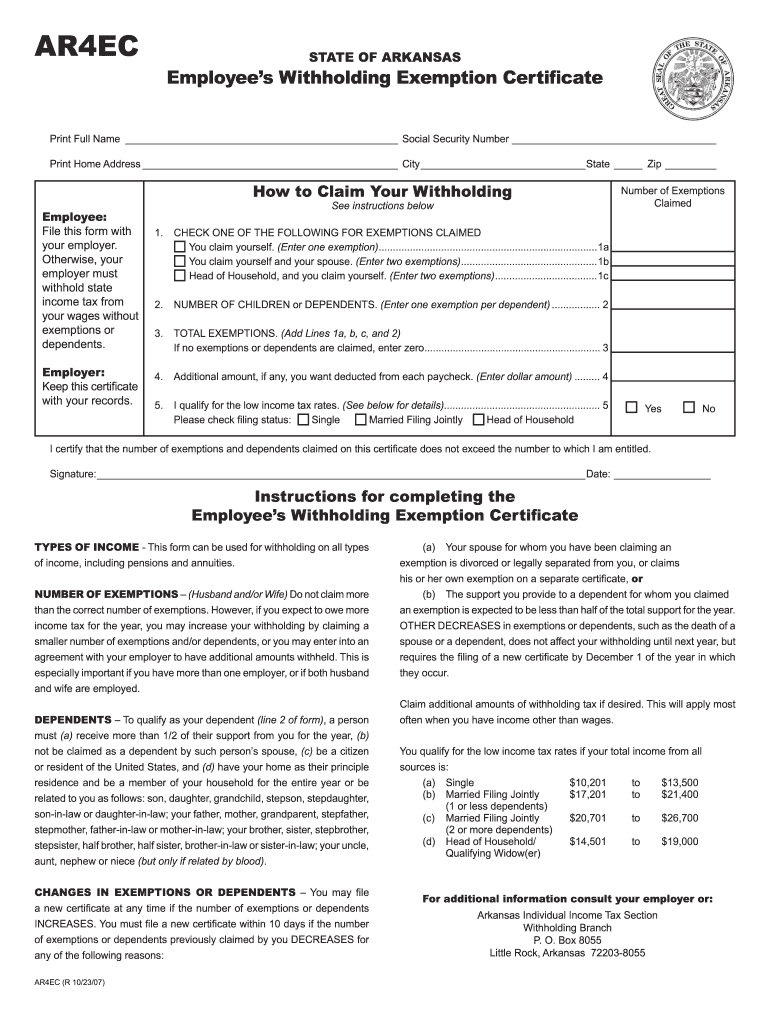

Employee's Withholding Exemption Certificate Arkansas Free Download

Web state of arkansas withholding tax revised: Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Enter the total amount of arkansas income tax withheld for this monthly reporting period only. Web state of arkansas arkansas individual income tax section.

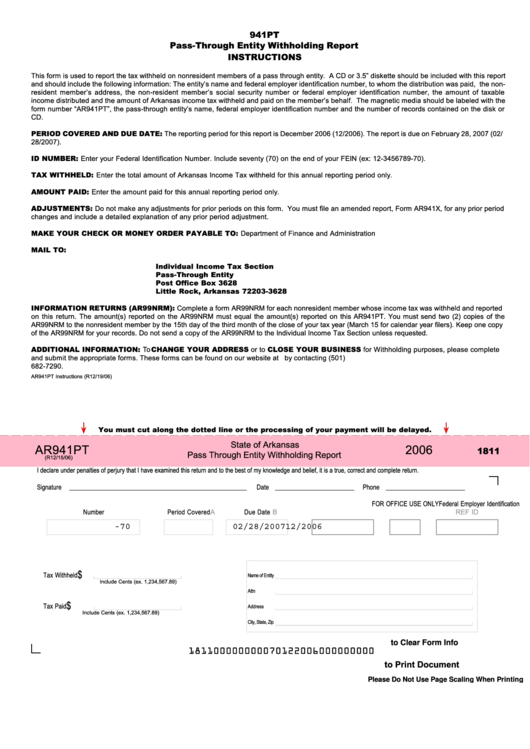

Fillable Form Ar941pt State Of Arkansas Pass Through Entity

If you want state income tax withheld at the rate set by law (married with three allowances), write. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip certify that the number. Web however, if you expect to owe more income tax for the year, you may increase your.

Arkansas State Tax Form and Booklet Fill Out and Sign

Enter the amount paid for this monthly reporting. Unless changes are required, employees who have submitted a w. Individuals with simple tax returns may instead file a simplified return, form ar1000s. Web state of arkansas department of finance and administration july 31, 2023. To notify the withholding tax section of a mailing address change, or business.

Federal Withholding Calculator 2023 Per Paycheck Hashimdenver Gambaran

Web arkansas state income tax withholding. Enter the amount paid for this monthly reporting. All retailers that are registered for arkansas sales tax and sell qualifying products must participate in. Web employee’s state withholding exemption certificate (form ar4ec) contact. Web state of arkansas department of finance and administration july 31, 2023.

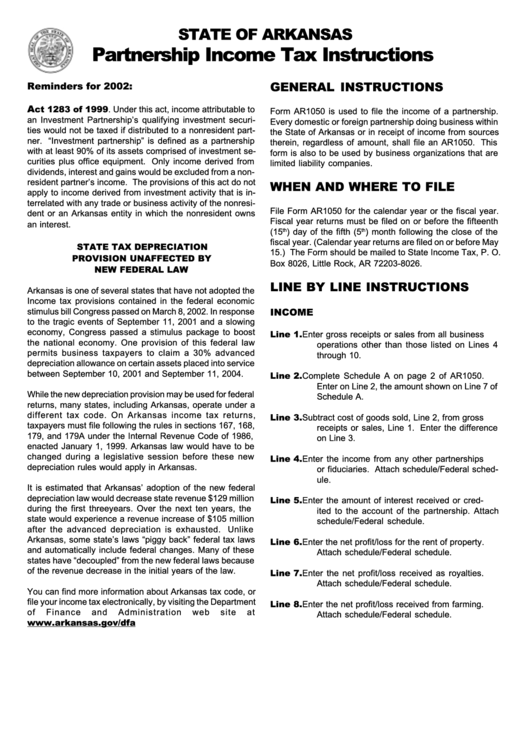

State Of Arkansas Partnership Tax Instructions printable pdf

Web employee’s state withholding exemption certificate (form ar4ec) contact. If you want state income tax withheld at the rate set by law (married with three allowances), write. Arkansas income tax table learn how marginal tax brackets work 2. Web state of arkansas department of finance and administration july 31, 2023. Web arkansas state income tax withholding.

Arkansas Employee Tax Withholding Form 2023

Web employee’s state withholding exemption certificate (form ar4ec) contact. Web arkansas form ar1000f must be filed by all qualifying taxpayers yearly. Enter the amount paid for this monthly reporting. Arkansas income tax calculator how to use this calculator you can use our free arkansas income tax. Web state of arkansas arkansas individual income tax section withholding branch p.

Ar4ec Fill out & sign online DocHub

Vice chancellor for finance & administration 2801 s. All retailers that are registered for arkansas sales tax and sell qualifying products must participate in. 10/01/2022 page 3 of 11 change of address. Web state of arkansas department of finance and administration july 31, 2023. Individuals with simple tax returns may instead file a simplified return, form ar1000s.

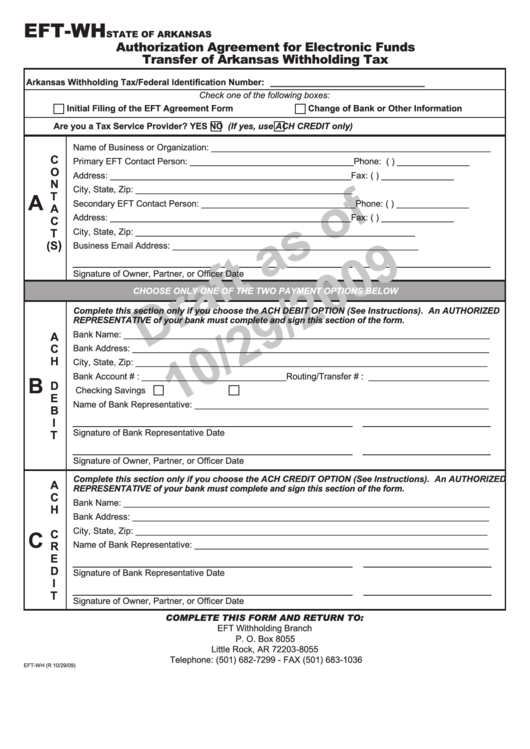

Form EftWh Draft Authorization Agreement For Electronic Funds

Web employee’s state withholding exemption certificate (form ar4ec) contact. The following updated withholding formula and tax tables are effective. Arkansas federal and state income tax rate. Web state of arkansas department of finance and administration july 31, 2023. Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller.

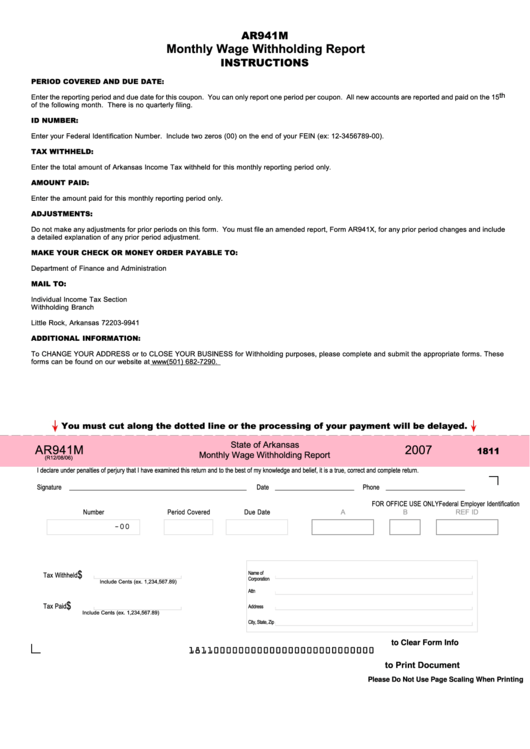

Fillable Form Ar941m State Of Arkansas Monthly Wage Withholding

Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip certify that the number. Web state of arkansas department of finance and administration july 31, 2023. Web state of arkansas arkansas individual income tax section withholding branch p. 2023 & previous versions save time and cut cost try qb.

Arkansas Income Tax Calculator How To Use This Calculator You Can Use Our Free Arkansas Income Tax.

All retailers that are registered for arkansas sales tax and sell qualifying products must participate in. Web the supplemental withholding rate, which is the highest marginal tax rate, is changed from 4.9% to 4.7%. Web employee’s state withholding exemption certificate (form ar4ec) contact. If you make $70,000 a year living in arkansas you will be taxed $11,683.

Web Arkansas Form Ar1000F Must Be Filed By All Qualifying Taxpayers Yearly.

Web want withholding, complete another form ar4p and submit it to your payer. Web state of arkansas withholding tax tax year 2023 formula method employers having electronic systems are authorized to use the following formula to compute the amount of. The following updated withholding formula and tax tables are effective. Enter the total amount of arkansas income tax withheld for this monthly reporting period only.

Arkansas Income Tax Table Learn How Marginal Tax Brackets Work 2.

Web arkansas state tax tables, tax year: Web however, if you expect to owe more income tax for the year, you may increase your withholding by claiming a smaller number of exemptions and/or dependents, or you. Arkansas federal and state income tax rate. 10/01/2022 page 3 of 11 change of address.

Web State Of Arkansas Withholding Tax Revised:

Unless changes are required, employees who have submitted a w. Web ar4ec state of arkansas employee’s withholding exemption certificate print full name social security number print home address city state zip certify that the number. Web state of arkansas arkansas individual income tax section withholding branch p. To notify the withholding tax section of a mailing address change, or business.