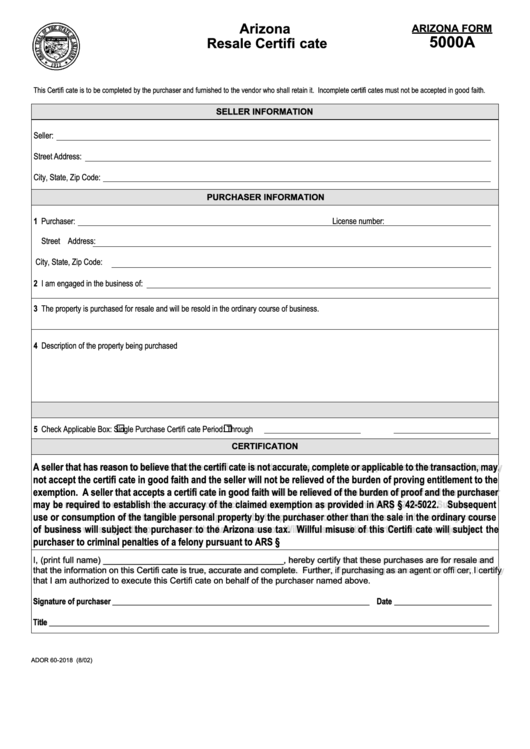

Arizona Form 5000A

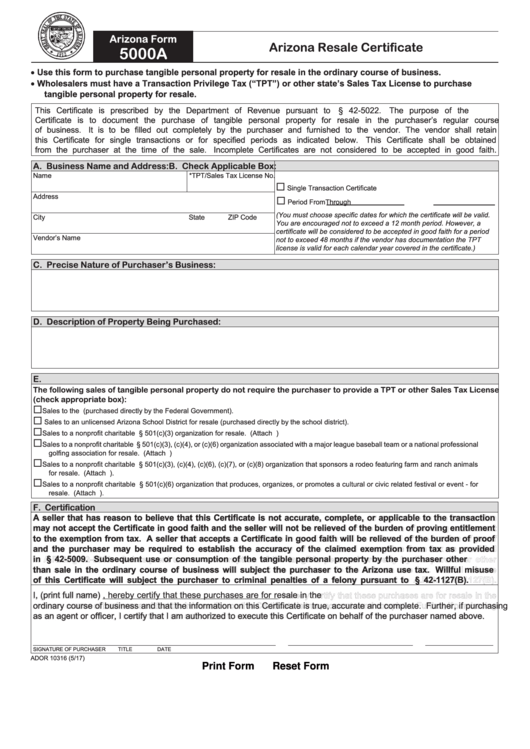

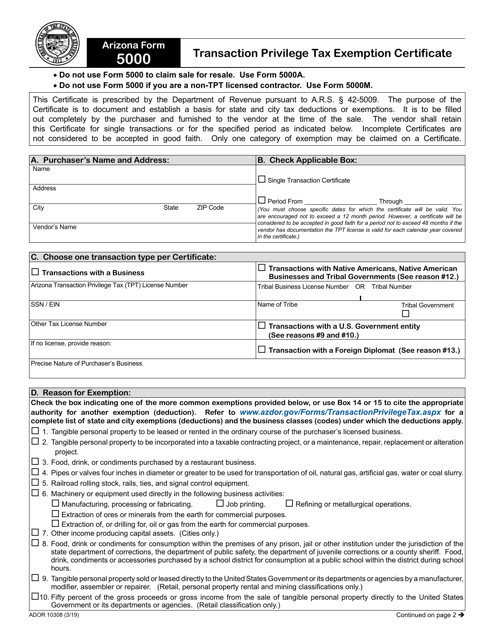

Arizona Form 5000A - Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. The certificate must be provided to the vendor in order for the vendor to document why. Electricity or natural gas sold to a business that is. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale. Web not related to the university of arizona, please seek guidance from the arizona department of revenue. Edit your arizona form 5000a online. Sign it in a few clicks. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from. Ad download or email az form 5000a & more fillable forms, register and subscribe now! The purpose of the certificate is.

Web find and fill out the correct 5000a form az. Wholesalers must have a transaction privilege. Do not use form 5000 to claim sale for resale. Web vendors should retain copies of the form 5000 for their files. For other arizona sales tax exemption certificates, go here. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s. Wholesalers must have a transaction privilege. Web use this form to purchase tangible personal property for resale in the ordinary course of business.

The purpose of the certificate is. Web arizona forms 5000 are used to claim arizona tpt (sales tax) exemptions from vendors. For other arizona sales tax exemption certificates, go here. The certificate must be provided to the vendor in order for the vendor to document why. Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Type text, add images, blackout confidential details, add comments, highlights and more. Repeating information will be added automatically after. Do not use form 5000 if you are. Electricity or natural gas sold to a business that is.

Fillable Arizona Form 5000a Arizona Resale Certificate 2002

Web 26 rows 5000a : Type text, add images, blackout confidential details, add comments, highlights and more. Electricity or natural gas sold to a business that is. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Sign it in a few clicks.

Arizona Form 111 Fill Online, Printable, Fillable, Blank pdfFiller

Choose the correct version of the editable pdf form from the list and. Ad download or email az form 5000a & more fillable forms, register and subscribe now! Web find and fill out the correct 5000a form az. Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web.

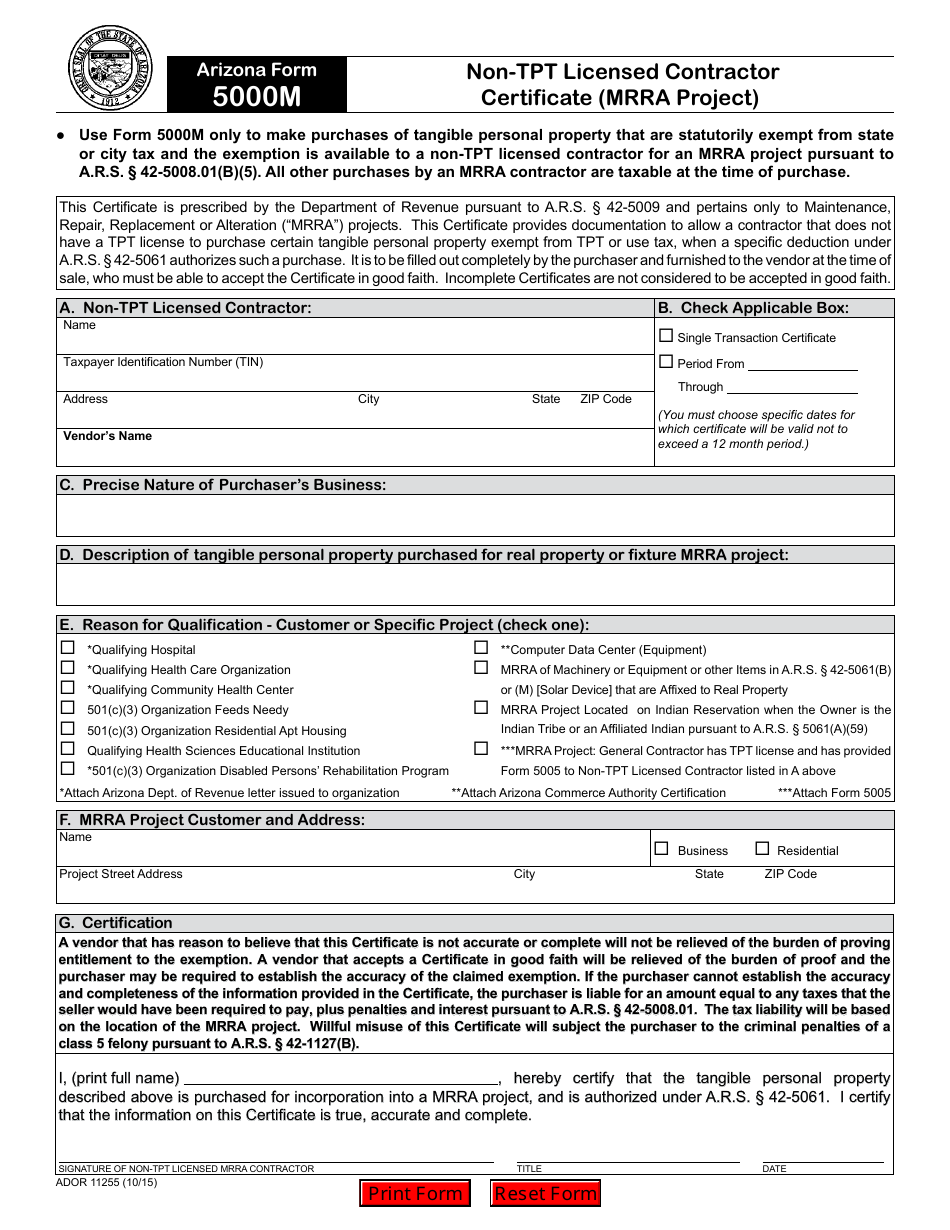

Arizona Form 5000M (ADOR11255) Download Fillable PDF or Fill Online Non

Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions. Web find and fill out the correct 5000a form az. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Do not use form 5000 if you are. Sign it in a few clicks.

Fillable Form 5000a Arizona Resale Certificate printable pdf download

Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. The state of arizona has updated az form 5000 and az form 5000a, which are provided to vendors when claiming sales tax. Electricity or natural gas sold to a business that is. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s. Ad.

Fill Free fillable forms for the state of Arizona

Web you can download a pdf of the arizona resale exemption certificate (form 5000a) on this page. Web vendors should retain copies of the form 5000 for their files. Web find and fill out the correct 5000a form az. Sign it in a few clicks. Web fill in all the details required in az form 5000a, using fillable fields.

Fill Free fillable forms Arizona Department of Real Estate

Web vendors should retain copies of the form 5000 for their files. Do not use form 5000 if you are. Add images, crosses, check and text boxes, if required. Choose the correct version of the editable pdf form from the list and. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course.

Arizona Form 5000a Fillable 2020 Fill and Sign Printable Template

Wholesalers must have a transaction privilege. Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions. Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Do not use form 5000 if you are. Electricity or natural gas sold to a business that is.

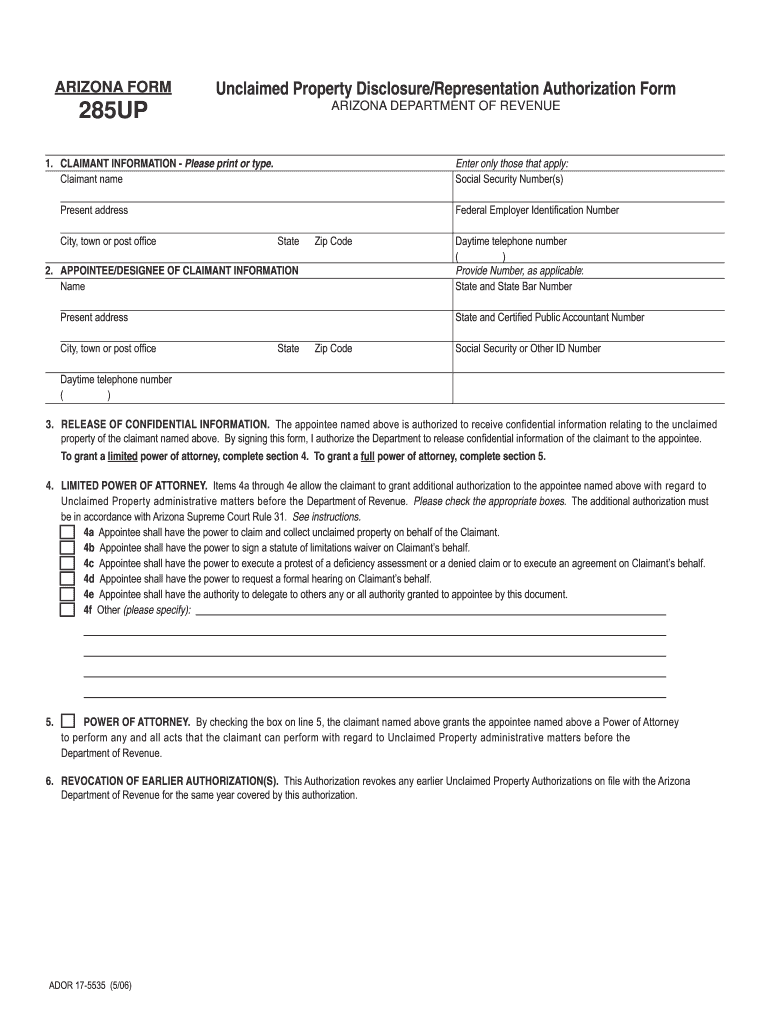

Arizona Form Property Disclosure Fill Online, Printable, Fillable

Arizona form 5000a is used to claim arizona tpt (sales tax) exemptions. Web arizona form 5000 is used to claim arizona tpt (sales tax) exemptions from a vendor. Web vendors should retain copies of the form 5000 for their files. The certificate must be provided to the vendor in order for the vendor to document why. Wholesalers must have a.

1346 Arizona Tax Forms And Templates free to download in PDF

Web fill in all the details required in az form 5000a, using fillable fields. Ad download or email az form 5000a & more fillable forms, register and subscribe now! Web you can download a pdf of the arizona resale exemption certificate (form 5000a) on this page. Web arizona forms 5000 are used to claim arizona tpt (sales tax) exemptions from.

Arizona Form 5000 (ADOR10308) Fill Out, Sign Online and Download

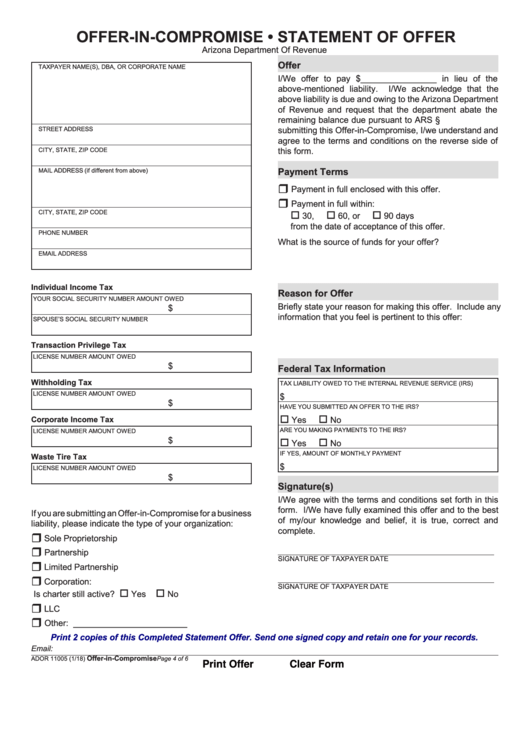

Web vendors should retain copies of the form 5000 for their files. Do not use form 5000 if you are. Edit your arizona form 5000a online. Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web arizona form 5000 transaction privilege tax exemption certificate do not use form.

Add Images, Crosses, Check And Text Boxes, If Required.

The purpose of the certificate is. Ad download or email az 5000 & more fillable forms, register and subscribe now! Choose the correct version of the editable pdf form from the list and. Web arizona form 5000a arizona resale certificate this certificate is prescribed by the department of revenue pursuant to a.r.s.

Type Text, Add Images, Blackout Confidential Details, Add Comments, Highlights And More.

Web you can download a pdf of the arizona resale exemption certificate (form 5000a) on this page. For other arizona sales tax exemption certificates, go here. Web 5000aarizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web arizona form 5000a is used to claim arizona tpt (sales tax) exemptions from a vendor when making purchases for resale.

The State Of Arizona Has Updated Az Form 5000 And Az Form 5000A, Which Are Provided To Vendors When Claiming Sales Tax.

Web 5000a arizona resale certificate use this form to purchase tangible personal property for resale in the ordinary course of business. Web 26 rows 5000a : Electricity or natural gas sold to a business that is. Wholesalers must have a transaction privilege tax (“tpt”) or other state’s.

Sign It In A Few Clicks.

Arizona forms 5000a are used to claim arizona tpt (sales tax) exemptions from. Ad download or email az form 5000a & more fillable forms, register and subscribe now! Web not related to the university of arizona, please seek guidance from the arizona department of revenue. Wholesalers must have a transaction privilege.