Arizona State Tax Form 2023

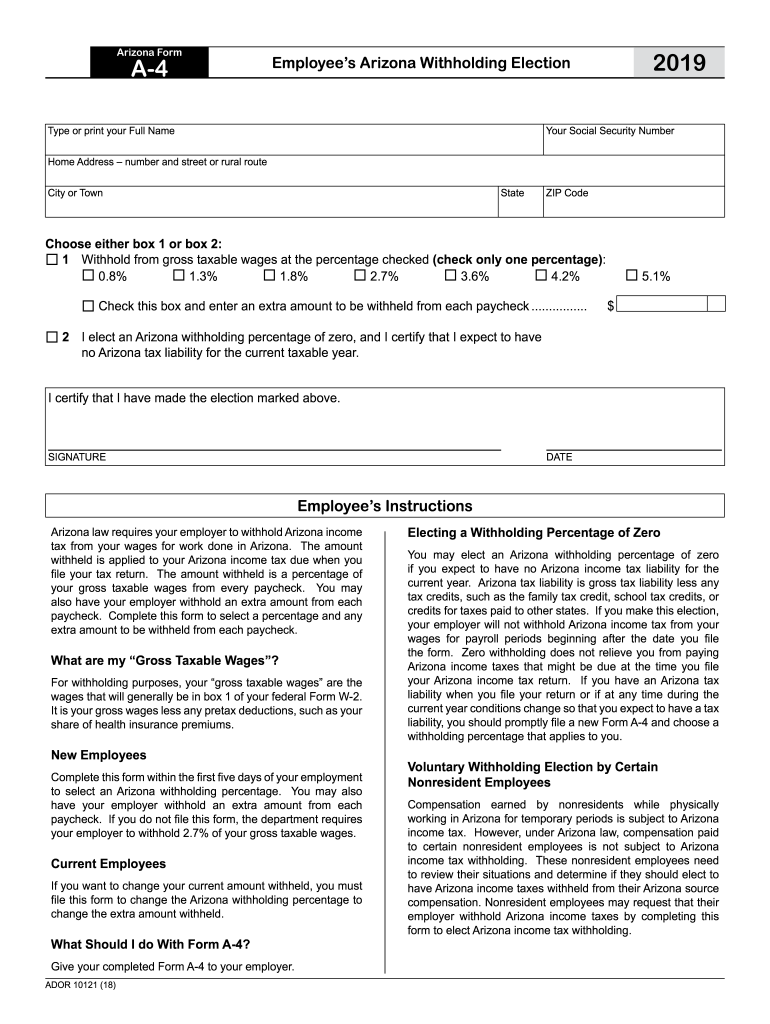

Arizona State Tax Form 2023 - Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Arizona's new rate of 2.5% for individuals kicked in jan. Payment for unpaid income tax small business payment type options include: 1, and new state forms are available for employees here who want to adjust their withholding. Web july 26, 2023. Sign, mail form 140x to one of the addresses listed above. Check the proper check box on the form. Web corporate tax forms : 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Income tax return, tax amendment, change of address.

Your taxable income is less than $50,000 regardless of your filing status. Arizona corporation income tax return (short form) corporate tax forms : Web friday, july 28, 2023. For more information on this change, please visit. Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot for voters before the current bill sunsets in 2025. Web home inspector certification renewal form. Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. 1, and new state forms are available for employees here who want to adjust their withholding. Web notable deaths in 2023 human. 2022 arizona state income tax rates and tax brackets arizona state income tax.

Employer's election to not withhold arizona taxes in december (includes instructions) withholding forms : 1 withhold from gross taxable wages at the percentage checked (check only one percentage): 2022 arizona state income tax rates and tax brackets arizona state income tax. Web aztaxes.gov allows electronic filing and payment of transaction privilege tax (tpt), use taxes, and withholding taxes. Select the az form 140x by tax year below. If this email was forwarded to you and you would like to receive future emails, subscribe to the business offices email list. The year starts on the day following the expiration date of your. The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing season. Arizona's new rate of 2.5% for individuals kicked in jan. Web make an individual or small business income payment individual payment type options include:

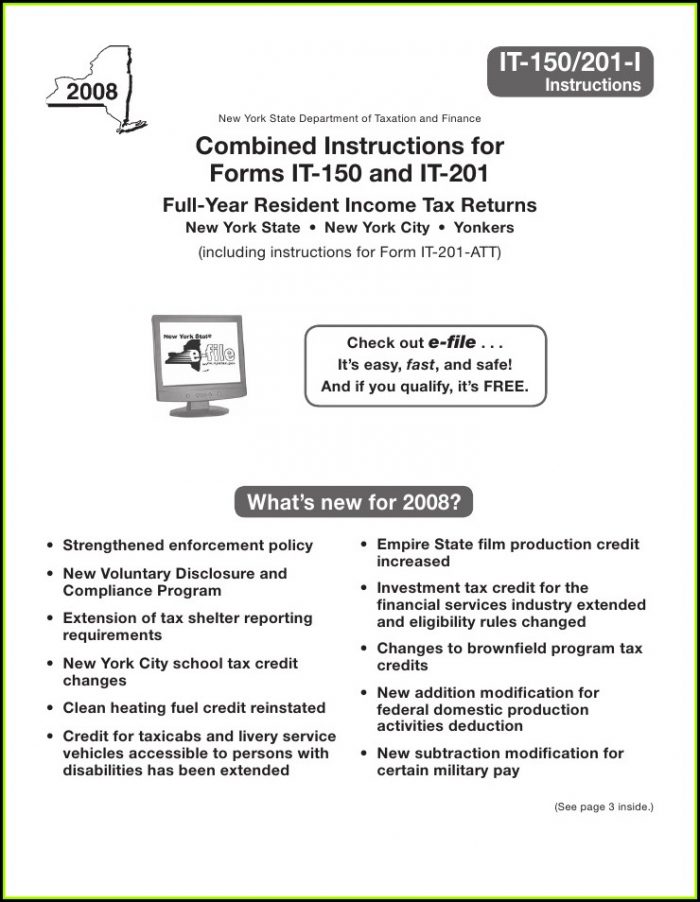

Ny State Tax Extension Form It 201 Form Resume Examples MW9pX8Z9AJ

Employer's election to not withhold arizona taxes in december (includes instructions) withholding forms : Previously (and for the 2022 tax year), arizonans had to pay one of two tax rates: Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Web aztaxes.gov allows electronic filing and payment.

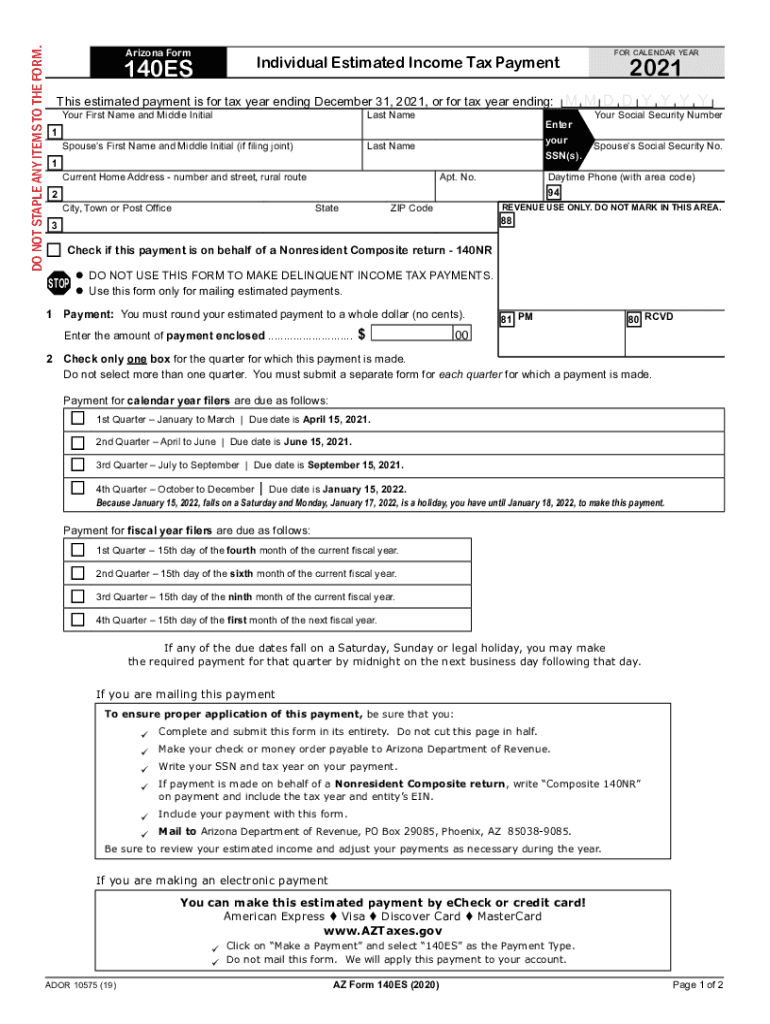

Arizona form 140 es Fill out & sign online DocHub

Your taxable income is less than $50,000 regardless of your filing status. Arizona corporation income tax return (short form) corporate tax forms : Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate of 2.5%. Because arizona electronic income tax returns are processed and accepted through the irs first, arizona’s electronic filing.

Gallery of Arizona State Tax form 2018 Unique New Hire forms Template

1, and new state forms are available for employees here who want to adjust their withholding. 2022 arizona state income tax rates and tax brackets arizona state income tax. Az tax amendment form 140x. You are single, or if married, you and your spouse are filing a joint return. The arizona department of revenue will follow the internal revenue service.

Free Arizona State Tax Power of Attorney (Form 285) PDF

This form can be used to file an: Choose either box 1 or box 2: State of arizona board of technical registration. Web corporate tax forms : Web make an individual or small business income payment individual payment type options include:

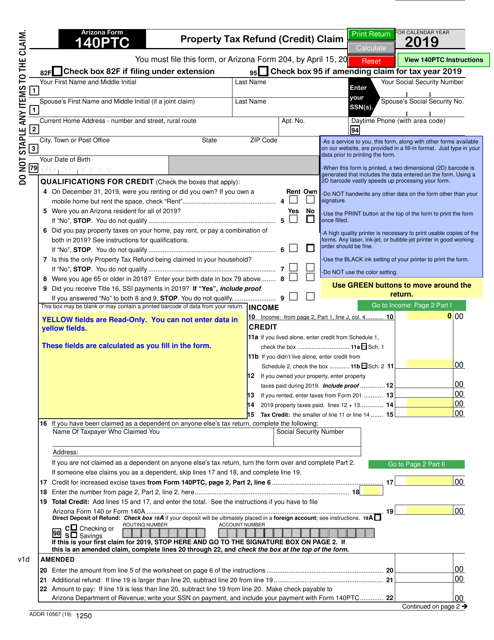

Arizona Form 140PTC (ADOR10567) Download Fillable PDF or Fill Online

Web notable deaths in 2023 human. You are single, or if married, you and your spouse are filing a joint return. Choose either box 1 or box 2: Select the az form 140x by tax year below. Web corporate tax forms :

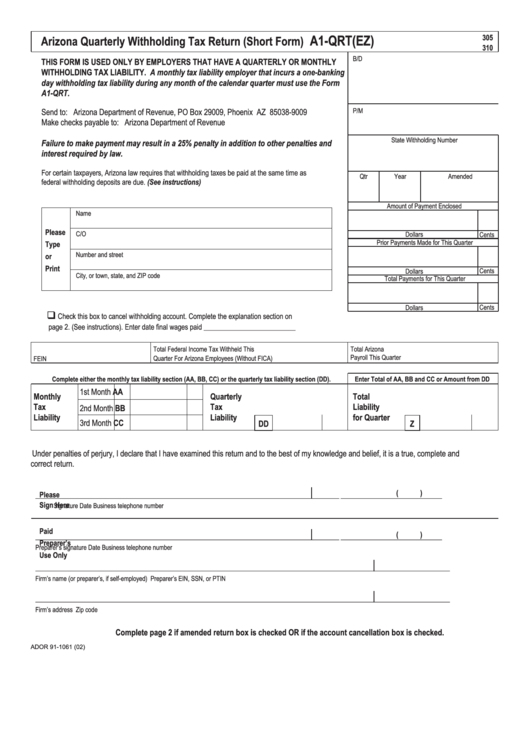

Form A1Qrt(Ez) Arizona Quarterly Withholding Tax Return (Short Form

Arizona quarterly withholding tax return: Be sure to verify that the form you are downloading is for the correct year. Payment for unpaid income tax small business payment type options include: In 2021, the arizona legislature passed senate bill. Form 140 arizona resident personal income tax.

Fillable Online Arizona Form 140IA Arizona Department of Revenue Fax

Single filers with a taxable income of up to $28,652 paid a 2.55% rate, and anyone that made more than that paid 2.98%. Your taxable income is less than $50,000 regardless of your filing status. Arizona s corporation income tax return: Arizona quarterly withholding tax return: Arizona's new rate of 2.5% for individuals kicked in jan.

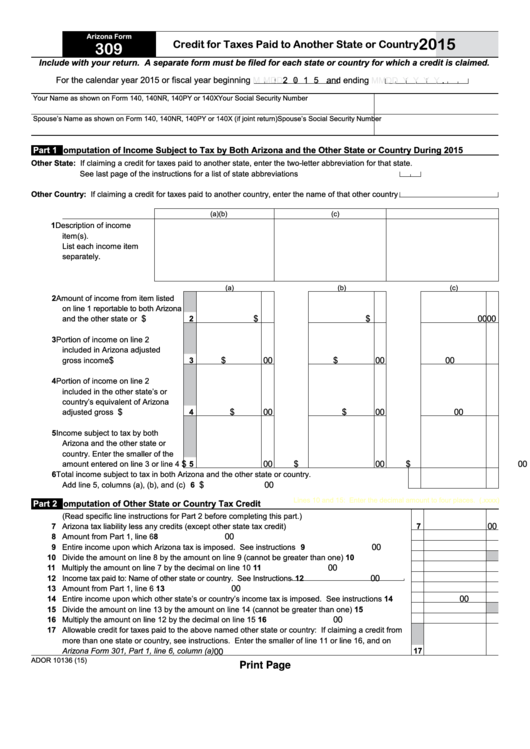

Fillable Arizona Form 309 Credit For Taxes Paid To Another State Or

Arizona quarterly withholding tax return: Web individual income tax forms. In 2021, the arizona legislature passed senate bill. Doug ducey for 2023, a year earlier than scheduled. Keep in mind that some states will not update their tax forms for 2023 until january 2024.

A4 Form Fill Out and Sign Printable PDF Template signNow

The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing season. Web home inspector certification renewal form. The new tax makes arizona’s flat rate the lowest in the country — but it was never voted on by the public. Check the proper check box on the form. 1, and.

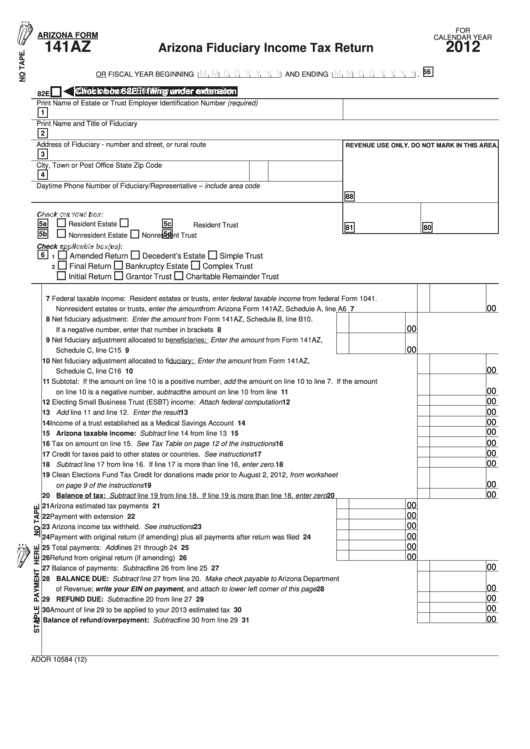

Fillable Arizona Form 141az Arizona Fiduciary Tax Return

Employer's election to not withhold arizona taxes in december (includes instructions) withholding forms : The year starts on the day following the expiration date of your. Web tax rates used on arizona’s withholding certificate are to decrease for 2023, and all taxpayers must complete a new form for 2023, the state revenue department said oct. Web for the 2023 tax.

You Are Single, Or If Married, You And Your Spouse Are Filing A Joint Return.

You may use form 140ez if all of the following apply: Payment for unpaid income tax small business payment type options include: Web 1 day agothe arizona legislature on july 31, 2023, approved placing an extension of maricopa county's transportation tax on the ballot for voters before the current bill sunsets in 2025. The new tax makes arizona’s flat rate the lowest in the country — but it was never voted on by the public.

Quarterly Payment Of Reduced Withholding For Tax Credits:.

Flush with a budget surplus. Be sure to verify that the form you are downloading is for the correct year. 1 withhold from gross taxable wages at the percentage checked (check only one percentage): Choose either box 1 or box 2:

State Of Arizona Board Of Technical Registration.

If this email was forwarded to you and you would like to receive future emails, subscribe to the business offices email list. Web corporate tax forms : Sign, mail form 140x to one of the addresses listed above. Web for the 2023 tax year (taxes filed in 2024), arizona will begin imposing a flat tax rate of 2.5%.

It Had Stopped 10,000 Pounds Of Fentanyl From Entering Arizona And Southern California From Mexico, The Special Name Attached To The Counternarcotics Initiative.

The arizona department of revenue will follow the internal revenue service (irs) announcement regarding the start of the 2022 electronic filing season. Doug ducey for 2023, a year earlier than scheduled. The year starts on the day following the expiration date of your. Web home inspector certification renewal form.